This version of the form is not currently in use and is provided for reference only. Download this version of

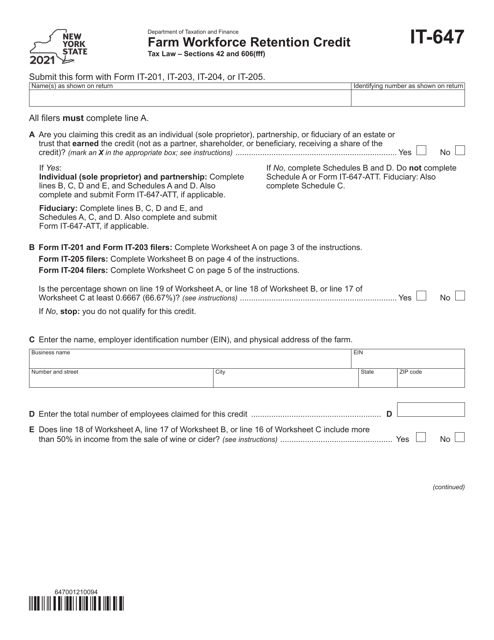

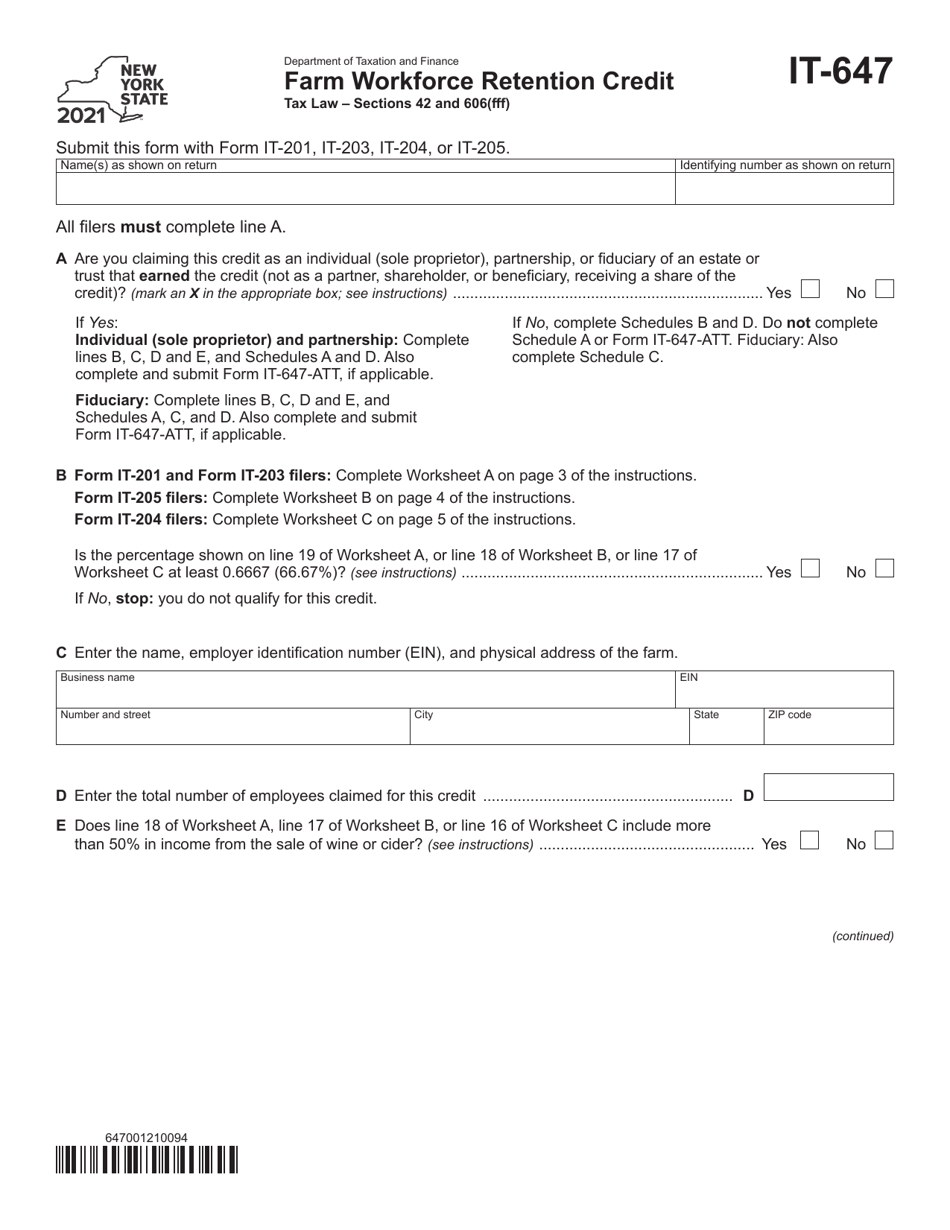

Form IT-647

for the current year.

