This version of the form is not currently in use and is provided for reference only. Download this version of

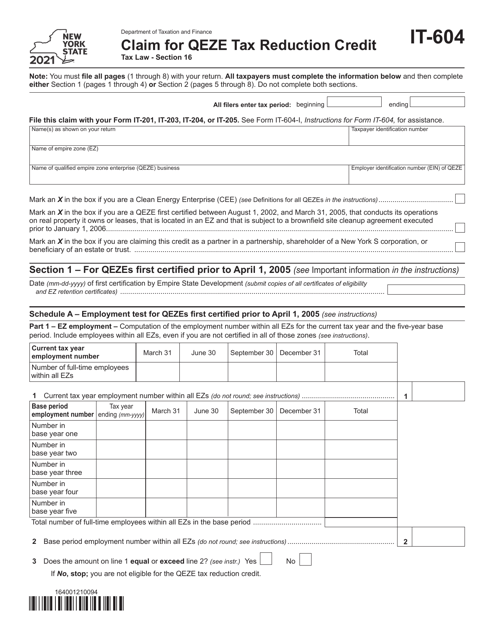

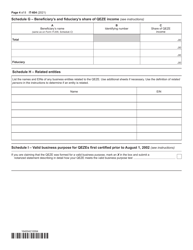

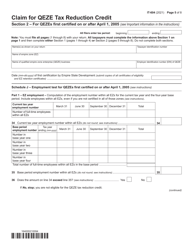

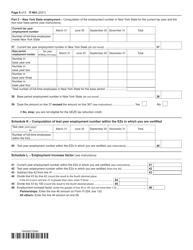

