This version of the form is not currently in use and is provided for reference only. Download this version of

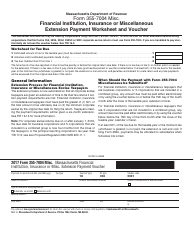

Form 63-FI

for the current year.

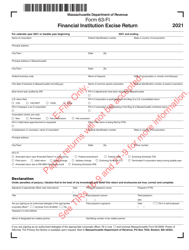

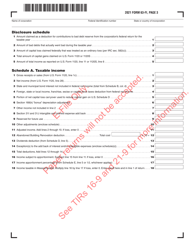

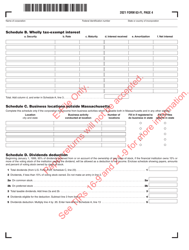

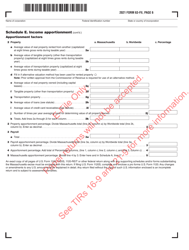

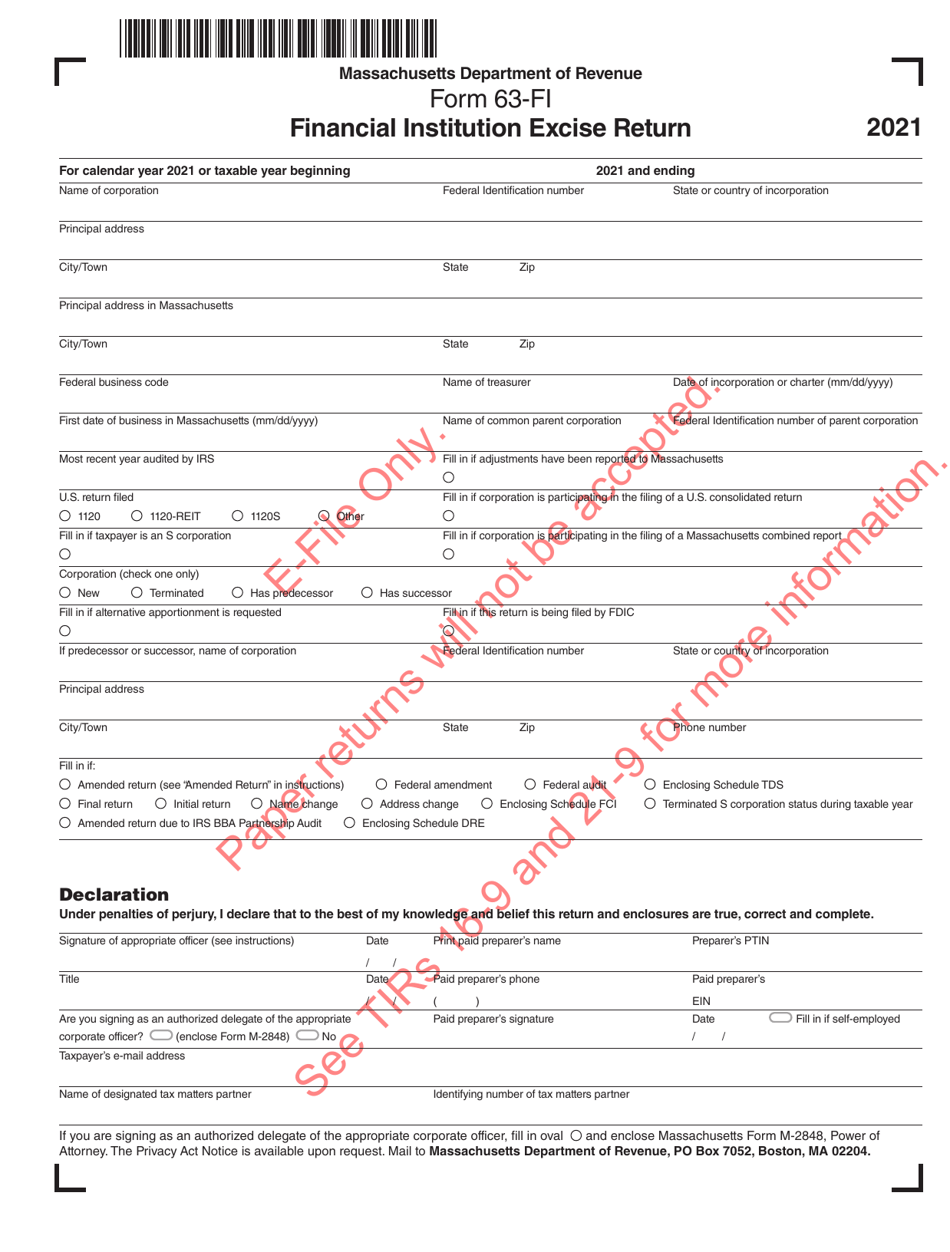

