This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-612

for the current year.

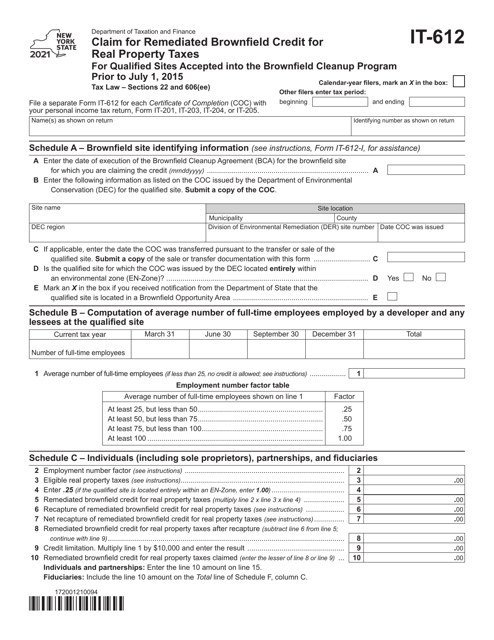

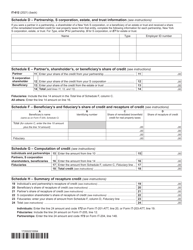

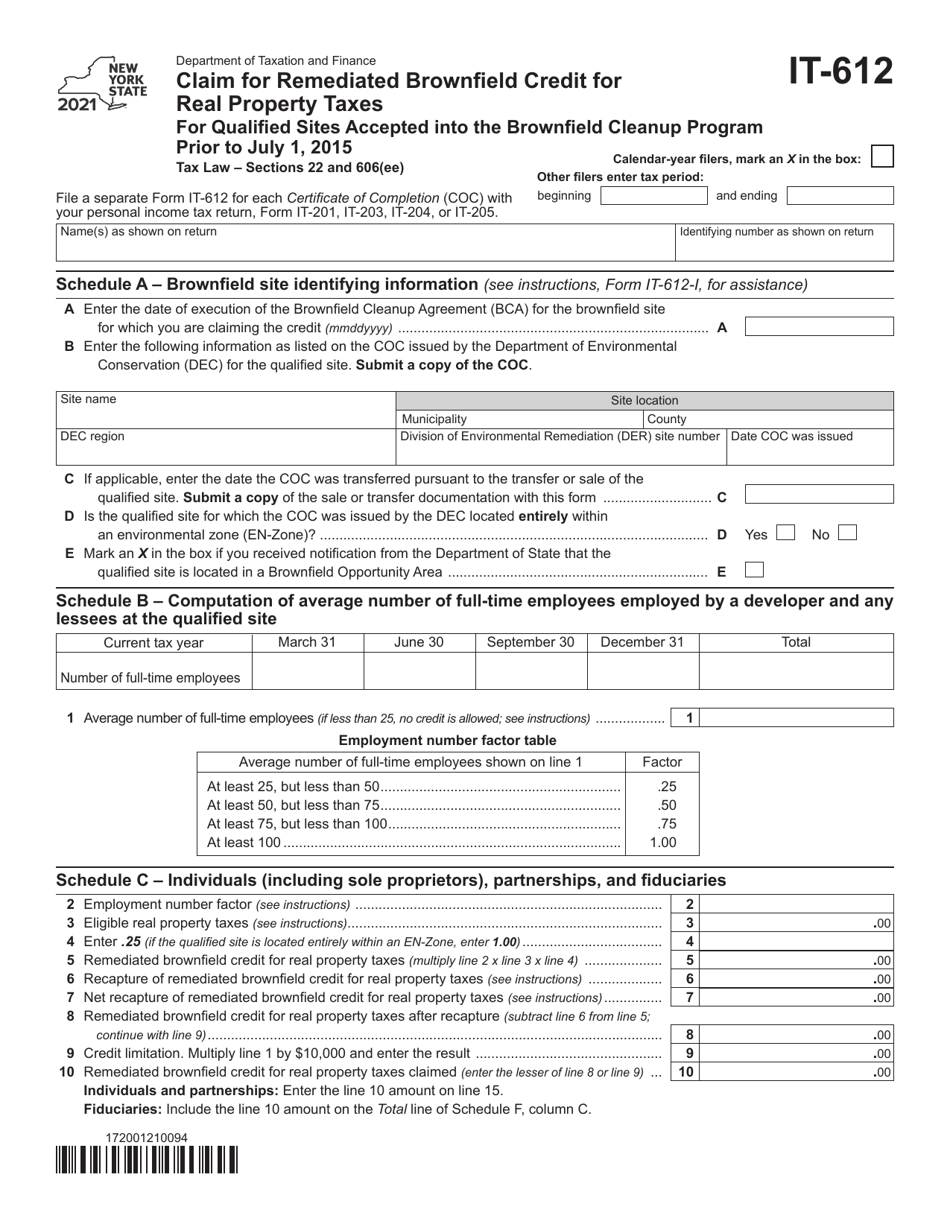

Form IT-612 Claim for Remediated Brownfield Credit for Real Property Taxes for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form IT-612?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-612?

A: Form IT-612 is a document used to claim the Remediated Brownfield Credit for Real Property Taxes in New York.

Q: Who can use Form IT-612?

A: This form can be used by individuals and businesses who have qualified sites accepted into the Brownfield Cleanup Program in New York.

Q: What is the purpose of the Remediated Brownfield Credit?

A: The purpose of the Remediated Brownfield Credit is to provide tax relief for the remediation and redevelopment of brownfield sites.

Q: What is the deadline for filing Form IT-612?

A: Form IT-612 must be filed on or before the fifteenth day of the fourth month following the close of the taxable year.

Q: What information is required on Form IT-612?

A: The form requires information about the property, the tax credit being claimed, and details of the brownfield cleanup program acceptance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-612 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.