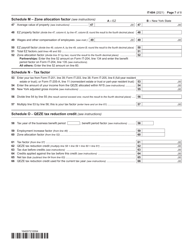

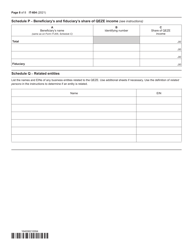

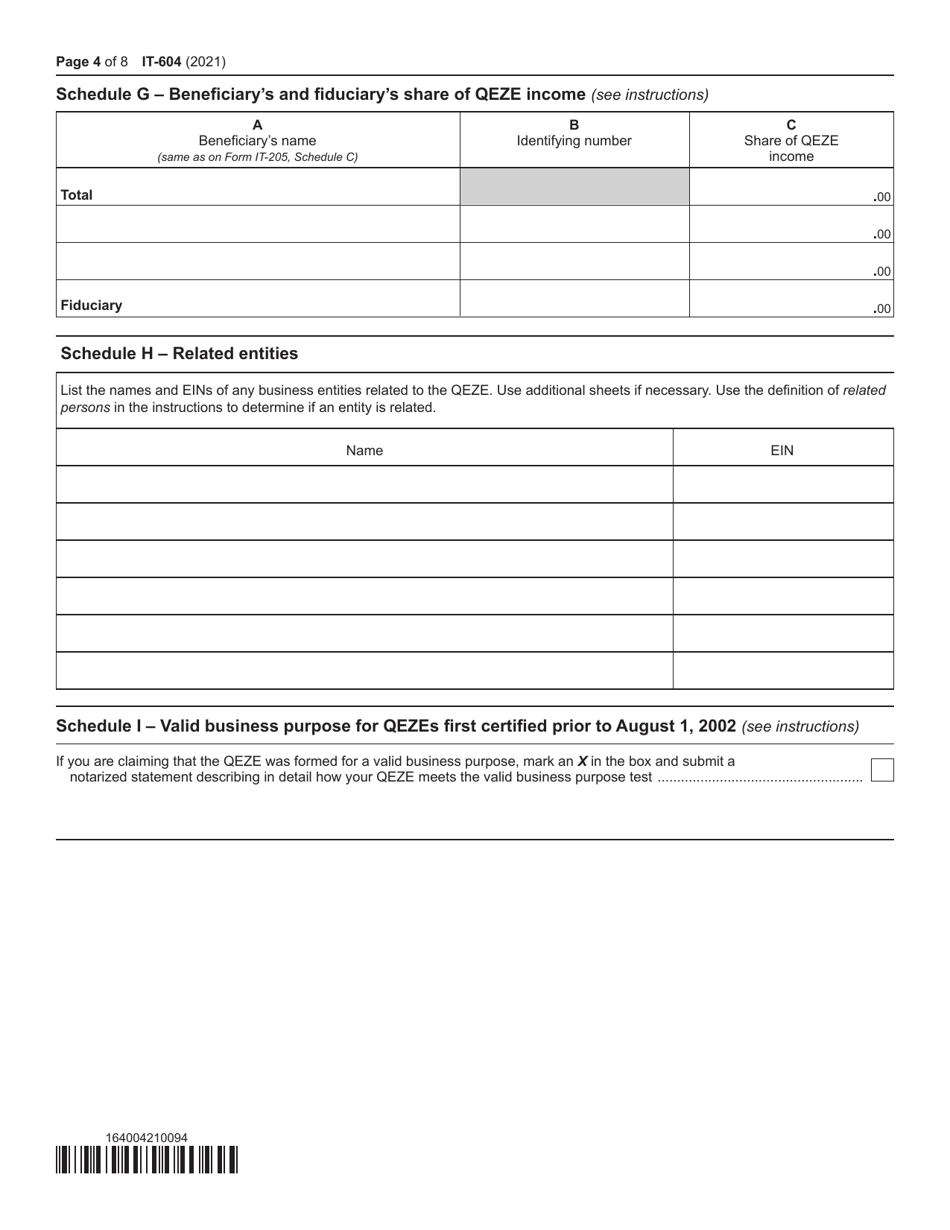

