This version of the form is not currently in use and is provided for reference only. Download this version of

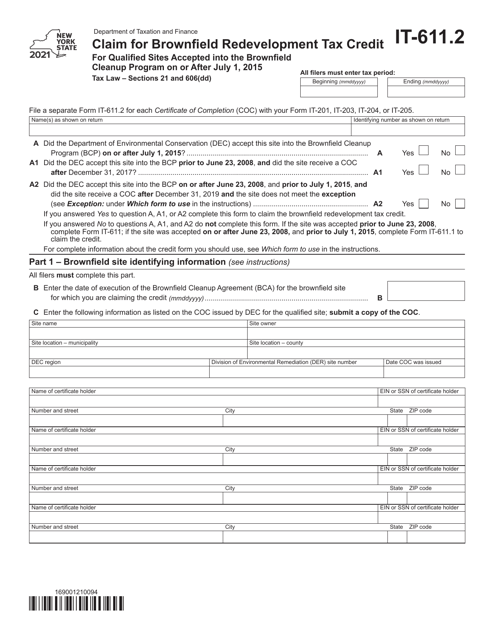

Form IT-611.2

for the current year.

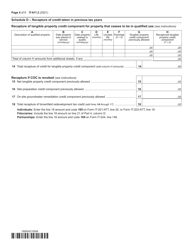

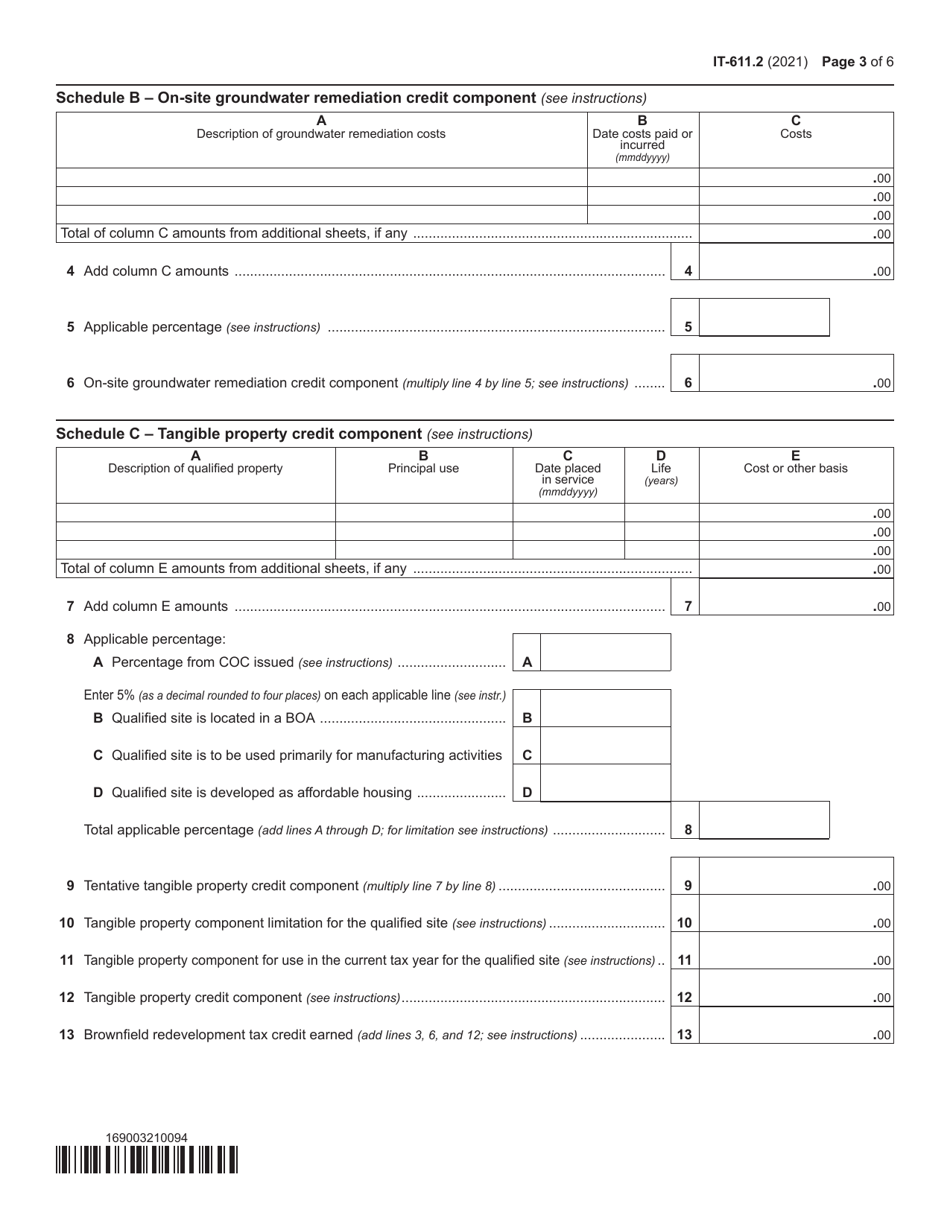

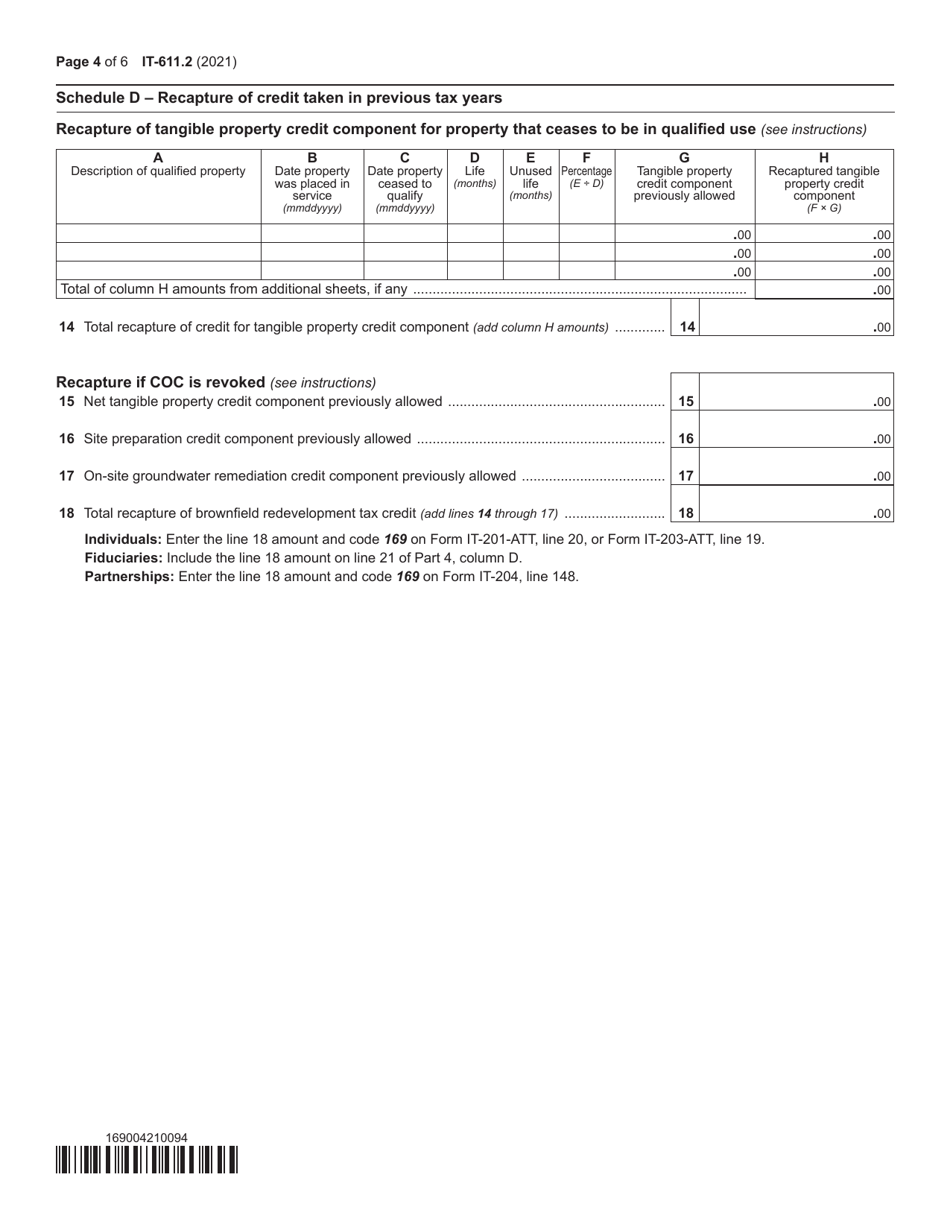

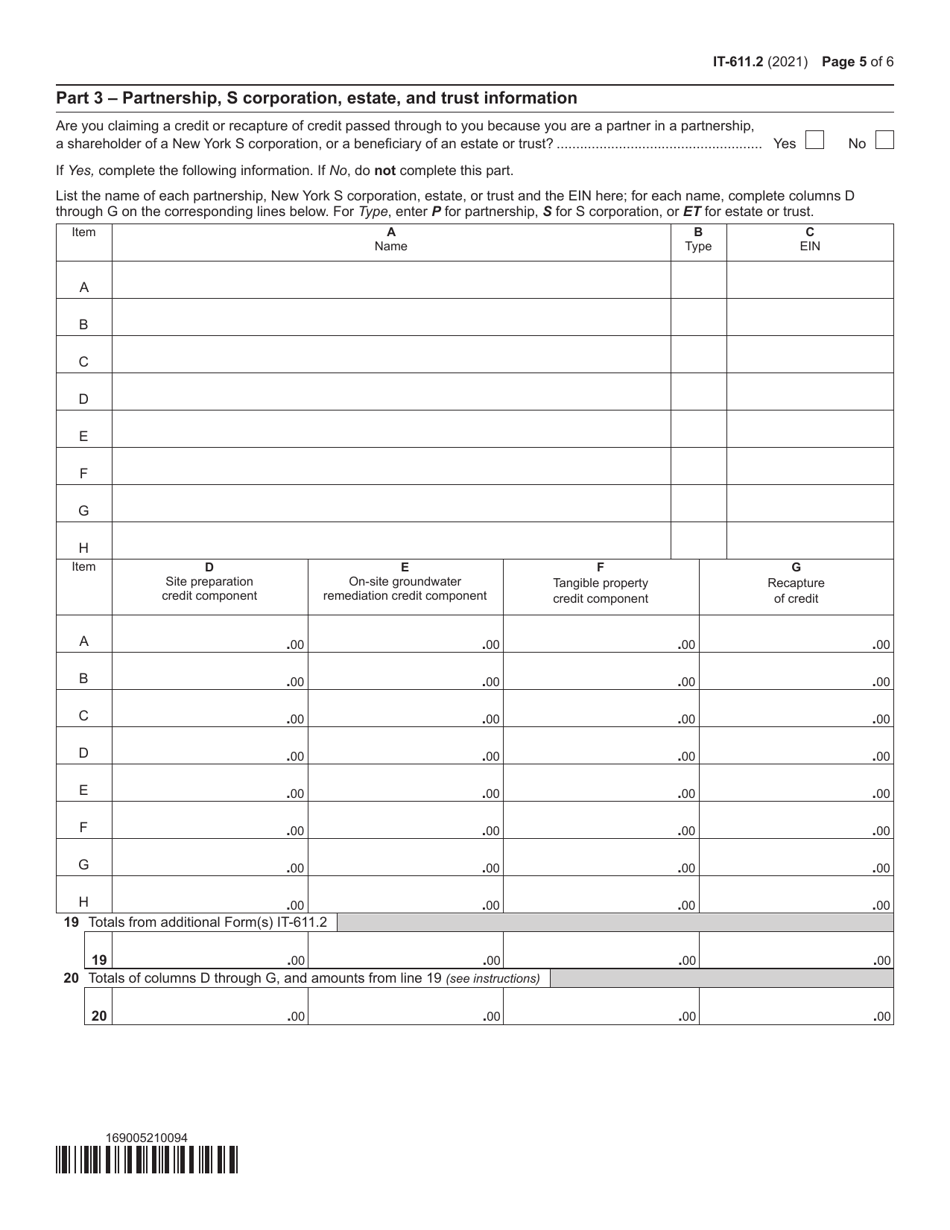

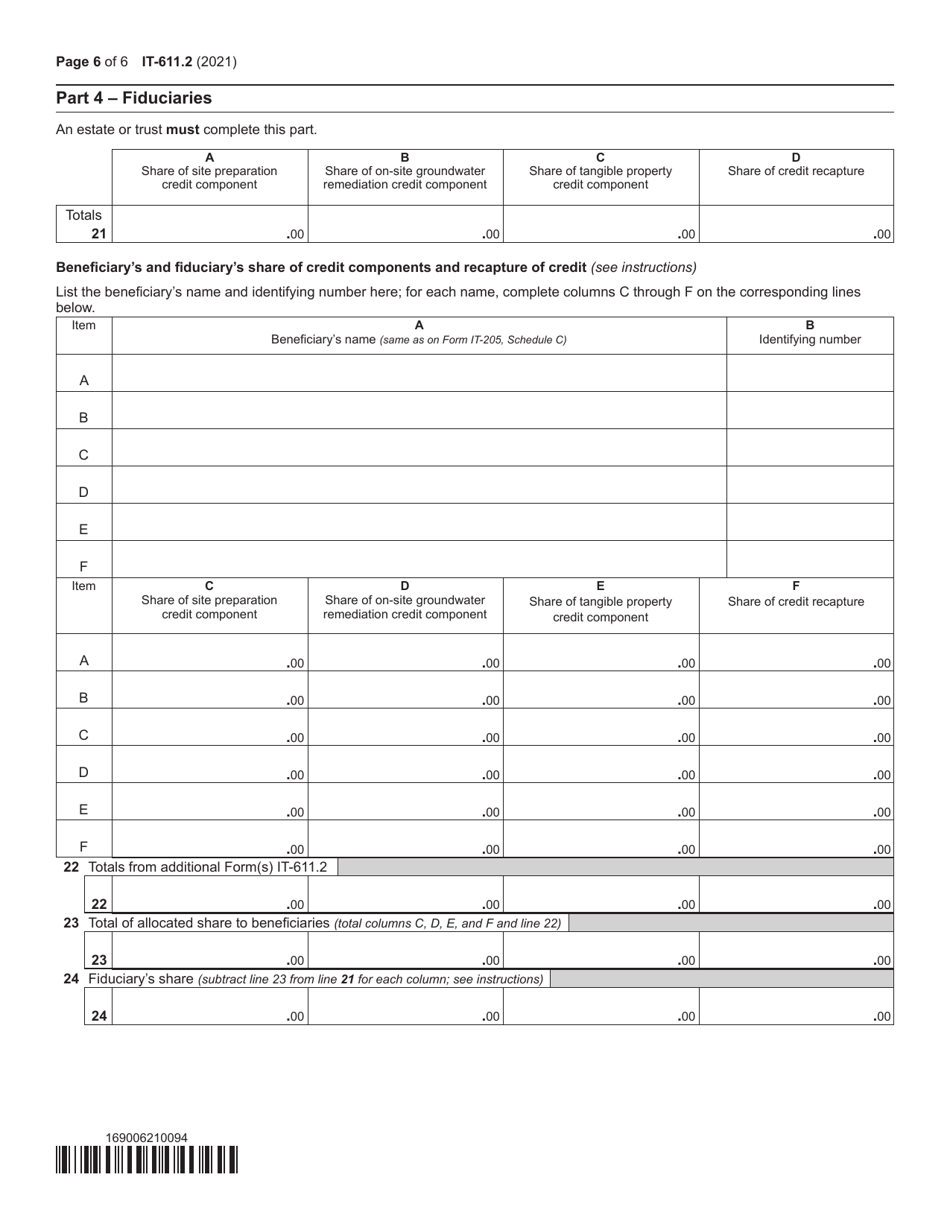

Form IT-611.2 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 - New York

What Is Form IT-611.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-611.2?

A: Form IT-611.2 is a form used to claim the Brownfield RedevelopmentTax Credit for Qualified Sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax incentive provided by New York State to encourage the remediation and redevelopment of brownfield sites.

