This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-239

for the current year.

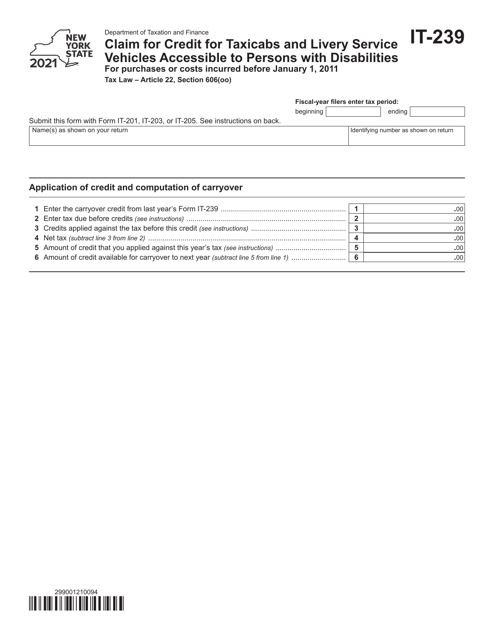

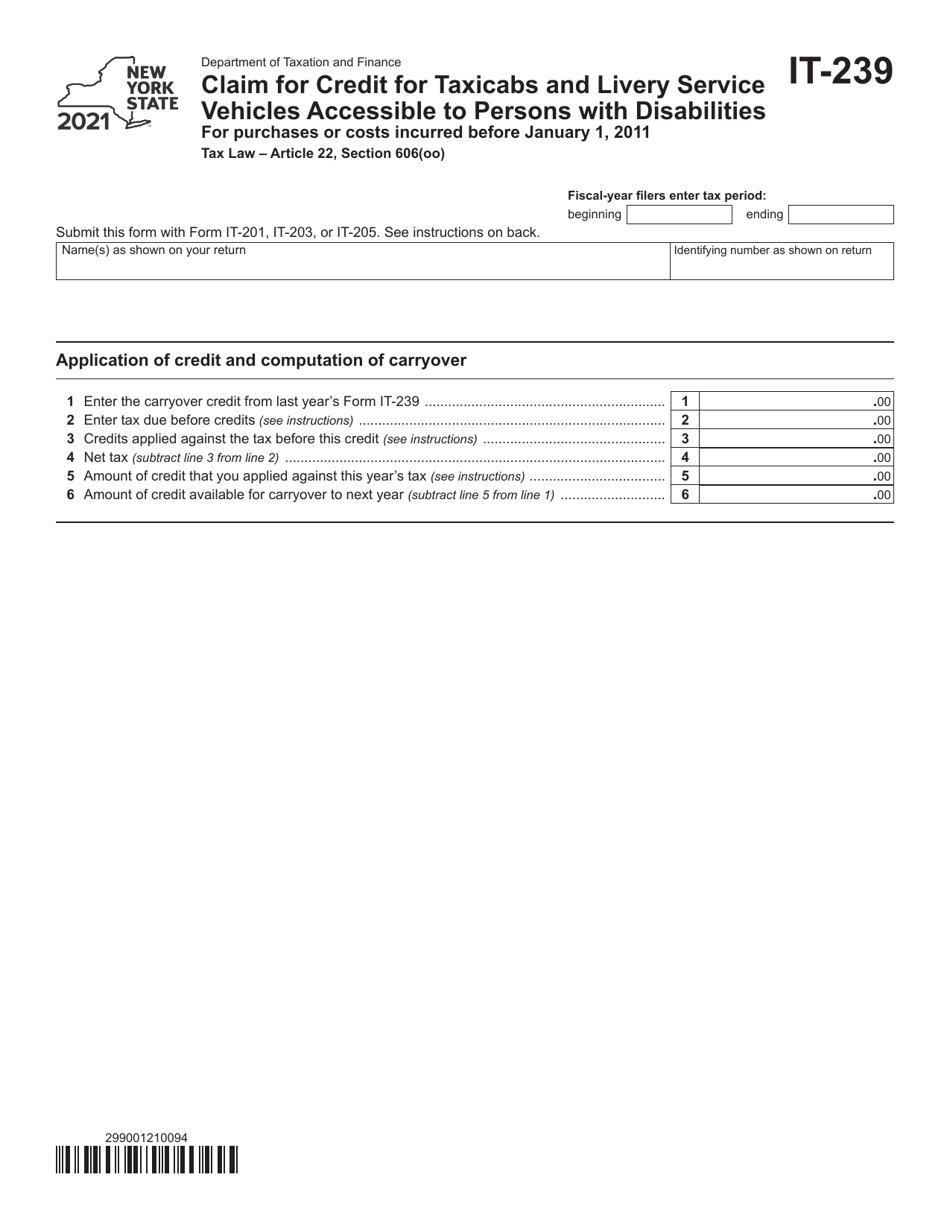

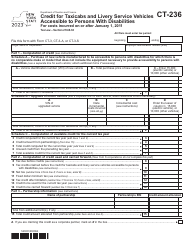

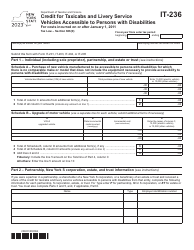

Form IT-239 Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities for Purchases or Costs Incurred Before January 1, 2011 - New York

What Is Form IT-239?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of form IT-239?

