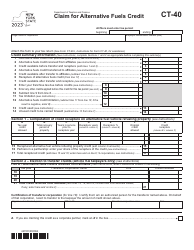

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-253

for the current year.

Form IT-253 Claim for Alternative Fuels Credit - New York

What Is Form IT-253?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

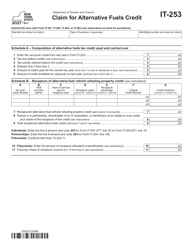

Q: What is Form IT-253?

A: Form IT-253 is the Claim for Alternative Fuels Credit form in New York.

Q: What is the Alternative Fuels Credit?

A: The Alternative Fuels Credit is a credit available to eligible taxpayers in New York for the purchase or conversion of alternative fuel vehicles.

Q: How do I qualify for the Alternative Fuels Credit?

A: To qualify for the Alternative Fuels Credit, you must meet certain criteria, such as purchasing or converting an eligible vehicle that runs on alternative fuel.

Q: When is the deadline to file Form IT-253?

A: The deadline to file Form IT-253 is usually April 15th of the year following the tax year for which the credit is being claimed.

Q: Is the Alternative Fuels Credit refundable?

A: No, the Alternative Fuels Credit is not refundable. It can only be used to offset your tax liability.

Q: Are there any limitations to claiming the Alternative Fuels Credit?

A: Yes, there are limitations on the amount of the credit that can be claimed, based on the type of vehicle and the cost of the purchase or conversion.

Q: Can I claim the Alternative Fuels Credit for multiple vehicles?

A: Yes, you can claim the Alternative Fuels Credit for multiple vehicles, as long as each vehicle meets the eligibility criteria.

Q: Do I need to provide documentation with Form IT-253?

A: Yes, you will need to provide documentation supporting your claim for the Alternative Fuels Credit, such as receipts or invoices for the purchase or conversion of the vehicle.

Q: Can I e-file Form IT-253?

A: Yes, you can e-file Form IT-253 if you are using approved tax software or working with a tax professional who offers e-filing services.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-253 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.