This version of the form is not currently in use and is provided for reference only. Download this version of

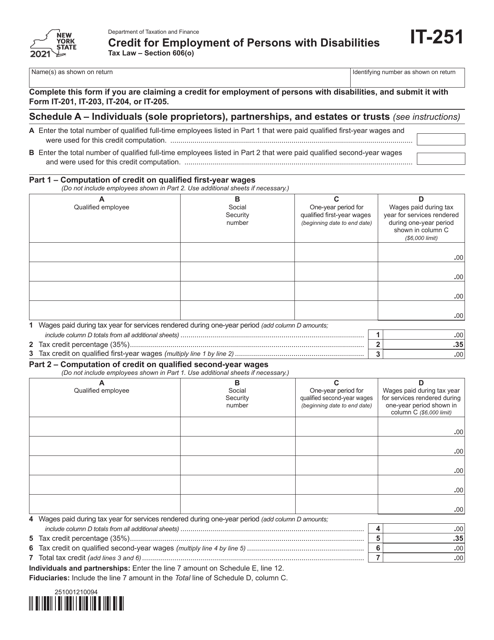

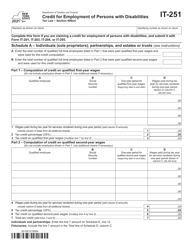

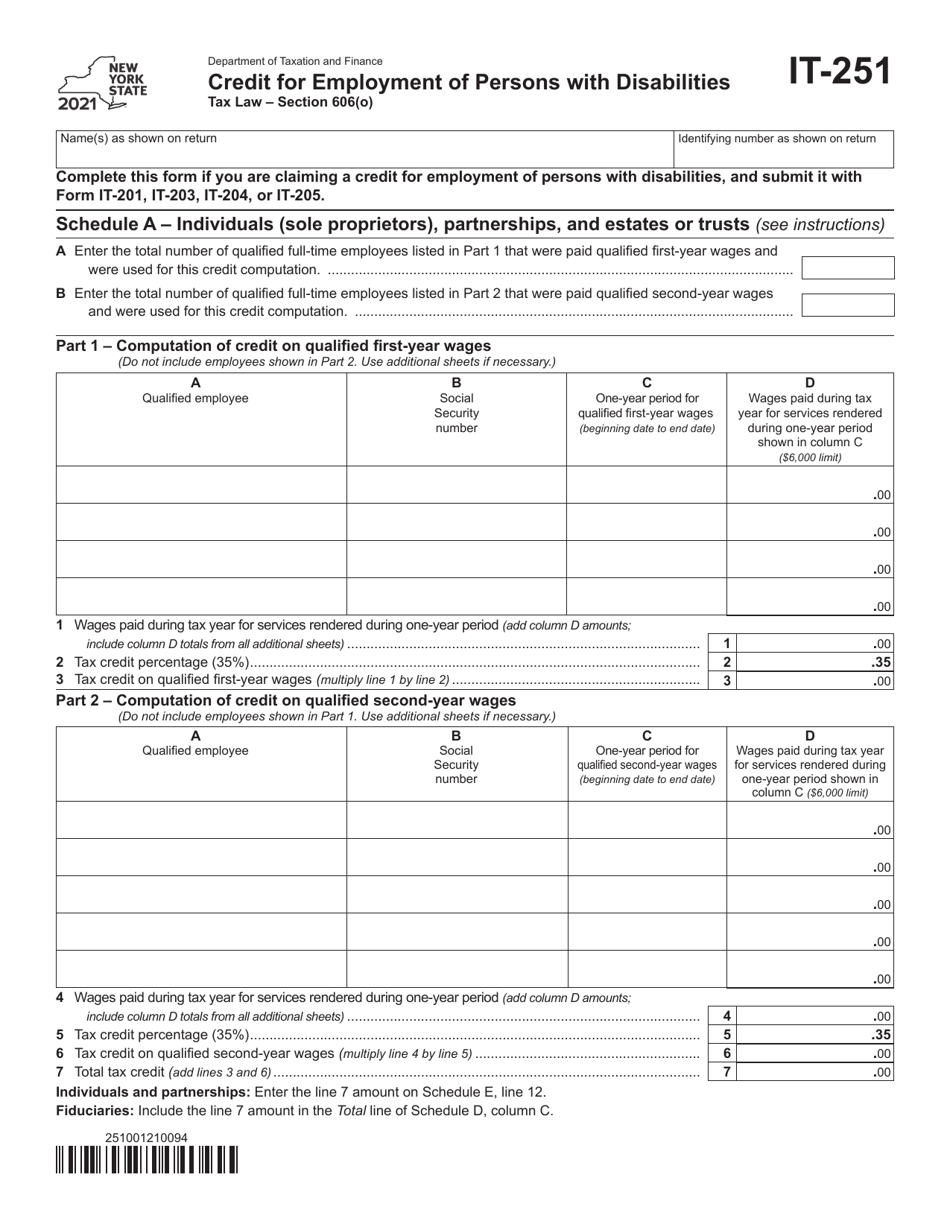

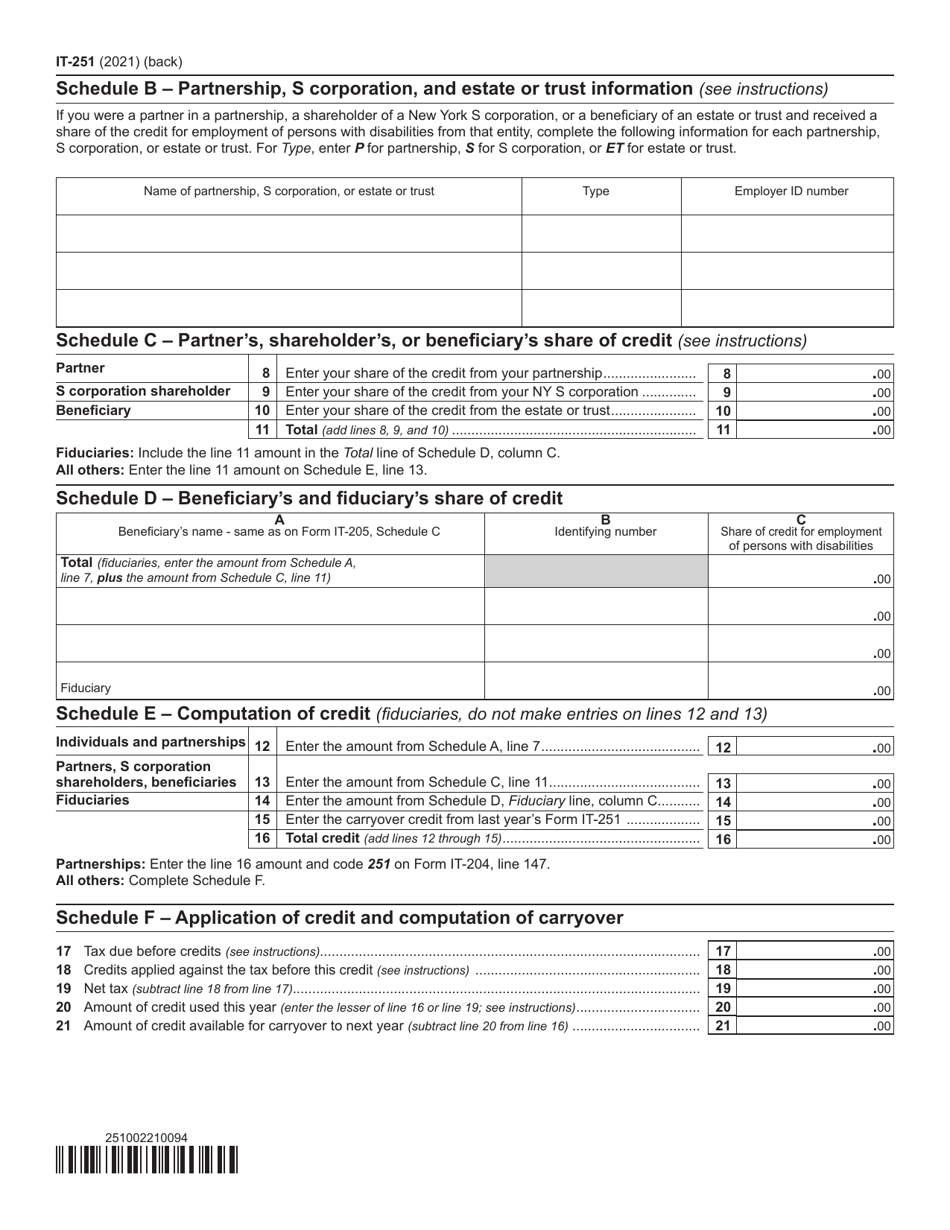

Form IT-251

for the current year.

Form IT-251 Credit for Employment of Persons With Disabilities - New York

What Is Form IT-251?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-251?

A: Form IT-251 is the Credit for Employment of Persons With Disabilities form for New York.

Q: Who can claim the credit?

A: Employers in New York who hire individuals with disabilities can claim the credit.

Q: What is the purpose of the credit?

A: The credit encourages employers to hire individuals with disabilities and provide equal employment opportunities.

Q: How much is the credit?

A: The credit amount is 50% of the wages paid to qualified individuals, up to $5,000 per eligible employee.

Q: What are the eligibility criteria?

A: To be eligible, the individual must have a disability that qualifies under the American with Disabilities Act and must be employed by the taxpayer for at least 180 days during the tax year.

Q: How is the credit calculated?

A: The credit is calculated by multiplying the qualified employee's wages by 50%.

Q: How do I claim the credit?

A: To claim the credit, file Form IT-251 with your New York State income tax return.

Q: Are there any limitations on the credit?

A: Yes, the credit cannot exceed the taxpayer's tax liability for the tax year.

Q: Are there any other requirements?

A: Yes, employers must retain records and documentation to support the credit claimed.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-251 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.