This version of the form is not currently in use and is provided for reference only. Download this version of

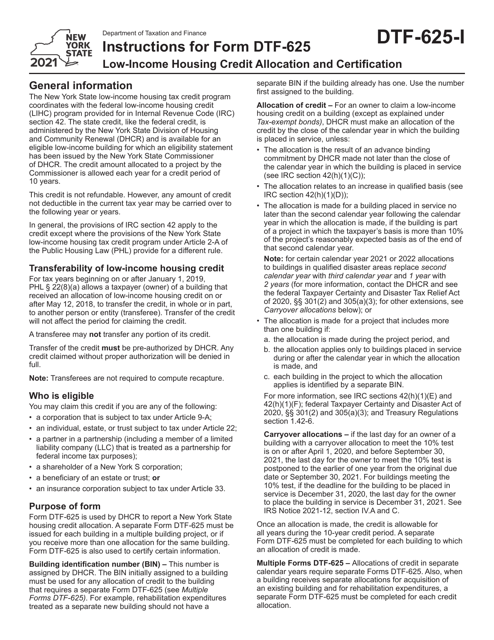

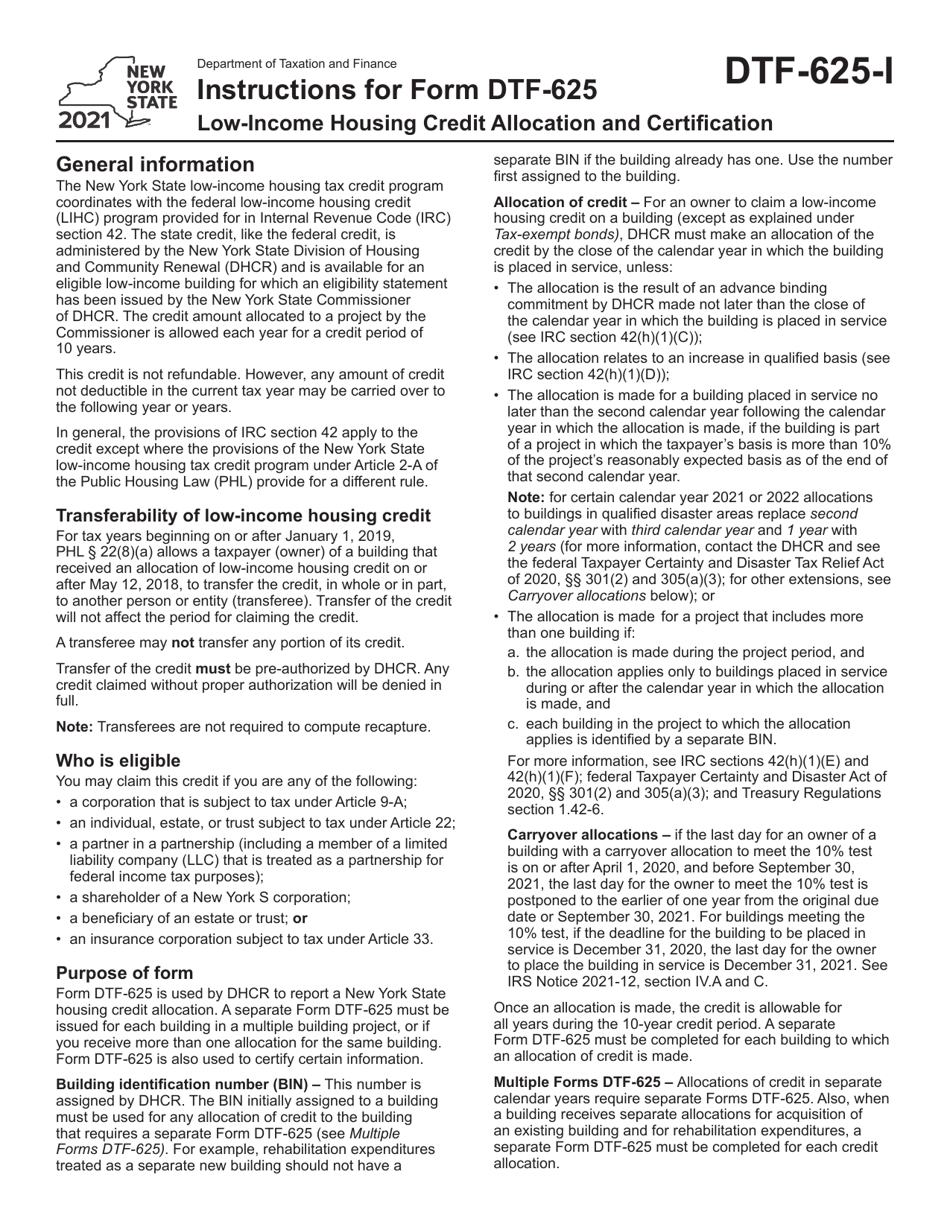

Instructions for Form DTF-625

for the current year.

Instructions for Form DTF-625 Low-Income Housing Credit Allocation and Certification - New York

This document contains official instructions for Form DTF-625 , Low-Income Housing Credit Allocation and Certification - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form DTF-625 is available for download through this link.

FAQ

Q: What is Form DTF-625?

A: Form DTF-625 is a document used in New York for the allocation and certification of low-income housing credits.

Q: Who needs to fill out Form DTF-625?

A: Developers or sponsors of low-income housing projects in New York need to fill out Form DTF-625.

Q: What is the purpose of Form DTF-625?

A: The purpose of Form DTF-625 is to request an allocation of low-income housing credits and certify that the project meets the requirements.

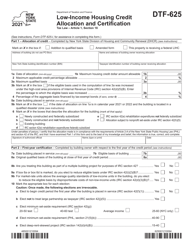

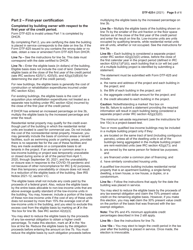

Q: What information is required on Form DTF-625?

A: Form DTF-625 requires information about the project, the developer, the location, and the anticipated low-income tenants.

Q: What is the deadline for filing Form DTF-625?

A: The deadline for filing Form DTF-625 depends on the specific program for which you are seeking an allocation. It is important to check the instructions or consult with the Department of Taxation and Finance for the specific deadline.

Q: What happens after Form DTF-625 is submitted?

A: After Form DTF-625 is submitted, the Department of Taxation and Finance will review the application and notify the applicant of their allocation decision.

Q: Are there any penalties for false information on Form DTF-625?

A: Yes, there can be penalties for providing false information on Form DTF-625. It is important to provide accurate and truthful information on the form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.