This version of the form is not currently in use and is provided for reference only. Download this version of

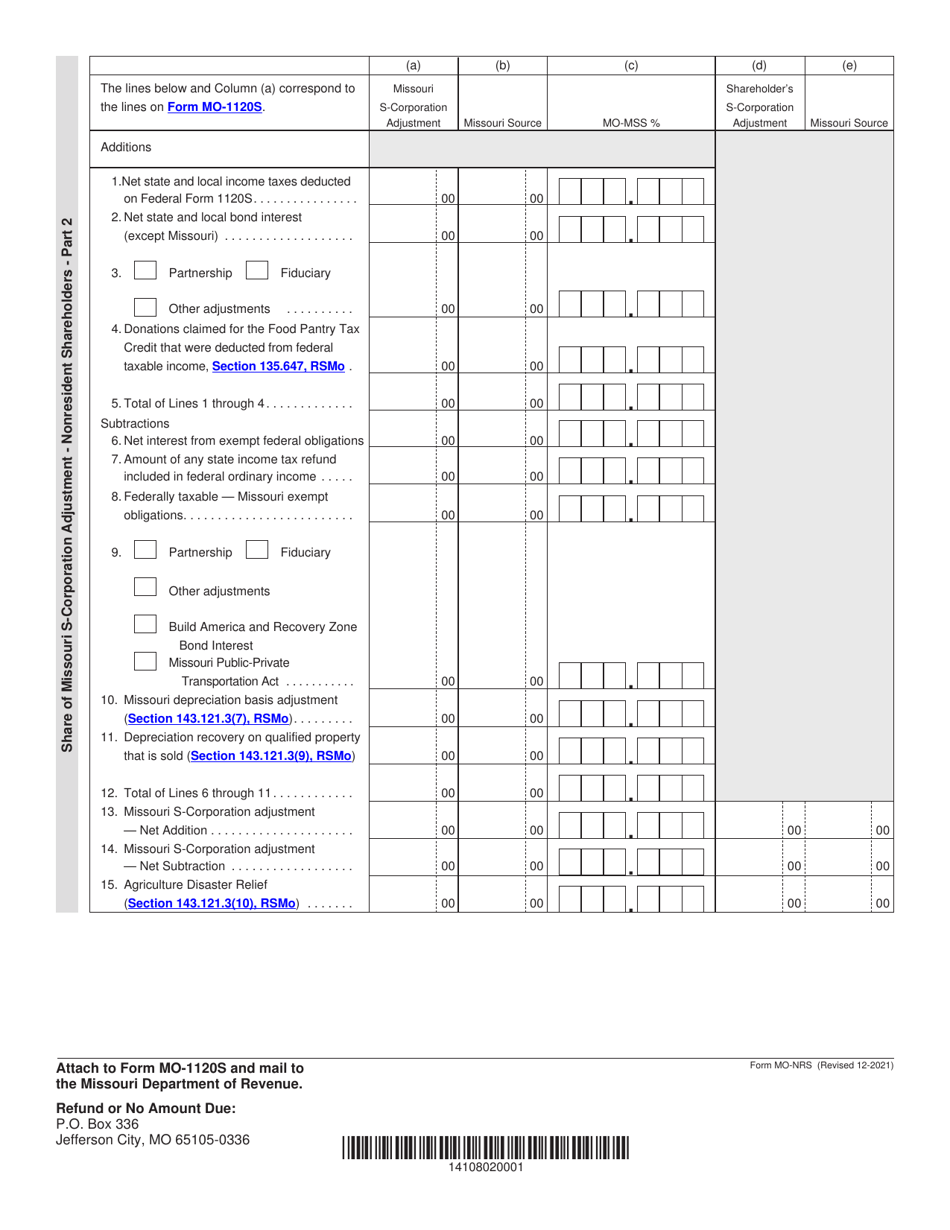

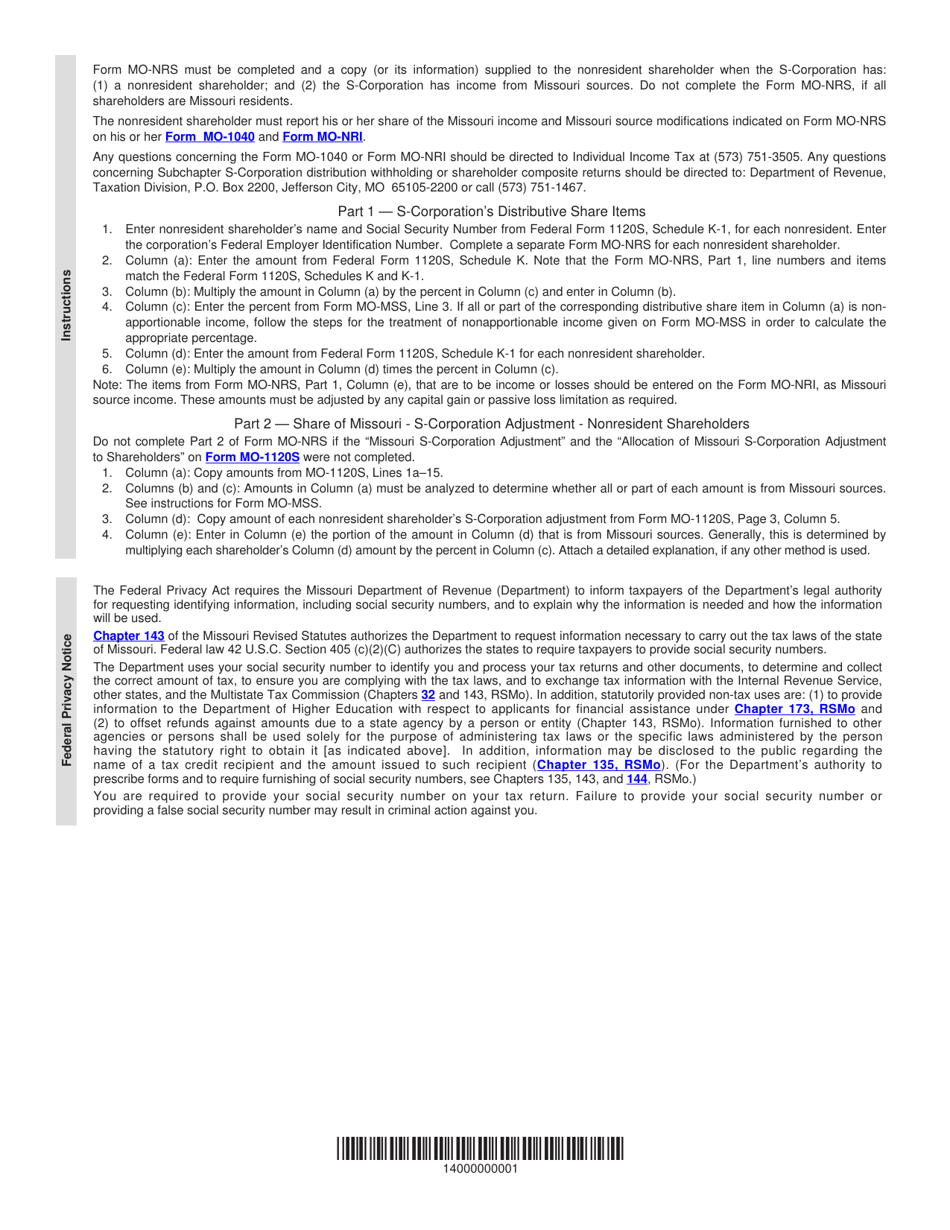

Form MO-NRS

for the current year.

