This version of the form is not currently in use and is provided for reference only. Download this version of

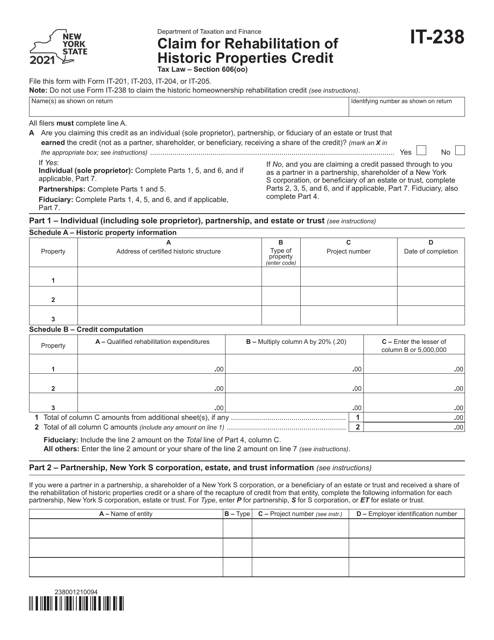

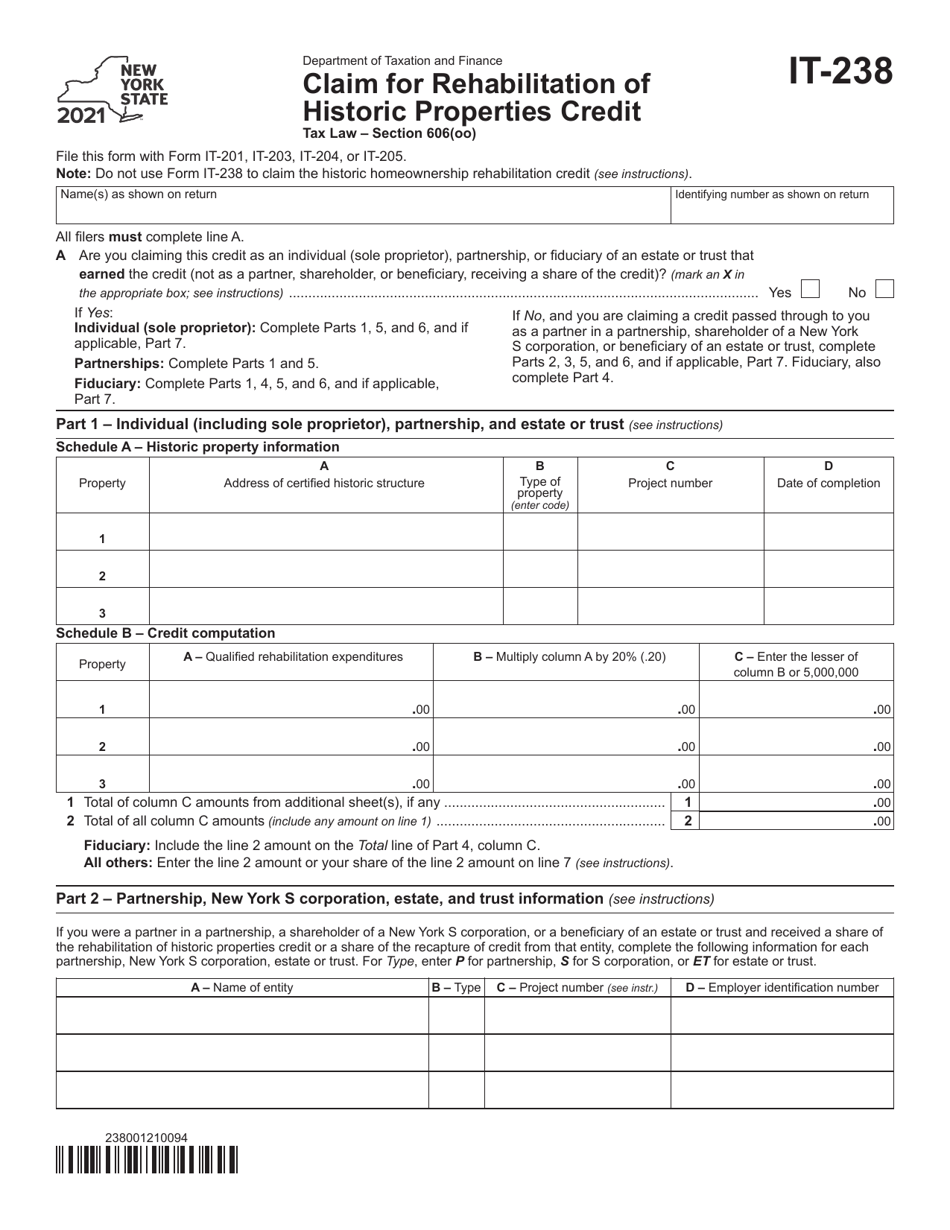

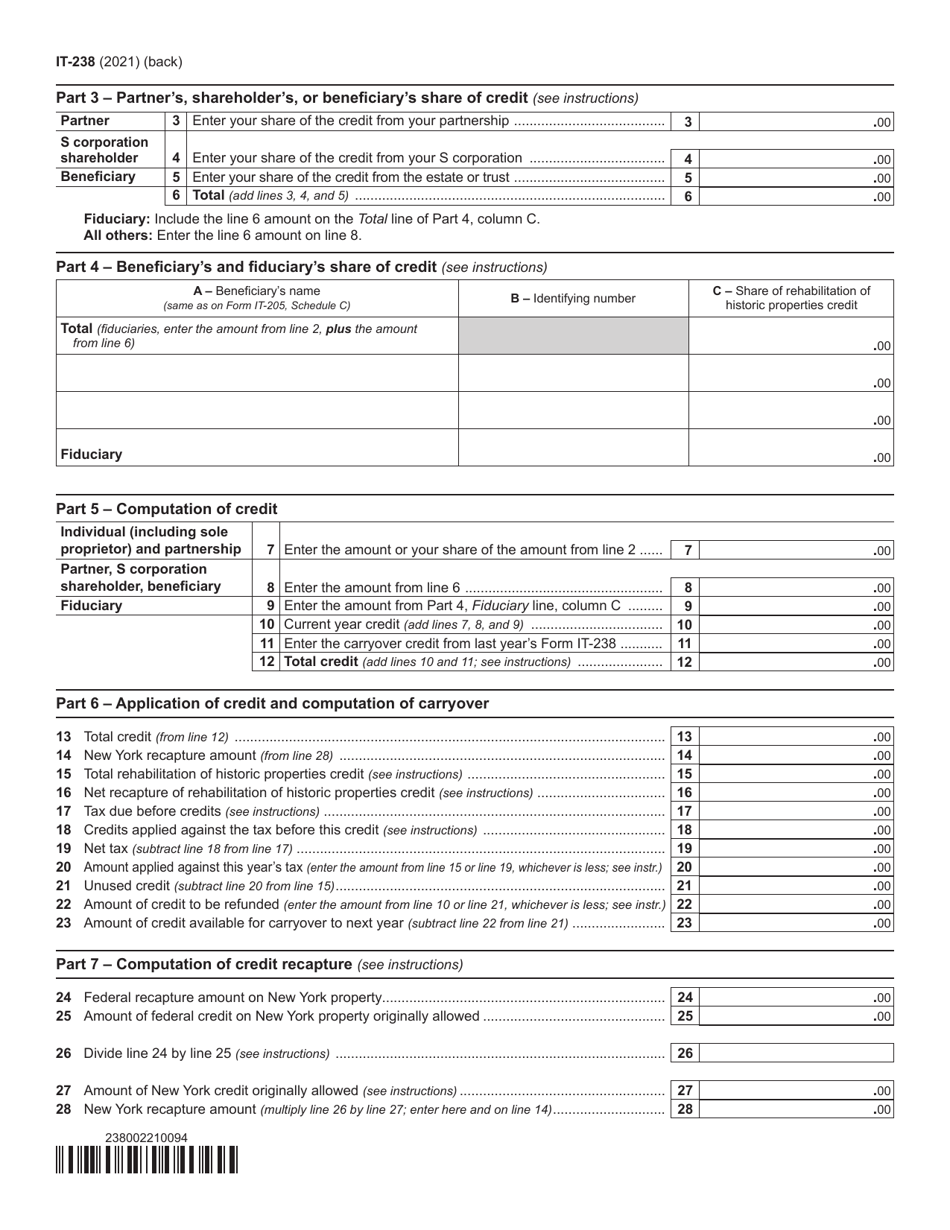

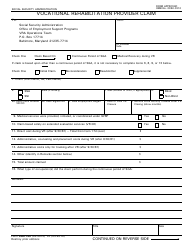

Form IT-238

for the current year.

Form IT-238 Claim for Rehabilitation of Historic Properties Credit - New York

What Is Form IT-238?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-238?

A: Form IT-238 is a tax form used for claiming the Rehabilitation of Historic Properties Credit in New York.

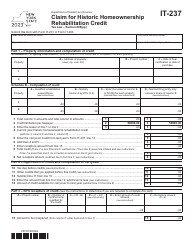

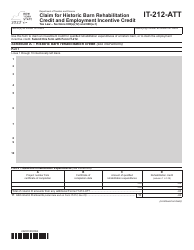

Q: What is the Rehabilitation of Historic Properties Credit?

A: The Rehabilitation of Historic Properties Credit is a tax credit offered in New York to individuals or businesses that restore and preserve historic properties.

Q: Who can claim the Rehabilitation of Historic Properties Credit?

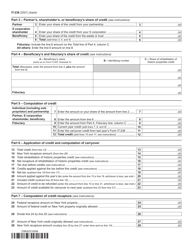

A: Individuals and businesses who have incurred qualified rehabilitation expenses for eligible historic properties in New York can claim this credit.

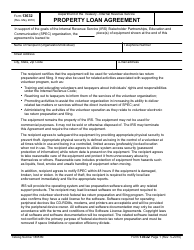

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses are certain expenses incurred for the rehabilitation, renovation, or restoration work done on a historic property.

Q: What is an eligible historic property?

A: An eligible historic property is a property that is listed on the State Register of Historic Places or is located in a historic district that is certified by the New York State Office of Parks, Recreation and Historic Preservation.

Q: How do I file Form IT-238?

A: Form IT-238 can be filed with your New York state income tax return. You will need to provide detailed information about the rehabilitation project and the qualified rehabilitation expenses.

Q: Is there a deadline for filing Form IT-238?

A: Yes, Form IT-238 must be filed by the due date of your New York state income tax return, including extensions.

Q: What is the benefit of claiming the Rehabilitation of Historic Properties Credit?

A: By claiming this credit, individuals and businesses can offset a portion of the qualified rehabilitation expenses and reduce their New York state income tax liability.

Q: Can I claim the Rehabilitation of Historic Properties Credit if I used federal historic preservation tax credits?

A: Yes, you can still claim the Rehabilitation of Historic Properties Credit in addition to any federal historic preservation tax credits you may have received.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-238 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.