This version of the form is not currently in use and is provided for reference only. Download this version of

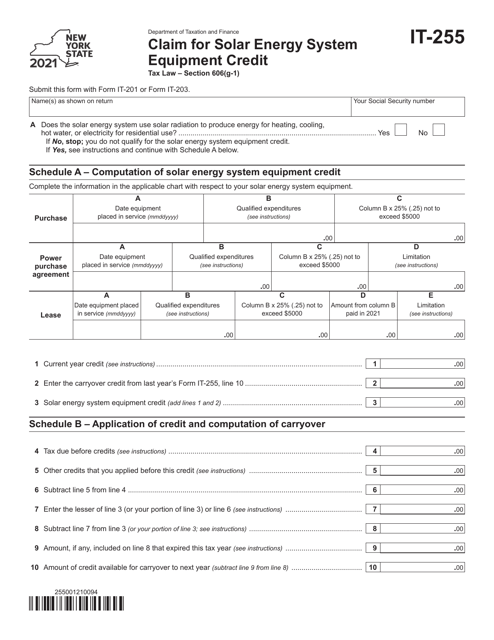

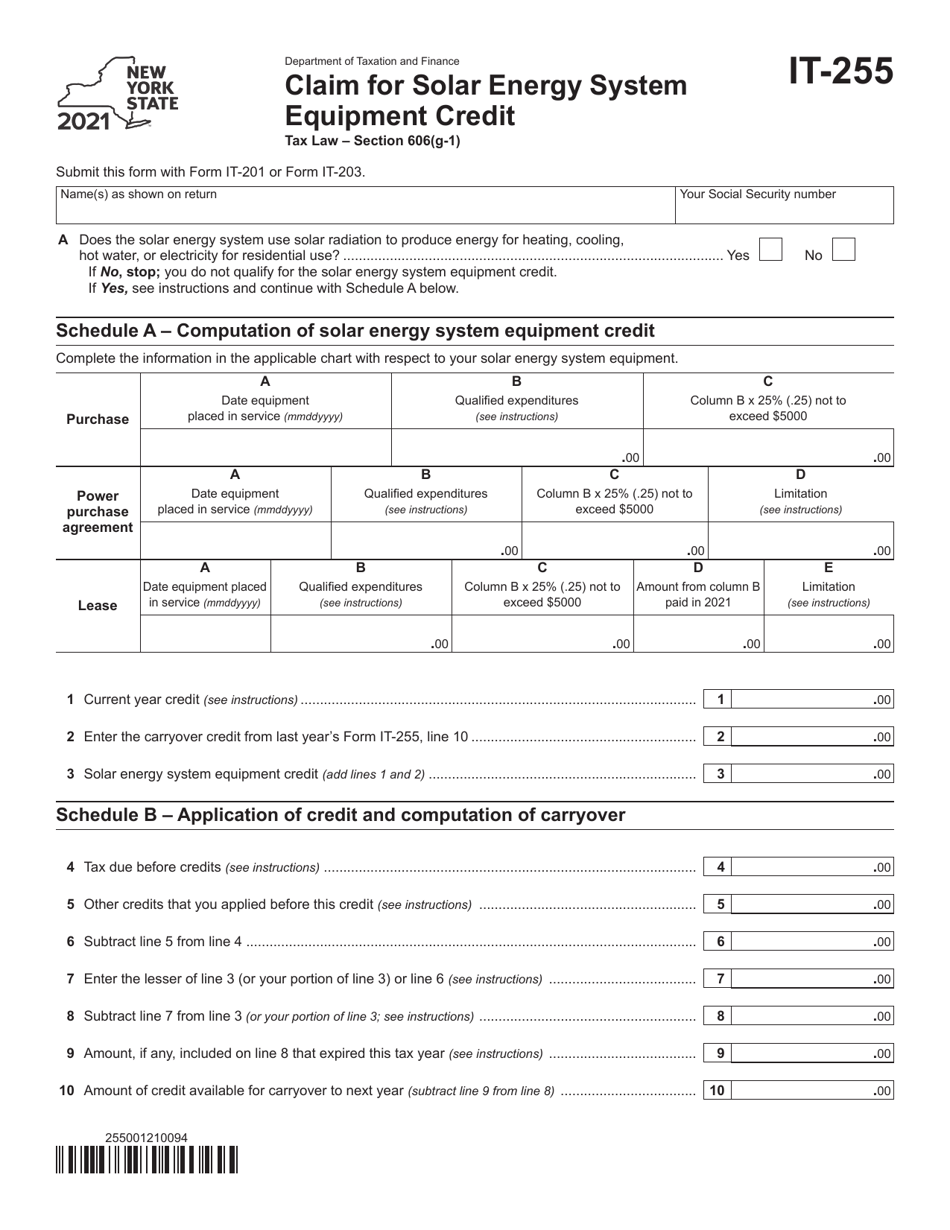

Form IT-255

for the current year.

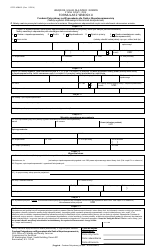

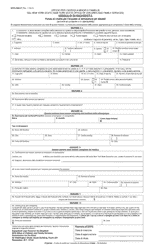

Form IT-255 Claim for Solar Energy System Equipment Credit - New York

What Is Form IT-255?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-255?

A: Form IT-255 is a tax form used in New York to claim the Solar Energy System Equipment Credit.

Q: What is the Solar Energy System Equipment Credit?

A: The Solar Energy System Equipment Credit is a tax credit available in New York for purchasing and installing qualifying solar energy system equipment.

Q: Who can claim the Solar Energy System Equipment Credit?

A: Individuals, estates, and trusts that own or lease eligible solar energy system equipment in New York may be eligible to claim the credit.

Q: What expenses are eligible for the credit?

A: Expenses related to the purchase and installation of solar energy system equipment, including solar panels and inverters, may be eligible for the credit.

Q: How much is the Solar Energy System Equipment Credit?

A: The credit amount is equal to 25% of eligible expenses, up to a maximum credit of $5,000 per taxpayer.

Q: How do I claim the Solar Energy System Equipment Credit?

A: To claim the credit, you must complete and file Form IT-255 with your New York state tax return.

Q: Are there any limitations or restrictions for the credit?

A: Yes, there are certain limitations and restrictions for the credit. For example, the credit cannot exceed the taxpayer's tax liability, and it may not be refundable.

Q: Is the Solar Energy System Equipment Credit available in other states?

A: The Solar Energy System Equipment Credit is specific to New York state. Other states may have their own tax incentives for solar energy systems.

Q: Can I claim the Solar Energy System Equipment Credit for multiple years?

A: No, the credit can only be claimed for the year in which the equipment is placed in service.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-255 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.