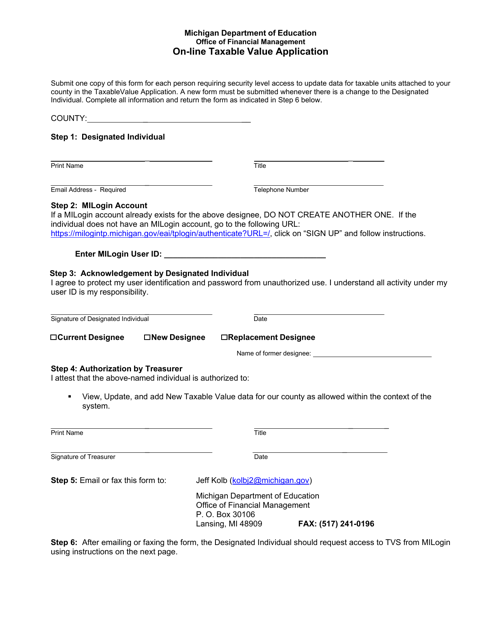

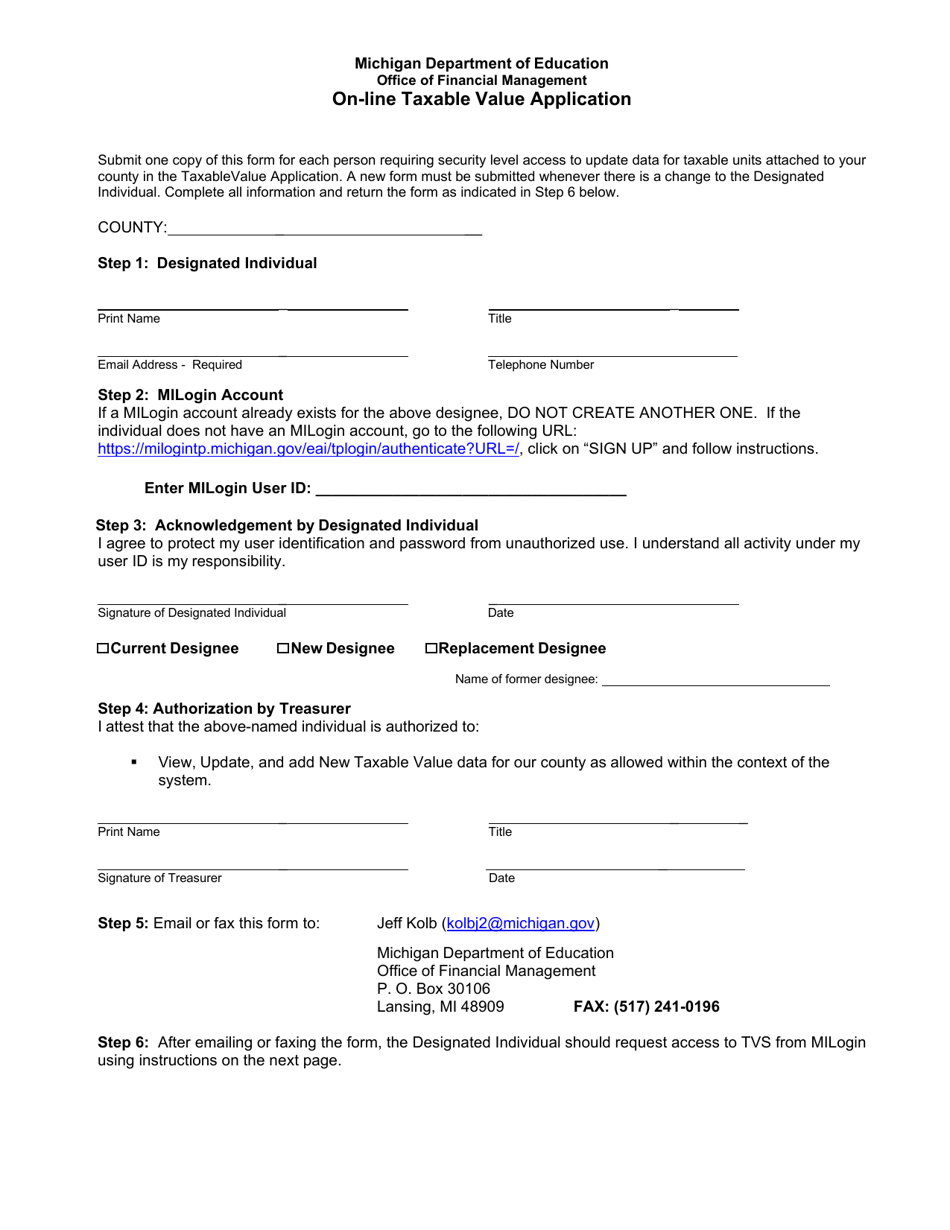

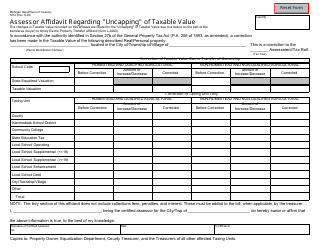

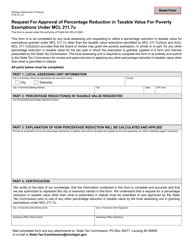

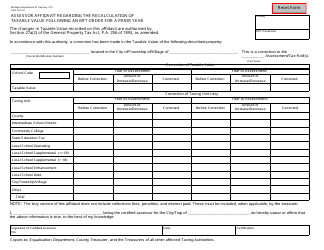

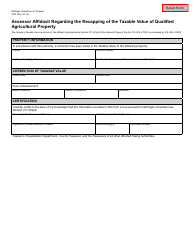

On-Line Taxable Value Application - Michigan

On-Line Taxable Value Application is a legal document that was released by the Michigan Department of Education - a government authority operating within Michigan.

