This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-249

for the current year.

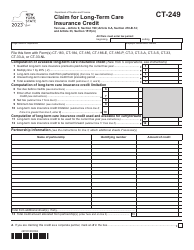

Form IT-249 Claim for Long-Term Care Insurance Credit - New York

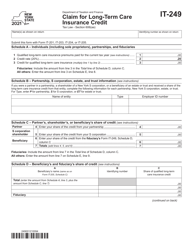

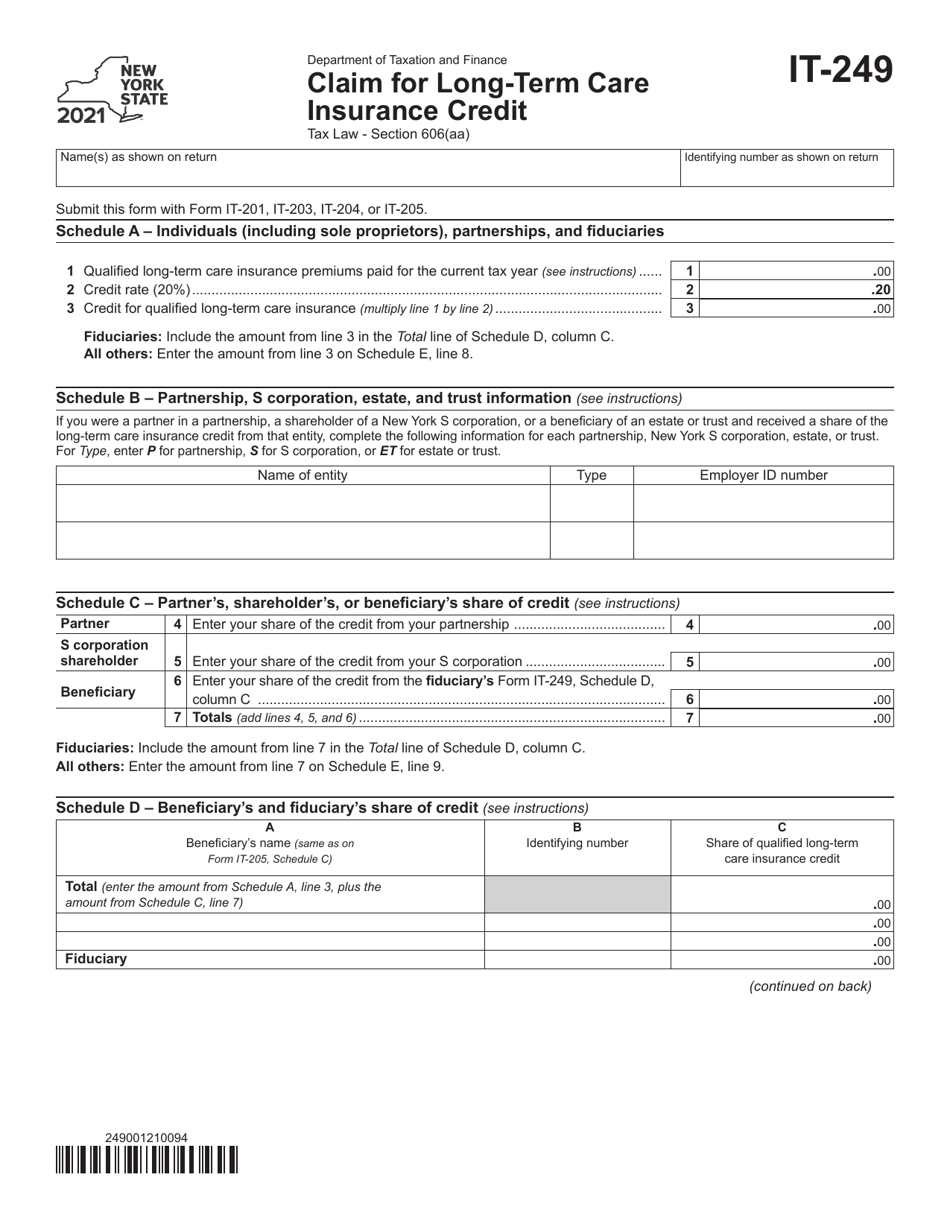

What Is Form IT-249?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-249?

A: Form IT-249 is a tax form used in New York to claim the Long-Term Care Insurance Credit.

Q: What is the Long-Term Care Insurance Credit?

A: The Long-Term Care Insurance Credit is a credit that can be claimed by New York residents who have paid premiums for long-term care insurance.

Q: Who can claim the Long-Term Care Insurance Credit?

A: New York residents who have paid premiums for qualifying long-term care insurance policies can claim the credit.

Q: How much is the Long-Term Care Insurance Credit?

A: The credit is equal to 20% of the premiums paid for qualifying long-term care insurance policies, up to a maximum of $1,500 per taxpayer.

Q: What should I do with Form IT-249 once I fill it out?

A: You should attach Form IT-249 to your New York State income tax return when filing.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-249 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.