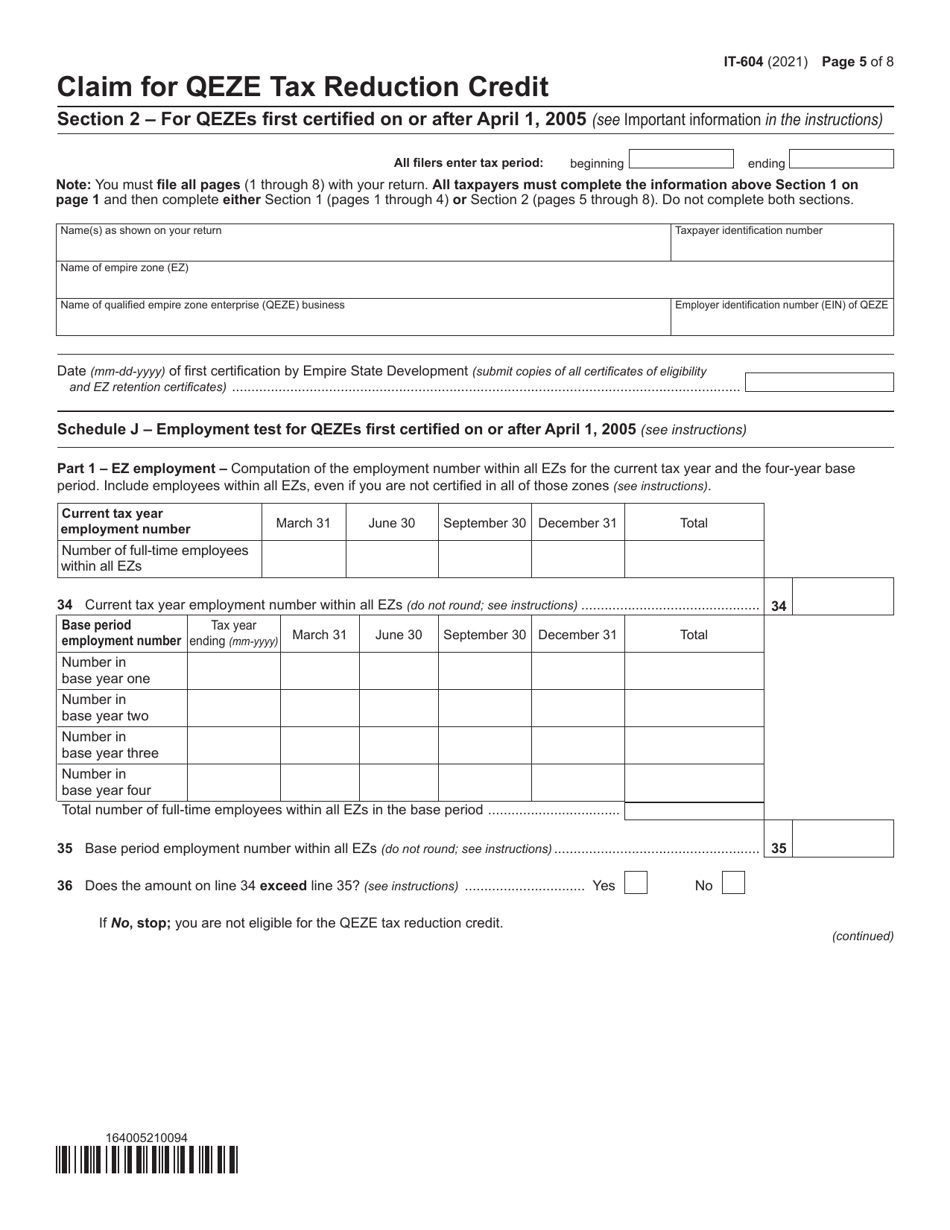

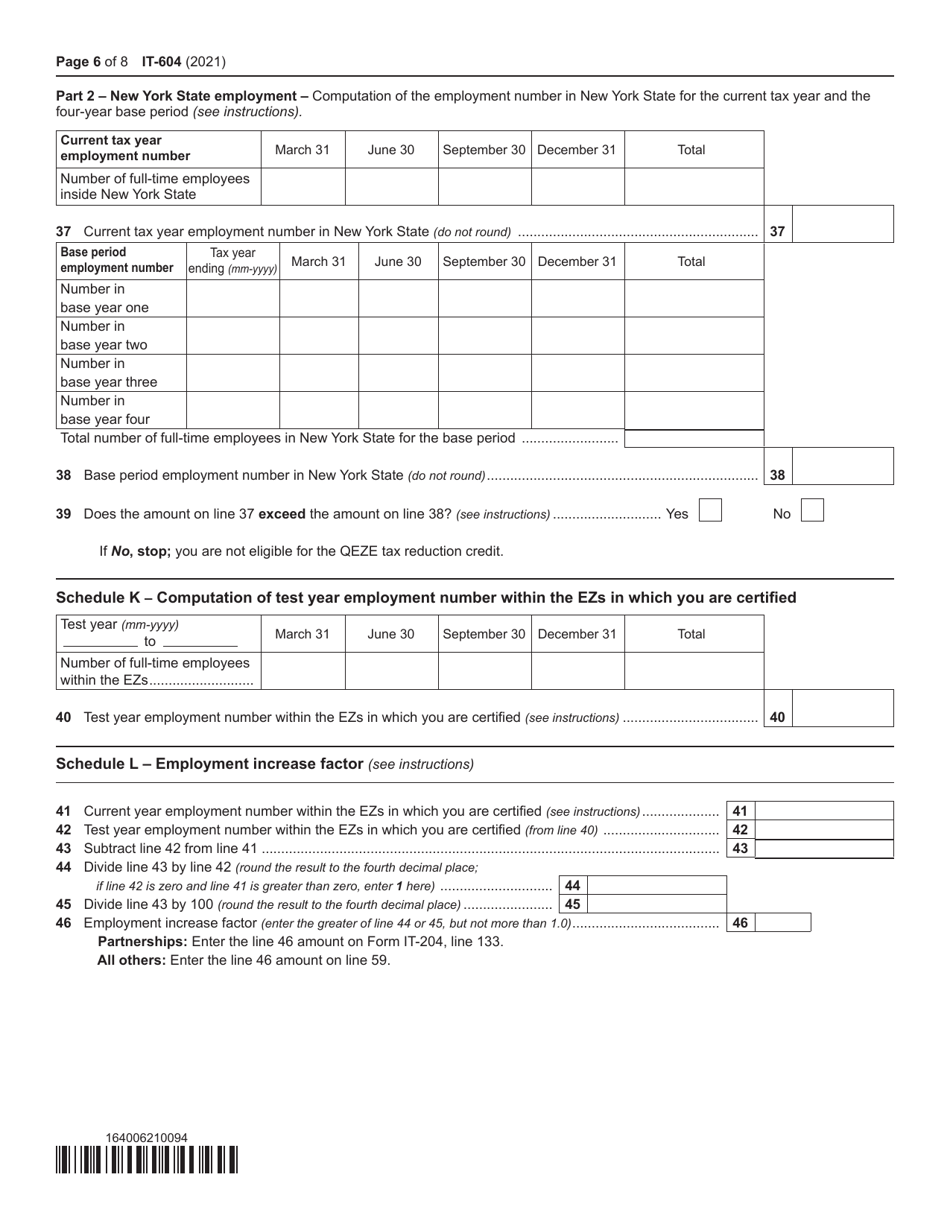

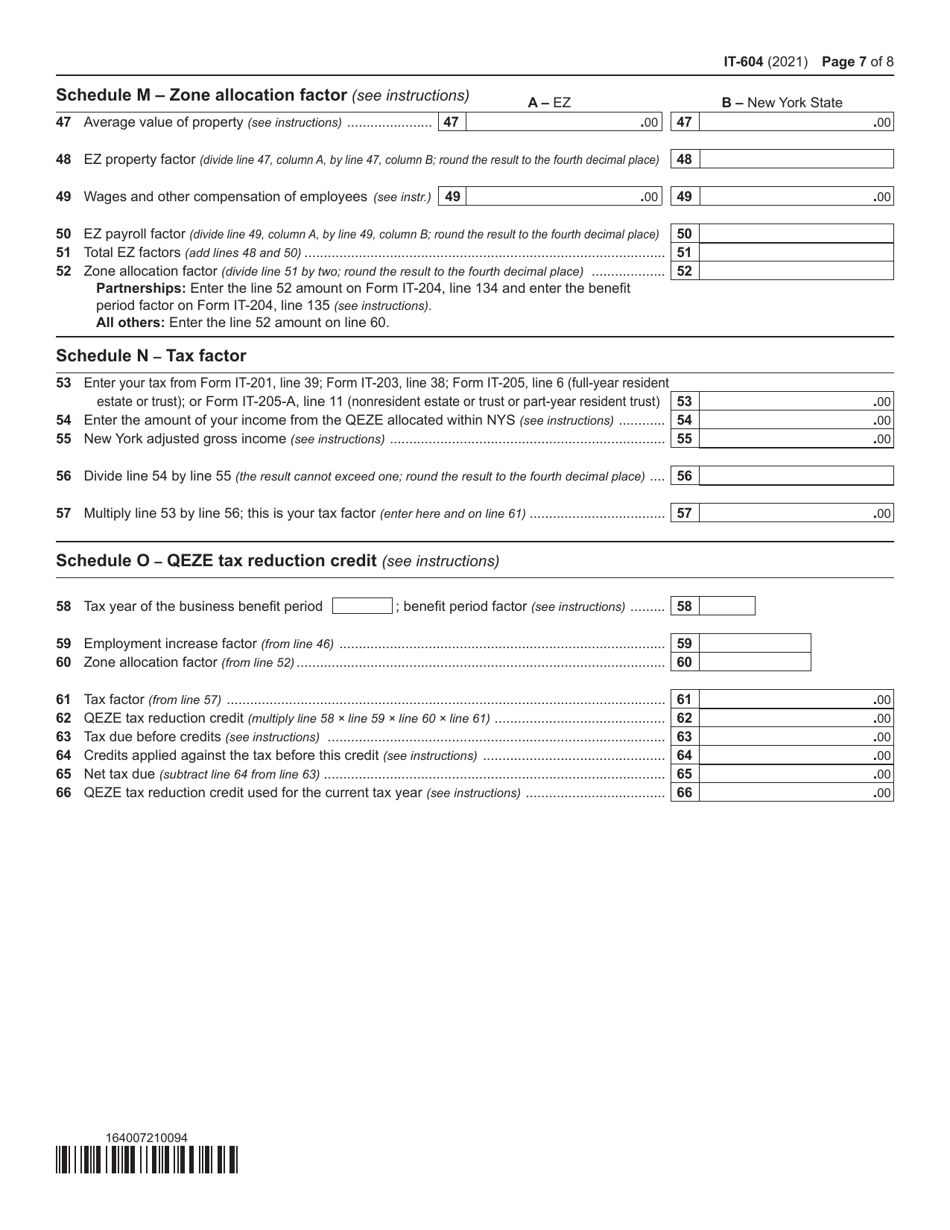

Form IT-604

for the current year.

