This version of the form is not currently in use and is provided for reference only. Download this version of

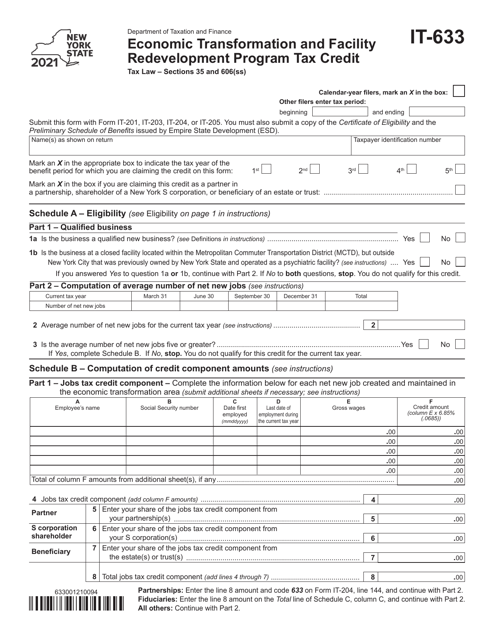

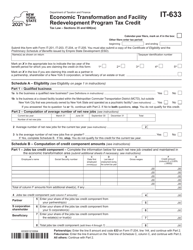

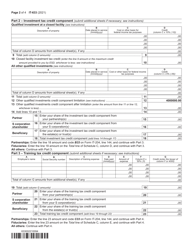

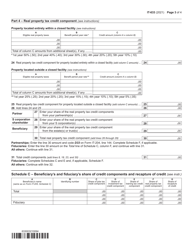

Form IT-633

for the current year.

