This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-501

for the current year.

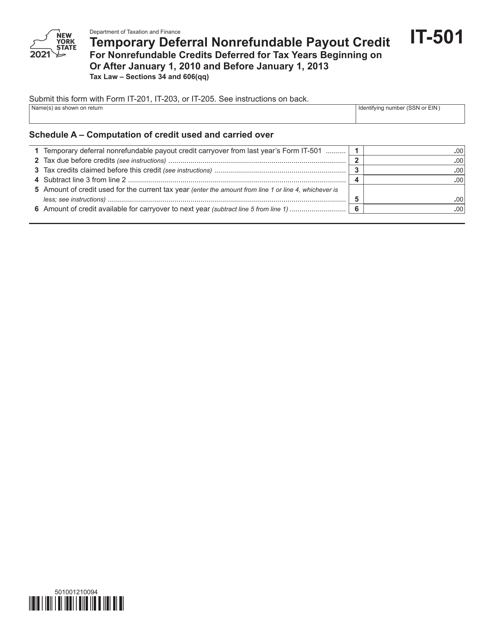

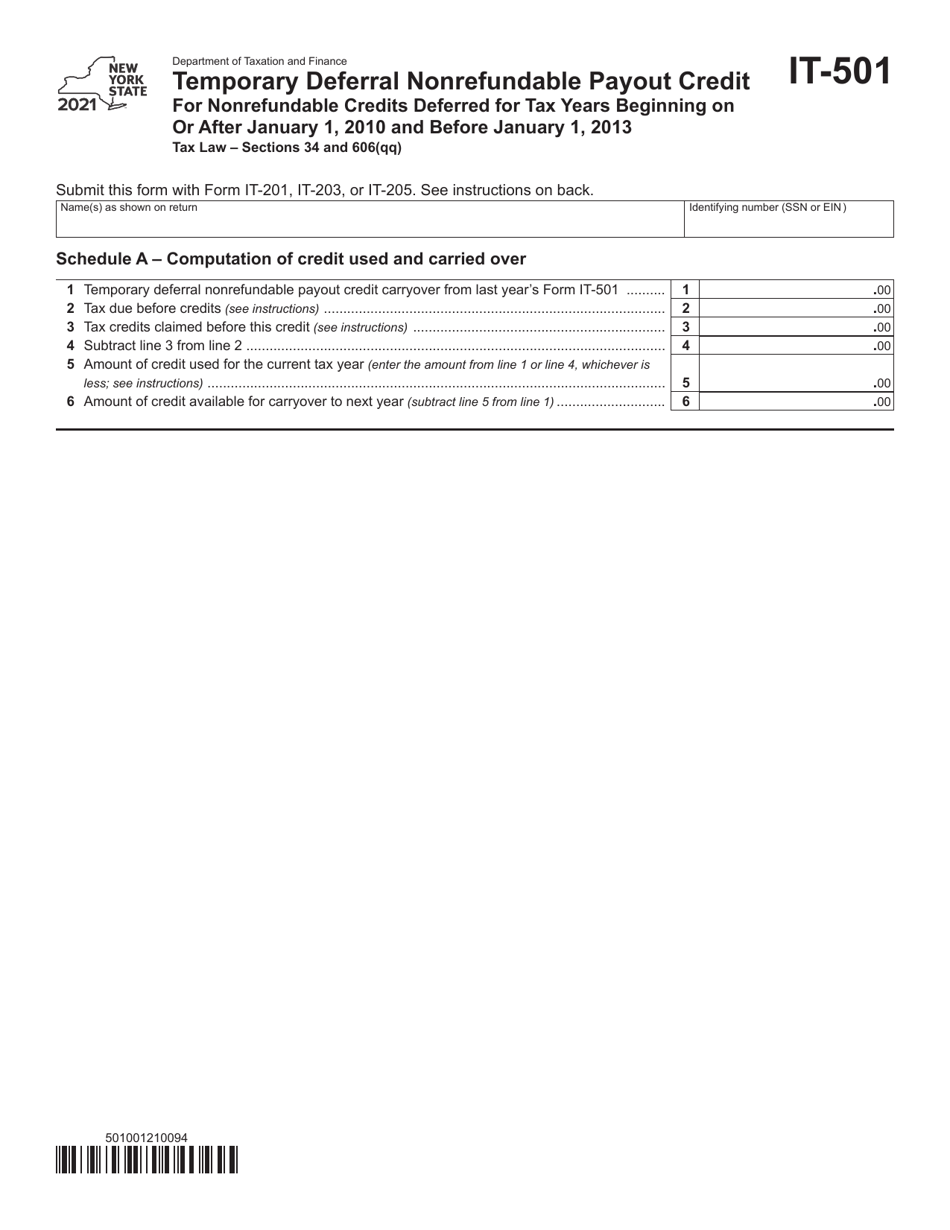

Form IT-501 Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits Deferred for Tax Years Beginning on or After January 1, 2010 and Before January 1, 2013 - New York

What Is Form IT-501?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-501?