A: The purpose of form IT-239 is to claim a tax credit for taxicabs and livery service vehicles accessible to persons with disabilities.

Q: What expenses can be claimed using form IT-239?

A: You can claim expenses for purchases or costs incurred before January 1, 2011 for taxicabs and livery service vehicles accessible to persons with disabilities.

Q: Is form IT-239 specific to New York?

A: Yes, form IT-239 is specific to New York. It is used to claim a tax credit for expenses incurred in New York for taxicabs and livery service vehicles accessible to persons with disabilities.

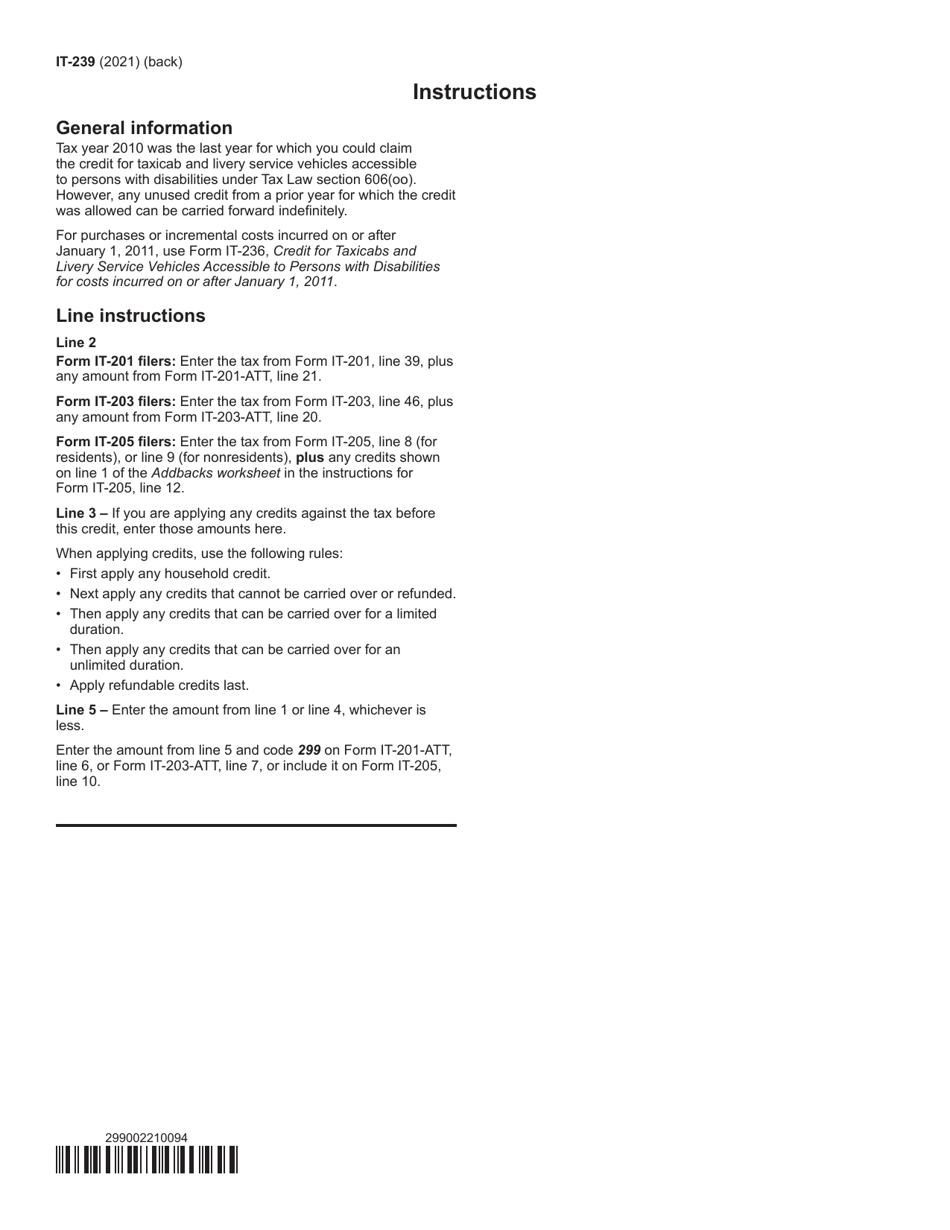

Q: How do I file form IT-239?

A: You can file form IT-239 by mailing it to the New York Department of Taxation and Finance along with any required documentation.

Q: Is there a deadline for filing form IT-239?

A: Yes, there is a deadline for filing form IT-239. The specific deadline can be found on the form or by contacting the New York Department of Taxation and Finance.

Q: Can I claim the tax credit if the expenses were incurred after January 1, 2011?

A: No, form IT-239 can only be used to claim a tax credit for expenses incurred before January 1, 2011.

Q: Can I claim the tax credit for expenses incurred in a different state?

A: No, form IT-239 can only be used to claim a tax credit for expenses incurred in New York.

Q: What documentation do I need to include with form IT-239?

A: You may need to include documentation such as receipts or invoices to support your claim for the tax credit.

Q: Are there any other requirements to be eligible for the tax credit?

A: There may be additional requirements to be eligible for the tax credit. Please refer to the instructions on form IT-239 or contact the New York Department of Taxation and Finance for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-239 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.