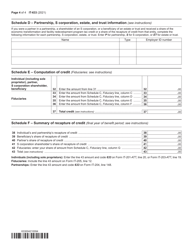

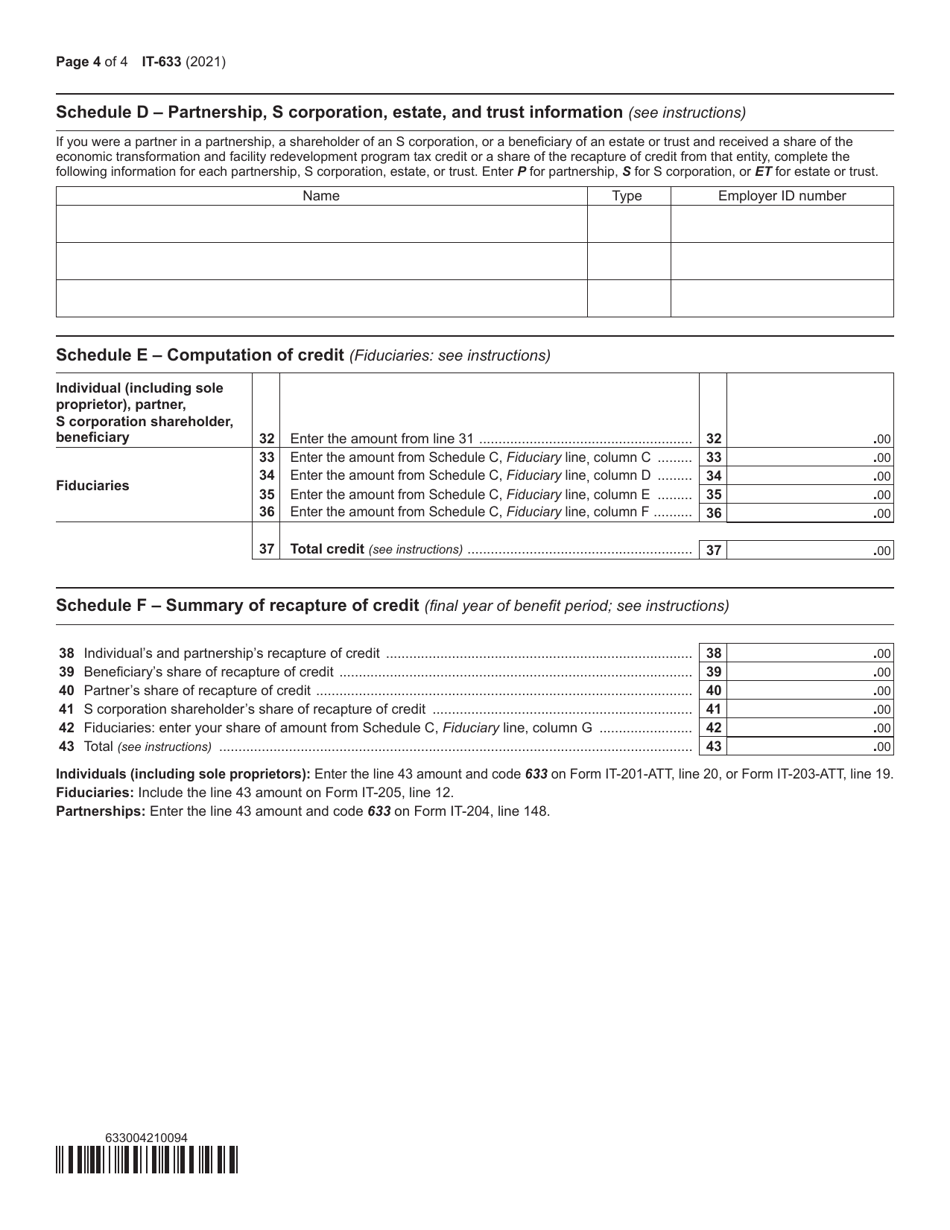

Form IT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form IT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-633?

A: Form IT-633 is a tax form specifically for the Economic Transformation and Facility Redevelopment Program (ETFRP) Tax Credit in New York.

Q: What is the purpose of the ETFRP Tax Credit?

A: The purpose of the ETFRP Tax Credit is to encourage economic growth and development by providing tax incentives for qualified projects.

Q: Who can claim the ETFRP Tax Credit?

A: Eligible taxpayers who have qualified projects approved by the New York State Department of Economic Development can claim the ETFRP Tax Credit.

Q: What types of projects are eligible for the ETFRP Tax Credit?

A: Projects that involve the substantial renovation, rehabilitation, or redevelopment of a building or facility located in New York State may be eligible for the ETFRP Tax Credit.

