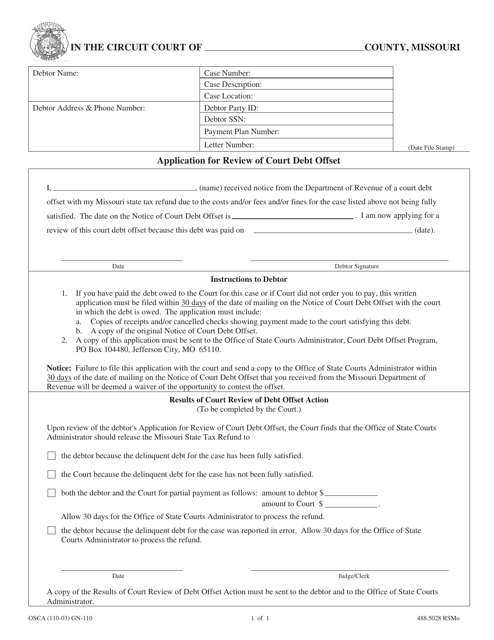

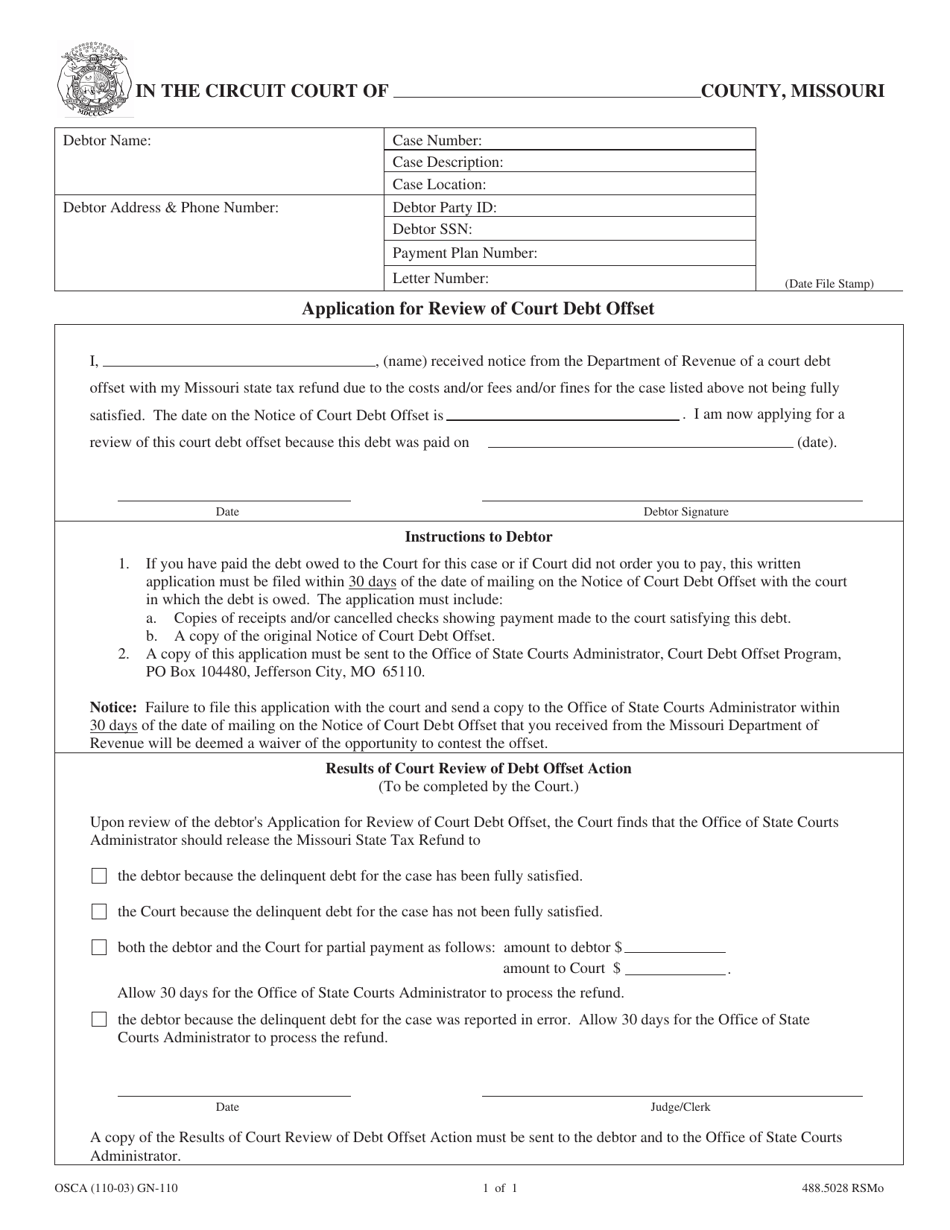

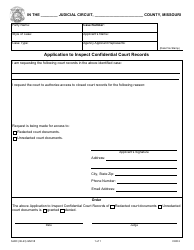

Form GN-110 Application for Review of Court Debt Offset - Missouri

What Is Form GN-110?

This is a legal form that was released by the Missouri Circuit Court - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GN-110?

A: Form GN-110 is the Application for Review of Court Debt Offset in the state of Missouri.

Q: What is a Court Debt Offset?

A: A Court Debt Offset is when the government deducts money from your federal income tax refund to pay off court-ordered debts.

Q: Who can use Form GN-110?

A: Form GN-110 can be used by individuals who want to request a review of their court debt offset in Missouri.

Q: What information is needed to fill out Form GN-110?

A: Form GN-110 requires personal information such as your name, address, Social Security number, and details about the court debt being offset.

Q: What should I do after completing Form GN-110?

A: After completing Form GN-110, you should submit it to the Missouri Department of Revenue along with any supporting documents requested.

Q: How long does the review process take?

A: The review process duration can vary, but you will receive a response from the Missouri Department of Revenue once the review is complete.

Q: Can I appeal the decision made on my court debt offset?

A: Yes, if you are dissatisfied with the decision made on your court debt offset, you may have the option to appeal the decision.

Q: Are there any fees associated with filing Form GN-110?

A: There are typically no fees associated with filing Form GN-110 for the Application for Review of Court Debt Offset in Missouri.

Q: Can I get legal assistance with filling out Form GN-110?

A: If you require legal assistance with filling out Form GN-110, you may consider consulting with an attorney or seeking guidance from legal aid organizations.

Form Details:

- Released on October 1, 2003;

- The latest edition provided by the Missouri Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GN-110 by clicking the link below or browse more documents and templates provided by the Missouri Circuit Court.