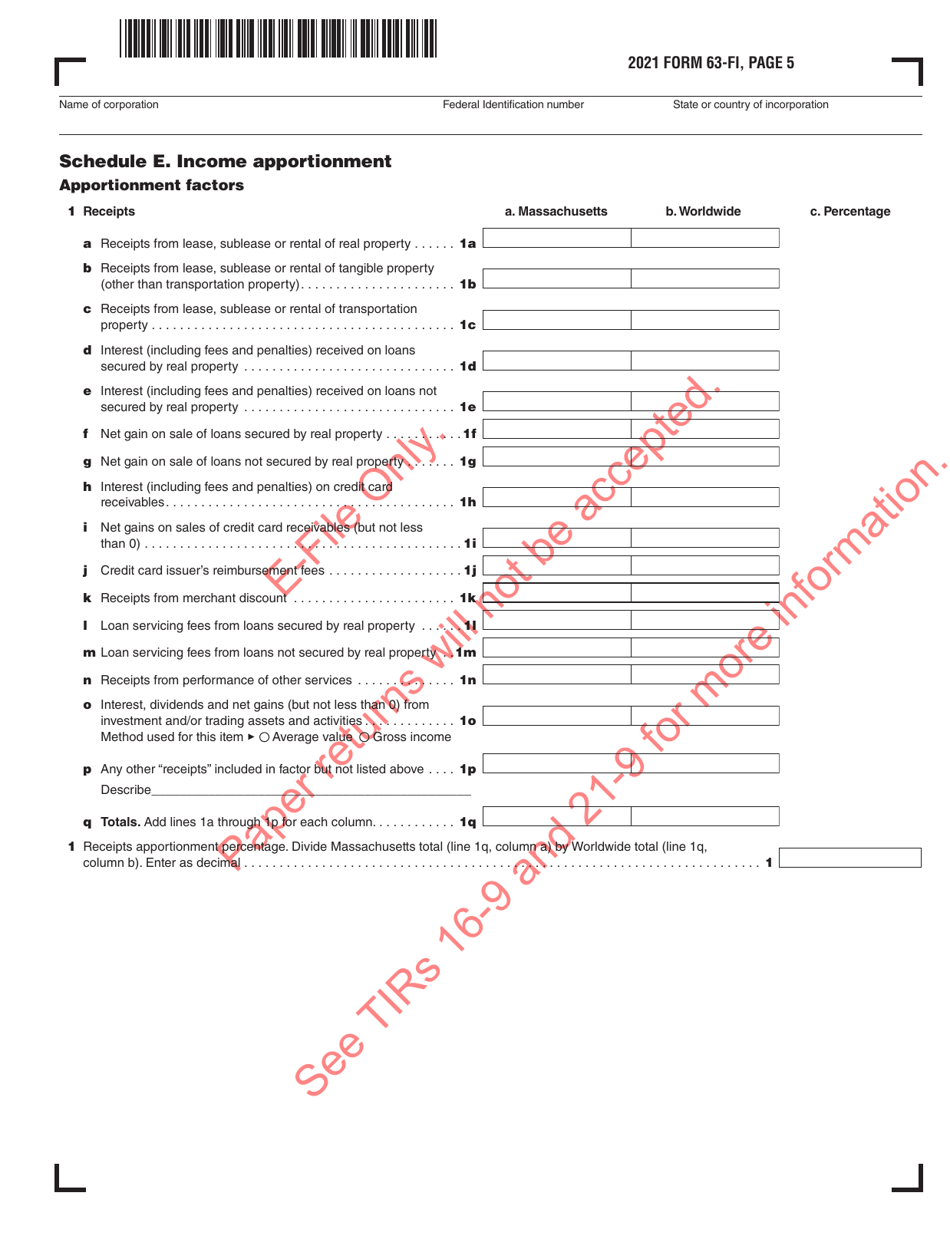

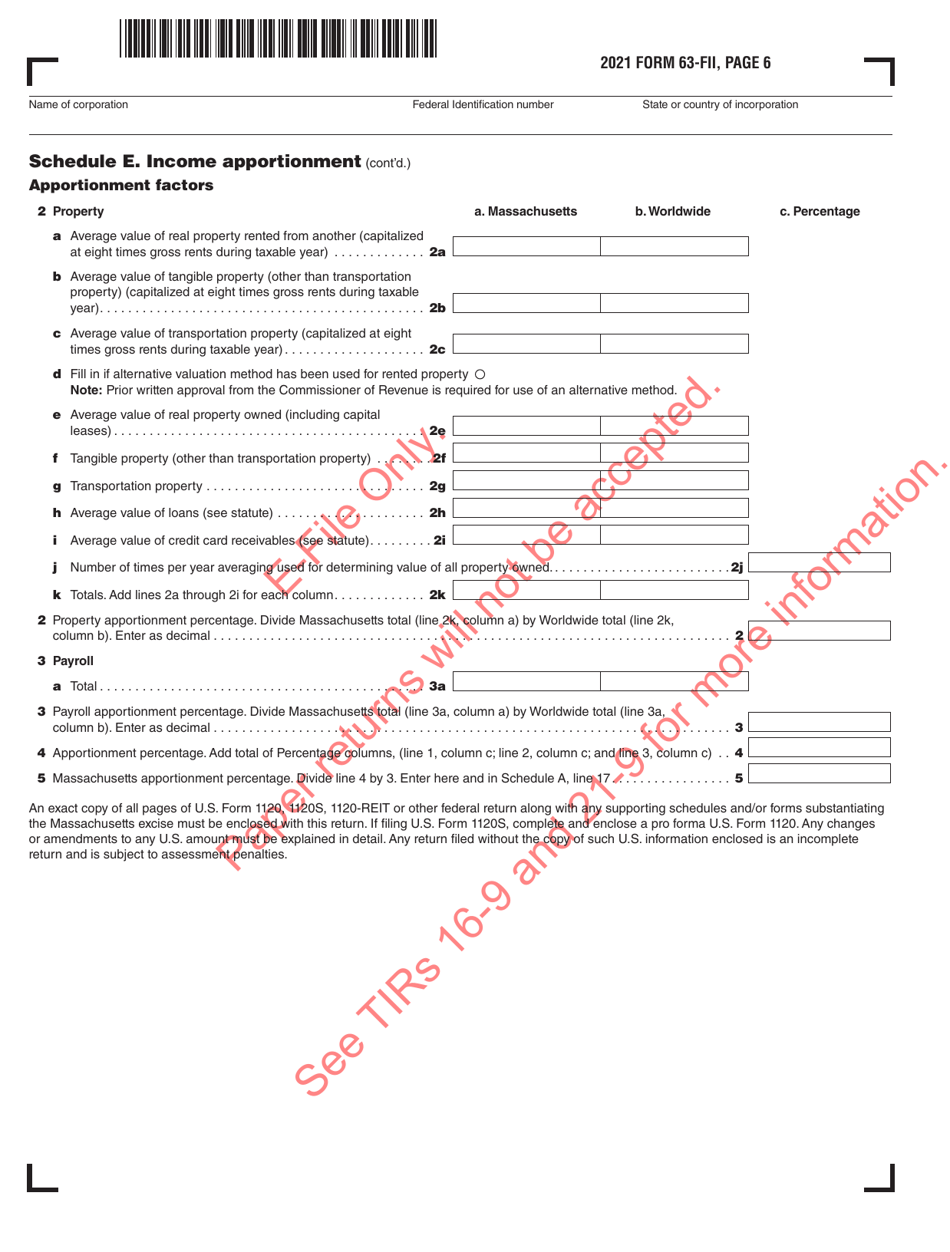

Form 63-FI Financial Institution Excise Return - Massachusetts

What Is Form 63-FI?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 63-FI?

