This version of the form is not currently in use and is provided for reference only. Download this version of

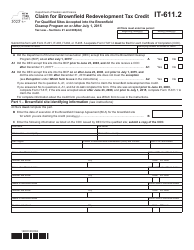

Instructions for Form IT-611.1

for the current year.

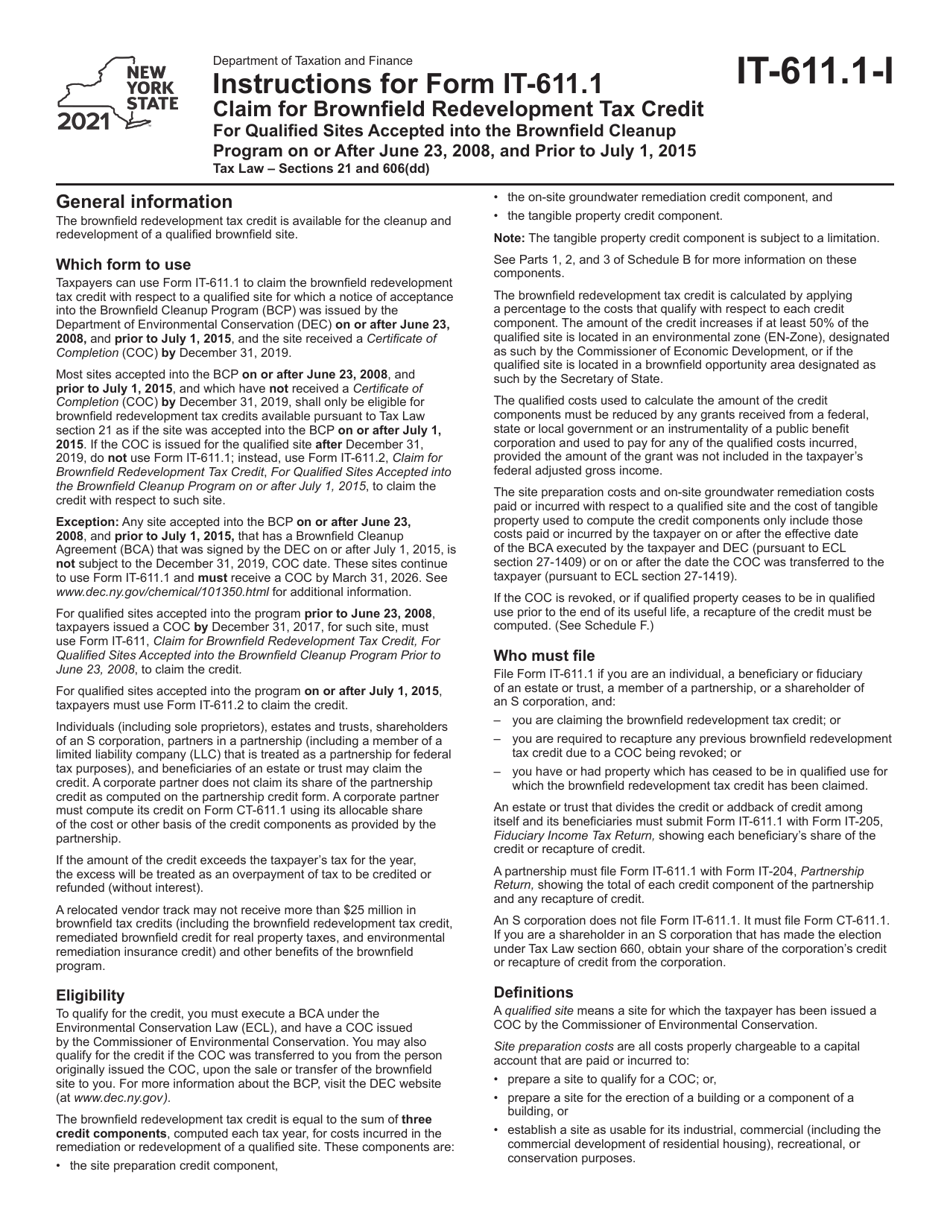

Instructions for Form IT-611.1 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After June 23, 2008, and Prior to July 1, 2015 - New York

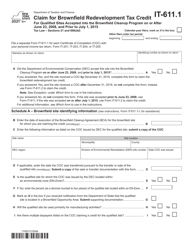

This document contains official instructions for Form IT-611.1 , Claim for Brownfield Cleanup Program on or After June 23, 2008, and Prior to July 1, 2015 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-611.1 is available for download through this link.

FAQ

Q: What is Form IT-611.1?

A: Form IT-611.1 is a form used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program.

Q: Who can use Form IT-611.1?

A: Form IT-611.1 can be used by taxpayers who have qualified sites accepted into the Brownfield Cleanup Program in New York.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax credit available to taxpayers who remediate and redevelop contaminated properties in New York State.

Q: What is the purpose of the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is designed to encourage the cleanup and redevelopment of contaminated properties in New York.

Q: What is the eligibility period for claiming the Brownfield Redevelopment Tax Credit?

A: The eligibility period for claiming the Brownfield Redevelopment Tax Credit is for qualified sites accepted into the Brownfield Cleanup Program on or after June 23, 2008, and prior to July 1, 2015.

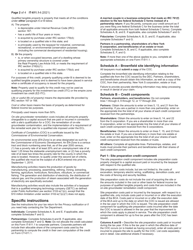

Q: How do I fill out Form IT-611.1?

A: You need to provide the required information on Form IT-611.1, including details about the qualified site, the costs incurred for remediation and redevelopment, and other relevant information.

Q: Is there a deadline for filing Form IT-611.1?

A: Yes, there is a deadline for filing Form IT-611.1. The specific deadline can be found on the form or by contacting the New York State Department of Taxation and Finance.

Q: How long does it take to receive the Brownfield Redevelopment Tax Credit?

A: The processing time for the Brownfield Redevelopment Tax Credit varies, but it typically takes several weeks to several months to receive the credit.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.