FAQ

Q: What is the On-Line Taxable Value Application?

A: The On-Line Taxable Value Application is a tool used in Michigan to calculate the taxable value of a property.

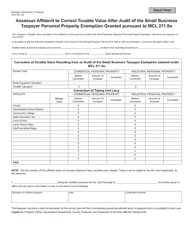

Q: How does the On-Line Taxable Value Application work?

A: The On-Line Taxable Value Application uses the formula set by the Michigan Department of Treasury to calculate the taxable value based on the State Equalized Value and the annual growth rate.

Q: What is the State Equalized Value?

A: The State Equalized Value is the assessed value of a property that has been adjusted by a state equalization factor.

Q: Why is the On-Line Taxable Value Application important?

A: The On-Line Taxable Value Application is important because it helps determine the amount of property taxes that should be paid by the property owner.

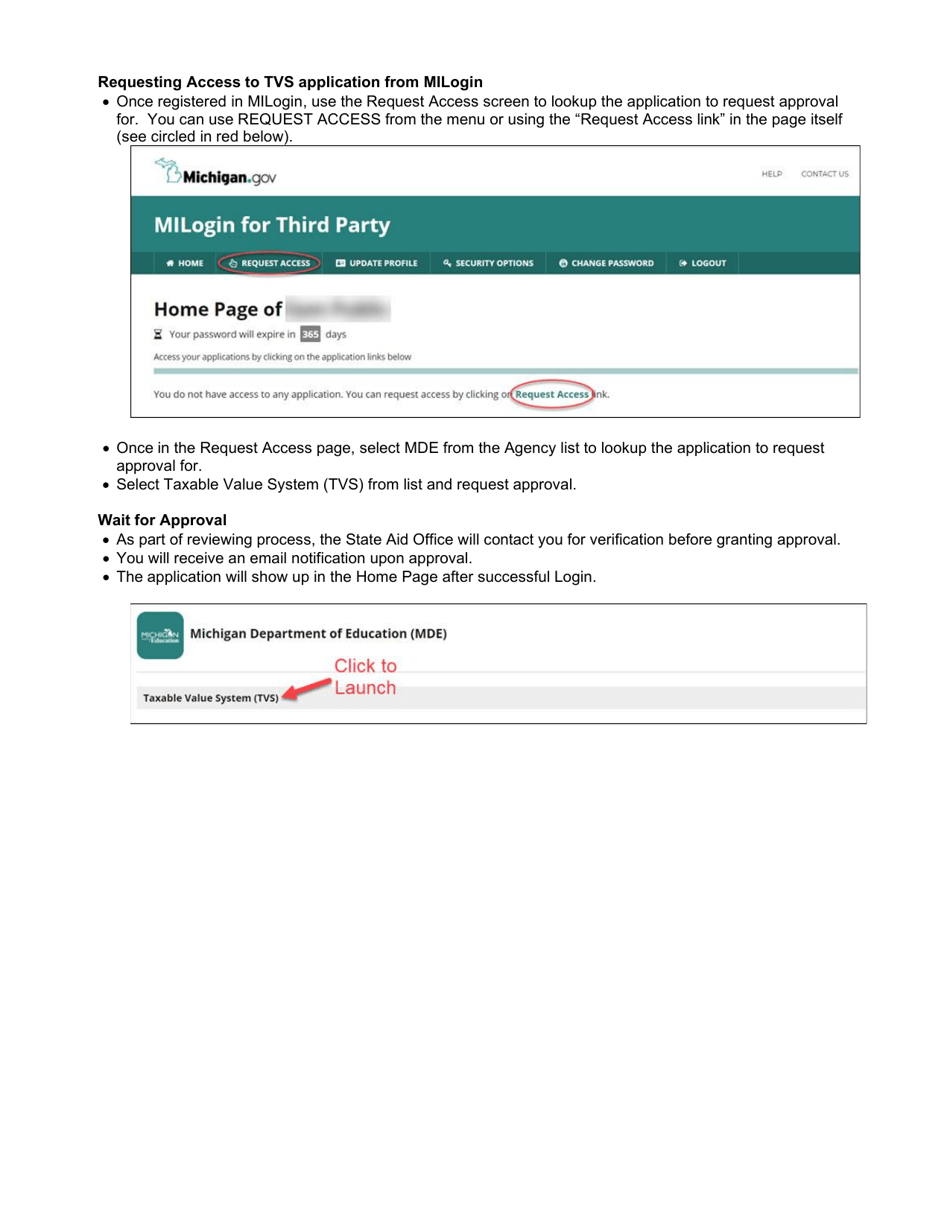

Q: Is the On-Line Taxable Value Application available for everyone to use?

A: Yes, the On-Line Taxable Value Application is available for everyone to use.

Form Details:

- The latest edition currently provided by the Michigan Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Education.