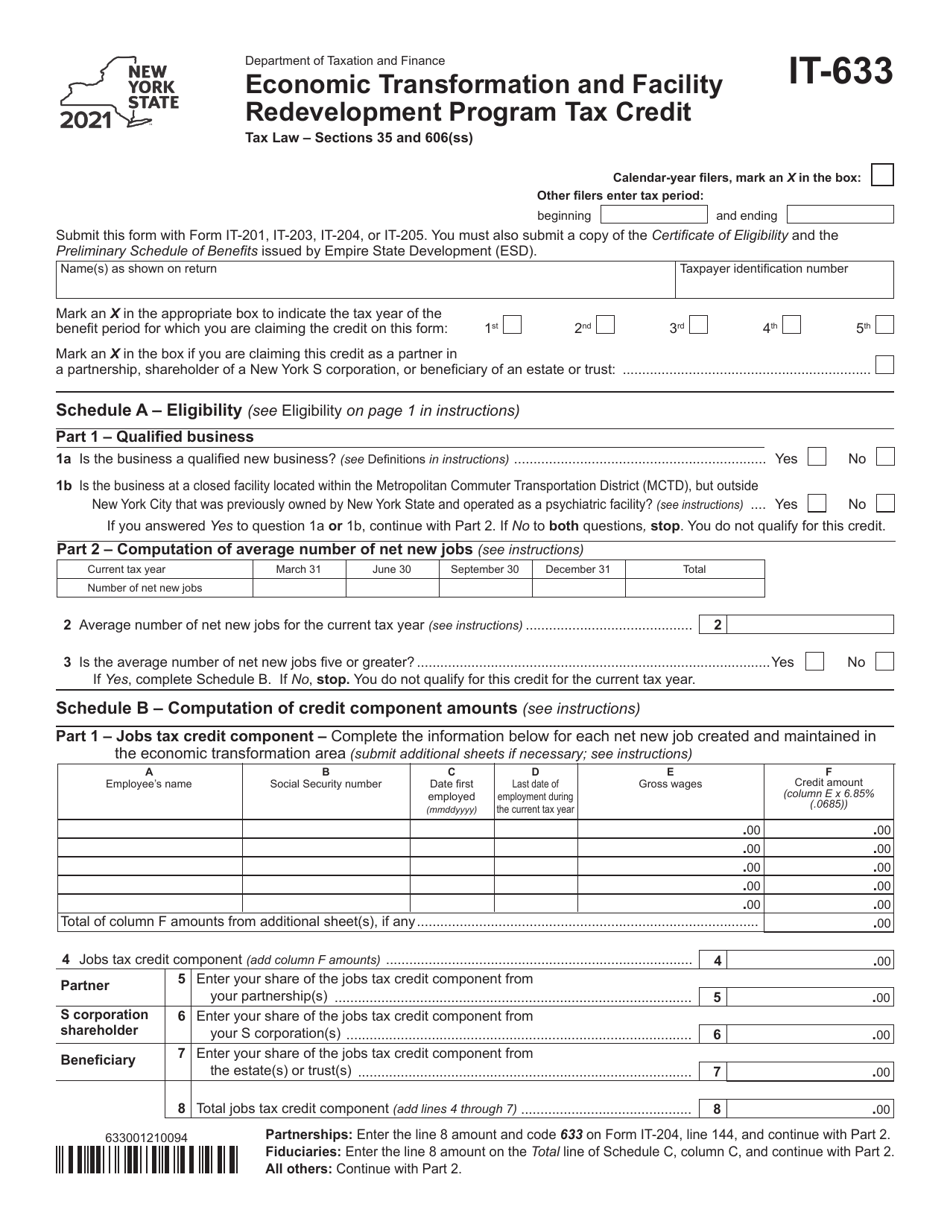

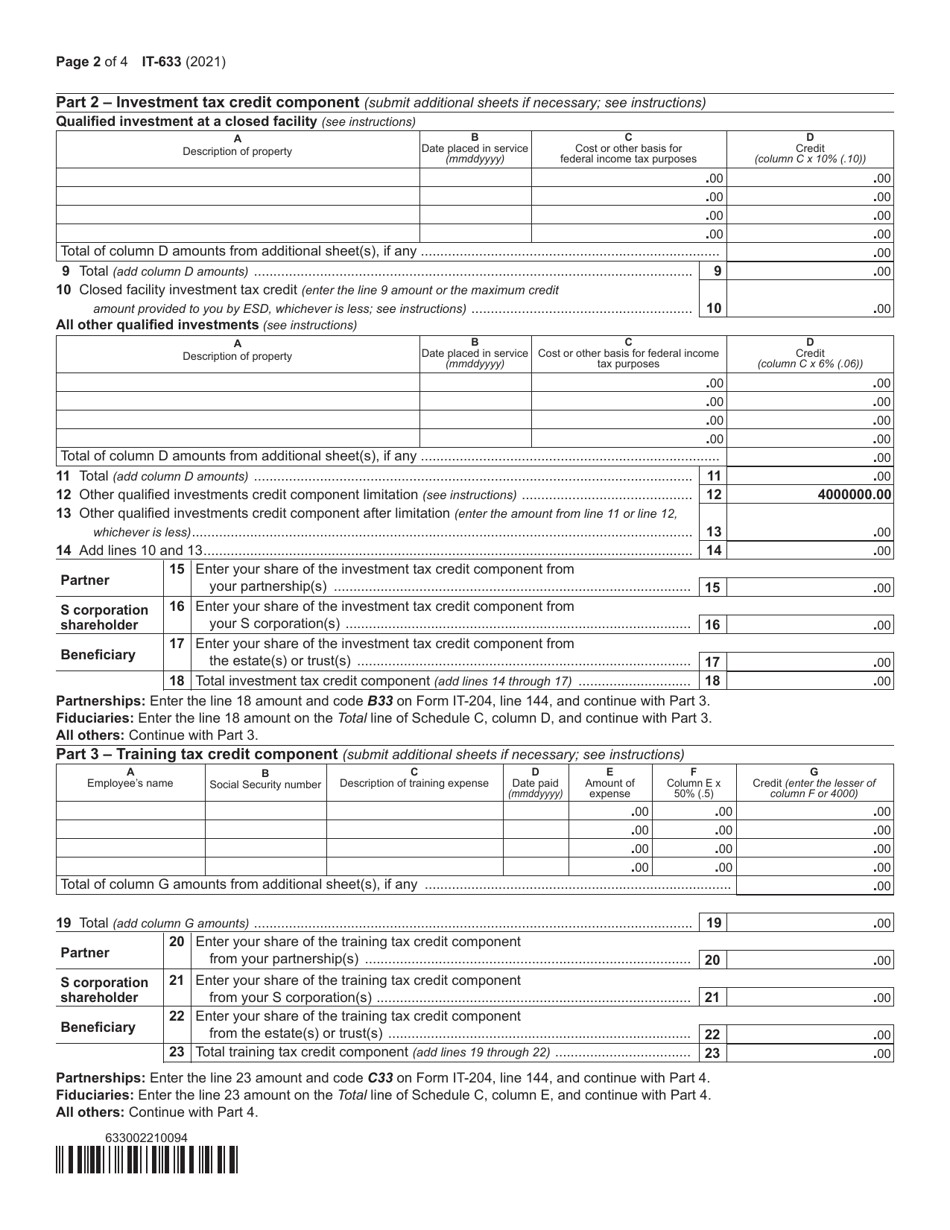

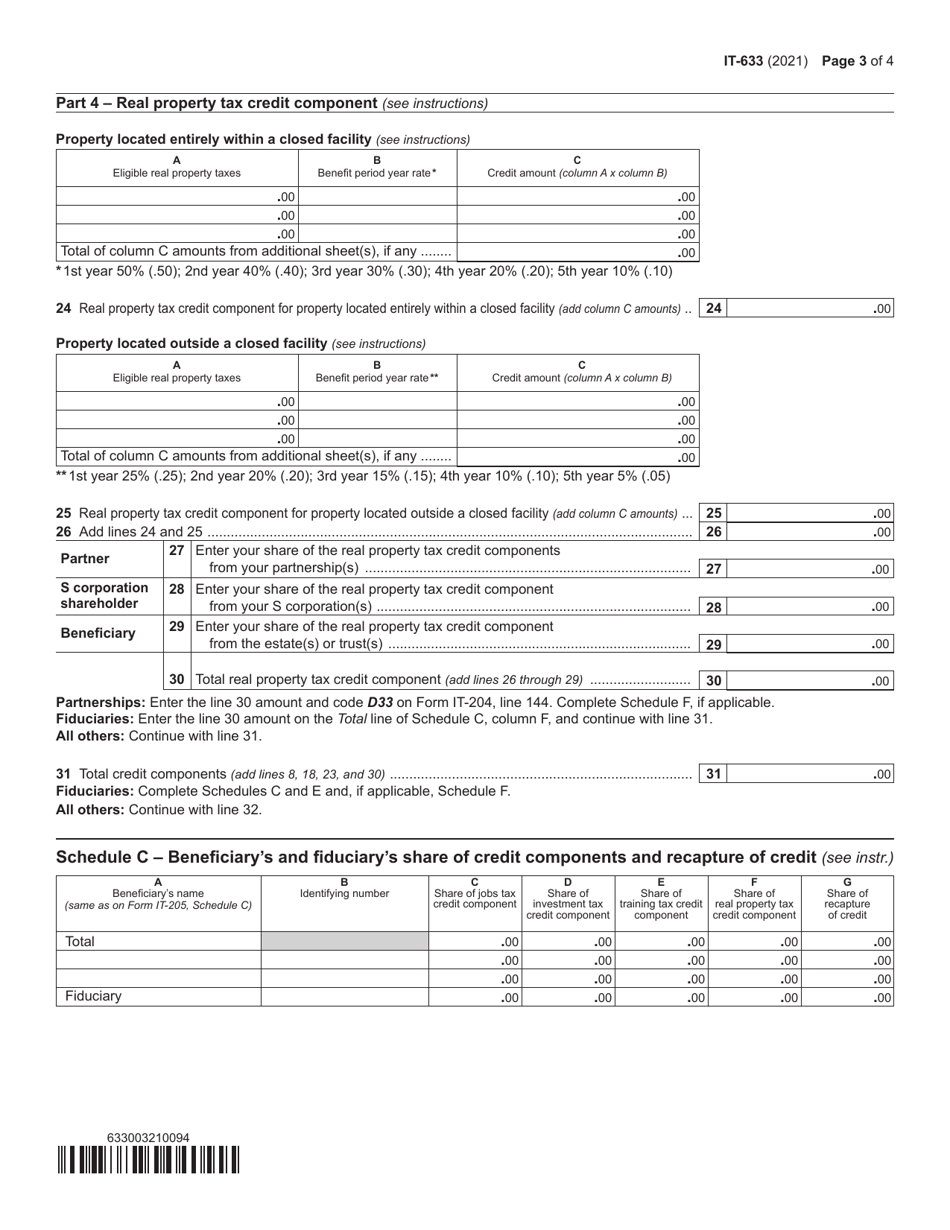

Q: How much is the ETFRP Tax Credit?

A: The amount of the ETFRP Tax Credit varies and is determined by the New York State Department of Economic Development based on the approved project.

Q: How do I apply for the ETFRP Tax Credit?

A: To apply for the ETFRP Tax Credit, you need to submit an application to the New York State Department of Economic Development and receive approval for your project.

Q: When is the deadline to submit Form IT-633?

A: The deadline to submit Form IT-633 is the same as the taxpayer's deadline for filing their New York State income tax return.

Q: What supporting documents are required for Form IT-633?

A: Supporting documents such as project plans, cost estimates, and evidence of project approval from the New York State Department of Economic Development may be required for Form IT-633.

Q: Can I claim the ETFRP Tax Credit if I am a sole proprietor?

A: Yes, sole proprietors are eligible to claim the ETFRP Tax Credit if they meet the eligibility requirements and have an approved project.

Q: Is the ETFRP Tax Credit refundable?

A: No, the ETFRP Tax Credit is not refundable. However, any unused credit may be carried forward for up to 15 years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.