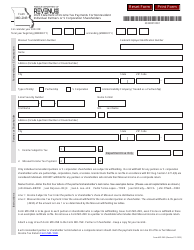

This version of the form is not currently in use and is provided for reference only. Download this version of

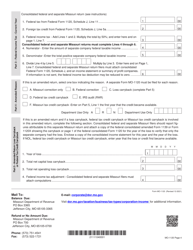

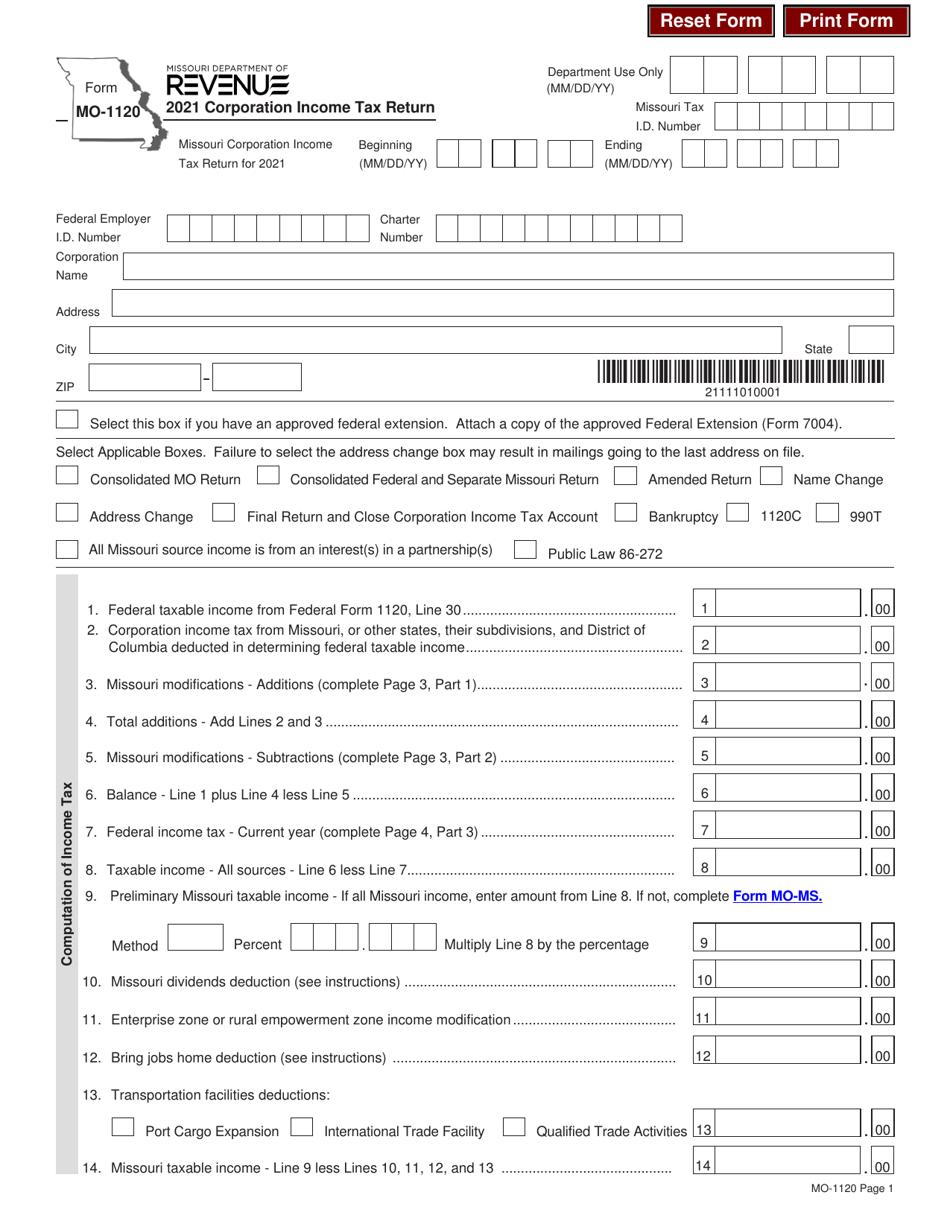

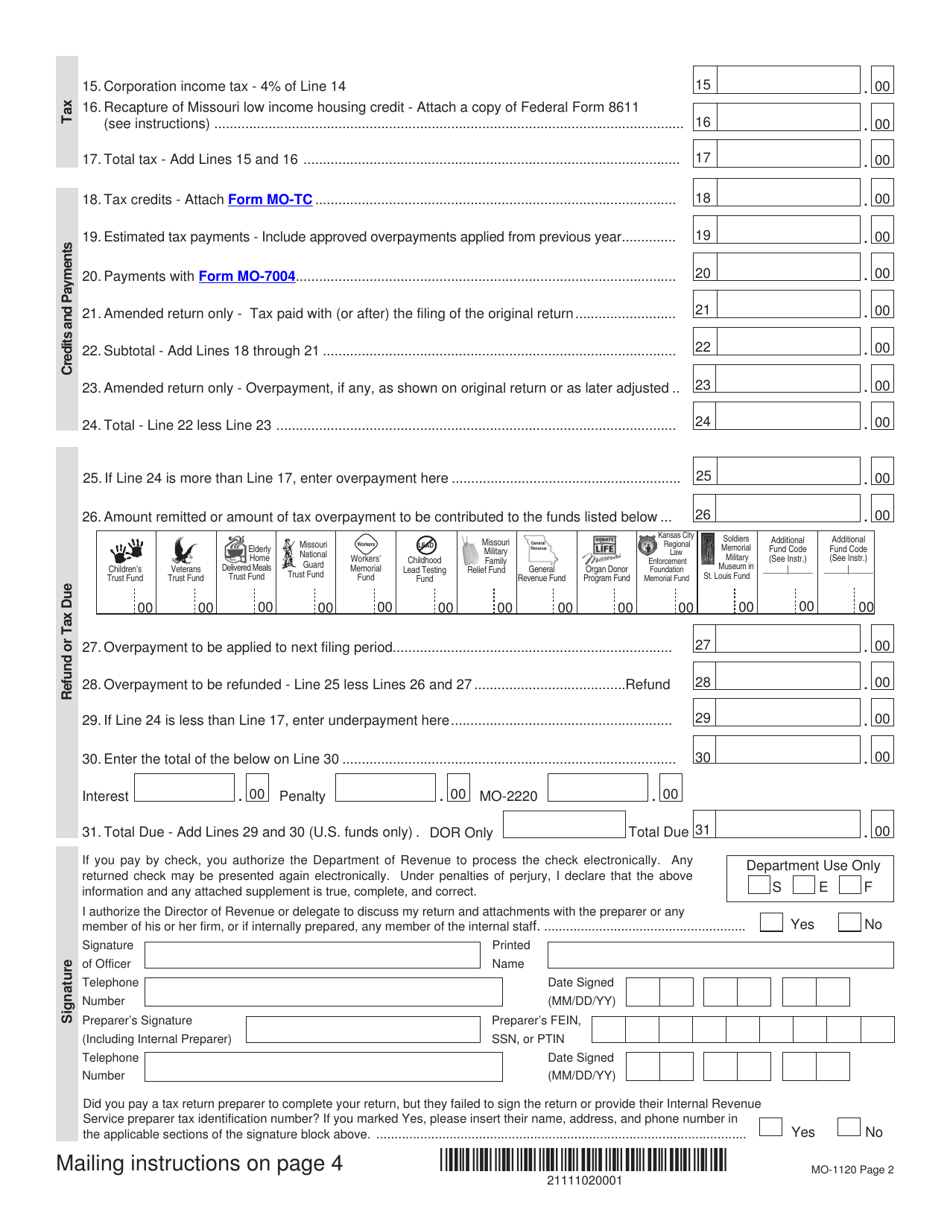

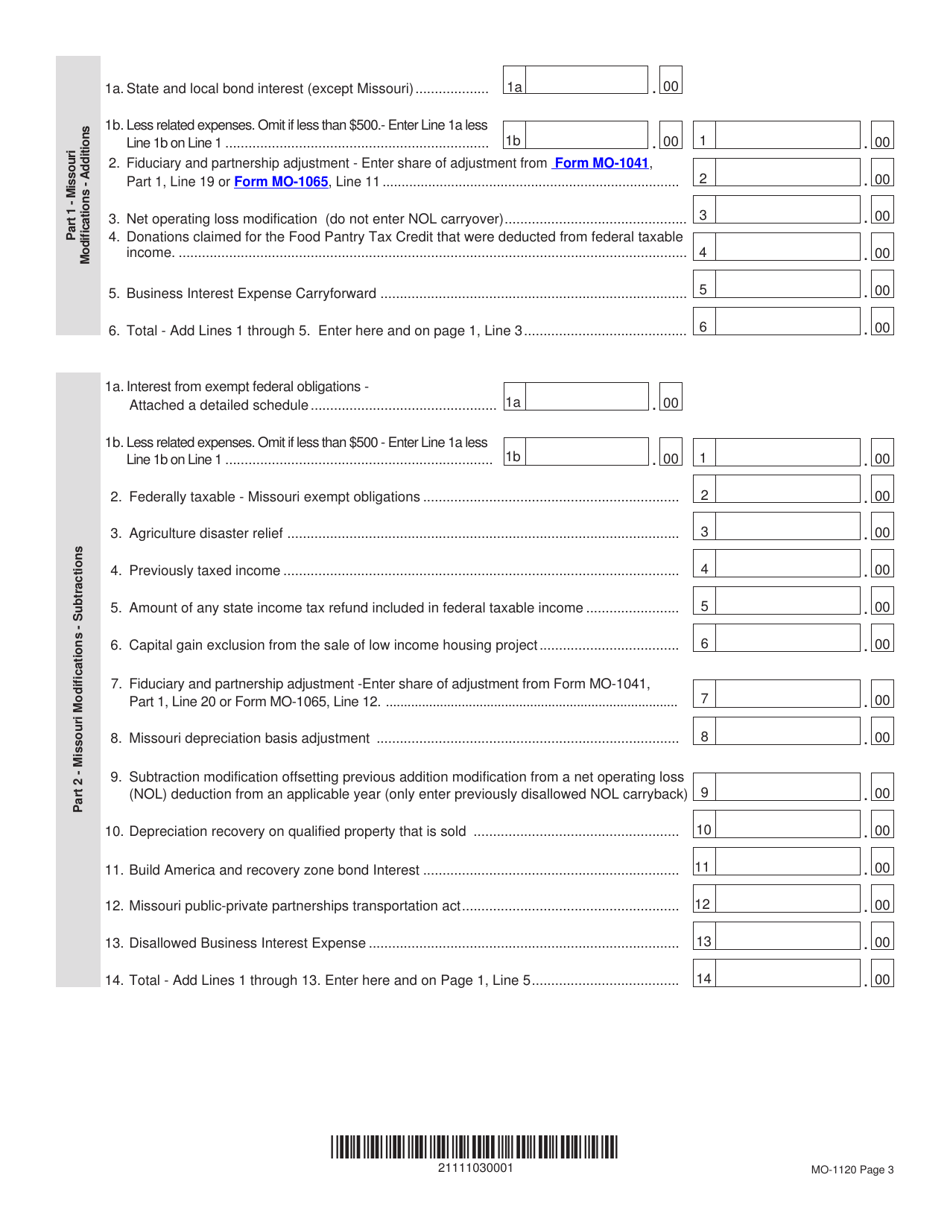

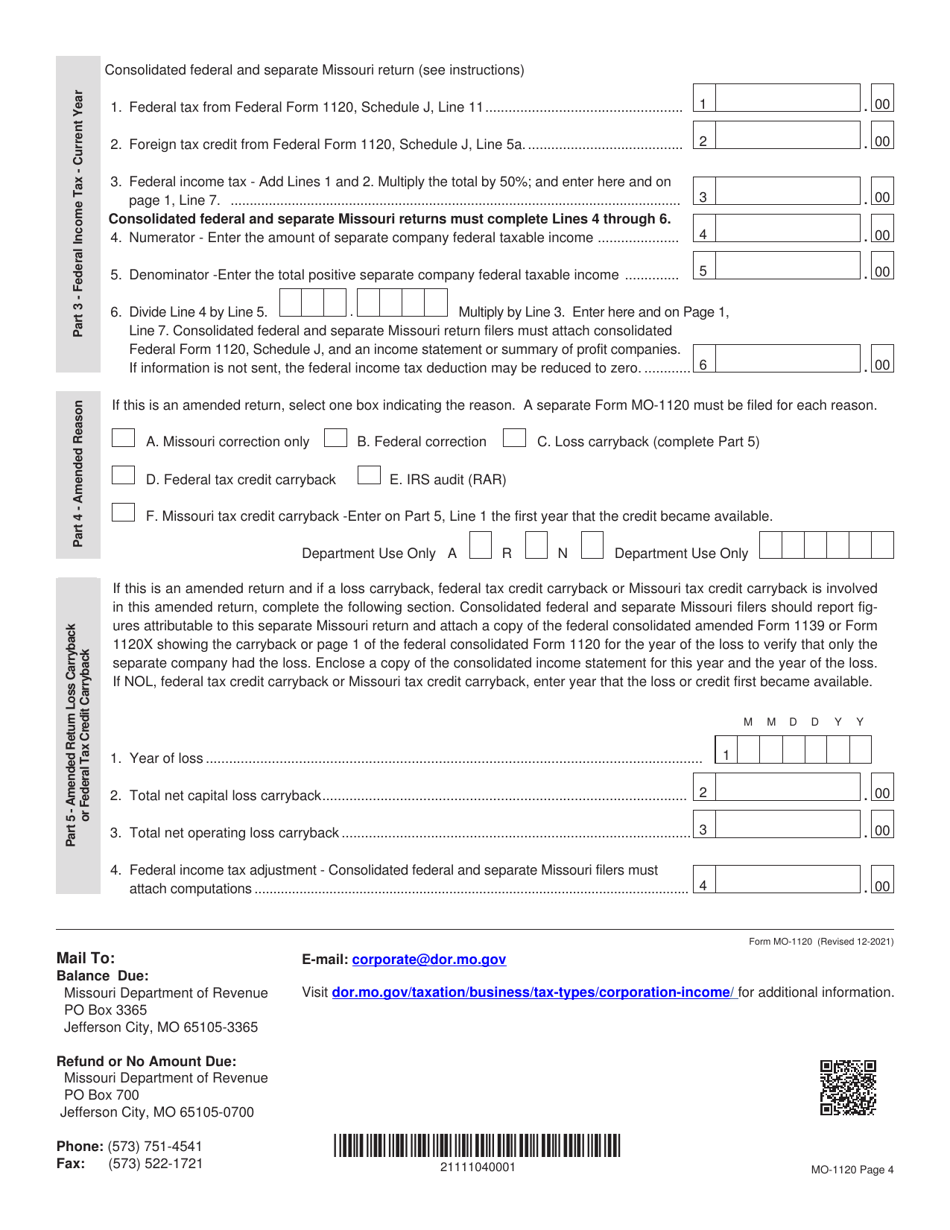

Form MO-1120

for the current year.

