This version of the form is not currently in use and is provided for reference only. Download this version of

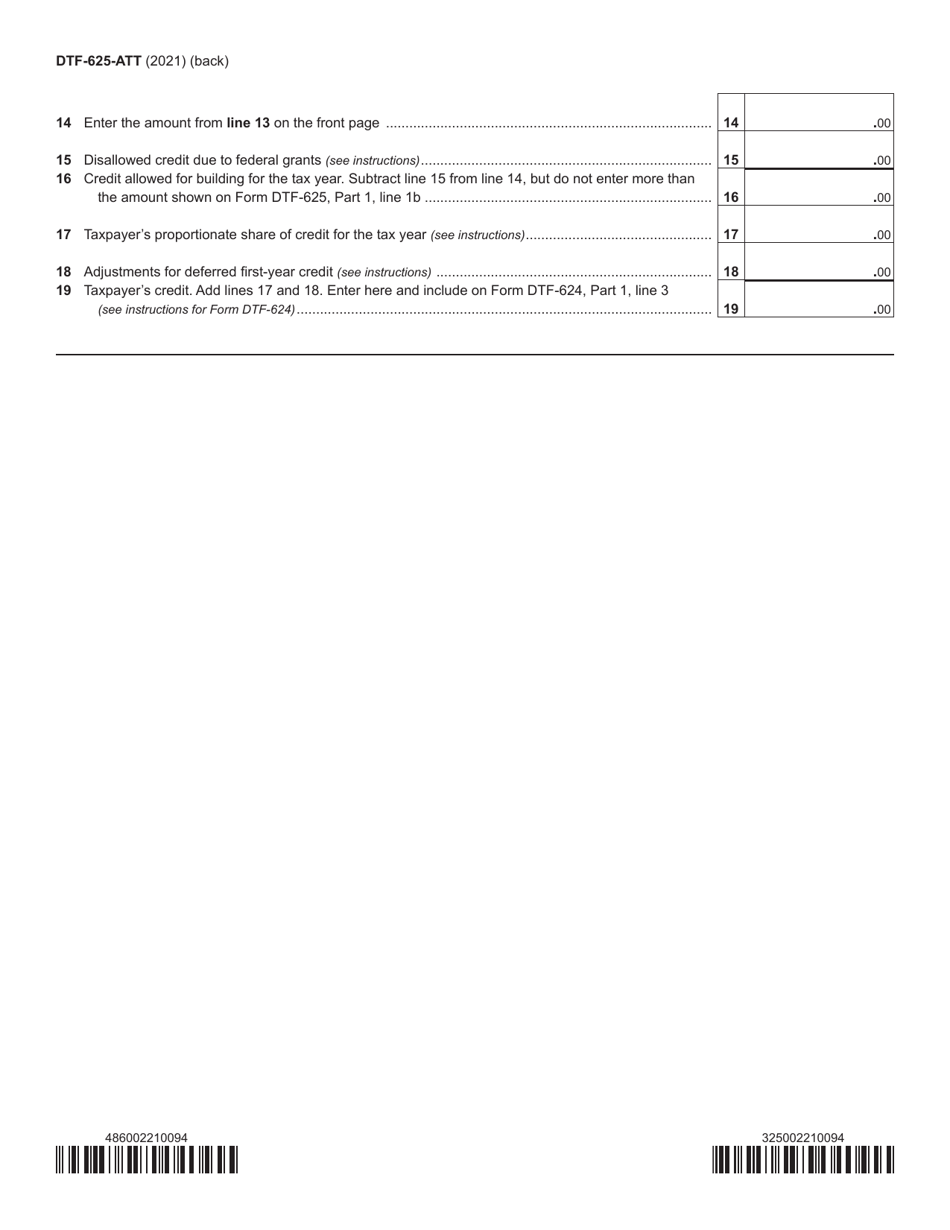

Form DTF-625-ATT

for the current year.

