This version of the form is not currently in use and is provided for reference only. Download this version of

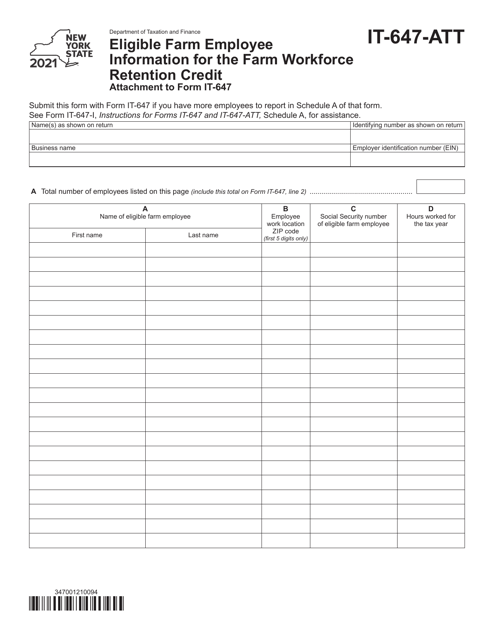

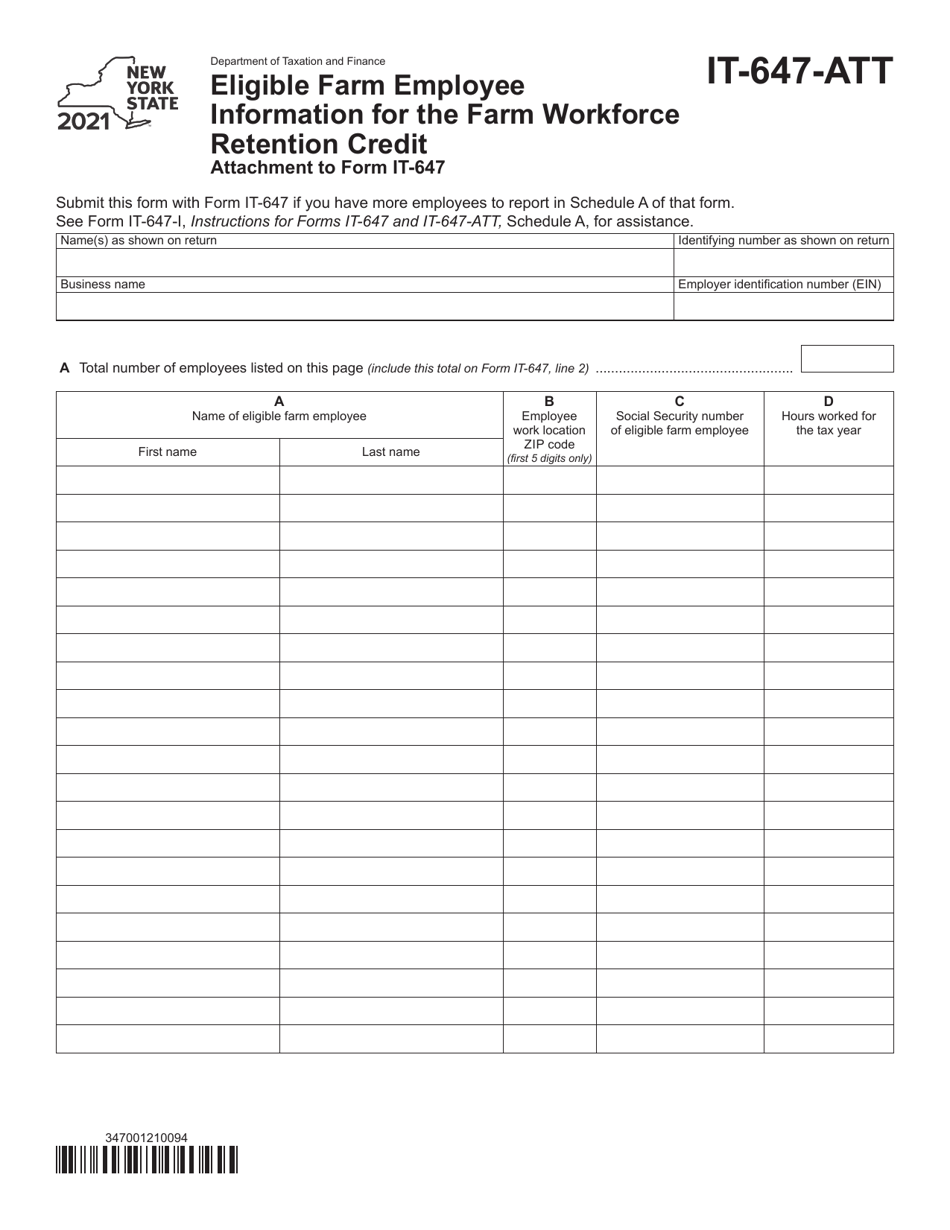

Form IT-647-ATT

for the current year.

Form IT-647-ATT Eligible Farm Employee Information for the Farm Workforce Retention Credit - New York

What Is Form IT-647-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647-ATT?

A: Form IT-647-ATT is the form used to provide eligible farm employee information for the Farm Workforce Retention Credit in New York.

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to farming businesses in New York that hire eligible farm employees.

Q: Who is an eligible farm employee?

A: An eligible farm employee is an individual who performs agricultural labor for a farming business in New York.

Q: What information is required on Form IT-647-ATT?

A: Form IT-647-ATT requires information about the eligible farm employees hired by the farming business, including their names, social security numbers, and wages.

Q: How can the Farm Workforce Retention Credit benefit farming businesses?

A: The Farm Workforce Retention Credit provides a tax credit to eligible farming businesses in New York, helping to offset the costs of hiring and retaining farm employees.

Q: Is there a deadline for filing Form IT-647-ATT?

A: Yes, Form IT-647-ATT must be filed with the New York State Department of Taxation and Finance by the due date specified by the department.

Q: Are there any other requirements to be eligible for the Farm Workforce Retention Credit?

A: Yes, there are additional requirements for farming businesses to be eligible for the Farm Workforce Retention Credit. It is recommended to review the specific eligibility criteria provided by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.