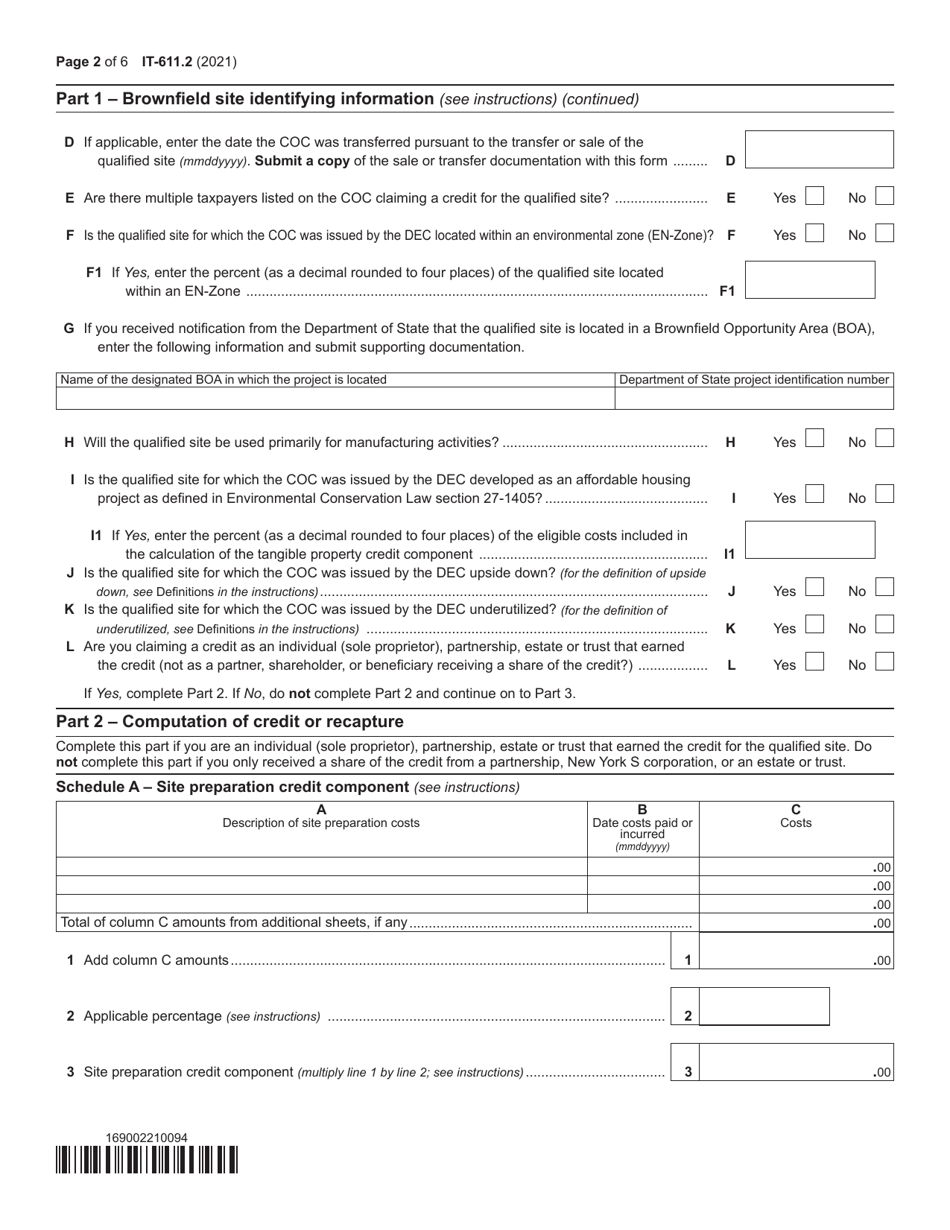

Q: Who can claim the Brownfield Redevelopment Tax Credit?

A: Individuals and businesses that have qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in New York can claim the Brownfield Redevelopment Tax Credit.

Q: What is the purpose of the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is designed to encourage the cleanup and redevelopment of contaminated properties, known as brownfield sites, in New York State.

Q: What are qualified sites under the Brownfield Cleanup Program?

A: Qualified sites under the Brownfield Cleanup Program are contaminated properties that have been accepted into the program for remediation and redevelopment.

Q: What is the deadline to file Form IT-611.2?

A: The deadline to file Form IT-611.2 to claim the Brownfield Redevelopment Tax Credit is generally the same as the deadline to file your New York State income tax return.

