This version of the form is not currently in use and is provided for reference only. Download this version of

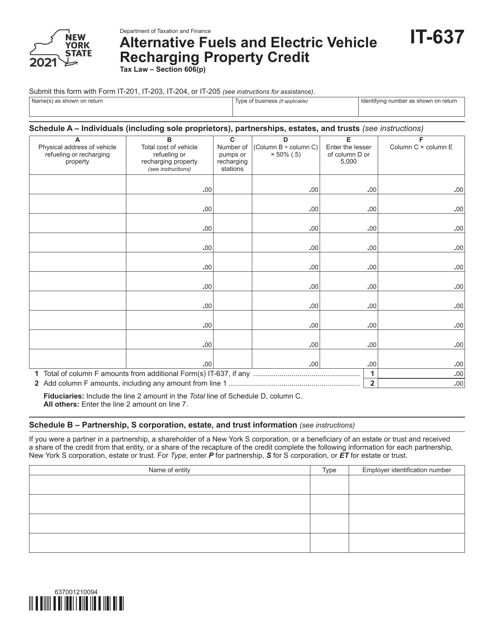

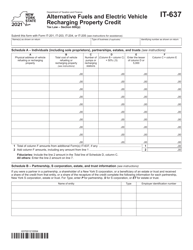

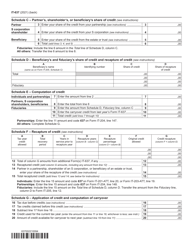

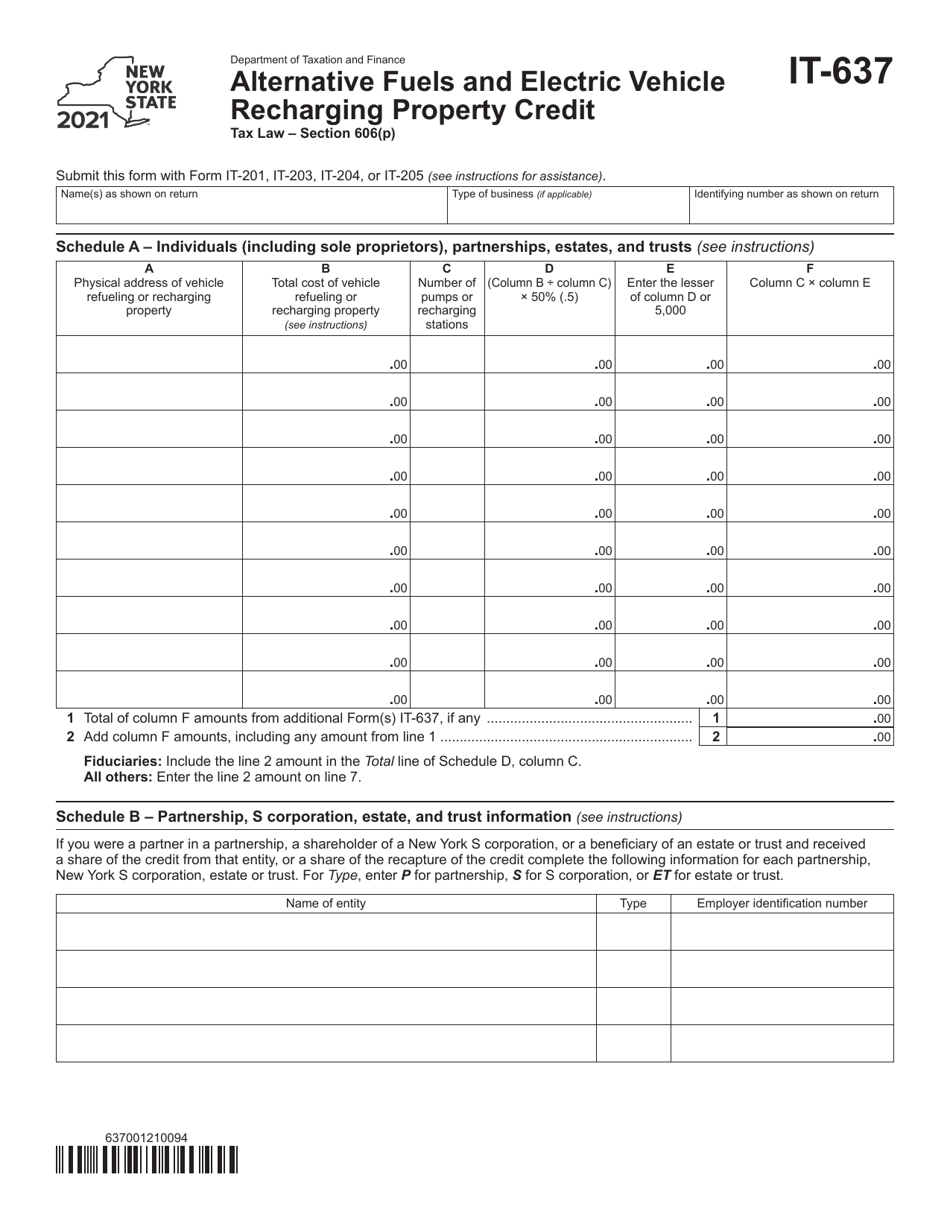

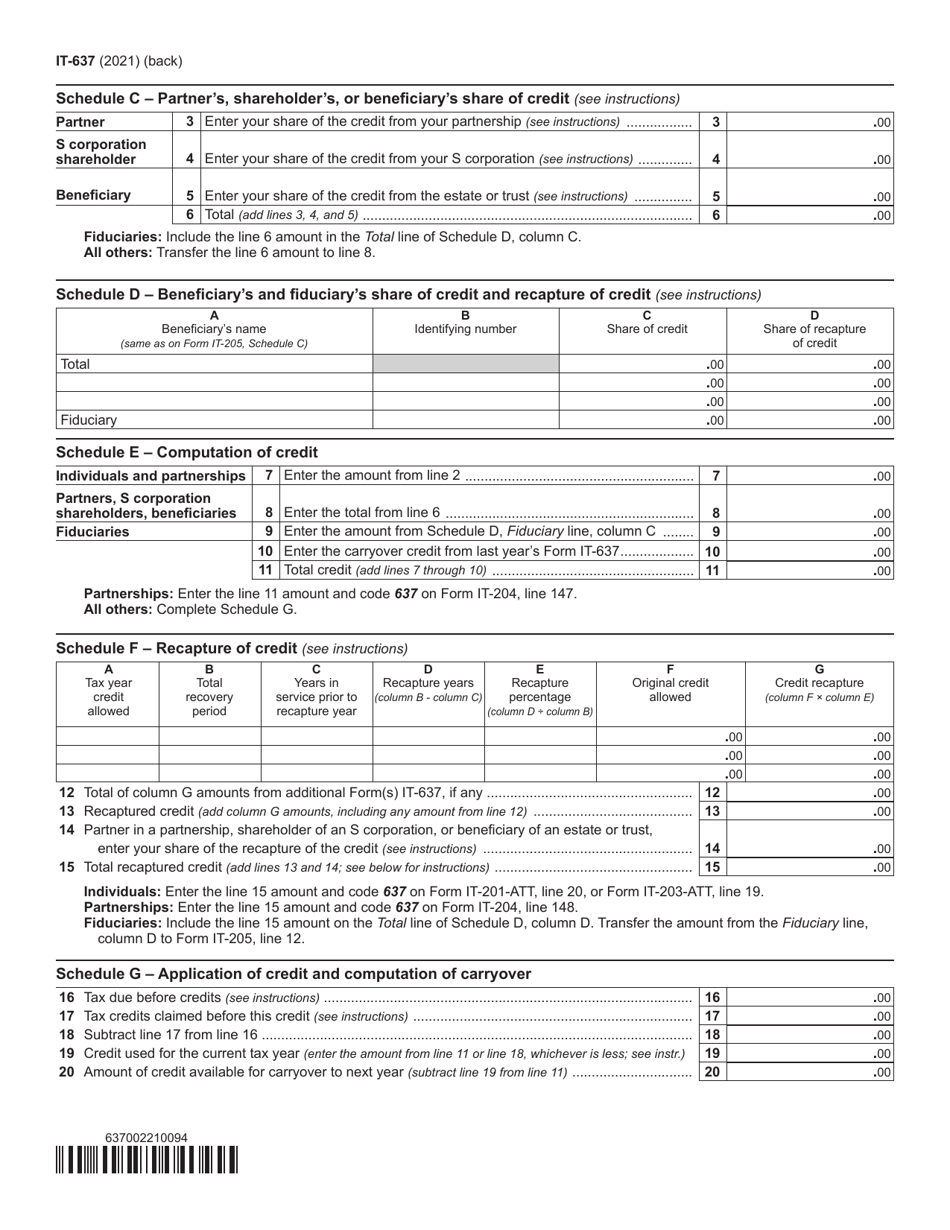

Form IT-637

for the current year.

Form IT-637 Alternative Fuels and Electric Vehicle Recharging Property Credit - New York

What Is Form IT-637?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-637?

A: Form IT-637 is a tax form used in New York to claim the Alternative Fuels and Electric Vehicle Recharging Property Credit.

Q: What is the Alternative Fuels and Electric Vehicle Recharging Property Credit?

A: The Alternative Fuels and Electric Vehicle Recharging Property Credit is a tax credit available in New York for the purchase and installation of alternative fuels and electric vehicle recharging property.

Q: Who can claim the Alternative Fuels and Electric Vehicle Recharging Property Credit?

A: Individuals, businesses, and organizations in New York who have purchased and installed eligible alternative fuels and electric vehicle recharging property.

Q: What types of property are eligible for the credit?

A: Eligible properties include alternative fueling stations, electric vehicle recharging property, and certain flexible fuel property.

Q: How much is the credit?

A: The credit amount varies depending on the type and cost of the eligible property. The maximum credit for each property type is specified in the tax form instructions.

Q: What are the requirements for claiming the credit?

A: To claim the credit, you must meet certain requirements such as owning or leasing the property, having it in service during the tax year, and meeting any applicable performance standards.

Q: How do I file Form IT-637?

A: Form IT-637 should be filed with your New York state income tax return. Make sure to carefully follow the instructions provided with the form.

Q: Is there a deadline for filing Form IT-637?

A: Yes, the form must be filed by the due date of your New York state income tax return, including any extensions.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-637 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.