This version of the form is not currently in use and is provided for reference only. Download this version of

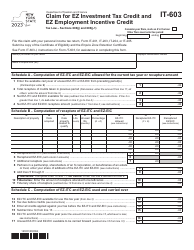

Form IT-602

for the current year.

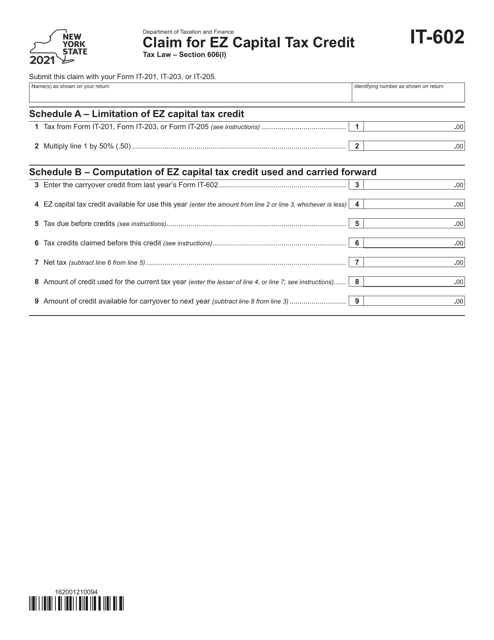

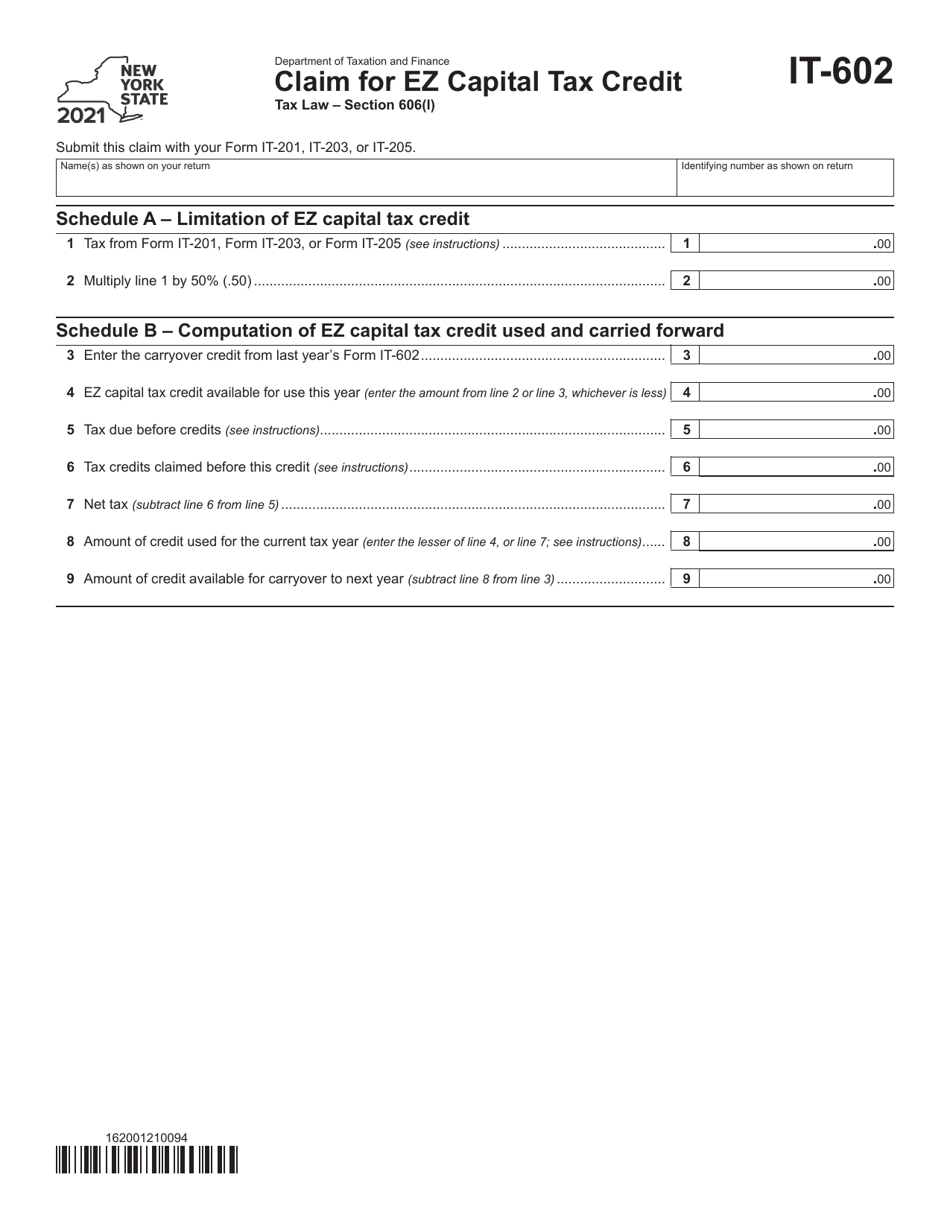

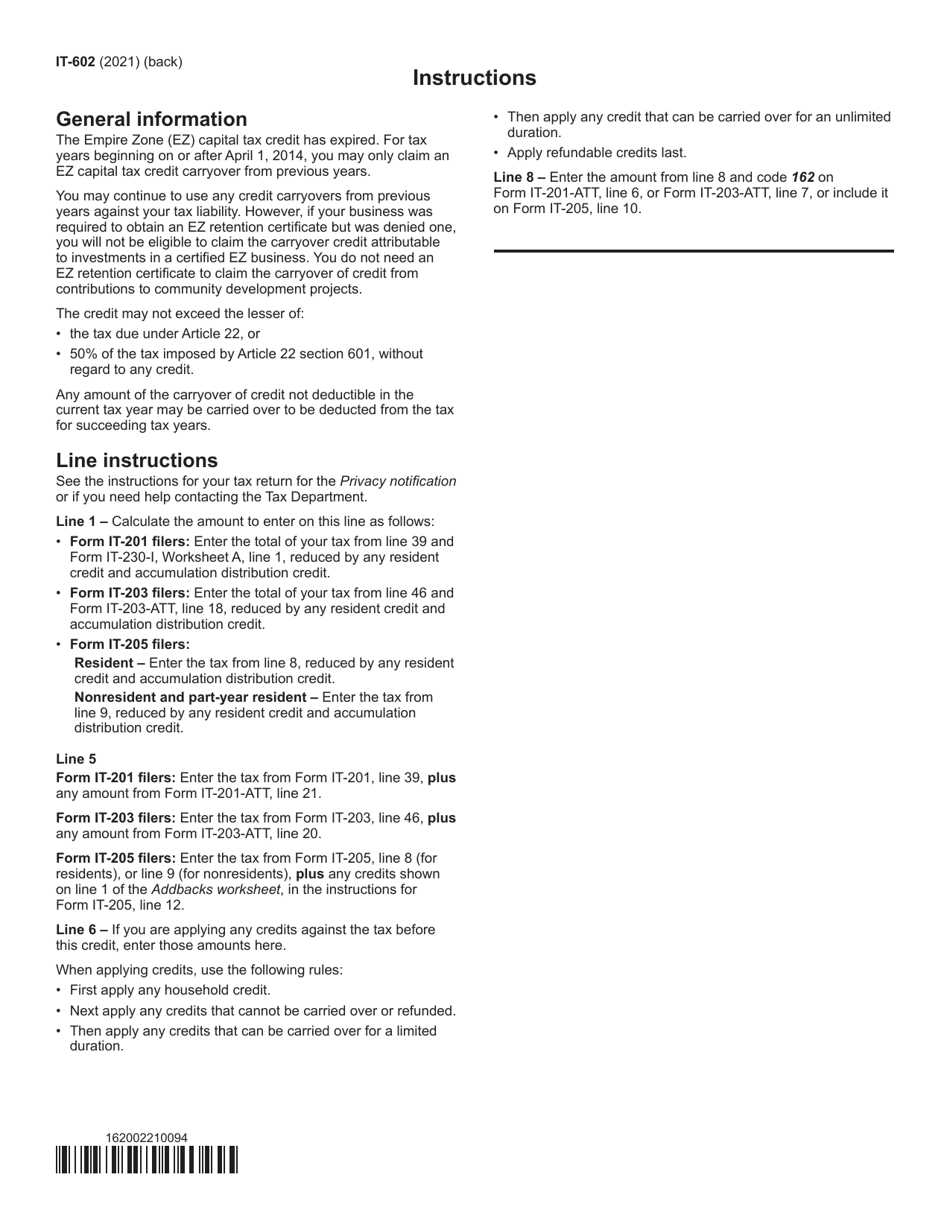

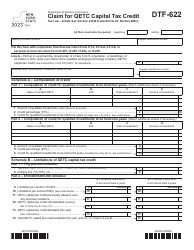

Form IT-602 Claim for Ez Capital Tax Credit - New York

What Is Form IT-602?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-602?

A: Form IT-602 is the claim for the EZ Capital Tax Credit in New York.

Q: Who can use Form IT-602?

A: Any taxpayer in New York who is eligible for the EZ Capital Tax Credit can use Form IT-602.

Q: What is the EZ Capital Tax Credit?

A: The EZ Capital Tax Credit is a credit available to businesses that make eligible investments in specified areas of New York.

Q: What is the purpose of Form IT-602?

A: The purpose of Form IT-602 is to calculate and claim the EZ Capital Tax Credit.

Q: What information do I need to fill out Form IT-602?

A: You will need to provide information about your eligible investments and calculate the amount of credit you are claiming.

Q: When is the deadline to file Form IT-602?

A: The deadline to file Form IT-602 is the same as the deadline for filing your New York State tax return, which is usually April 15th.

Q: Are there any supporting documents required with Form IT-602?

A: Yes, you may need to attach additional supporting documents, such as investment-related receipts or documentation.

Q: Is there a fee to file Form IT-602?

A: There is no fee to file Form IT-602.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-602 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.