This version of the form is not currently in use and is provided for reference only. Download this version of

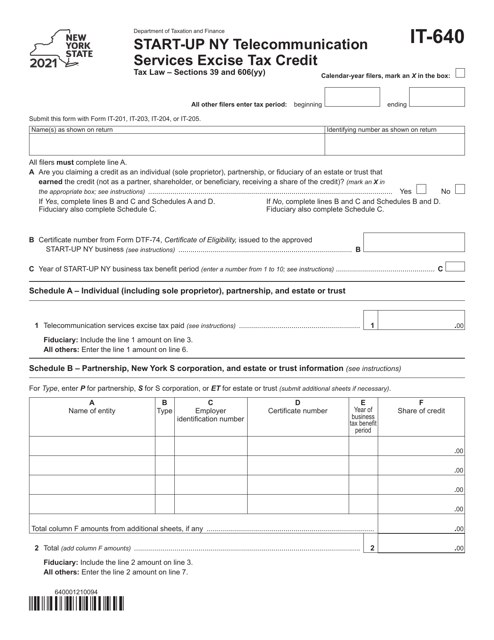

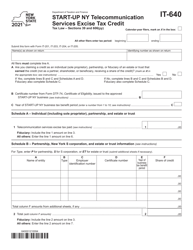

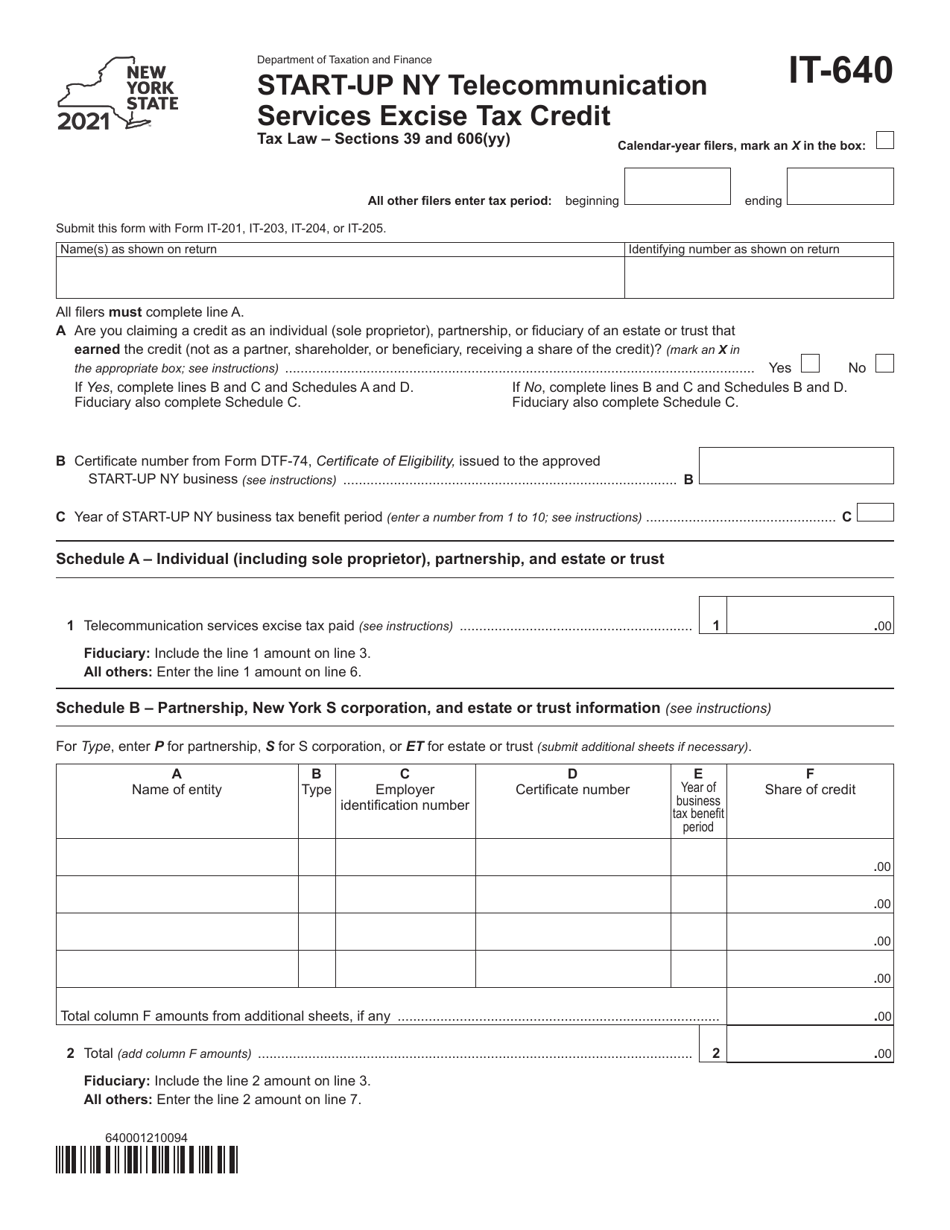

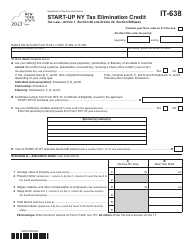

Form IT-640

for the current year.

Form IT-640 Start-Up Ny Telecommunication Services Excise Tax Credit - New York

What Is Form IT-640?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-640?

A: Form IT-640 is a tax form in New York that is used to claim the Start-Up NY Telecommunications Services Excise Tax Credit.

Q: Who can claim the Start-Up NY Telecommunications Services Excise Tax Credit?

A: Telecommunications businesses that participate in the Start-Up NY program and meet certain requirements can claim this tax credit.

Q: What is the Start-Up NY program?

A: The Start-Up NY program is a New York State initiative that provides tax incentives to businesses that create jobs in certain industries.

Q: What is the Telecommunications Services Excise Tax Credit?

A: The Telecommunications Services Excise Tax Credit is a tax credit available to eligible telecommunications businesses who qualify under the Start-Up NY program.

Q: What are the requirements to claim this tax credit?

A: To claim the Start-Up NY Telecommunications Services Excise Tax Credit, businesses must meet certain job creation and investment requirements outlined in the program.

Q: How do I file Form IT-640?

A: Form IT-640 can be filed electronically or by mail using the instructions provided on the form.

Q: Are there any deadlines for filing this form?

A: Yes, Form IT-640 must be filed by the due date of the business's franchise tax return, including extensions.

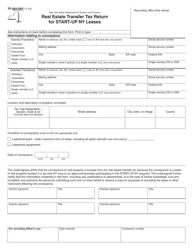

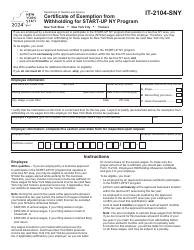

Q: Are there any other forms related to the Start-Up NY program?

A: Yes, depending on the nature of the business, there may be additional forms required to claim other tax credits under the Start-Up NY program.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-640 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.