This version of the form is not currently in use and is provided for reference only. Download this version of

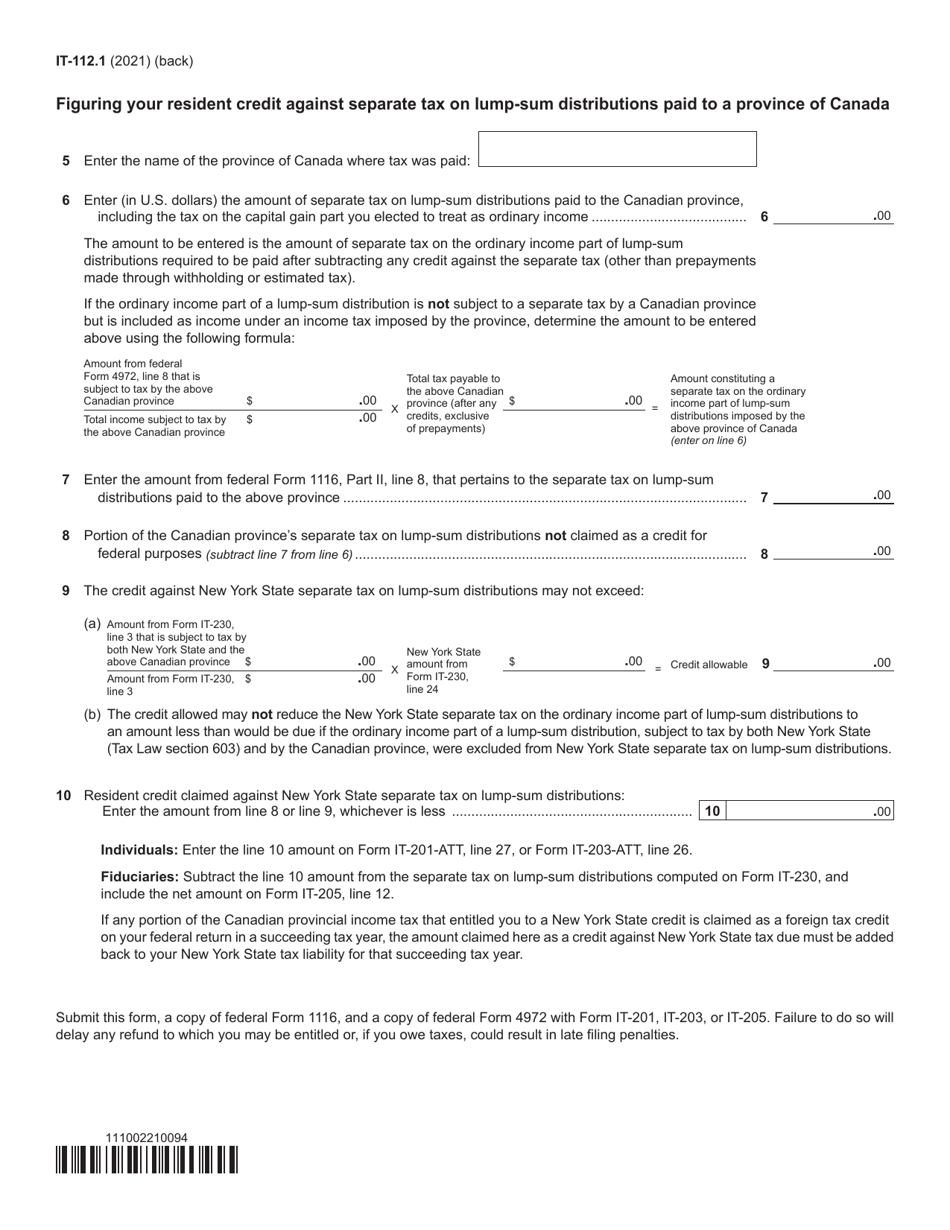

Form IT-112.1

for the current year.

