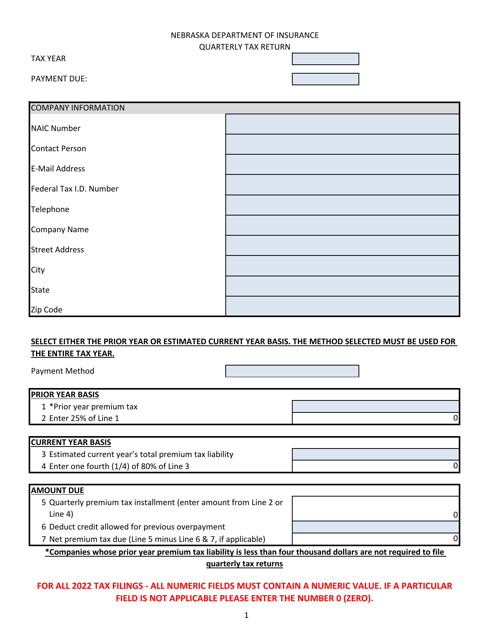

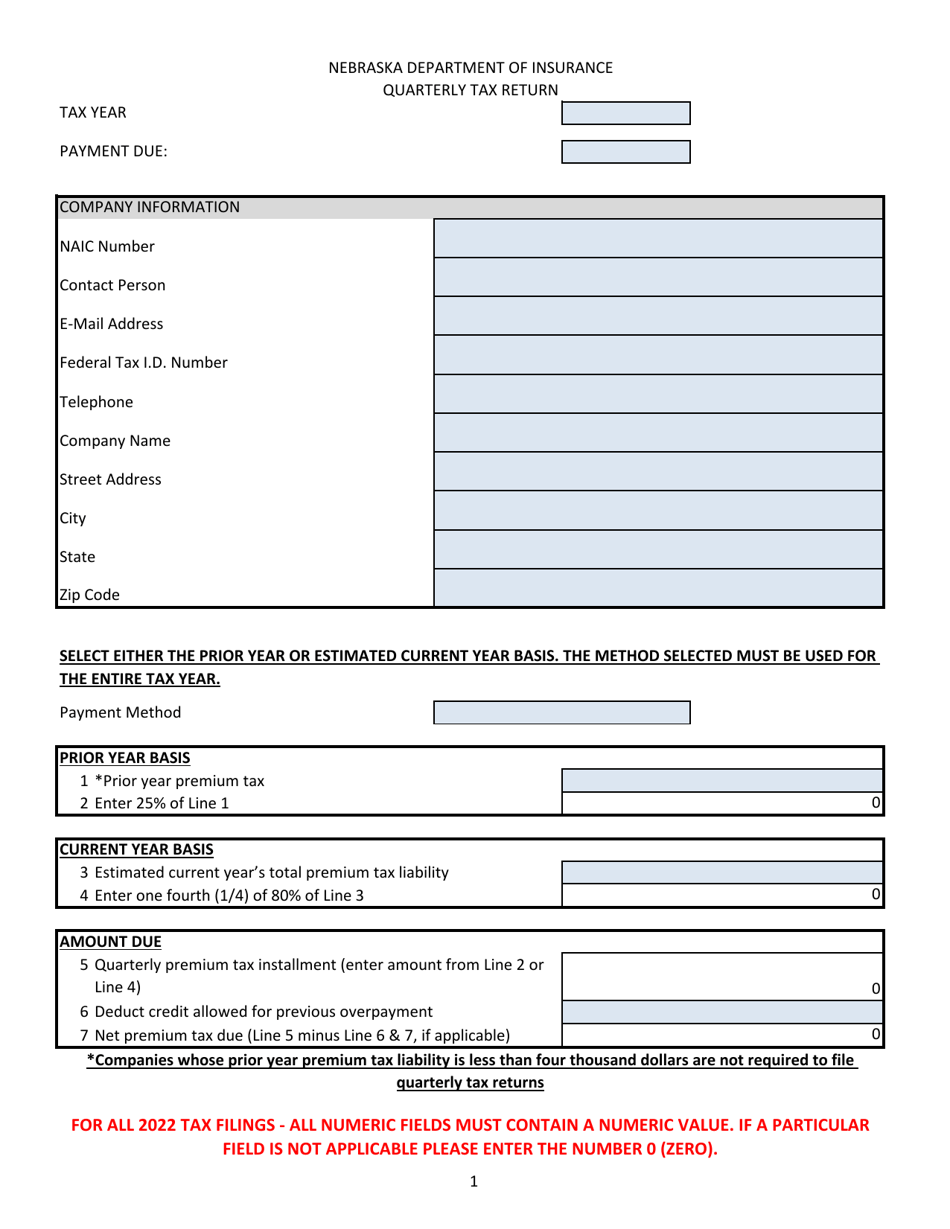

Quarterly Premium Tax Return - Nebraska

Quarterly Premium Tax Return is a legal document that was released by the Nebraska Department of Insurance - a government authority operating within Nebraska.

FAQ

Q: What is a Quarterly Premium Tax Return?

A: A Quarterly Premium Tax Return is a form that businesses in Nebraska use to report and pay their insurance premium taxes on a quarterly basis.

Q: Who needs to file a Quarterly Premium Tax Return in Nebraska?

A: Businesses that engage in insurance activities in Nebraska, including insurance companies, agents, and brokers, are required to file a Quarterly Premium Tax Return.

Q: When are Quarterly Premium Tax Returns due in Nebraska?

A: Quarterly Premium Tax Returns in Nebraska are due on the last day of the month following the end of each calendar quarter. For example, the return for the first quarter (January to March) is due by April 30th.

Q: What information do I need to include in a Quarterly Premium Tax Return?

A: When filing a Quarterly Premium Tax Return in Nebraska, you will need to provide information about your insurance activities, including premiums written and received during the quarter.

Q: Are there any penalties for late or non-filing of Quarterly Premium Tax Returns in Nebraska?

A: Yes, there are penalties for late or non-filing of Quarterly Premium Tax Returns in Nebraska. The penalties can vary depending on the amount of tax owed and the duration of the delay.

Form Details:

- The latest edition currently provided by the Nebraska Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Insurance.