This version of the form is not currently in use and is provided for reference only. Download this version of

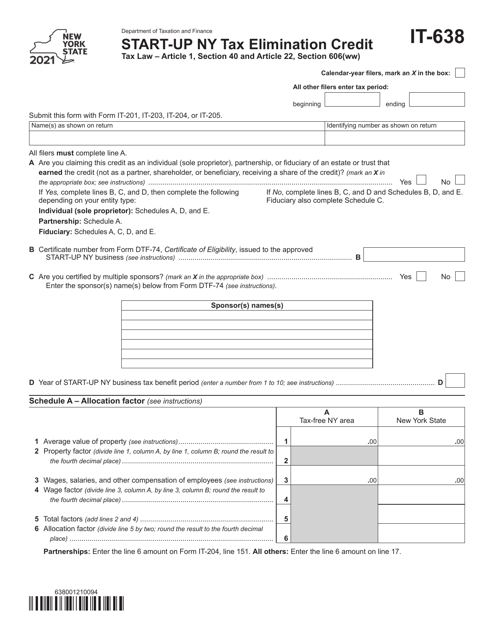

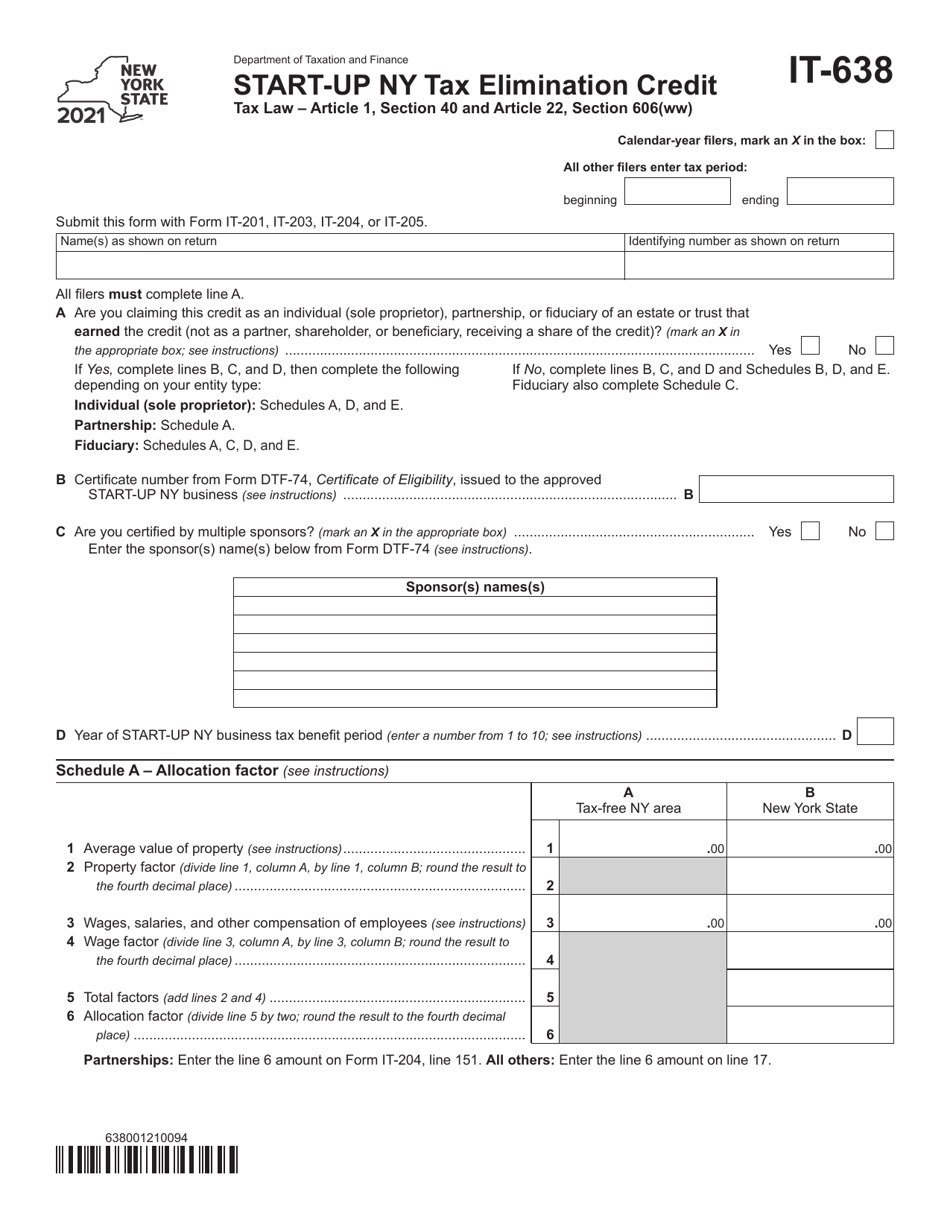

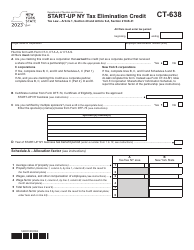

Form IT-638

for the current year.

Form IT-638 Start-Up Ny Tax Elimination Credit - New York

What Is Form IT-638?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-638?

A: Form IT-638 is a tax form used in New York to claim the Start-Up NY Tax Elimination Credit.

Q: What is the Start-Up NY Tax Elimination Credit?

A: The Start-Up NY Tax Elimination Credit is a tax credit available to businesses participating in the Start-Up NY program in New York.

