This version of the form is not currently in use and is provided for reference only. Download this version of

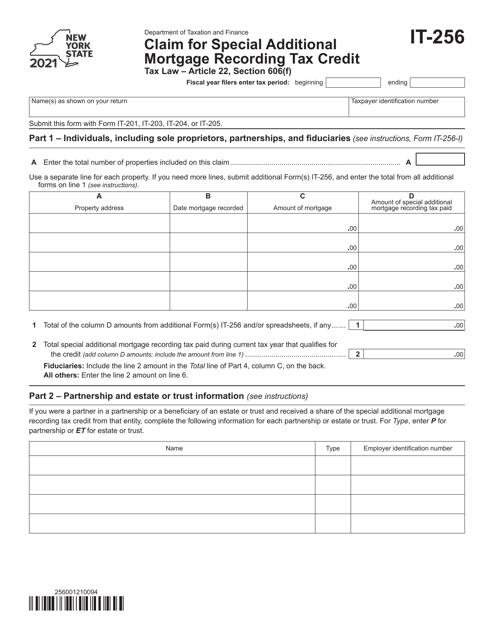

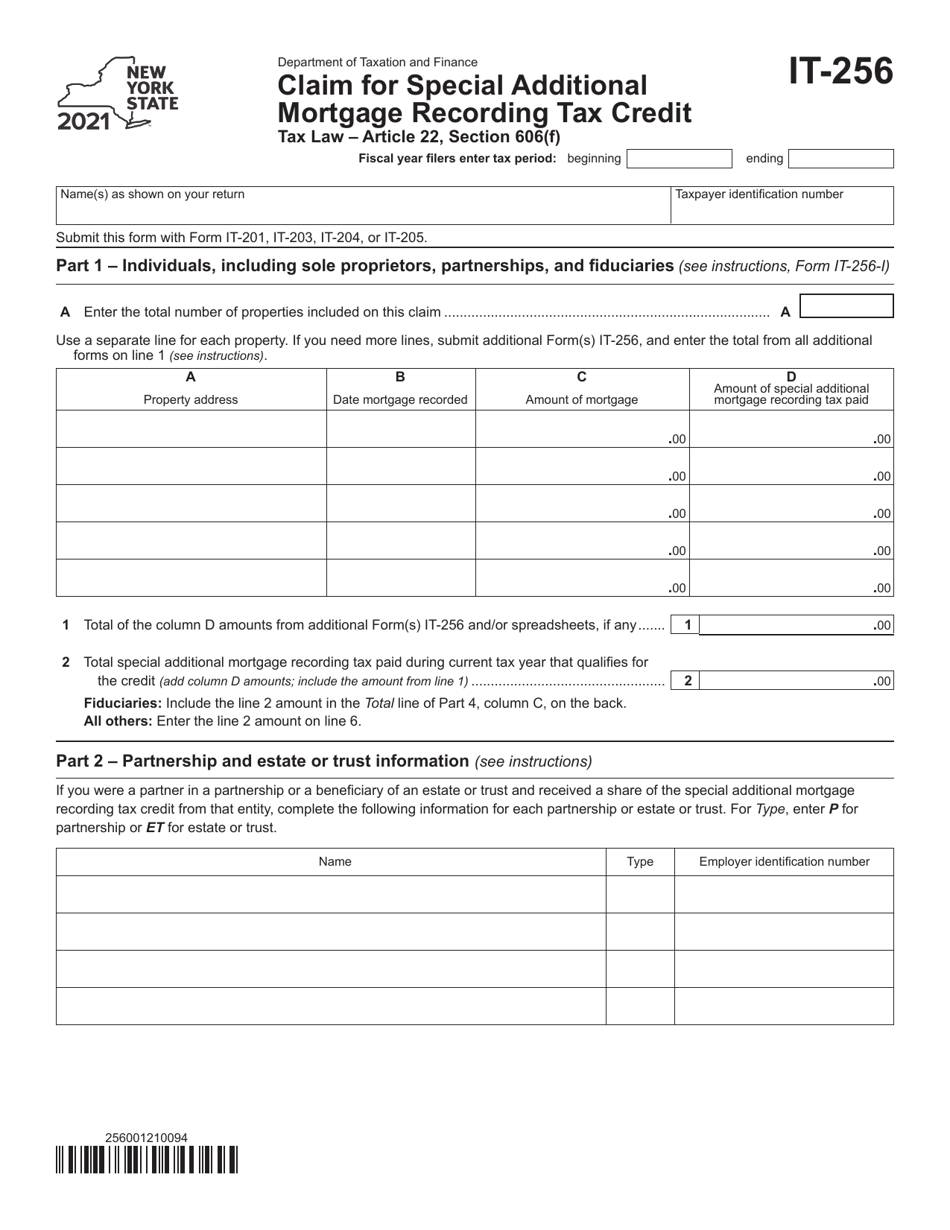

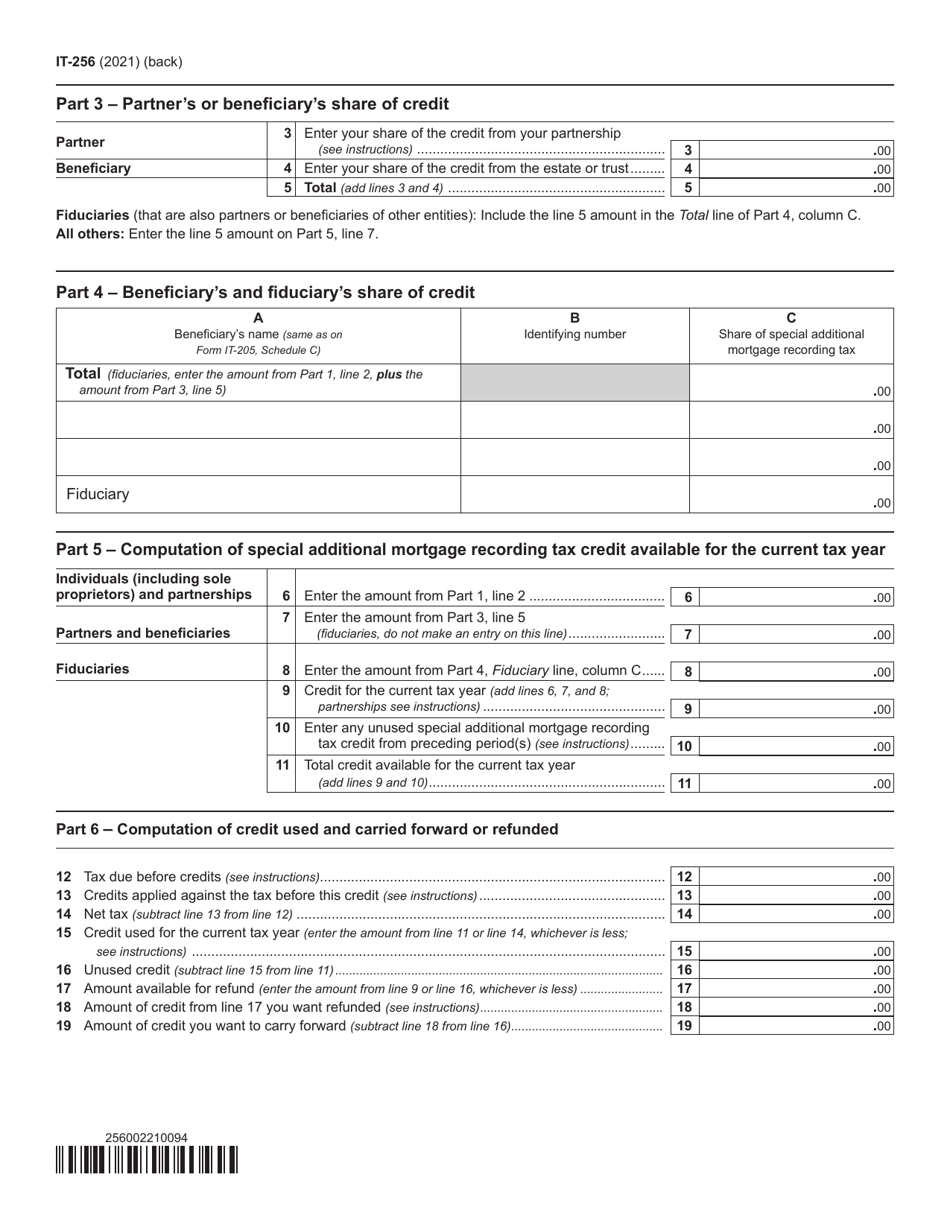

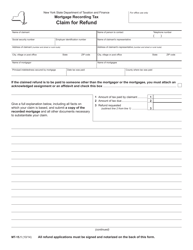

Form IT-256

for the current year.

Form IT-256 Claim for Special Additional Mortgage Recording Tax Credit - New York

What Is Form IT-256?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-256?

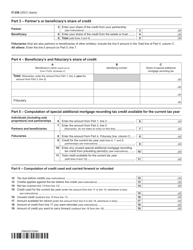

A: Form IT-256 is a tax form used in New York to claim the Special Additional Mortgage Recording Tax Credit.

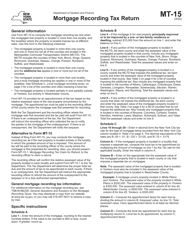

Q: What is the Special Additional Mortgage Recording Tax Credit?

A: The Special Additional Mortgage Recording Tax Credit is a credit available to certain homebuyers in New York who paid a special additional mortgage recording tax.

Q: Who is eligible to claim the Special Additional Mortgage Recording Tax Credit?

A: Homebuyers who meet certain criteria, including income and purchase price limits, may be eligible to claim the credit.

Q: How do I claim the Special Additional Mortgage Recording Tax Credit?

A: To claim the credit, you need to complete and file Form IT-256 with your New York state tax return.

Q: Are there any deadlines for filing Form IT-256?

A: The deadline for filing Form IT-256 is the same as the deadline for filing your New York state tax return, generally April 15th.

Q: Is the Special Additional Mortgage Recording Tax Credit refundable?

A: No, the credit is non-refundable, meaning it can reduce your tax liability, but you will not receive a refund for any unused portion.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-256 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.