This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-261

for the current year.

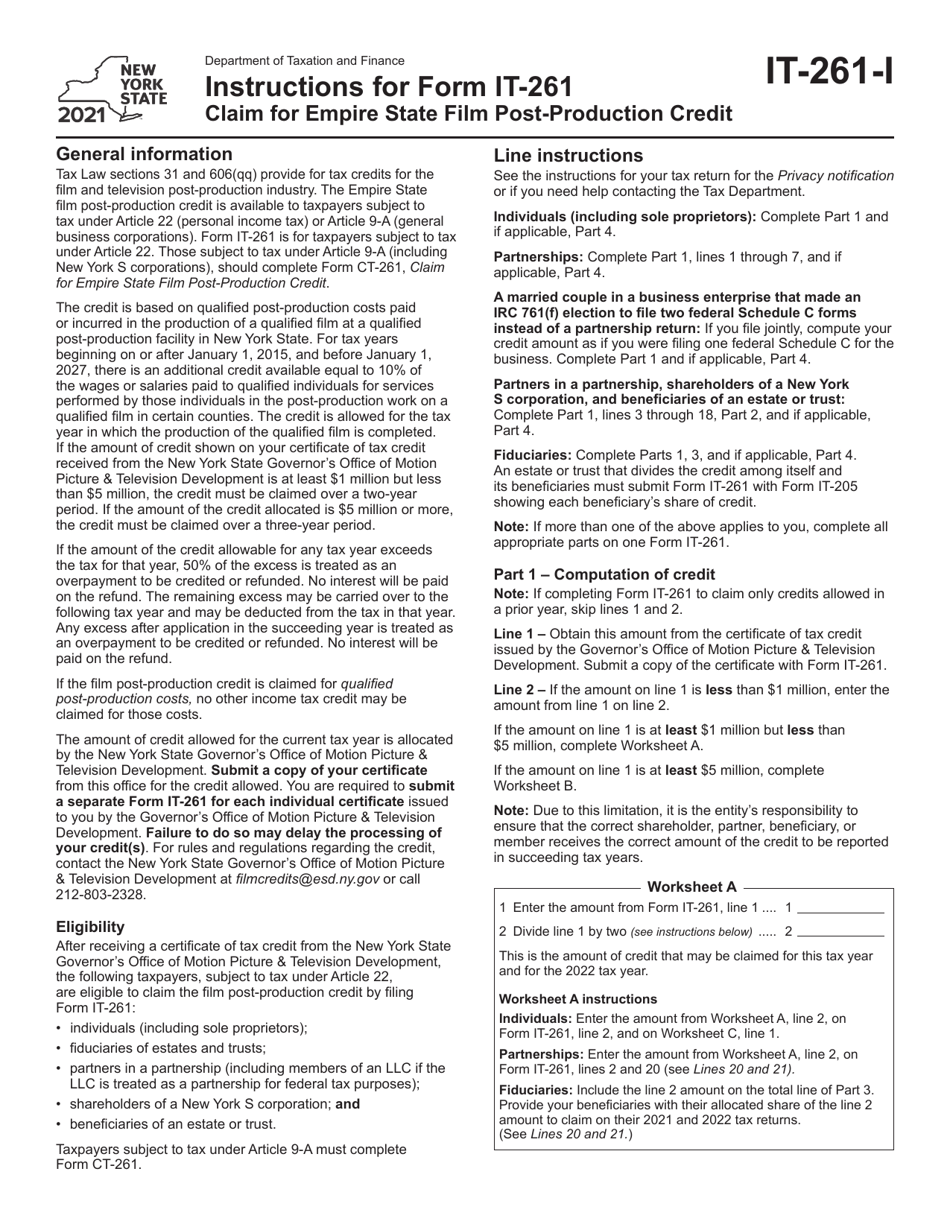

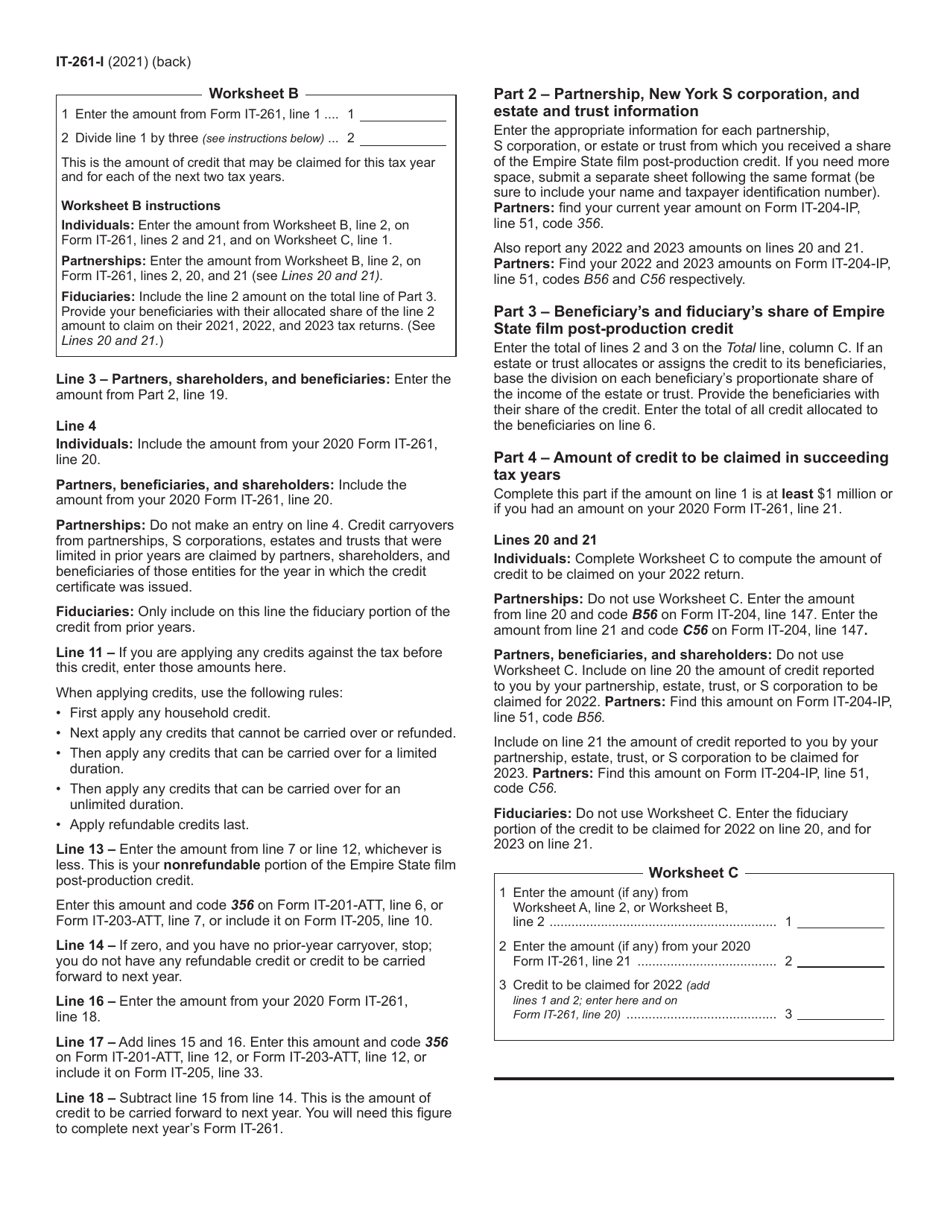

Instructions for Form IT-261 Claim for Empire State Film Post-production Credit - New York

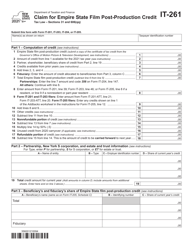

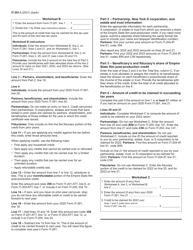

This document contains official instructions for Form IT-261 , Claim for Empire State Film Post-production Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-261 is available for download through this link.

FAQ

Q: What is Form IT-261?

A: Form IT-261 is a claim for Empire State Film Post-production Credit in New York.

Q: Who can file Form IT-261?

A: Any taxpayer who is eligible for the Empire State Film Post-production Credit in New York can file Form IT-261.

Q: What is the purpose of Form IT-261?

A: The purpose of Form IT-261 is to claim the Empire State Film Post-production Credit in New York.

Q: What is the Empire State Film Post-production Credit?

A: The Empire State Film Post-production Credit is a tax credit available to qualified post-production facilities in New York.

Q: How do I complete Form IT-261?

A: To complete Form IT-261, you need to provide information about the post-production facility, the eligible costs, and other required details.

Q: What are the deadlines for filing Form IT-261?

A: The deadlines for filing Form IT-261 vary depending on the tax year. Check the instructions provided with the form for the specific deadlines.

Q: Can I claim the Empire State Film Post-production Credit if I am not a post-production facility?

A: No, this credit is specifically available to qualified post-production facilities in New York.

Q: Are there any limitations on the Empire State Film Post-production Credit?

A: Yes, there are certain limitations on the credit, such as a maximum credit amount and a cap on the total credits available each year.

Q: Can I carry forward any unused credits?

A: Yes, any unused credits can be carried forward for up to three years.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.