This version of the form is not currently in use and is provided for reference only. Download this version of

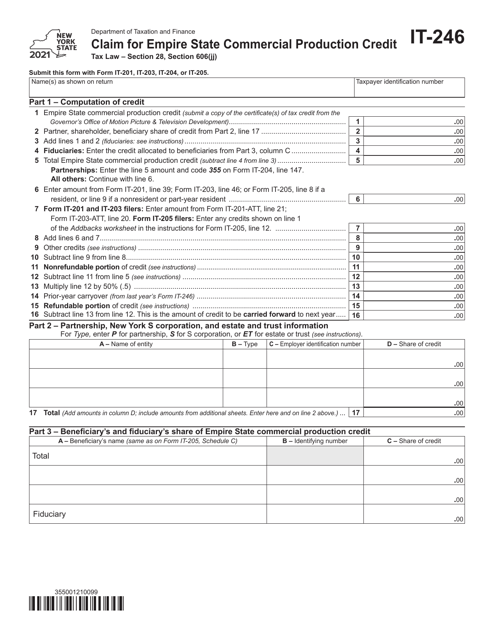

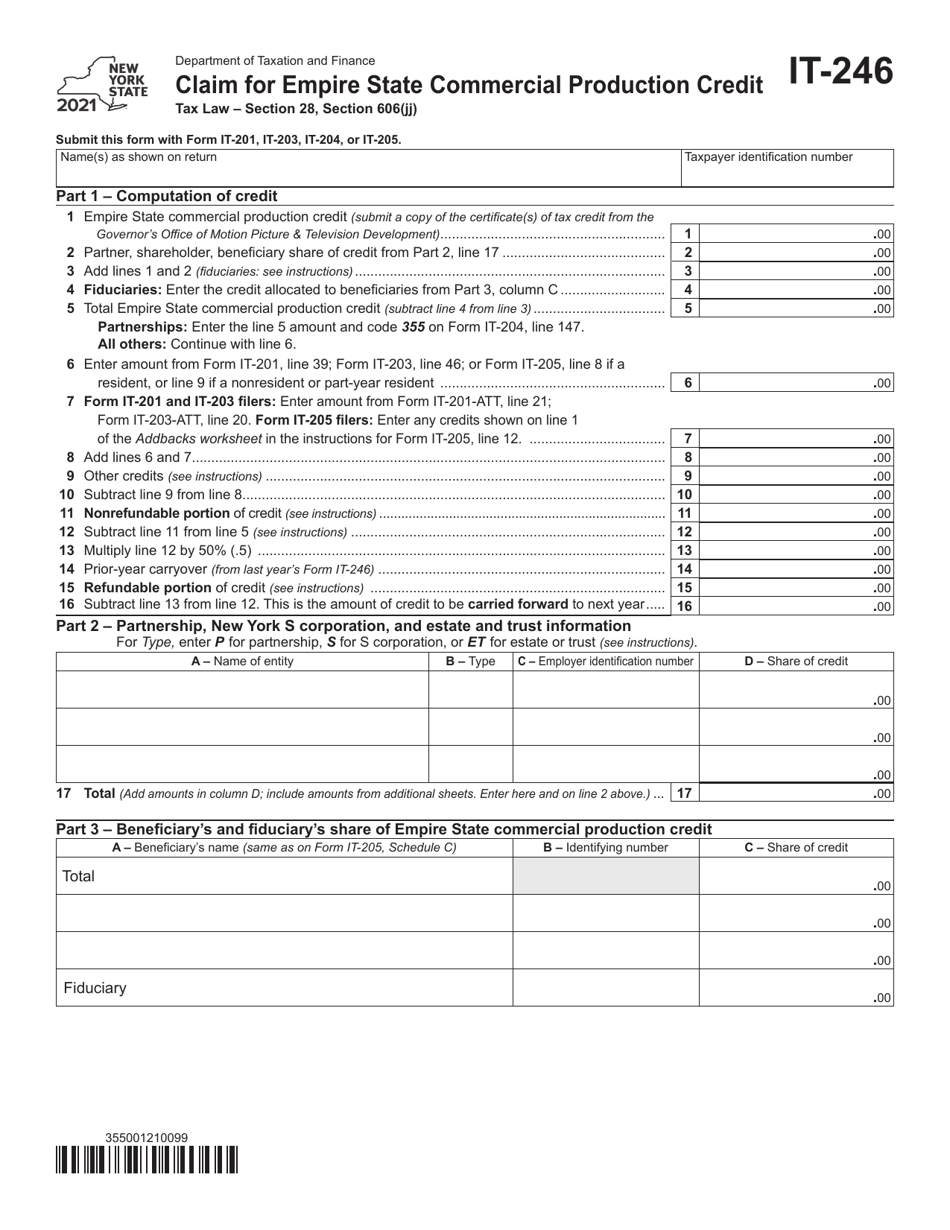

Form IT-246

for the current year.

Form IT-246 Claim for Empire State Commercial Production Credit - New York

What Is Form IT-246?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-246?

A: Form IT-246 is the Claim for Empire State Commercial Production Credit in New York.

Q: What is the Empire State Commercial Production Credit?

A: The Empire State Commercial Production Credit is a tax credit offered by the state of New York to incentivize commercial production activities.

Q: Who can claim the Empire State Commercial Production Credit?

A: Qualified taxpayers engaged in qualifying commercial production activities in New York can claim the credit.

Q: What qualifies as a commercial production activity?

A: Commercial production activities include film production, television production, and sound recording production conducted in New York.

Q: How much is the Empire State Commercial Production Credit?

A: The credit amount is equal to a percentage of the eligible production costs incurred in New York.

Q: How can I claim the Empire State Commercial Production Credit?

A: To claim the credit, you need to complete Form IT-246 and attach it to your New York state tax return.

Q: Are there any deadlines for claiming the Empire State Commercial Production Credit?

A: Yes, you must claim the credit within three years from the original due date of your tax return for the year in which the production costs were incurred.

Q: Are there any other requirements to claim the Empire State Commercial Production Credit?

A: Yes, you must meet certain eligibility criteria and provide supporting documentation to claim the credit.

Q: Can I claim the Empire State Commercial Production Credit if I am not a resident of New York?

A: Yes, non-residents can also claim the credit if they meet the eligibility criteria and have qualifying production activities in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-246 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.