This version of the form is not currently in use and is provided for reference only. Download this version of

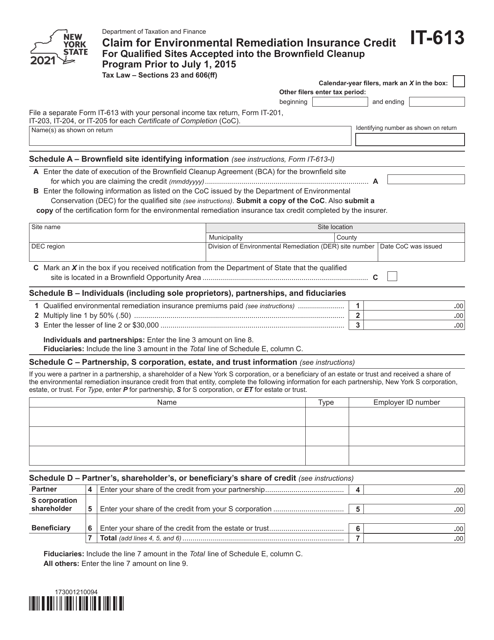

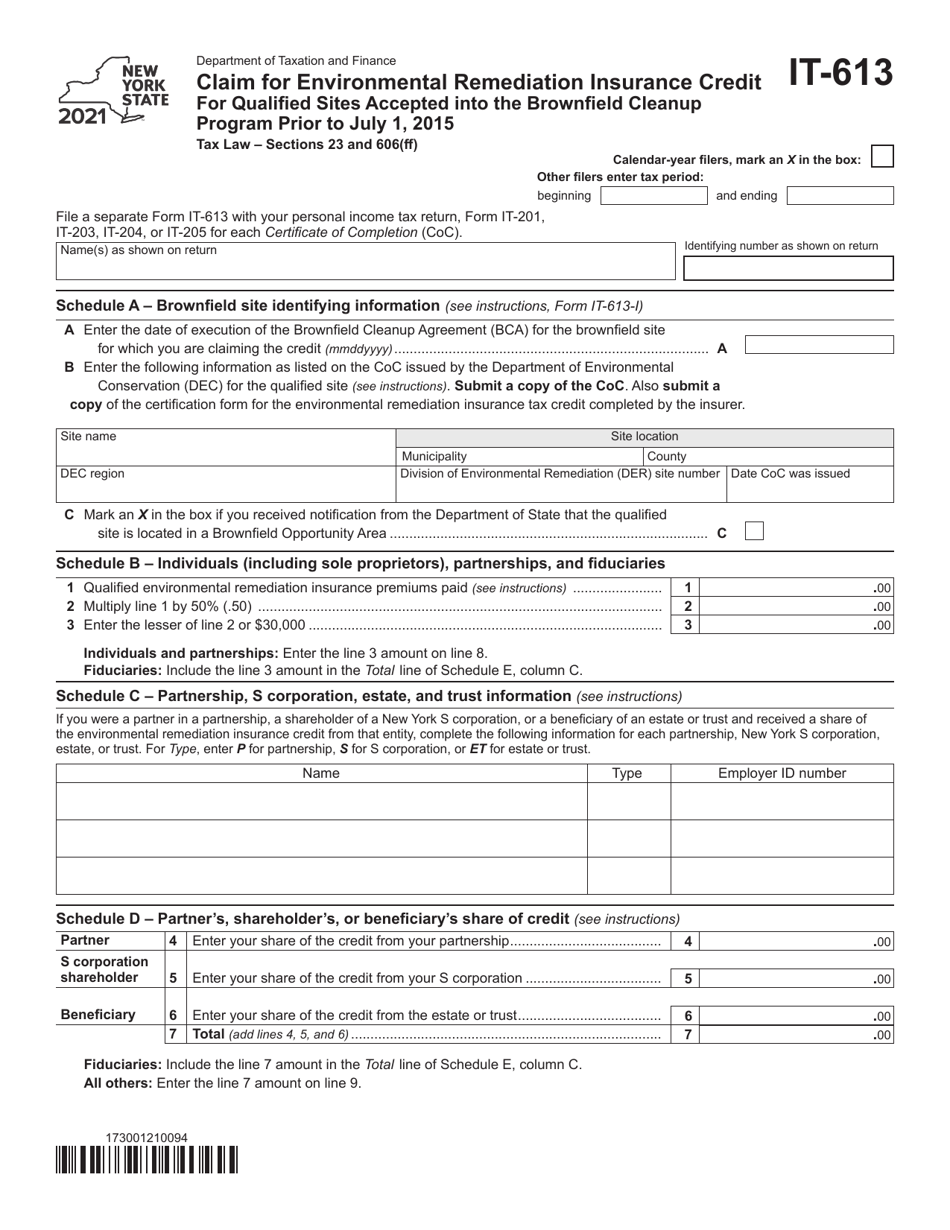

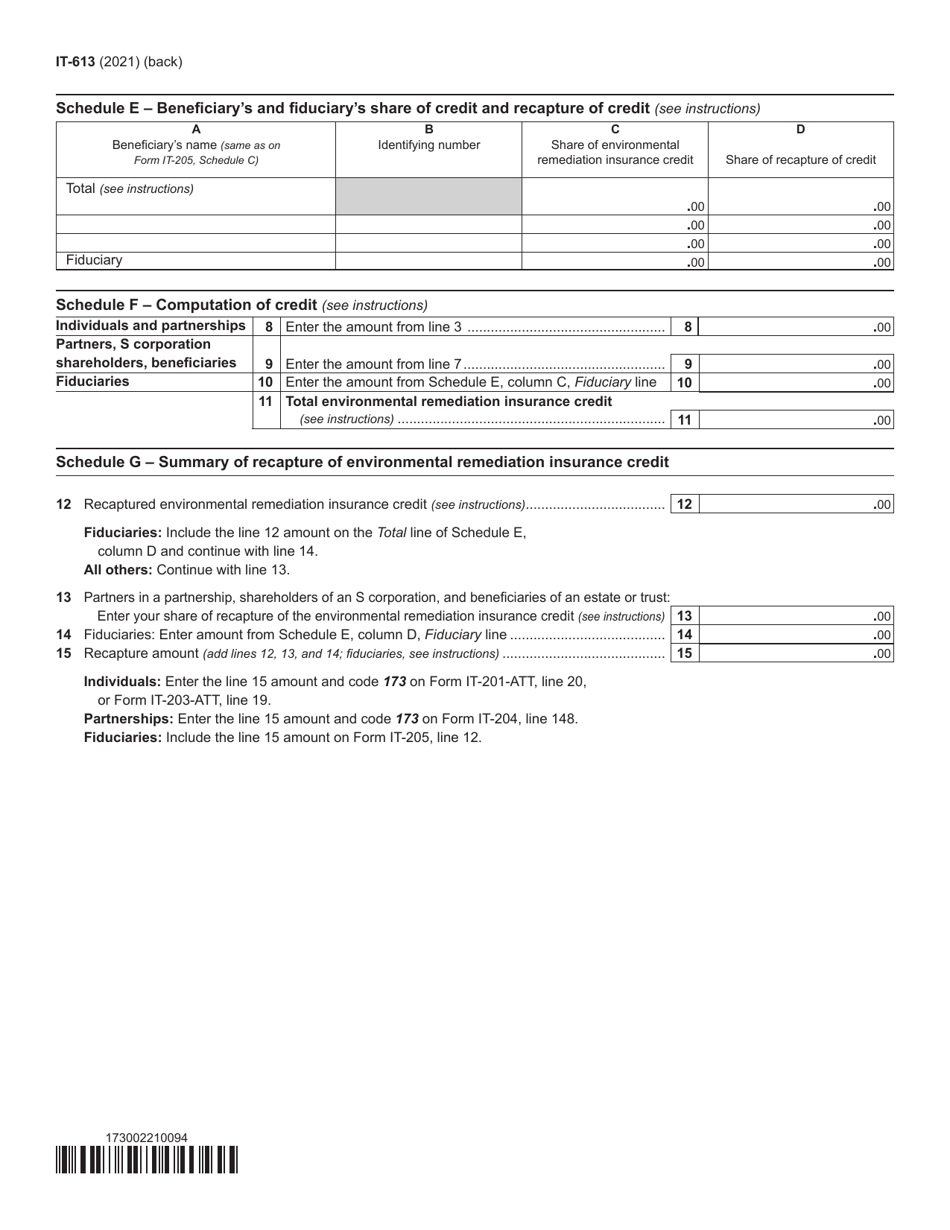

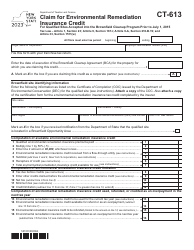

Form IT-613

for the current year.

Form IT-613 Claim for Environmental Remediation Insurance Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form IT-613?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the purpose of Form IT-613?

A: Form IT-613 is used to claim the Environmental RemediationInsurance Credit for Qualified Sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York.

Q: What is the Environmental Remediation Insurance Credit?

A: The Environmental Remediation Insurance Credit is a credit available to taxpayers who have qualified sites accepted into the Brownfield Cleanup Program in New York.

Q: Who is eligible to claim the credit?

A: Taxpayers who have qualified sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York are eligible to claim the credit.

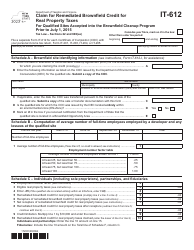

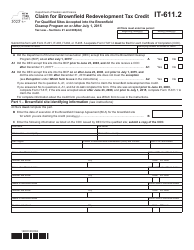

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that provides incentives for the cleanup and redevelopment of contaminated properties.

Q: What is the deadline for filing Form IT-613?

A: The deadline for filing Form IT-613 is generally the same as the deadline for filing your New York State tax return, which is April 15th.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions on the Environmental Remediation Insurance Credit. It is important to review the instructions and guidelines provided with Form IT-613 for more information.

Q: Can I claim the credit if my site was accepted into the Brownfield Cleanup Program after July 1, 2015?

A: No, Form IT-613 is specifically for sites accepted into the Brownfield Cleanup Program prior to July 1, 2015.

Q: What documentation do I need to include with Form IT-613?

A: You will generally need to include a copy of the acceptance letter from the Brownfield Cleanup Program and other supporting documentation as specified in the instructions for Form IT-613.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-613 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.