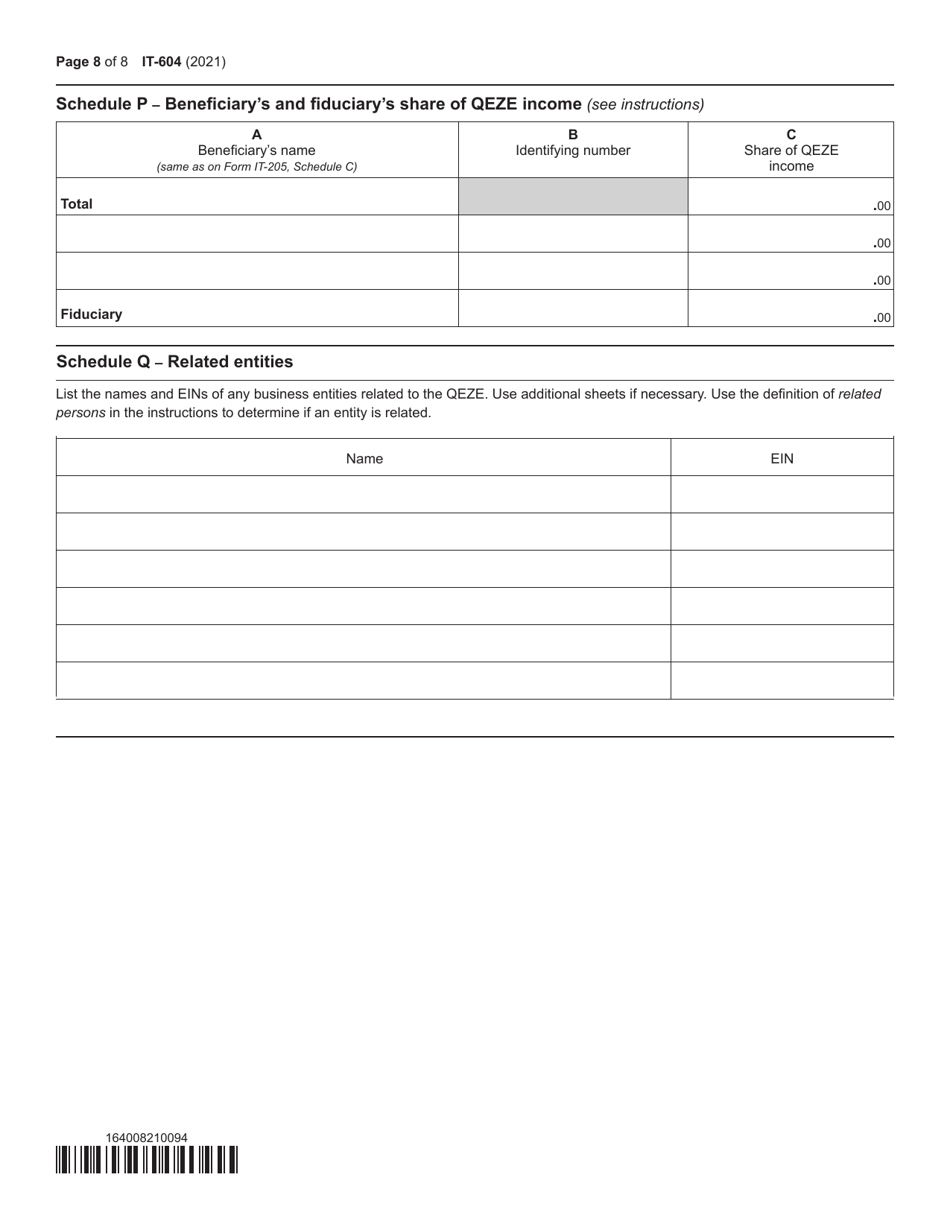

Form IT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form IT-604?

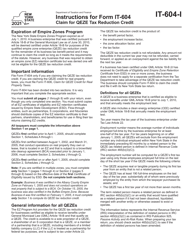

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-604?

A: Form IT-604 is a form used to claim the Qualified Emerging Technology Company (QETC) Tax Reduction Credit in the state of New York.

Q: What is the Qualified Emerging Technology Company (QETC) Tax Reduction Credit?

A: The QETC Tax Reduction Credit is a tax credit available to qualified emerging technology companies in New York, which provides a reduction in corporate franchise taxes.