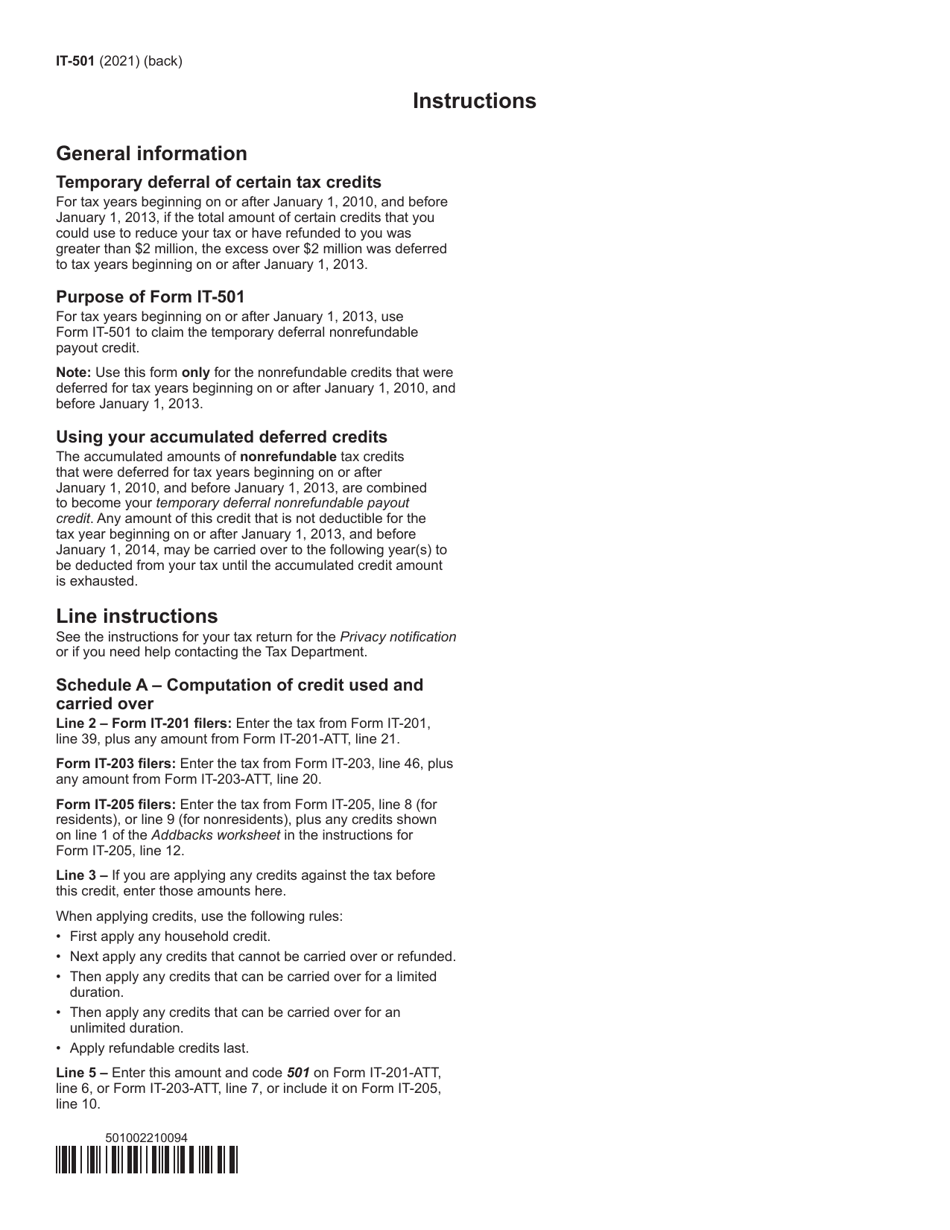

A: Form IT-501 is the form used to apply for the Temporary Deferral Nonrefundable Payout Credit for Nonrefundable Credits deferred for tax years beginning on or after January 1, 2010 and before January 1, 2013 in New York.

Q: What is the purpose of Form IT-501?

A: Form IT-501 is used to claim a credit for nonrefundable amounts that were deferred for tax years during the specified period.

Q: When should Form IT-501 be filed?

A: Form IT-501 should be filed when an individual or business wants to claim the Temporary Deferral Nonrefundable Payout Credit.

Q: What is the deadline for filing Form IT-501?

A: The deadline for filing Form IT-501 is typically April 15th of the year following the tax year for which the credit is being claimed.

Q: Do I qualify for the Temporary Deferral Nonrefundable Payout Credit?

A: To qualify for the credit, you must have had nonrefundable credits that were deferred for tax years beginning on or after January 1, 2010 and before January 1, 2013.

Q: How much is the Temporary Deferral Nonrefundable Payout Credit?

A: The amount of the credit will vary depending on the specific circumstances of the taxpayer and the amount of nonrefundable credits that were deferred.

Q: Can I claim the Temporary Deferral Nonrefundable Payout Credit for previous tax years?

A: No, the credit can only be claimed for nonrefundable amounts deferred for tax years beginning on or after January 1, 2010 and before January 1, 2013.

Q: Is the Temporary Deferral Nonrefundable Payout Credit refundable?

A: No, the credit is nonrefundable, meaning it can only reduce or eliminate any tax liability but cannot result in a refund.

Q: Are there any other requirements to claim the Temporary Deferral Nonrefundable Payout Credit?

A: Yes, there may be additional requirements and limitations based on the specific details of the taxpayer's situation. It is recommended to consult with a tax professional or refer to the instructions provided with Form IT-501.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-501 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.