This version of the form is not currently in use and is provided for reference only. Download this version of

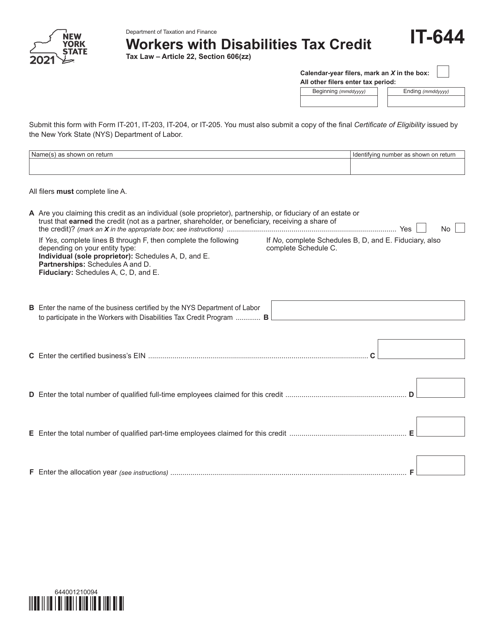

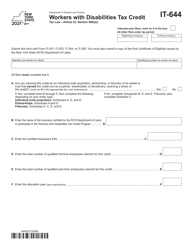

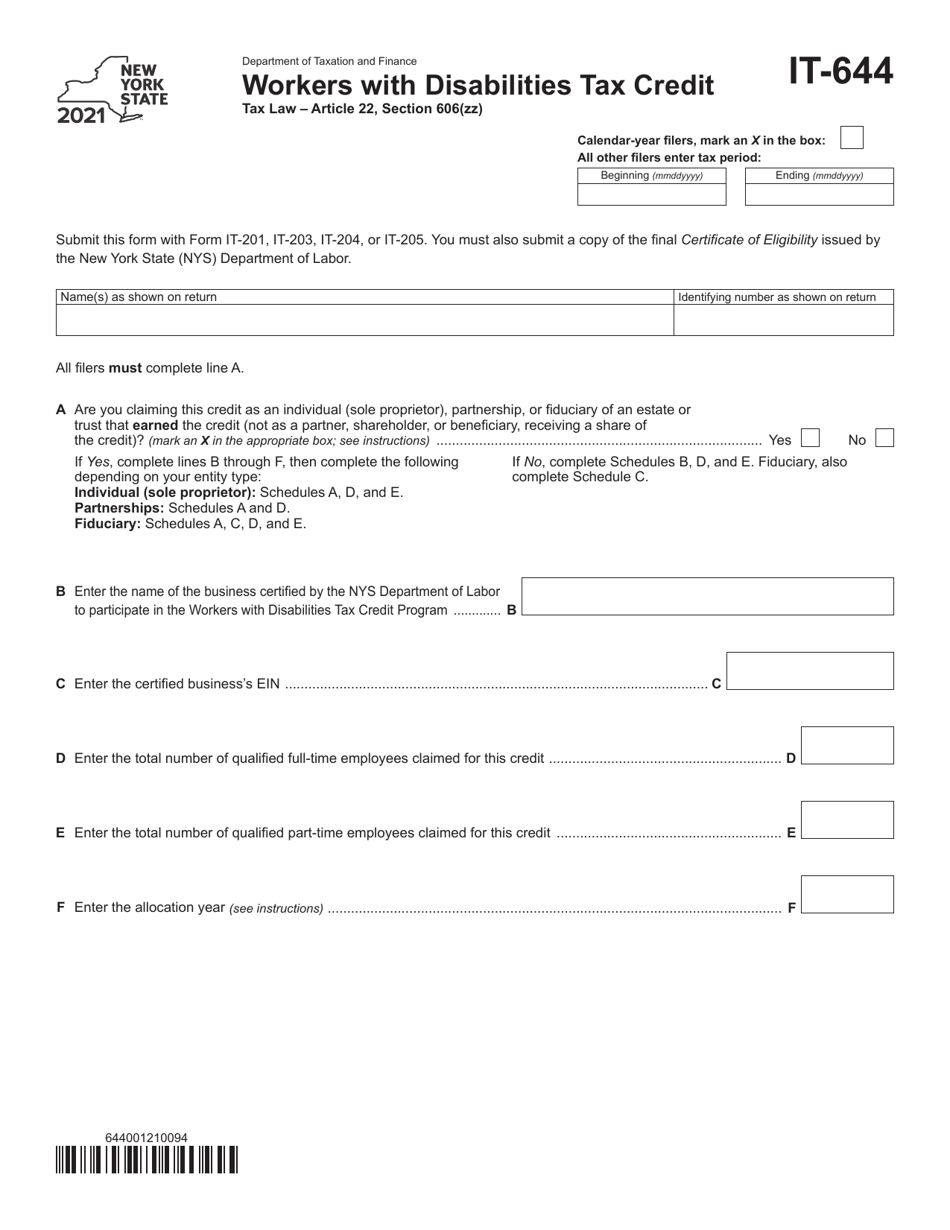

Form IT-644

for the current year.

