This version of the form is not currently in use and is provided for reference only. Download this version of

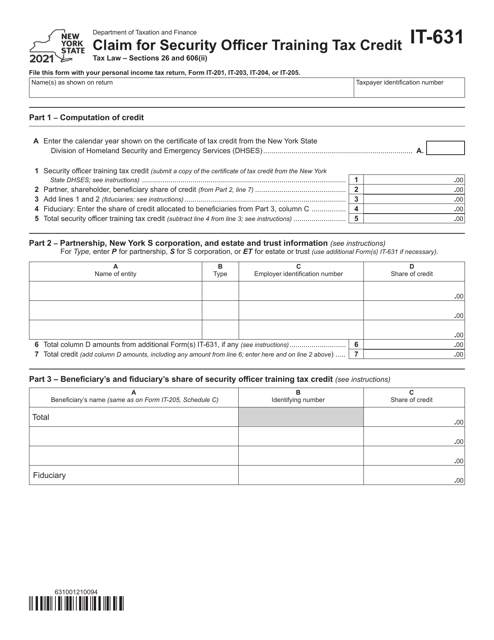

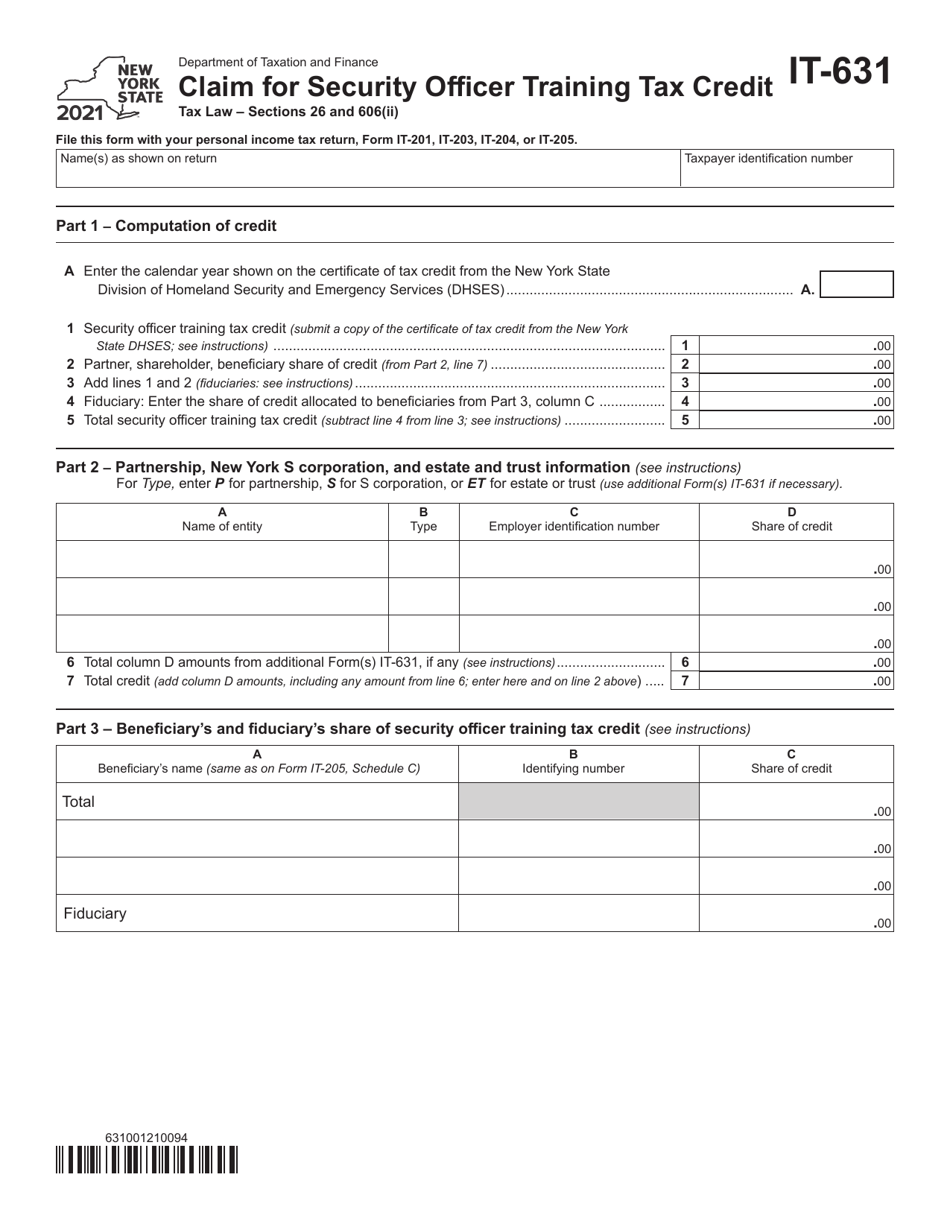

Form IT-631

for the current year.