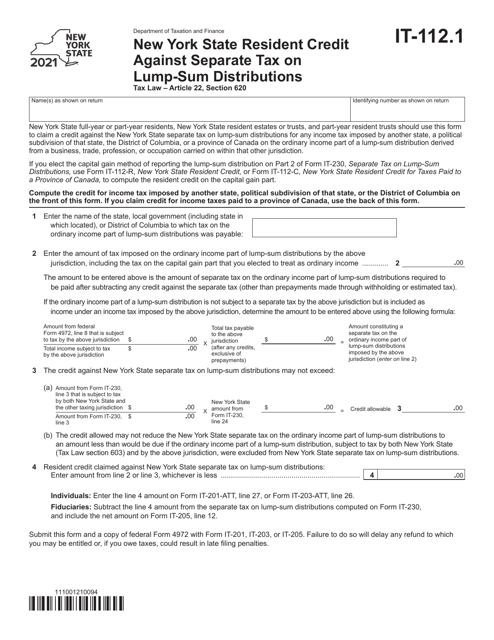

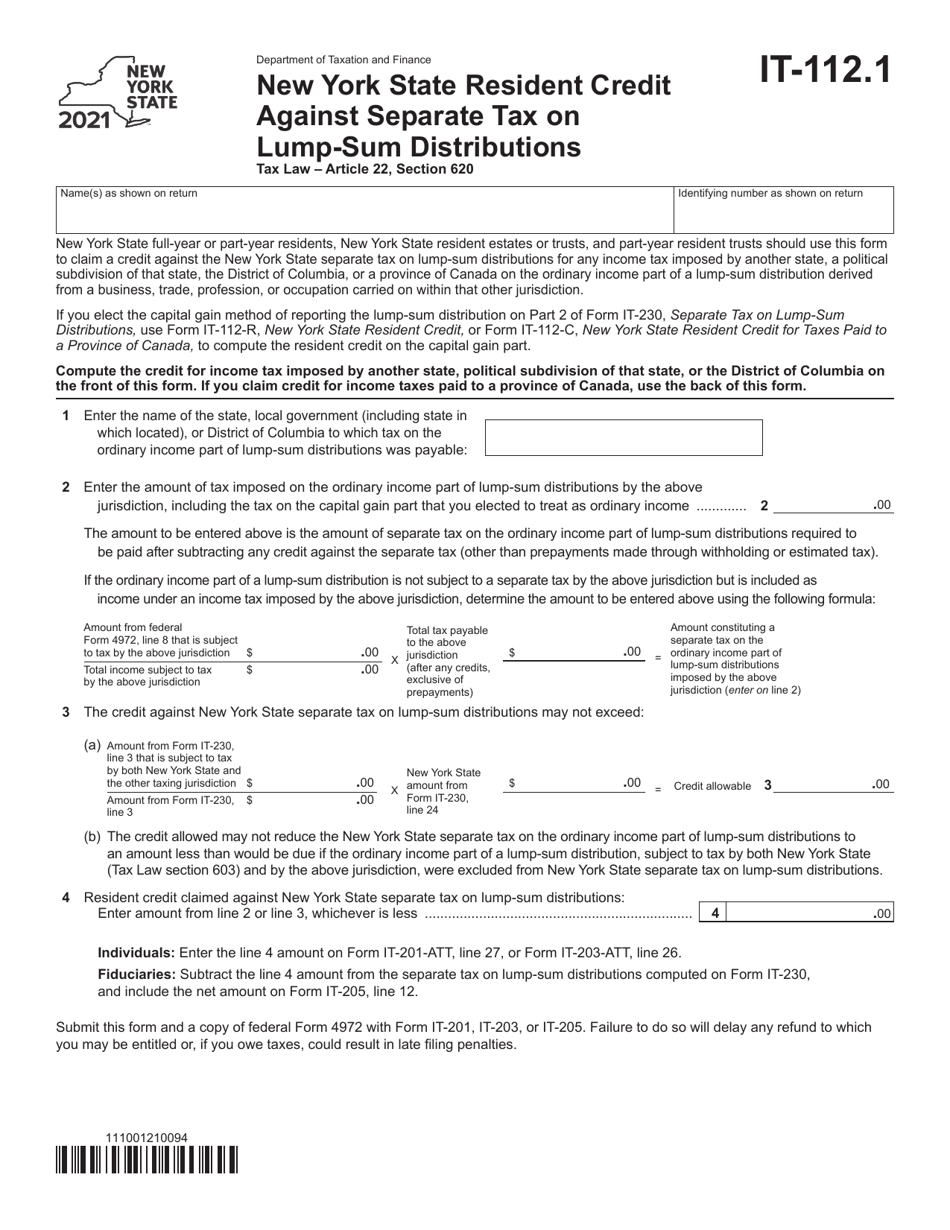

Form IT-112.1 New York State Resident Credit Against Separate Tax on Lump-Sum Distributions - New York

What Is Form IT-112.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-112.1?

A: Form IT-112.1 is a tax form used by New York State residents to claim a credit against the separate tax on lump-sum distributions.

Q: What is the purpose of Form IT-112.1?

A: The purpose of Form IT-112.1 is to calculate and claim a credit against the separate tax on lump-sum distributions.

Q: Who needs to file Form IT-112.1?

A: New York State residents who receive lump-sum distributions and are subject to the separate tax on these distributions.

Q: What are lump-sum distributions?

A: Lump-sum distributions refer to a one-time payment of a retirement plan, such as a pension, profit-sharing, or annuity plan.

Q: What is the separate tax on lump-sum distributions?

A: The separate tax on lump-sum distributions is an additional tax imposed on certain retirement plan distributions in New York State.

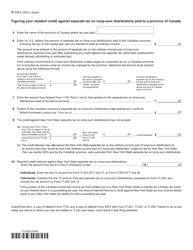

Q: How do I calculate the credit using Form IT-112.1?

A: Form IT-112.1 provides instructions and a worksheet to calculate the amount of credit you can claim against the separate tax on lump-sum distributions.

Q: When is the deadline for filing Form IT-112.1?

A: The deadline for filing Form IT-112.1 is the same as the deadline for filing your New York State income tax return, typically April 15th.

Q: Can I e-file Form IT-112.1?

A: Yes, you can e-file Form IT-112.1 if you are filing your New York State income tax return electronically.

Q: Do I need to attach any supporting documents to Form IT-112.1?

A: You may need to attach certain documents, such as a copy of your W-2 form and retirement plan distribution statements, depending on your specific situation.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-112.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.