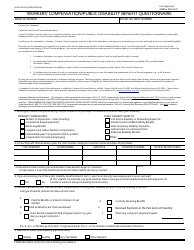

Form IT-644 Workers With Disabilities Tax Credit - New York

What Is Form IT-644?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-644?

A: Form IT-644 is a tax form used by taxpayers in New York to claim the Workers With Disabilities Tax Credit.

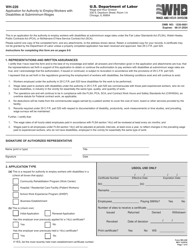

Q: Who is eligible for the Workers With Disabilities Tax Credit in New York?

A: Taxpayers in New York who employ individuals with disabilities and meet the eligibility requirements can claim the Workers With Disabilities Tax Credit.

Q: What is the purpose of the Workers With Disabilities Tax Credit?

A: The purpose of the Workers With Disabilities Tax Credit is to provide a tax credit to employers who hire individuals with disabilities.

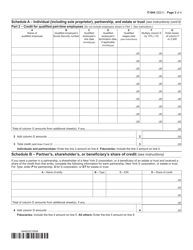

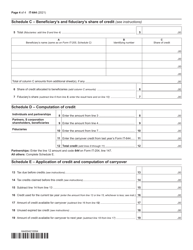

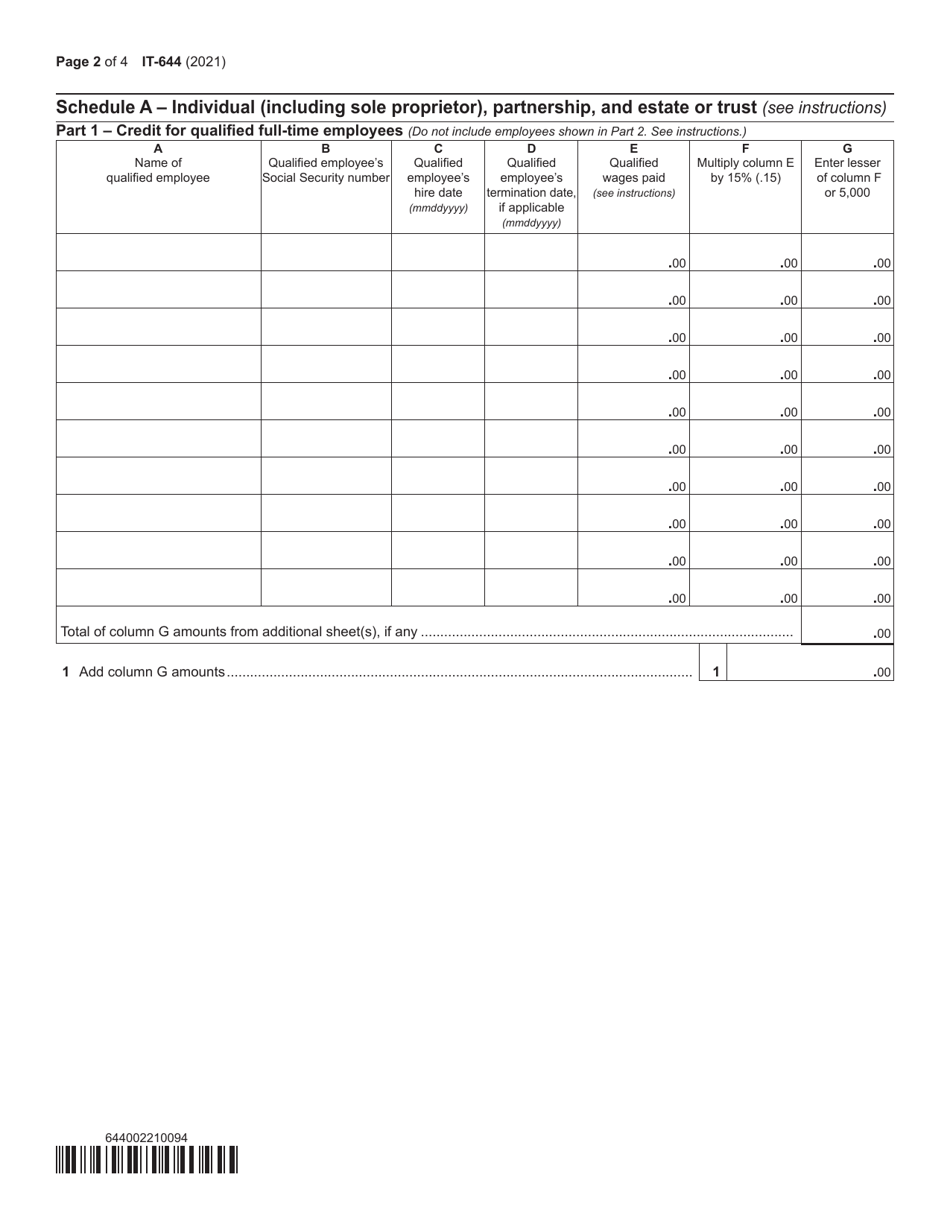

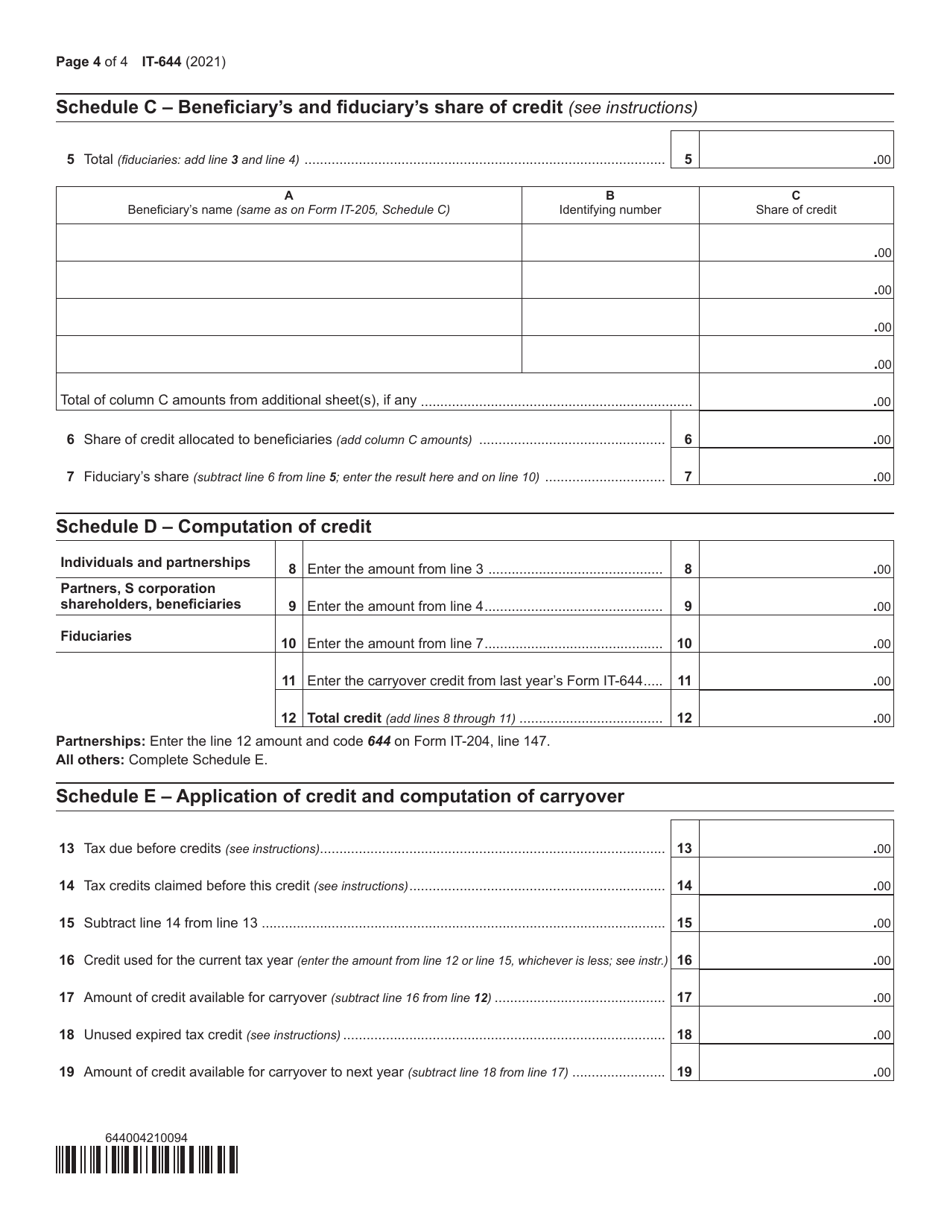

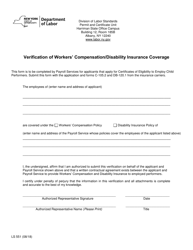

Q: What information is required to complete Form IT-644?

A: To complete Form IT-644, you will need to provide information about the employee with disabilities, including their name, social security number, and wages paid.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-644 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.