This version of the form is not currently in use and is provided for reference only. Download this version of

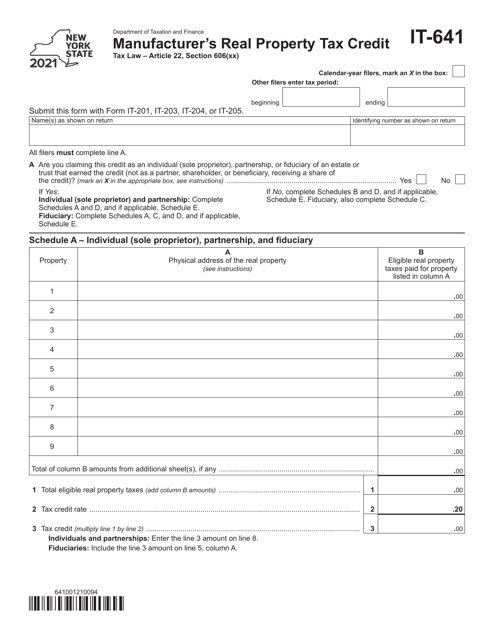

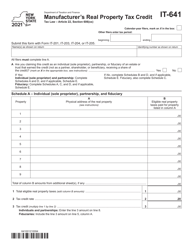

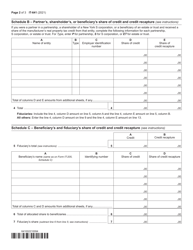

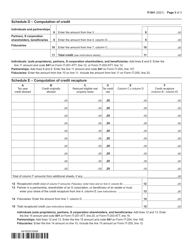

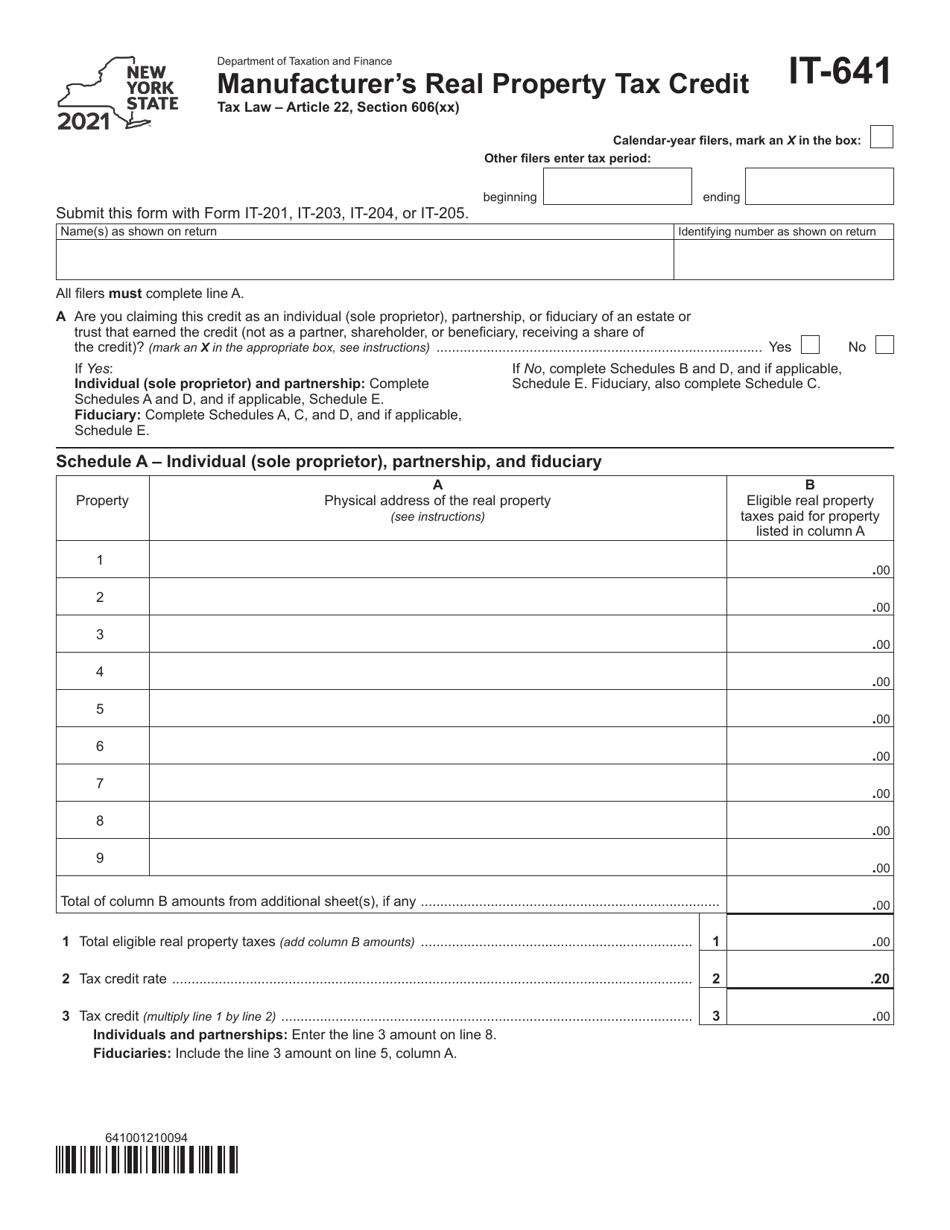

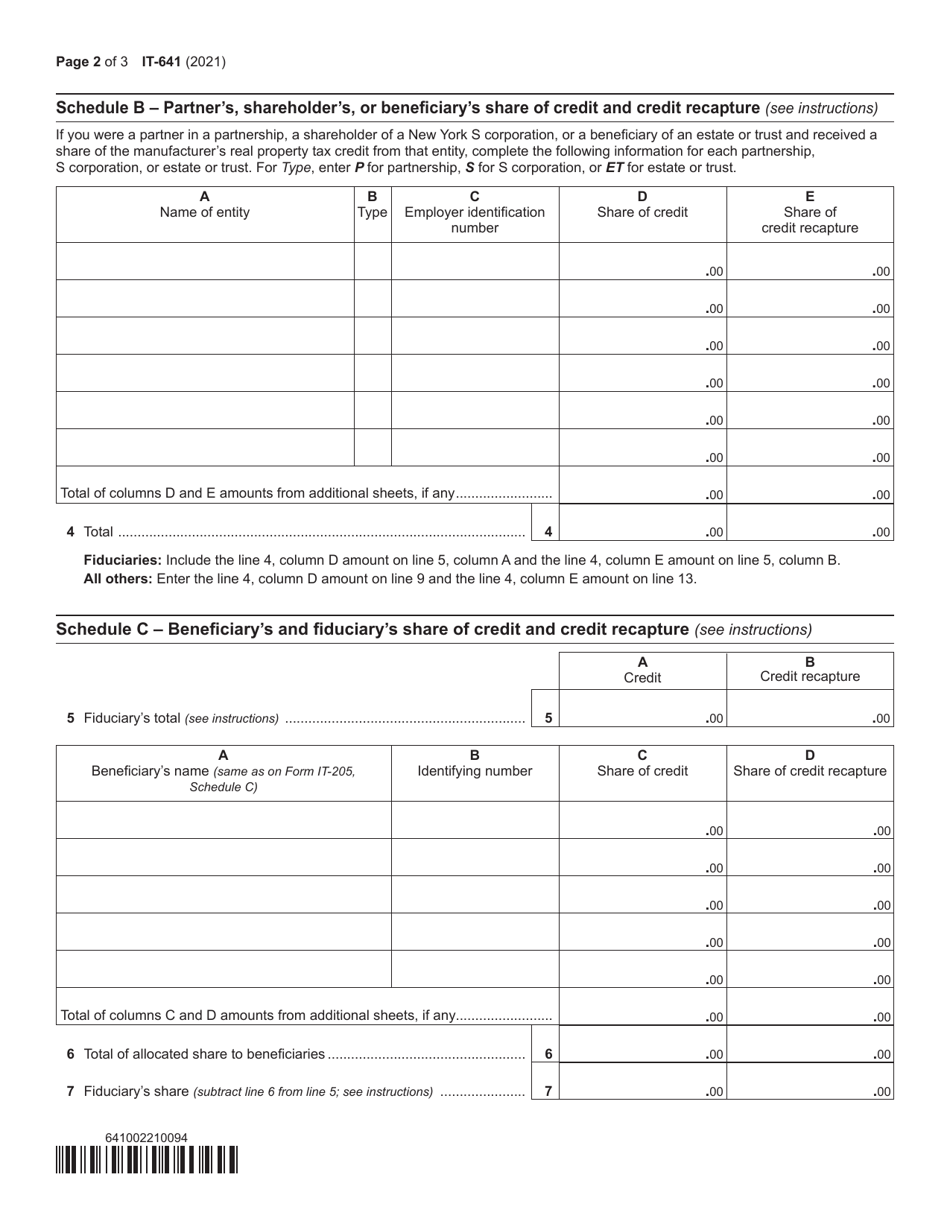

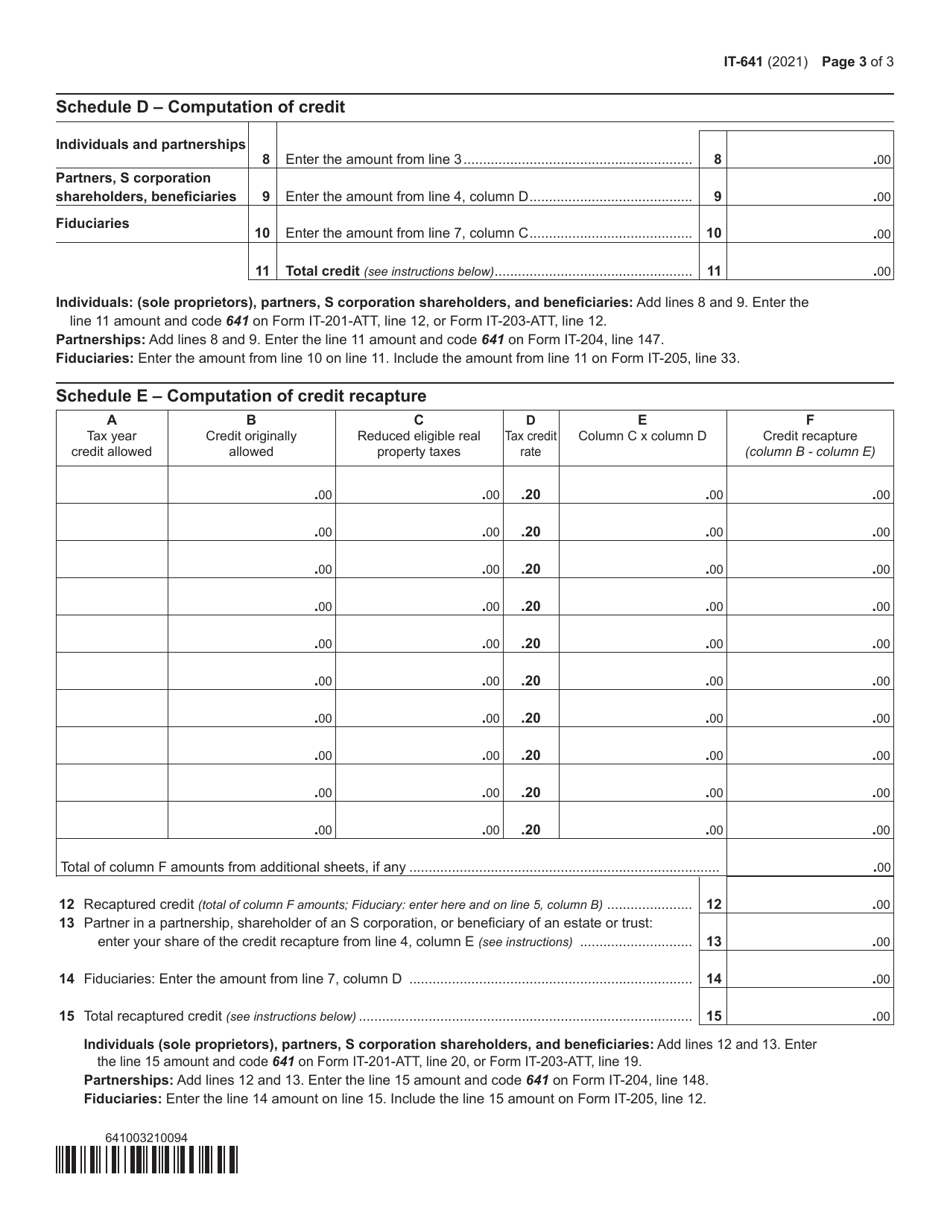

Form IT-641

for the current year.

Form IT-641 Manufacturer's Real Property Tax Credit - New York

What Is Form IT-641?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-641?

A: Form IT-641 is the Manufacturer's Real Property Tax Credit form in New York.

Q: Who is eligible to use Form IT-641?

A: Manufacturers in New York are eligible to use Form IT-641 to claim real property tax credit.

Q: What is the purpose of Form IT-641?

A: The purpose of Form IT-641 is to provide manufacturers with a tax credit for real property taxes paid.

Q: What information do I need to complete Form IT-641?

A: To complete Form IT-641, you will need information about your real property taxes paid and your manufacturing activities.

Q: When is the deadline to file Form IT-641?

A: The deadline for filing Form IT-641 is the same as the deadline for filing your New York state income tax return.

Q: Is there a maximum credit amount on Form IT-641?

A: Yes, there is a maximum credit amount that can be claimed on Form IT-641.

Q: Can I claim the Manufacturer's Real Property Tax Credit if I am not a manufacturer?

A: No, only manufacturers are eligible to claim the Manufacturer's Real Property Tax Credit.

Q: What do I do with Form IT-641 once it is completed?

A: Once Form IT-641 is completed, you should attach it to your New York state income tax return when filing.

Q: Are there any other eligibility requirements for the Manufacturer's Real Property Tax Credit?

A: Yes, there are additional eligibility requirements. You should refer to the instructions accompanying Form IT-641 for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-641 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.