Form IT-647 Farm Workforce Retention Credit - New York

What Is Form IT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647?

A: Form IT-647 is the Farm Workforce Retention Credit form for taxpayers in New York.

Q: Who is eligible to file Form IT-647?

A: Farmers or agricultural employers in New York who meet certain criteria are eligible to file Form IT-647.

Q: What is the purpose of Form IT-647?

A: The purpose of Form IT-647 is to claim the Farm Workforce Retention Credit, which is a tax credit designed to support agricultural employers in New York in retaining their workforce.

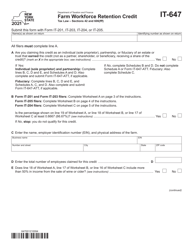

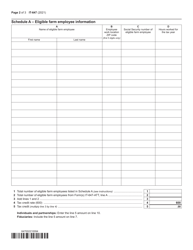

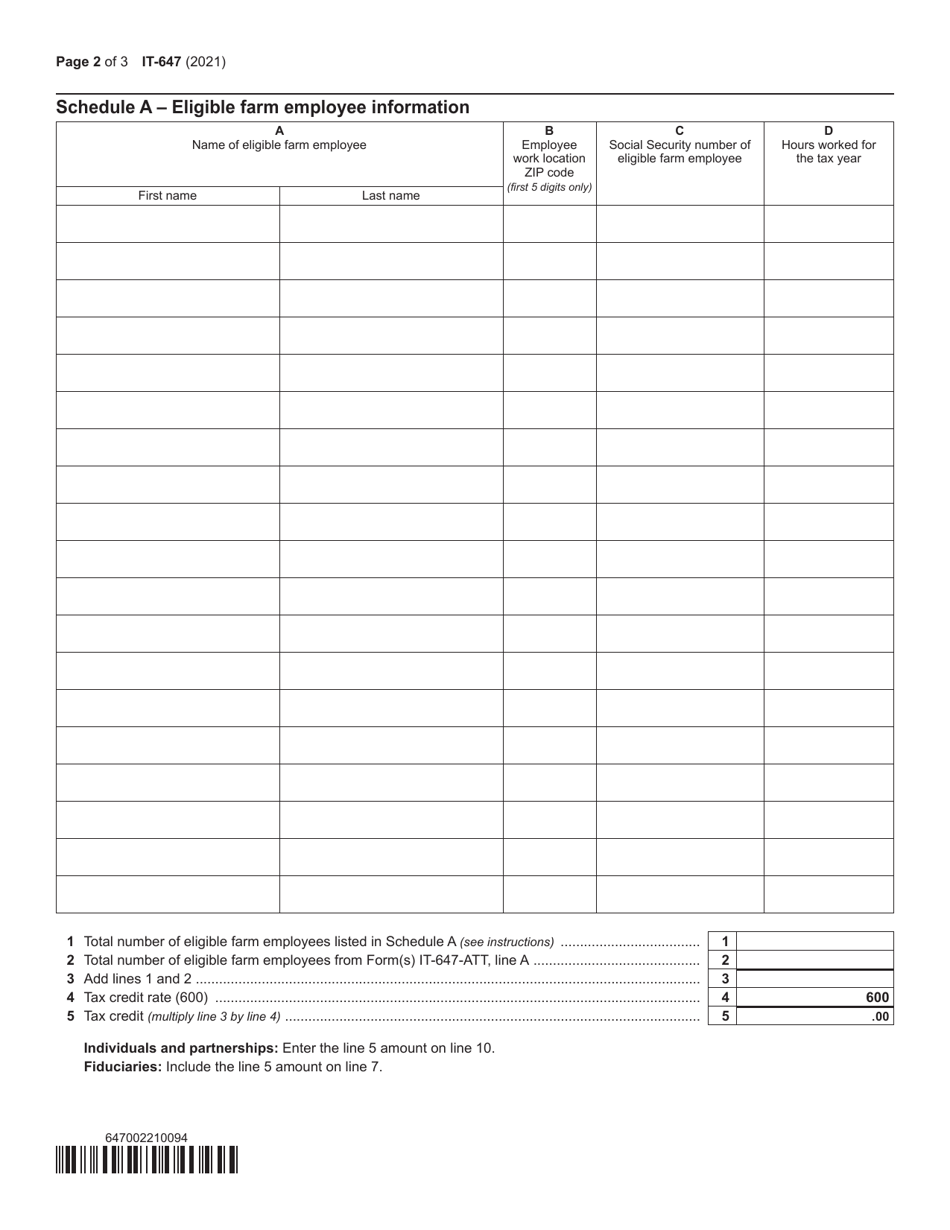

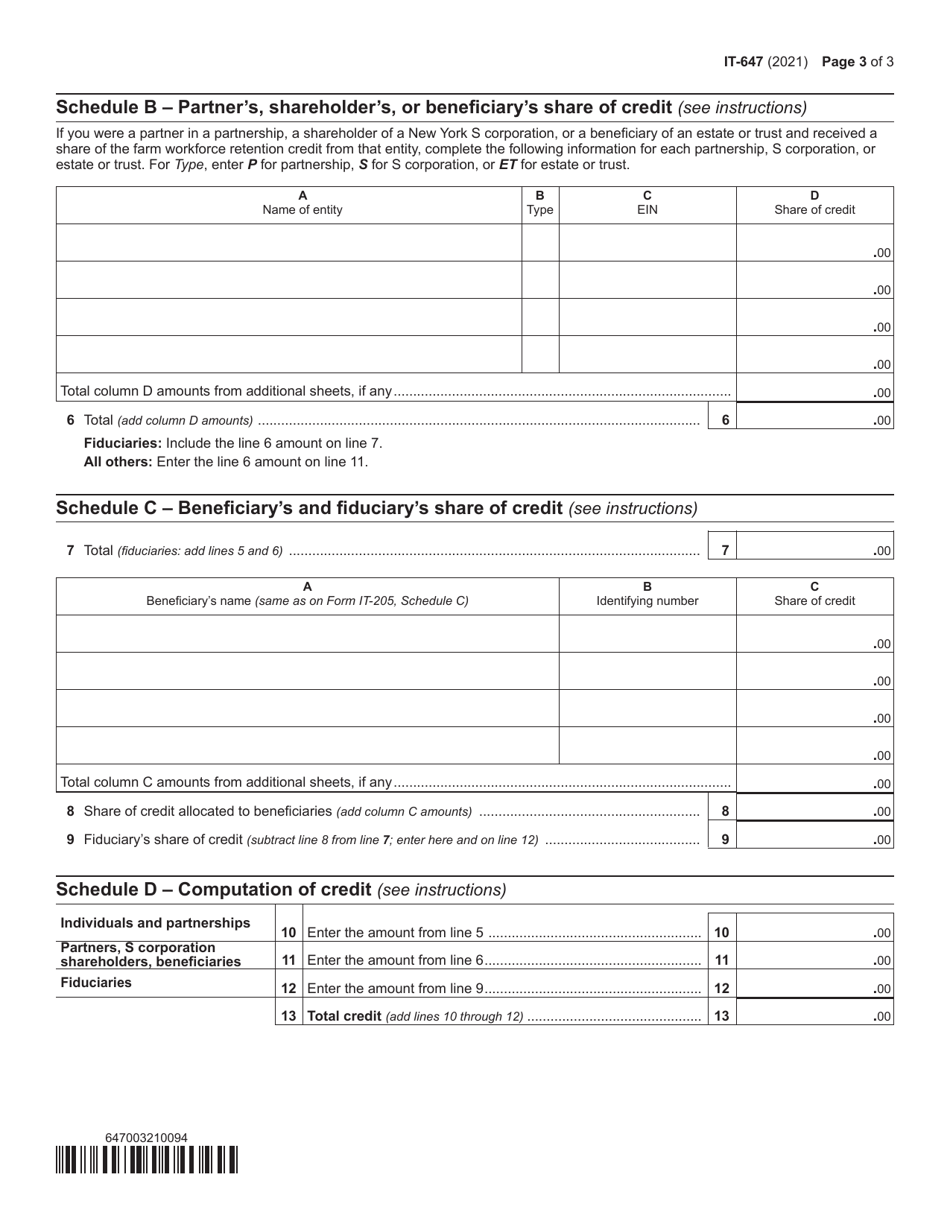

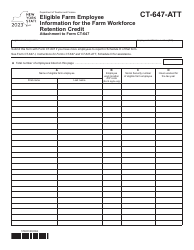

Q: What information is required to complete Form IT-647?

A: To complete Form IT-647, you will need to provide information about your farm or agricultural business, the number of eligible employees, and the wages paid to those employees.

Q: What is the deadline for filing Form IT-647?

A: The deadline for filing Form IT-647 is the same as the due date for your New York state income tax return, which is typically April 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.