This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-626

for the current year.

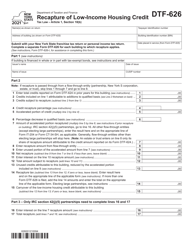

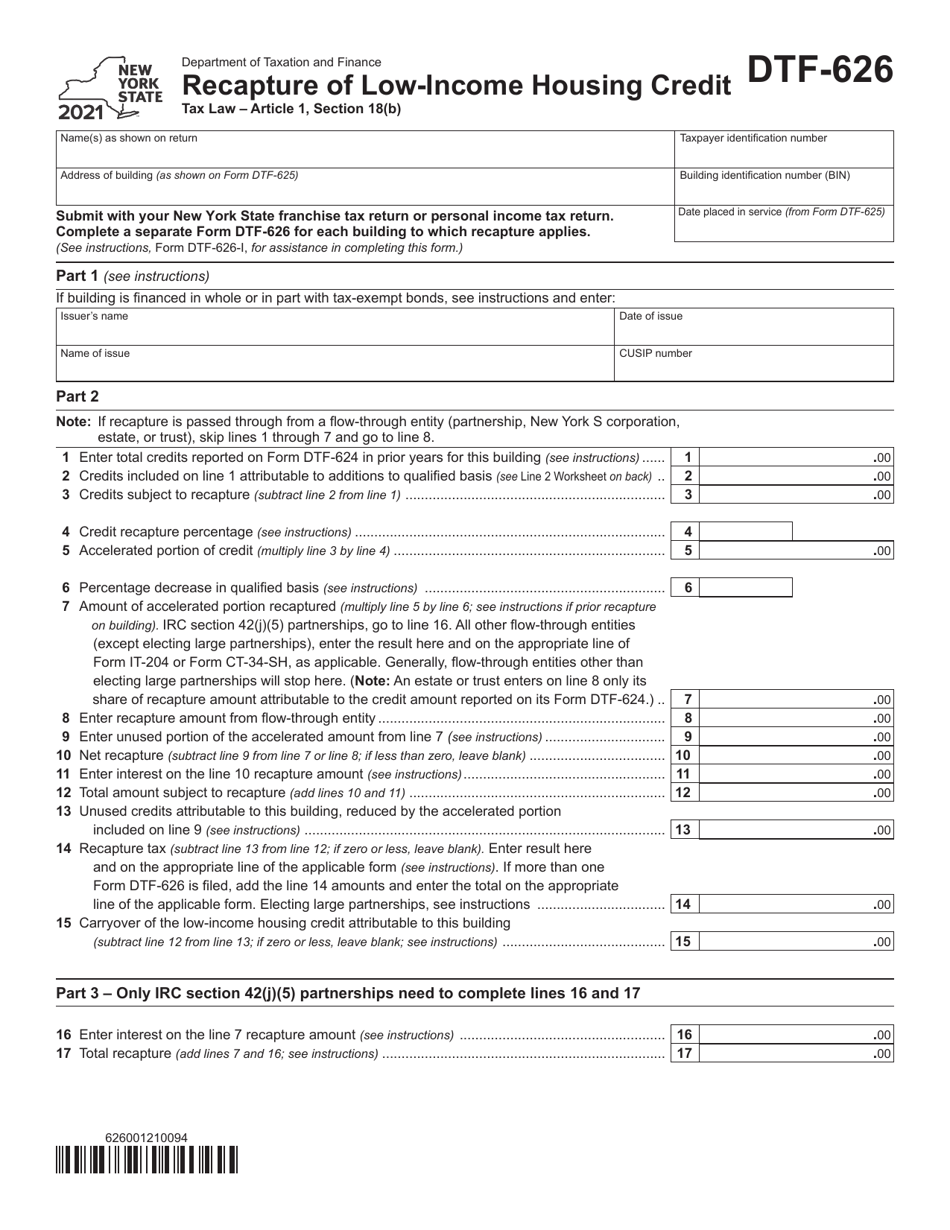

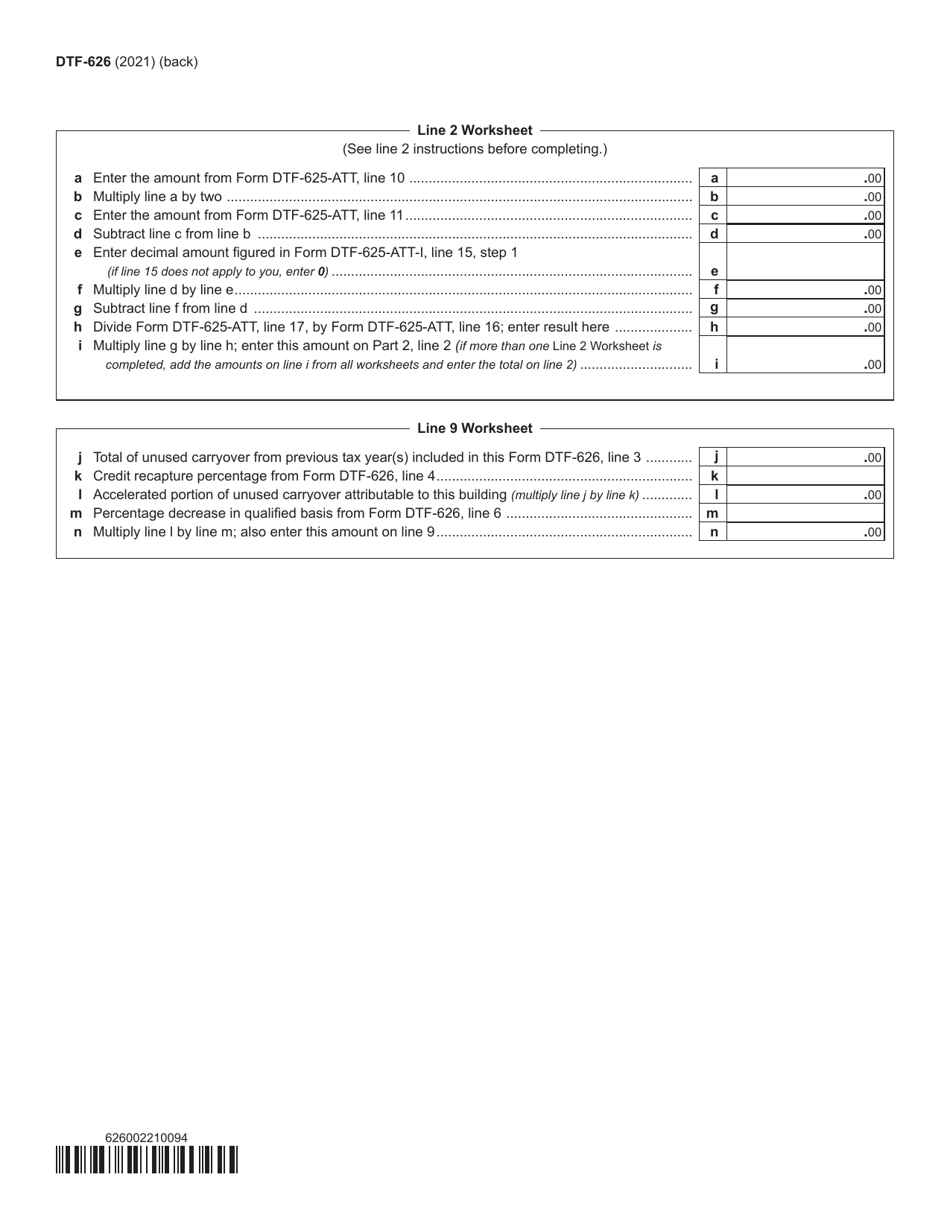

Form DTF-626 Recapture of Low-Income Housing Credit - New York

What Is Form DTF-626?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-626?

A: Form DTF-626 is a tax form used in New York for the recapture of low-income housing credit.

Q: What is the purpose of Form DTF-626?

A: The purpose of Form DTF-626 is to calculate and recapture any low-income housing credits that have been previously claimed.

Q: Who needs to use Form DTF-626?

A: Property owners or developers who have claimed low-income housing credits in New York may need to use Form DTF-626.

Q: When is Form DTF-626 due?

A: The due date for Form DTF-626 varies. It is typically due with the annual tax return, but it can also be due when there is a recapture event.

Q: Are there any penalties for not filing Form DTF-626?

A: Failure to file Form DTF-626 or pay the required recaptured credits may result in penalties and interest.

Q: Are there any resources available to help with Form DTF-626?

A: The New York State Department of Taxation and Finance provides instructions and guidance for completing Form DTF-626.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-626 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.