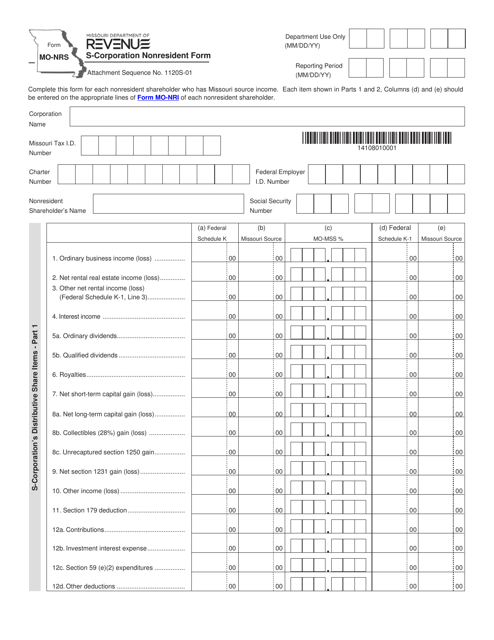

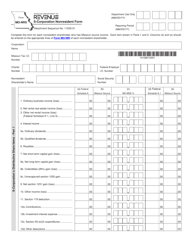

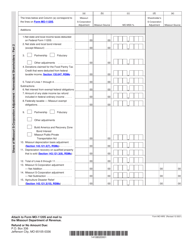

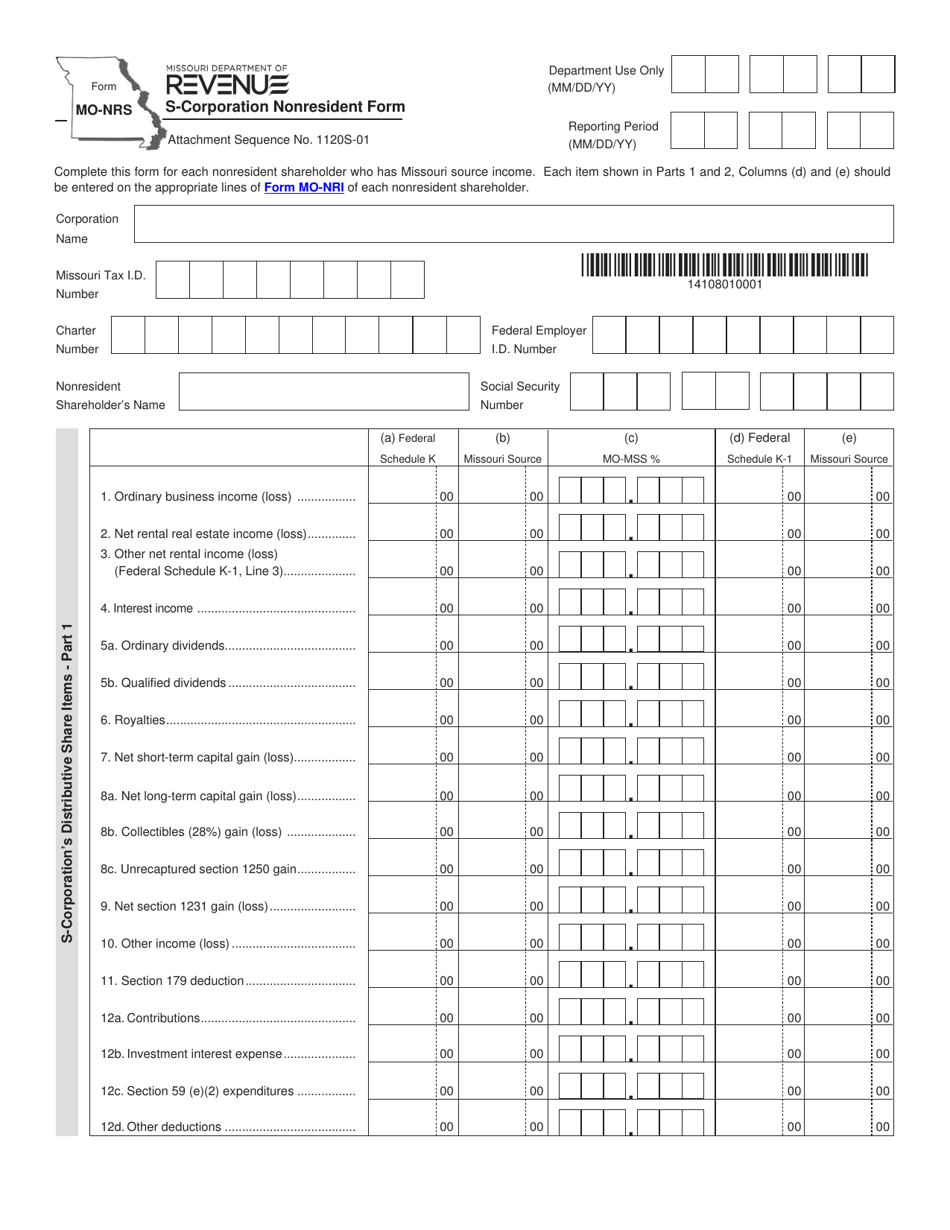

Form MO-NRS S-Corporation Nonresident Form - Missouri

What Is Form MO-NRS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MO-NRS S-Corporation Nonresident Form?

A: MO-NRS S-Corporation Nonresident Form is a tax form used by nonresident S-Corporations in Missouri.

Q: Who needs to file MO-NRS S-Corporation Nonresident Form?

A: Nonresident S-Corporations that have income or business activity in Missouri need to file this form.

Q: What is the purpose of MO-NRS S-Corporation Nonresident Form?

A: The purpose of this form is to report income or business activity of nonresident S-Corporations in Missouri.

Q: When is the deadline for filing MO-NRS S-Corporation Nonresident Form?

A: The filing deadline for this form is the same as the regular S-Corporation tax return deadline in Missouri, which is March 15th.

Q: Are there any penalties for late filing of MO-NRS S-Corporation Nonresident Form?

A: Yes, there may be penalties for late filing, such as the imposition of interest and penalties on the unpaid tax amount.

Q: What supporting documents do I need to include with MO-NRS S-Corporation Nonresident Form?

A: You may need to include copies of federal tax returns, schedules, and other relevant documents that show the income or business activity in Missouri.

Q: What if my nonresident S-Corporation doesn't have any income or business activity in Missouri?

A: If your nonresident S-Corporation has no income or business activity in Missouri, you may still need to file a zero return or provide an explanation.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NRS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.