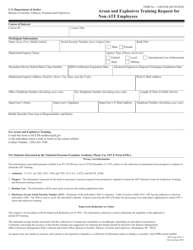

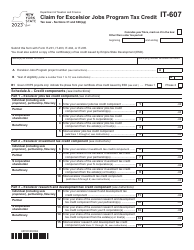

This version of the form is not currently in use and is provided for reference only. Download this version of

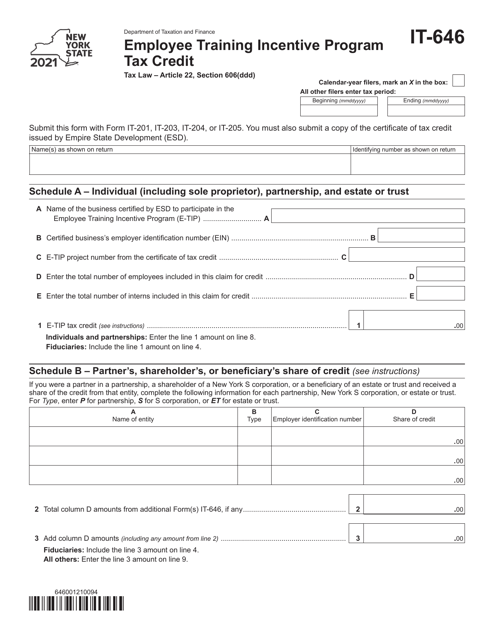

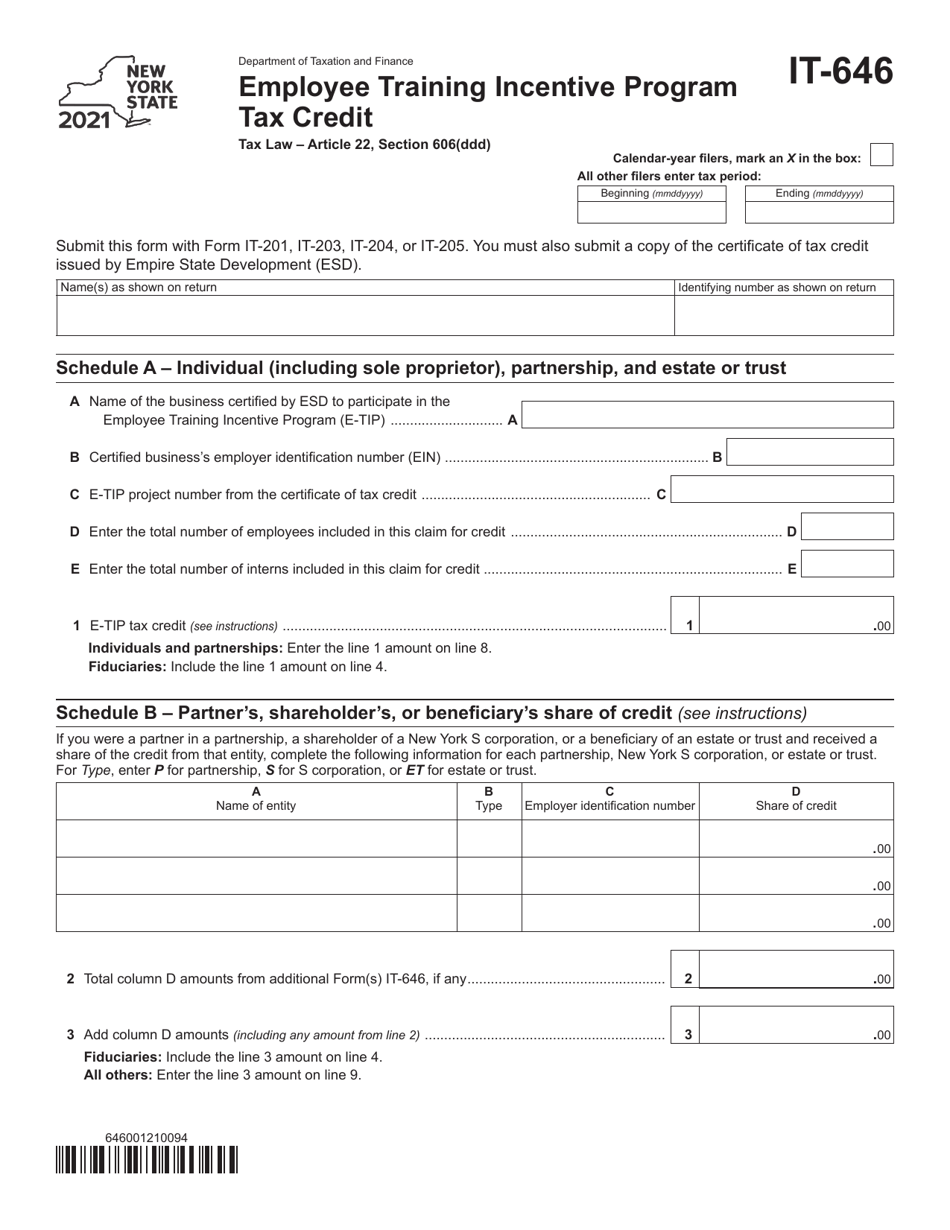

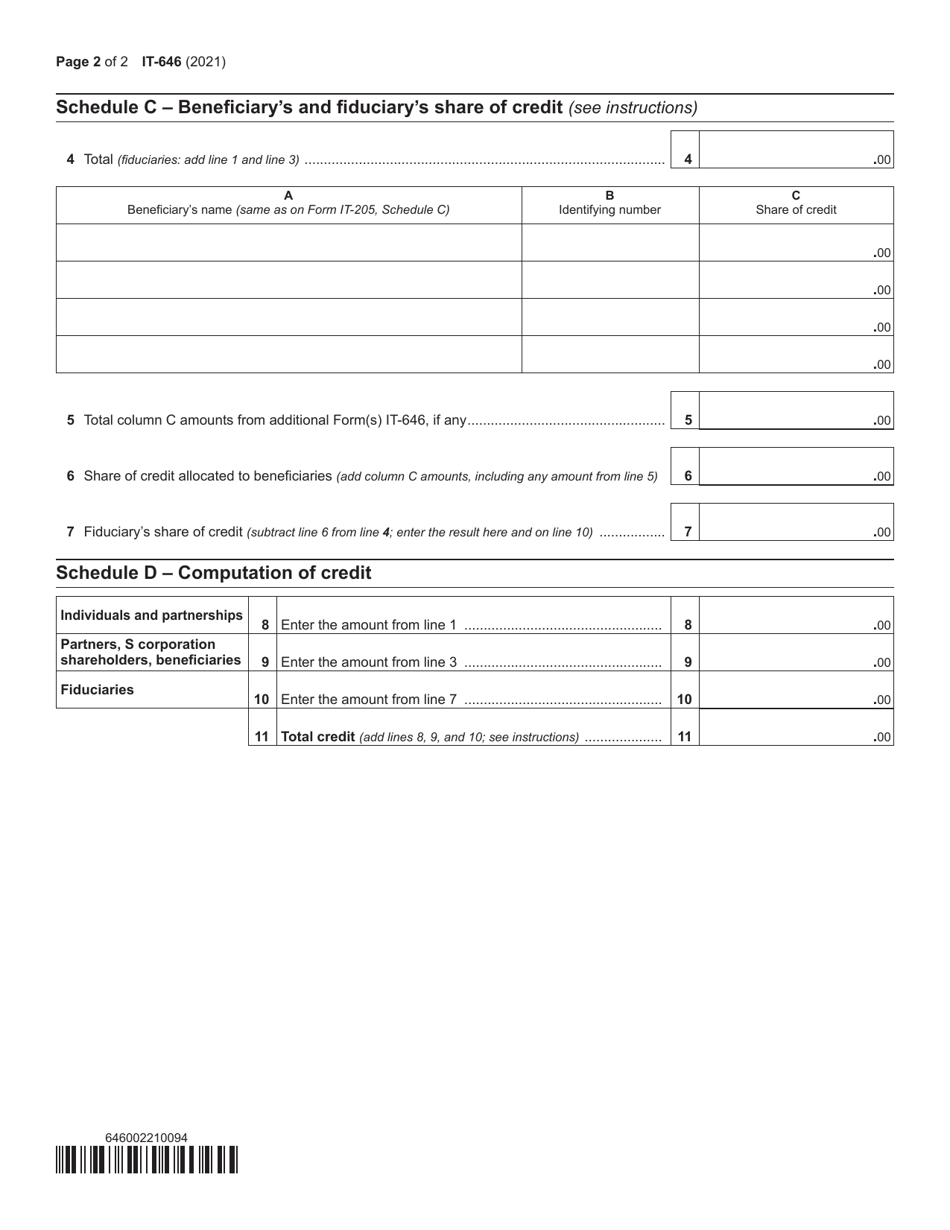

Form IT-646

for the current year.

Form IT-646 Employee Training Incentive Program Tax Credit - New York

What Is Form IT-646?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-646?

A: Form IT-646 is the official tax form used in New York for the Employee Training Incentive Program Tax Credit.

Q: What is the Employee Training Incentive Program Tax Credit?

A: The Employee Training Incentive Program Tax Credit is a program in New York that provides tax credits to employers who incur expenses for employee training.

Q: How can I qualify for the Employee Training Incentive Program Tax Credit?

A: To qualify for the tax credit, employers must meet certain criteria and submit Form IT-646 to the New York State Department of Taxation and Finance.

Q: What expenses are eligible for the tax credit?

A: Expenses related to employee training, such as tuition fees, training materials, and instructor fees, may be eligible for the tax credit.

Q: How much is the tax credit?

A: The amount of the tax credit may vary and is based on a percentage of the eligible expenses incurred by the employer.

Q: Can the tax credit be carried forward or back?

A: Yes, any excess tax credit can be carried forward for up to 15 years or carried back for up to 3 years.

Q: When is the deadline to file Form IT-646?

A: The deadline for filing Form IT-646 is generally April 15th of the year following the tax year in which the eligible expenses were incurred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-646 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.