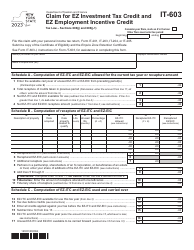

This version of the form is not currently in use and is provided for reference only. Download this version of

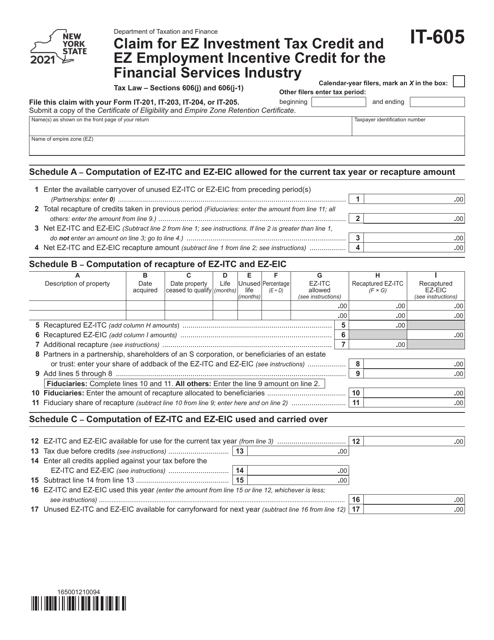

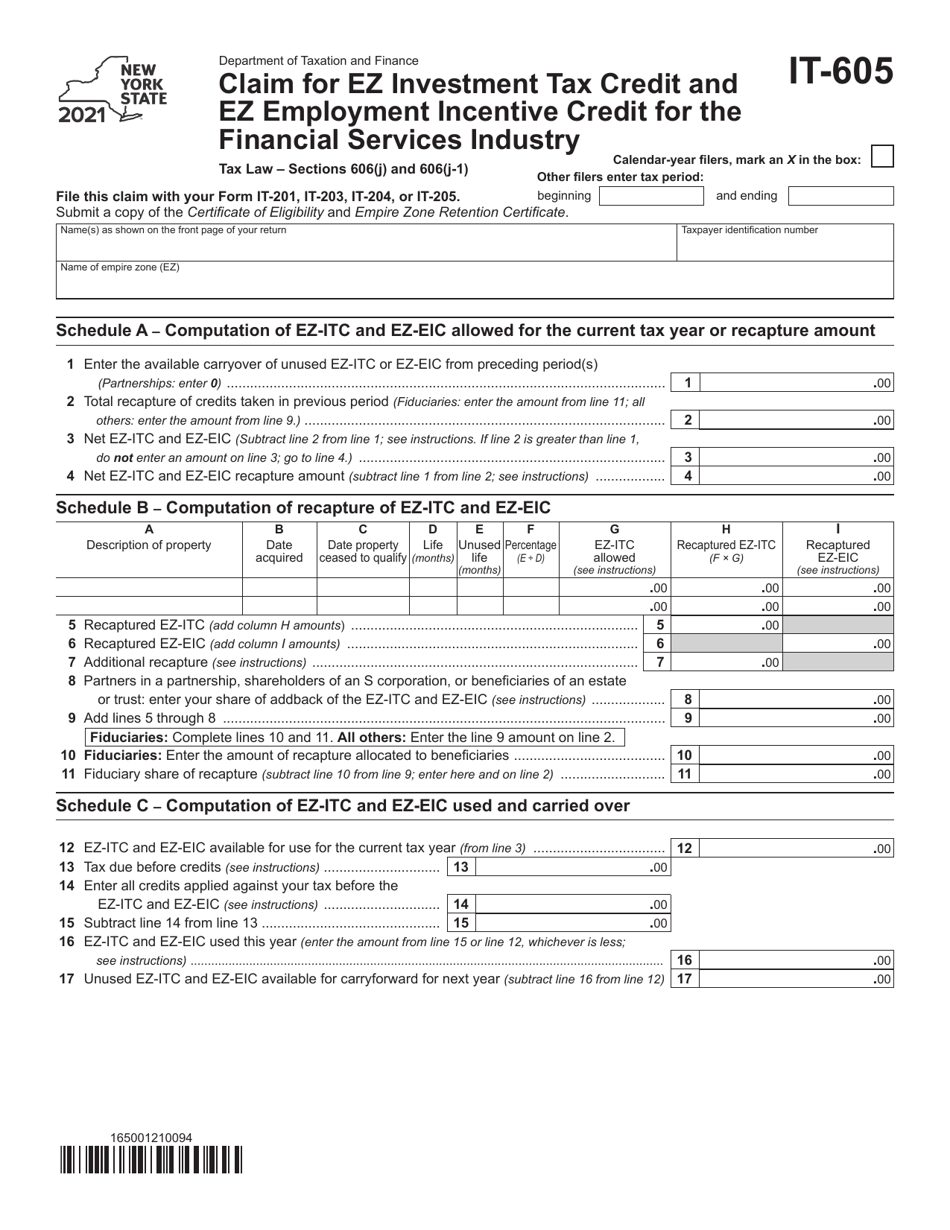

Form IT-605

for the current year.

Form IT-605 Claim for Ez Investment Tax Credit and Ez Employment Incentive Credit for the Financial Services Industry - New York

What Is Form IT-605?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-605?

A: Form IT-605 is a form that allows businesses in the financial services industry in New York to claim the Ez Investment Tax Credit and Ez Employment Incentive Credit.

Q: Who can use Form IT-605?

A: Businesses in the financial services industry in New York can use Form IT-605 to claim the Ez Investment Tax Credit and Ez Employment Incentive Credit.

Q: What are the Ez Investment Tax Credit and Ez Employment Incentive Credit?

A: The Ez Investment Tax Credit and Ez Employment Incentive Credit are tax credits available to businesses in the financial services industry in New York.

Q: What is the purpose of the Ez Investment Tax Credit?

A: The Ez Investment Tax Credit is designed to encourage investment in the financial services industry in New York by providing a tax credit for qualified investments.

Q: What is the purpose of the Ez Employment Incentive Credit?

A: The Ez Employment Incentive Credit is designed to encourage job creation in the financial services industry in New York by providing a tax credit for eligible wage expenses.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-605 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.