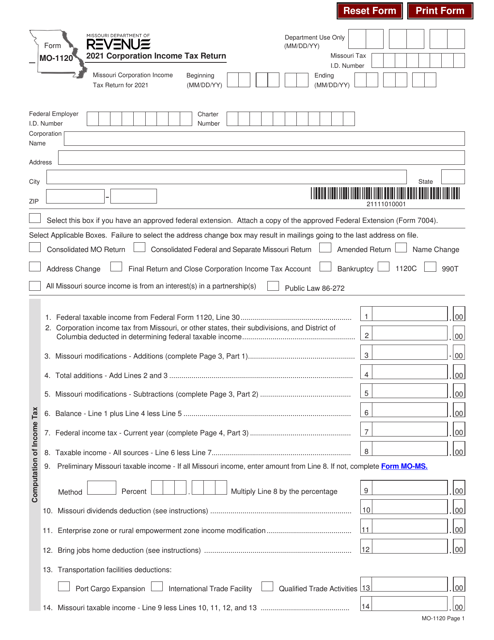

Form MO-1120 Corporation Income Tax Return - Missouri

What Is Form MO-1120?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MO-1120?

A: Form MO-1120 is the Corporation Income Tax Return for the state of Missouri.

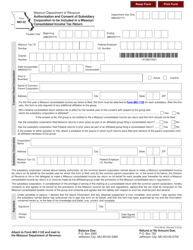

Q: Who needs to file Form MO-1120?

A: Corporations that have income from sources in Missouri or that are incorporated in Missouri need to file Form MO-1120.

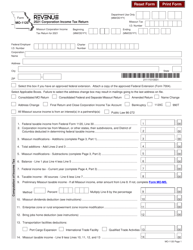

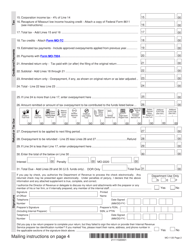

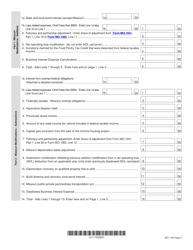

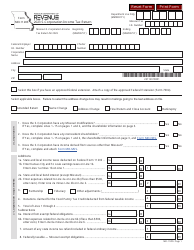

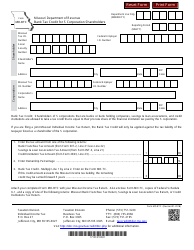

Q: What information is required on Form MO-1120?

A: Form MO-1120 requires information about the corporation's income, deductions, credits, and tax liability.

Q: When is Form MO-1120 due?

A: Form MO-1120 is due on the 15th day of the 4th month following the close of the corporation's tax year.

Q: Are there any penalties for late filing or payment?

A: Yes, there are penalties for late filing or payment of the tax due. It is important to file and pay on time to avoid these penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.