Q: Who is eligible to claim the QETC Tax Reduction Credit?

A: Qualified emerging technology companies that meet the eligibility criteria outlined by the New York State Department of Taxation and Finance are eligible to claim the QETC Tax Reduction Credit.

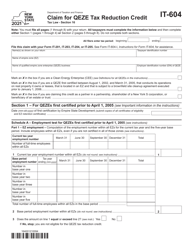

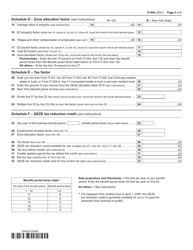

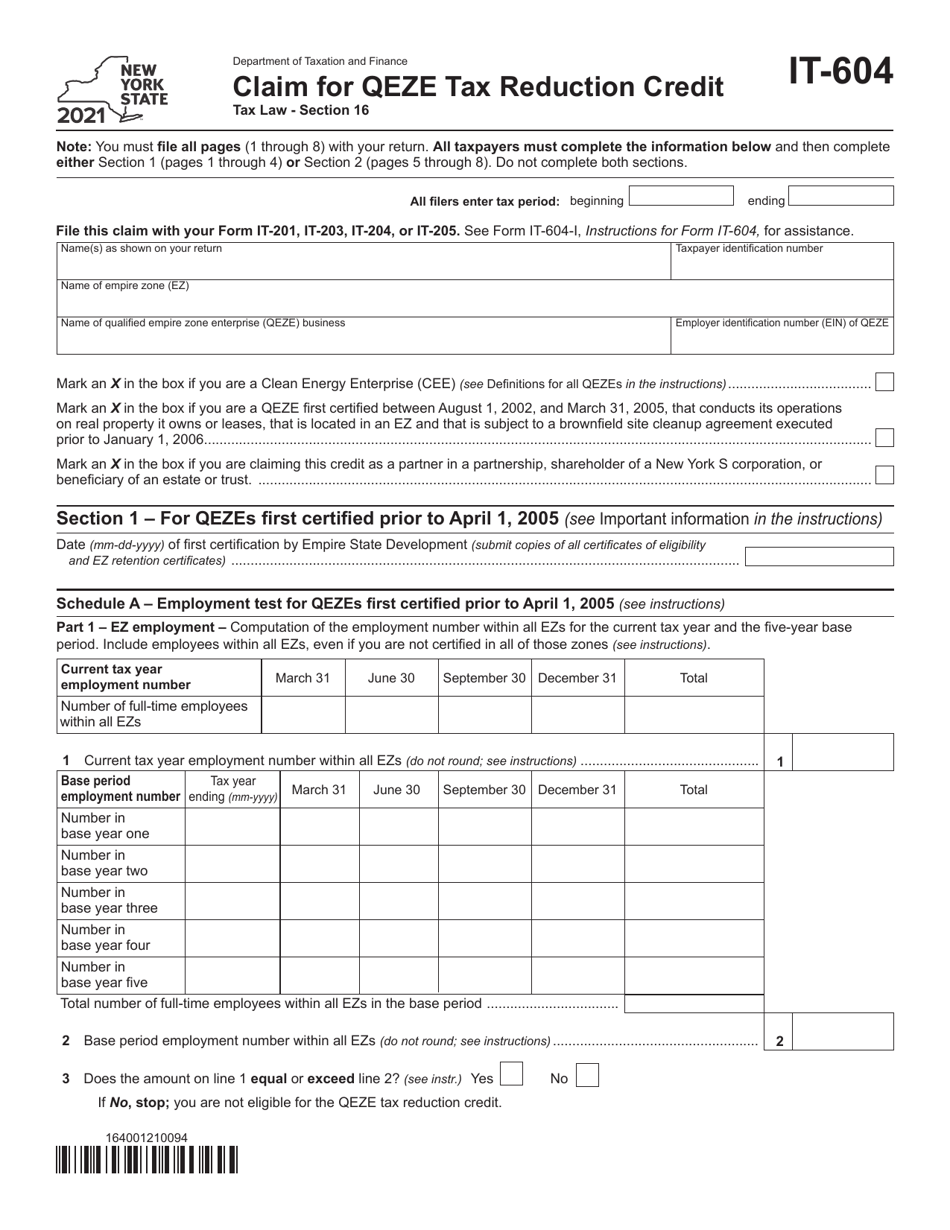

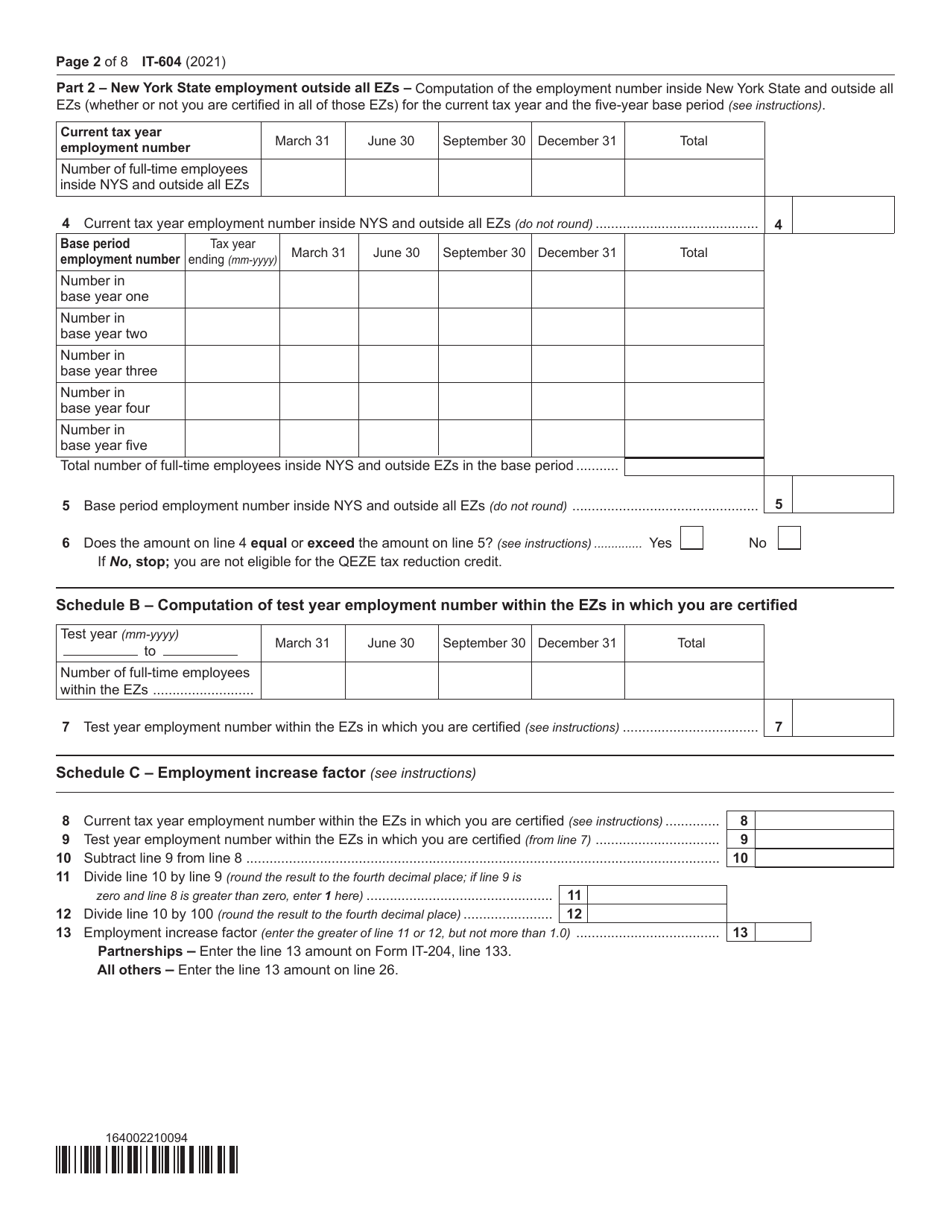

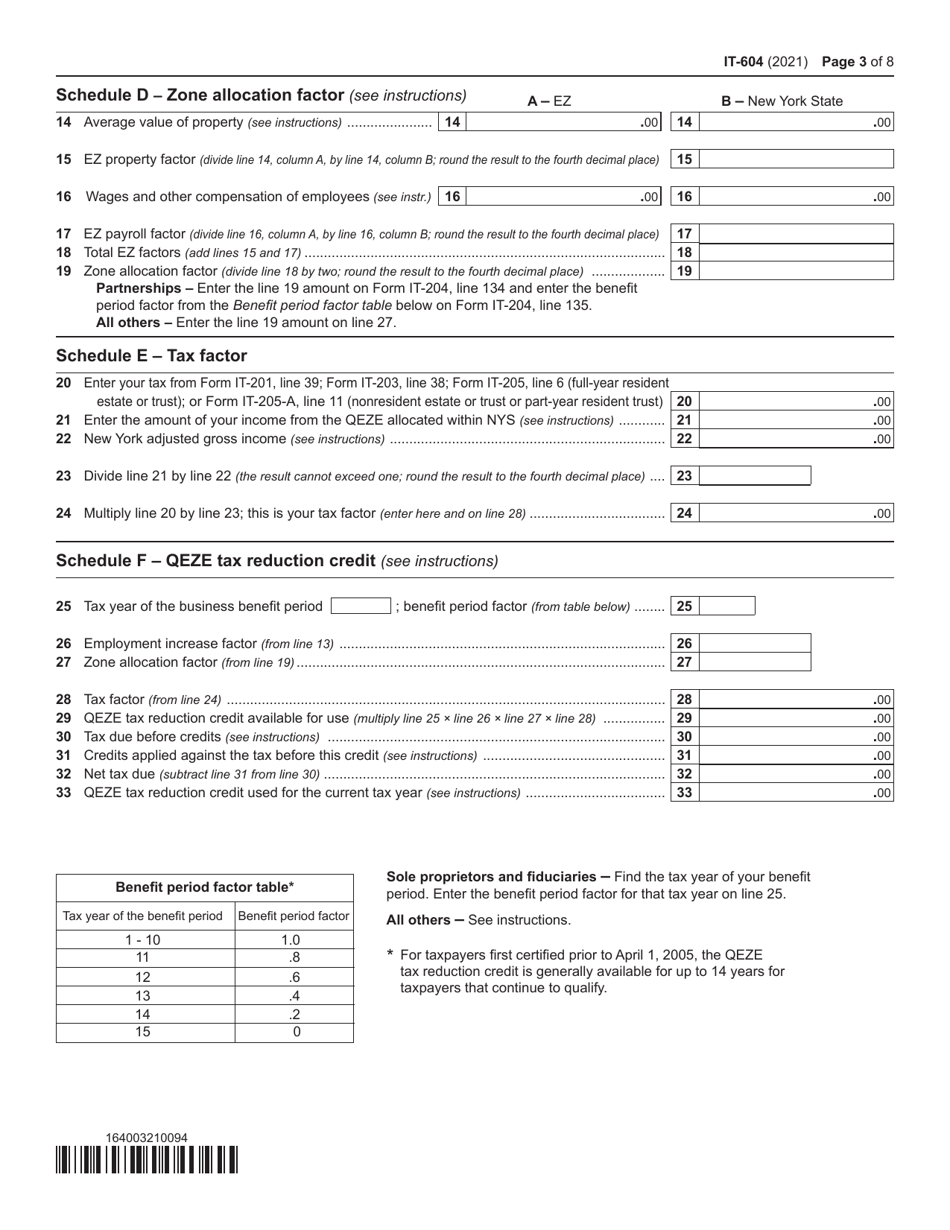

Q: What information is required to complete Form IT-604?

A: To complete Form IT-604, you will need to provide detailed information about your company, including its name, address, federal identification number, and information about qualifying activities and expenditures.

Q: Are there any documentation requirements for claiming the QETC Tax Reduction Credit?

A: Yes, documentation supporting the qualification for and computation of the credit must be maintained and made available upon request by the New York State Department of Taxation and Finance.

Q: When is the deadline to file Form IT-604?

A: Form IT-604 must be filed annually by the 15th day of the fourth month following the close of your taxable year.

Q: Is there a fee for filing Form IT-604?

A: No, there is no fee for filing Form IT-604.

Q: Can I claim the QETC Tax Reduction Credit if I am a sole proprietor or a partnership?

A: No, the QETC Tax Reduction Credit is only available to corporate taxpayers.

Q: Can I claim the QETC Tax Reduction Credit if my company is not based in New York?

A: No, the QETC Tax Reduction Credit is only available to qualified emerging technology companies that are based in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.