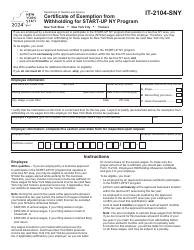

Q: Who is eligible to claim the Start-Up NY Tax Elimination Credit?

A: Businesses that are approved participants in the Start-Up NY program are eligible to claim the tax credit.

Q: What is the purpose of the Start-Up NY program?

A: The Start-Up NY program is designed to promote economic development and job creation in New York by attracting new businesses to the state.

Q: How do I claim the Start-Up NY Tax Elimination Credit?

A: To claim the tax credit, you need to file Form IT-638 with the New York State Department of Taxation and Finance.

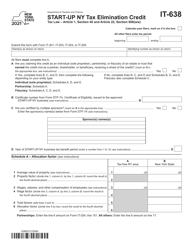

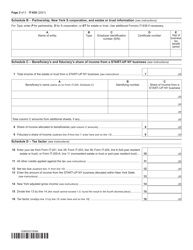

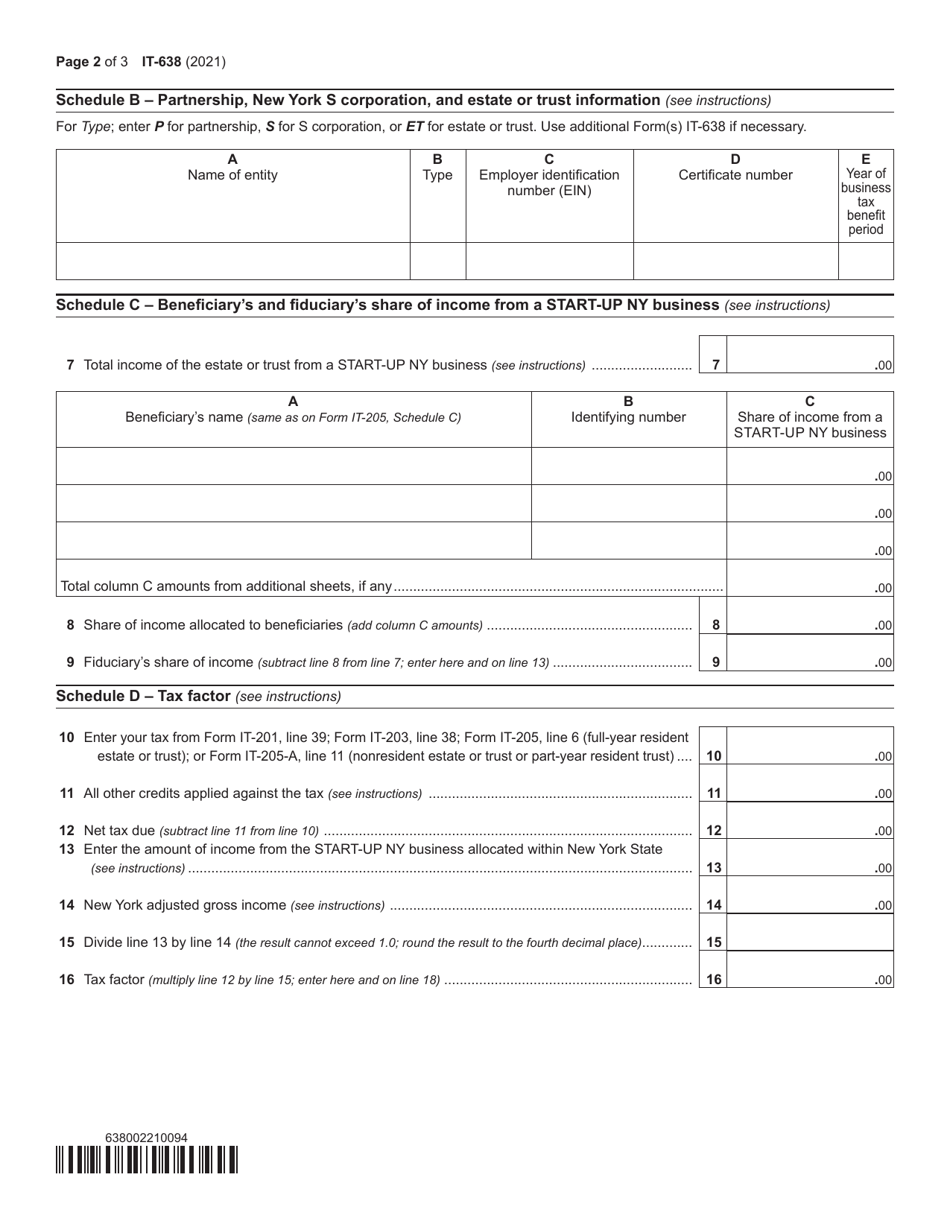

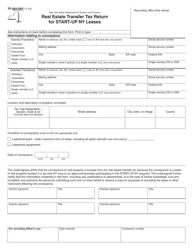

Q: What expenses can be included in the Start-Up NY Tax Elimination Credit?

A: The tax credit can be claimed for qualified expenses, which include real property taxes, sales and use taxes, and certain employee wages.

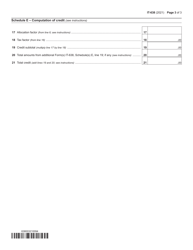

Q: Is there a limit to the amount of the Start-Up NY Tax Elimination Credit?

A: Yes, there is a maximum annual credit amount that can be claimed, which is determined by the number of net new jobs created by the business.

Q: Are there any other requirements to claim the Start-Up NY Tax Elimination Credit?

A: Yes, businesses must meet certain criteria, such as maintaining a physical presence in a tax-free NY area and being in an approved industry sector, among others.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-638 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.