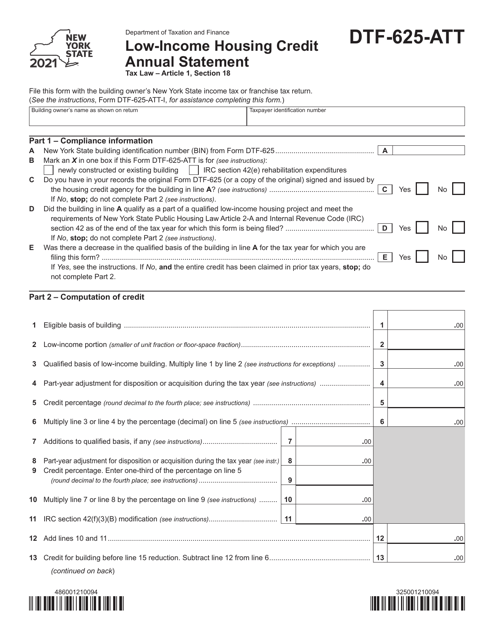

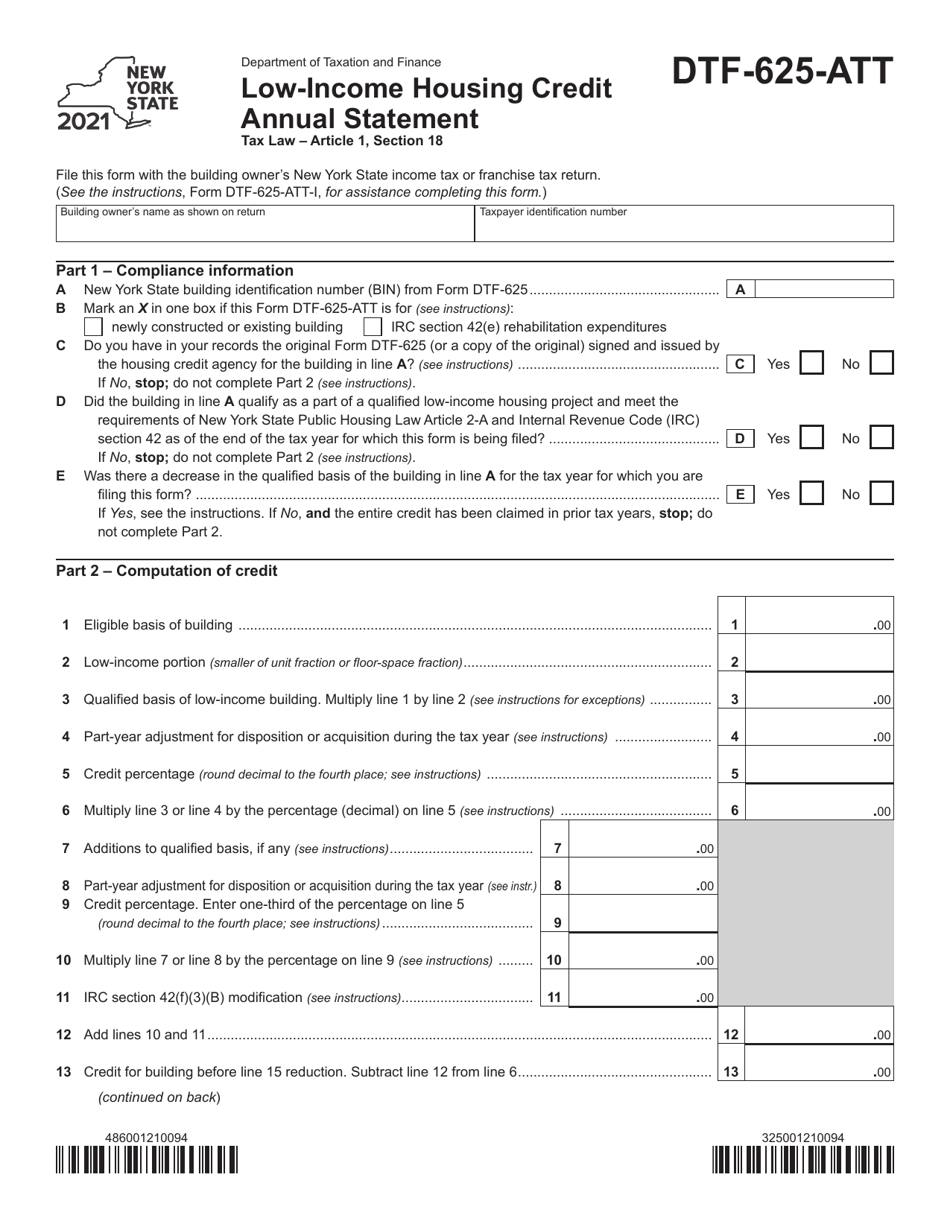

Form DTF-625-ATT Low-Income Housing Credit Annual Statement - New York

What Is Form DTF-625-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-625-ATT?

A: Form DTF-625-ATT is the Low-Income Housing CreditAnnual Statement for New York.

Q: What is the purpose of Form DTF-625-ATT?

A: The purpose of Form DTF-625-ATT is to report the low-income housing credits claimed and allocated in New York.

Q: Who needs to file Form DTF-625-ATT?

A: Owners of low-income housing projects in New York who have claimed or allocated low-income housing credits need to file Form DTF-625-ATT.

Q: When is Form DTF-625-ATT due?

A: Form DTF-625-ATT is due on or before the fifteenth day of the fourth month following the close of the taxable year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-625-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.