This version of the form is not currently in use and is provided for reference only. Download this version of

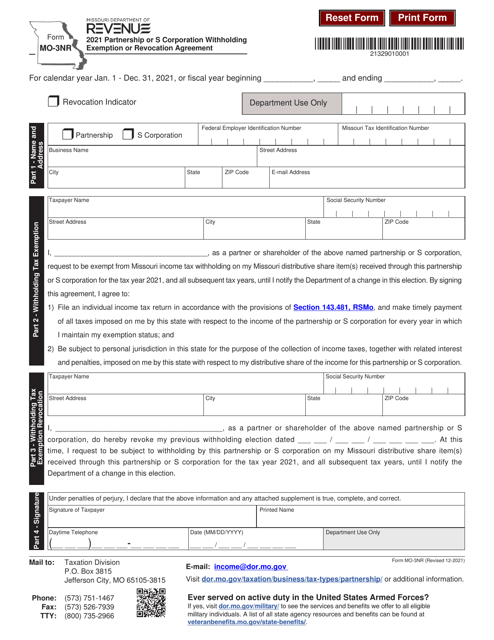

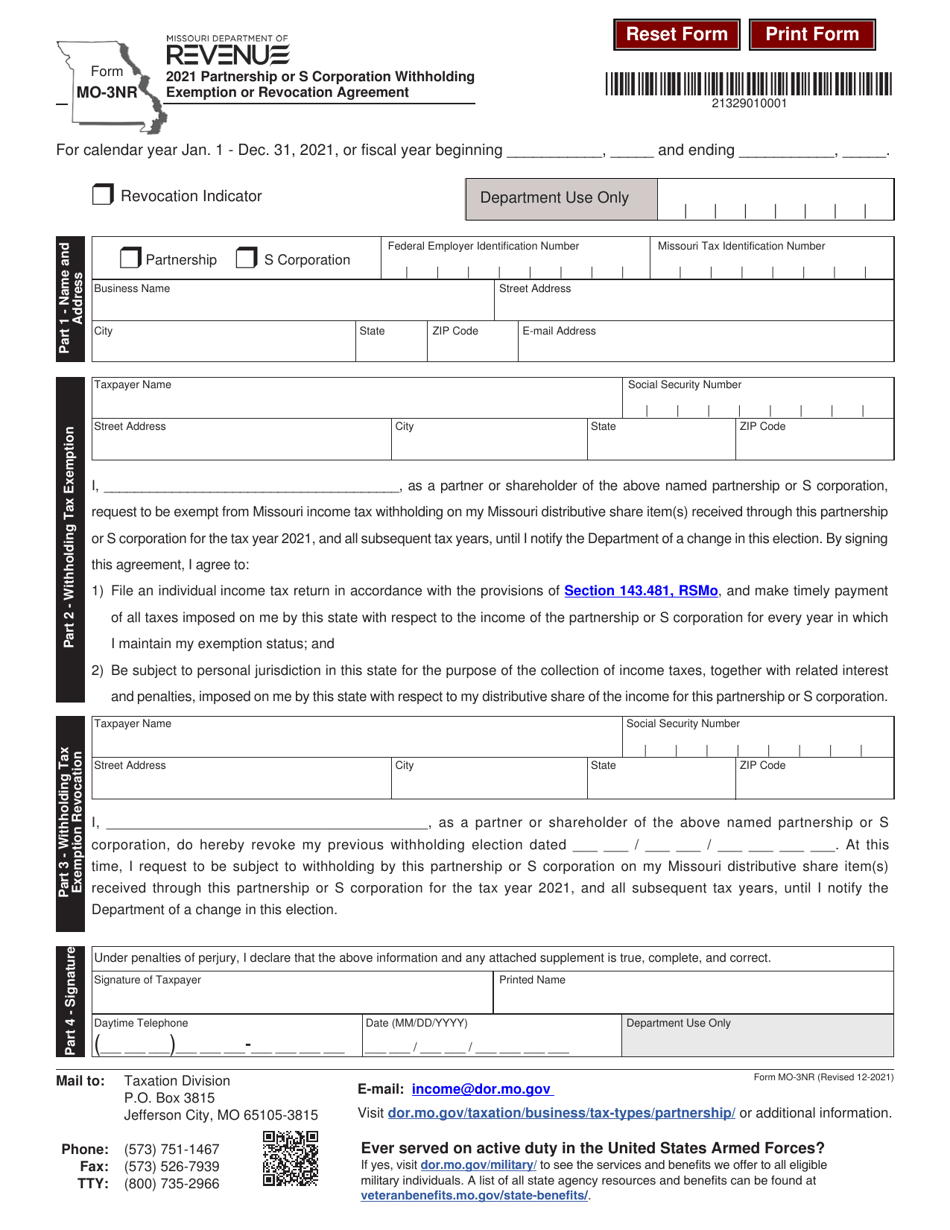

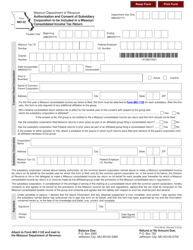

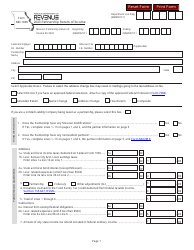

Form MO-3NR

for the current year.

Form MO-3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement - Missouri

What Is Form MO-3NR?

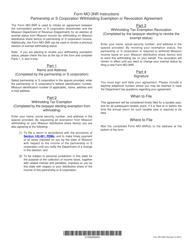

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-3NR?

A: Form MO-3NR is a document used for Partnership or S Corporation Withholding Exemption or Revocation Agreement in Missouri.

Q: Who needs to file Form MO-3NR?

A: Partnerships or S Corporations in Missouri who want to claim an exemption from withholding or revoke a previously claimed exemption.

Q: What is the purpose of Form MO-3NR?

A: The purpose of Form MO-3NR is to declare partnership or S corporation's withholding exemption or to revoke a previously claimed exemption.

Q: Do I need to file Form MO-3NR every year?

A: No, Form MO-3NR only needs to be filed when there is a change in the partnership or S corporation's withholding exemption status.

Q: What are the penalties for not filing Form MO-3NR?

A: Failure to file Form MO-3NR or providing false information can result in penalties and interest charges.

Q: Is there a deadline for filing Form MO-3NR?

A: Form MO-3NR should be filed within 60 days of the change in withholding exemption status.

Q: Can I e-file Form MO-3NR?

A: No, Form MO-3NR cannot be e-filed. It must be filed by mail or in person.

Q: What supporting documents are required with Form MO-3NR?

A: No supporting documents are required to be submitted with Form MO-3NR.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-3NR by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.