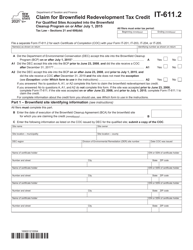

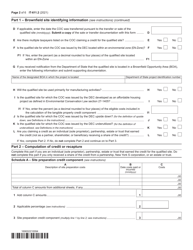

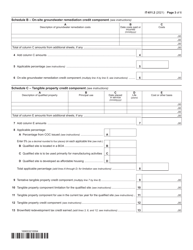

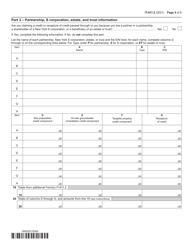

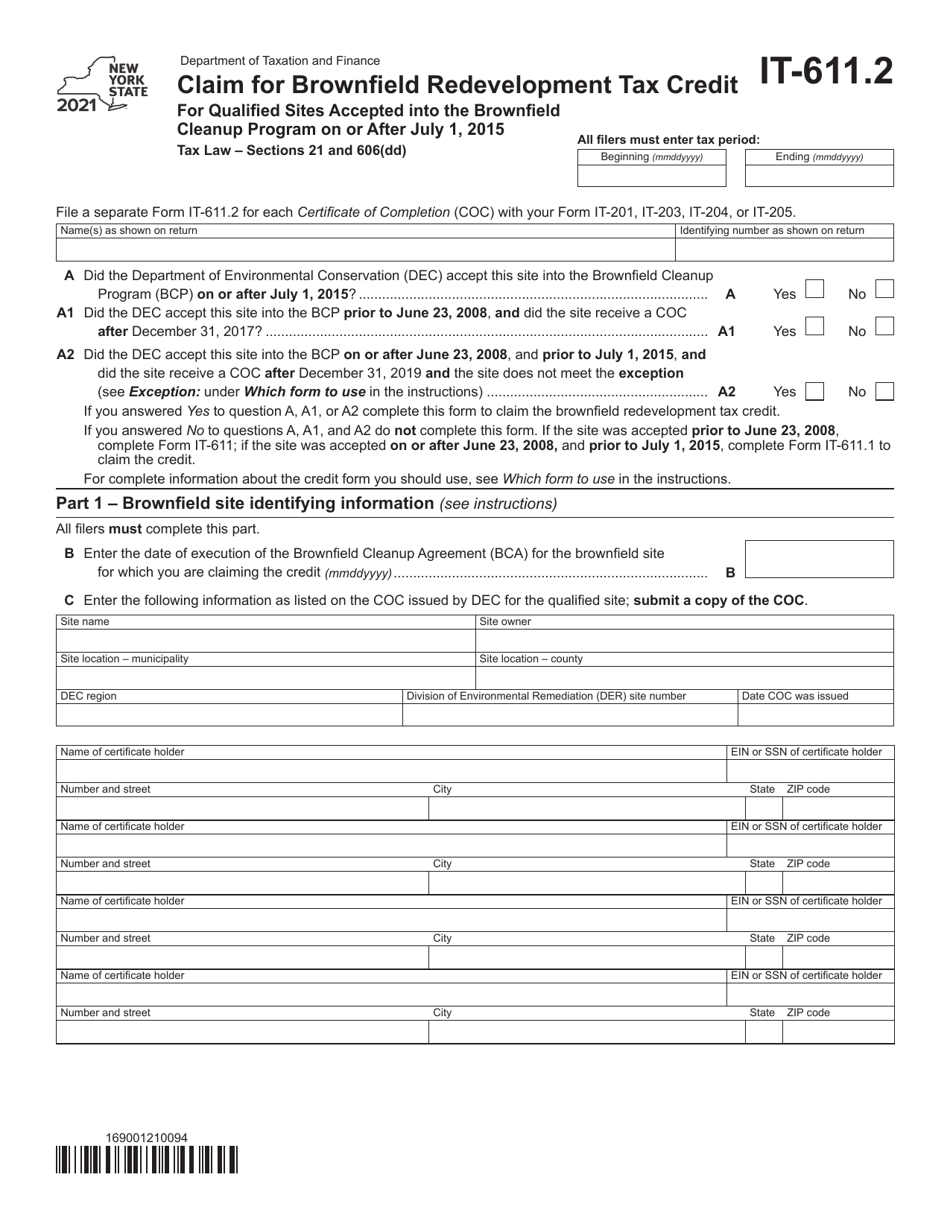

Q: What expenses can be claimed for the Brownfield Redevelopment Tax Credit?

A: Eligible expenses for the Brownfield Redevelopment Tax Credit include costs incurred for environmental remediation, site preparation, and infrastructure improvements.

Q: How much is the Brownfield Redevelopment Tax Credit?

A: The amount of the Brownfield Redevelopment Tax Credit varies depending on the eligible expenses incurred and the type of project.

Q: Can the Brownfield Redevelopment Tax Credit be carried forward?

A: Yes, any unused portion of the Brownfield Redevelopment Tax Credit can be carried forward for up to 15 years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-611.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.