Form IT-631 Claim for Security Officer Training Tax Credit - New York

What Is Form IT-631?

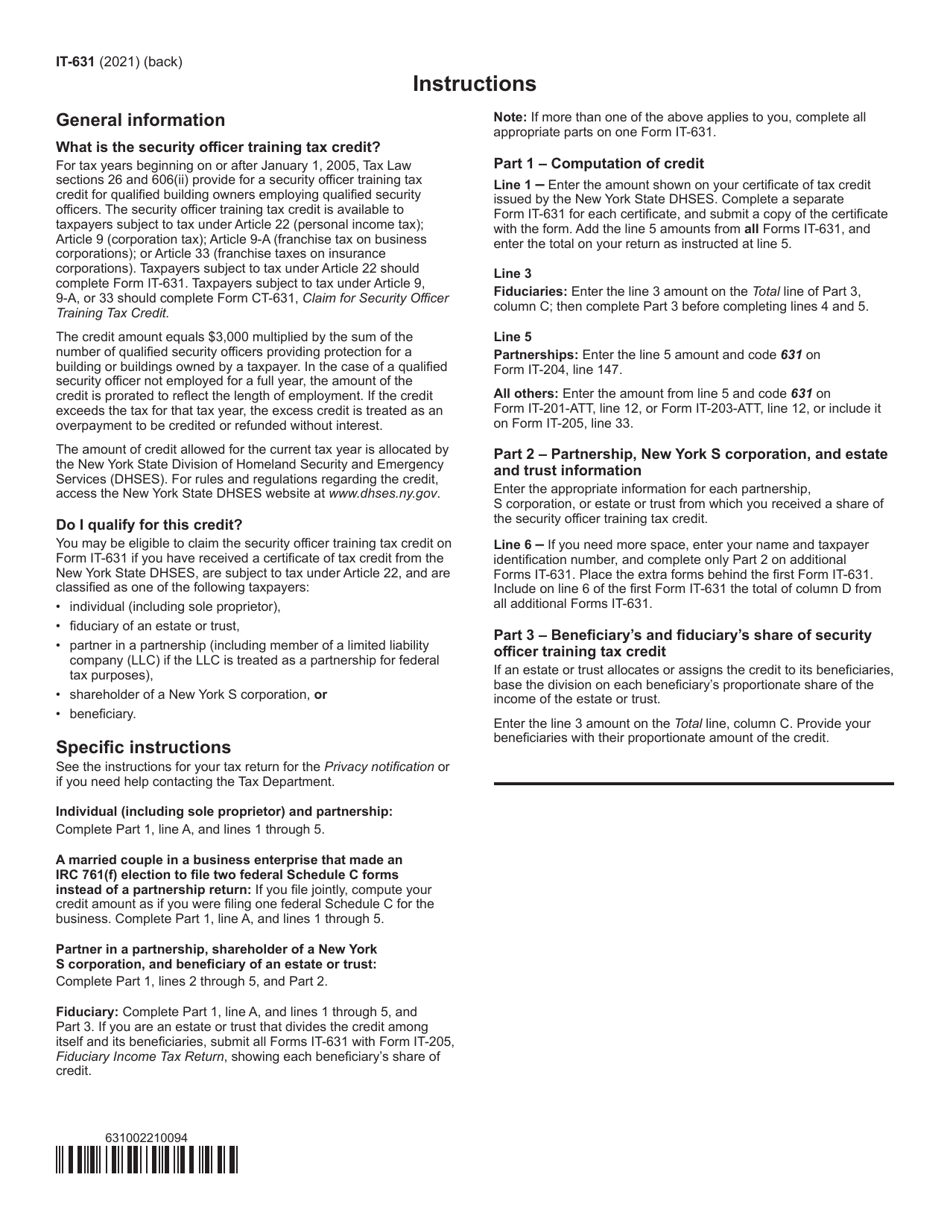

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-631?

A: Form IT-631 is the Claim for Security Officer Training Tax Credit in New York.

Q: What is the purpose of Form IT-631?

A: The purpose of Form IT-631 is to claim the security officer training tax credit in New York.

Q: Who can use Form IT-631?

A: Employers in New York who have incurred expenses for security officer training can use Form IT-631.

Q: What is the security officer training tax credit?

A: The security officer training tax credit is a tax incentive provided to employers in New York who have incurred expenses for security officer training.

Q: What expenses qualify for the security officer training tax credit?

A: Expenses for training conducted by certified security guard training schools or organizations authorized by New York State Division of Criminal Justice Services qualify for the tax credit.

Q: How much is the security officer training tax credit?

A: The tax credit is equal to 50% of eligible training expenses, up to a maximum credit of $350 per trainee.

Q: What is the deadline for filing Form IT-631?

A: Form IT-631 must be filed within three years from the end of the calendar year in which the eligible training expenses were incurred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-631 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.