A: Form 63-FI is the Financial Institution Excise Return for Massachusetts.

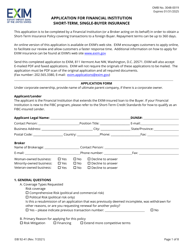

Q: Who needs to file Form 63-FI?

A: Financial institutions operating in Massachusetts need to file Form 63-FI.

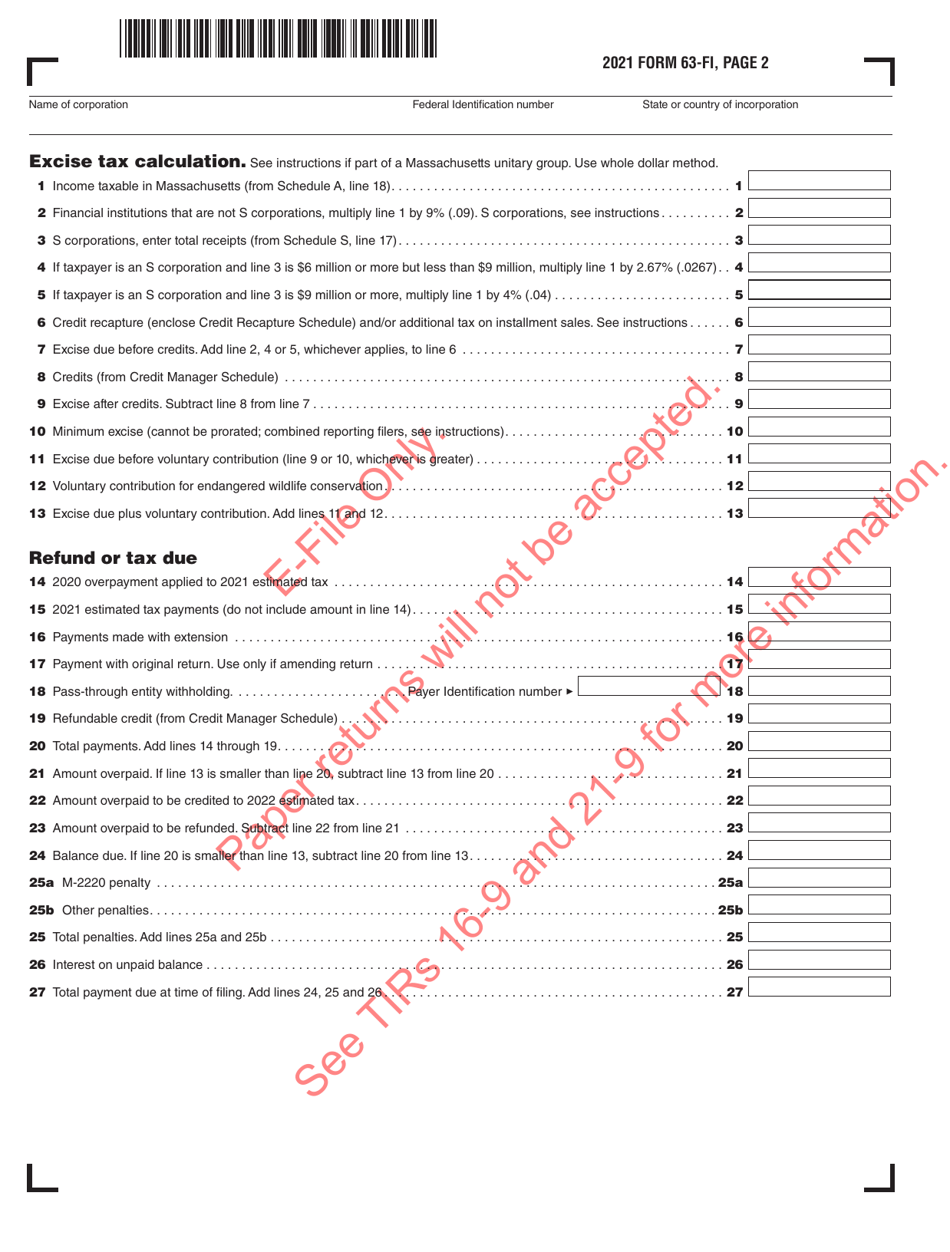

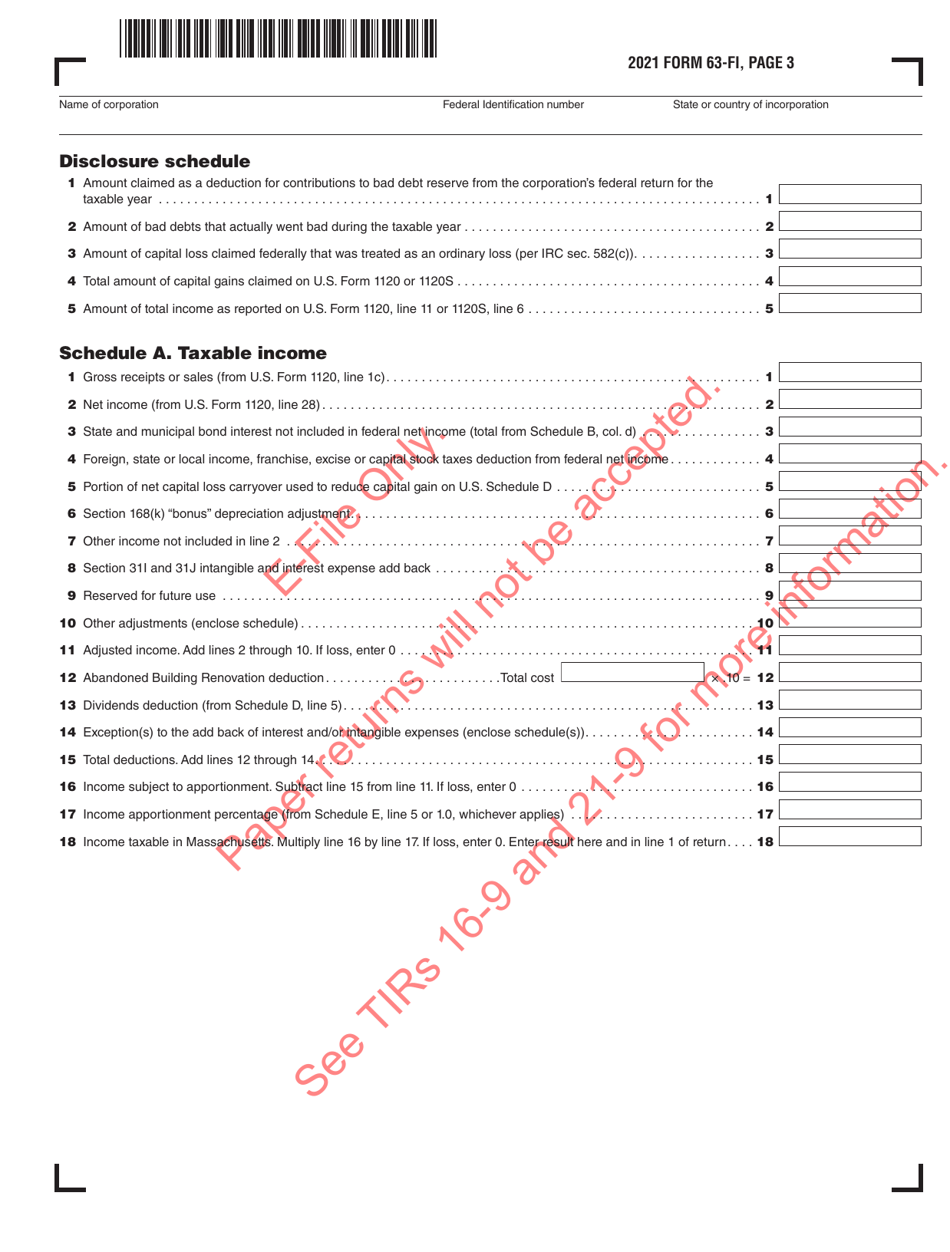

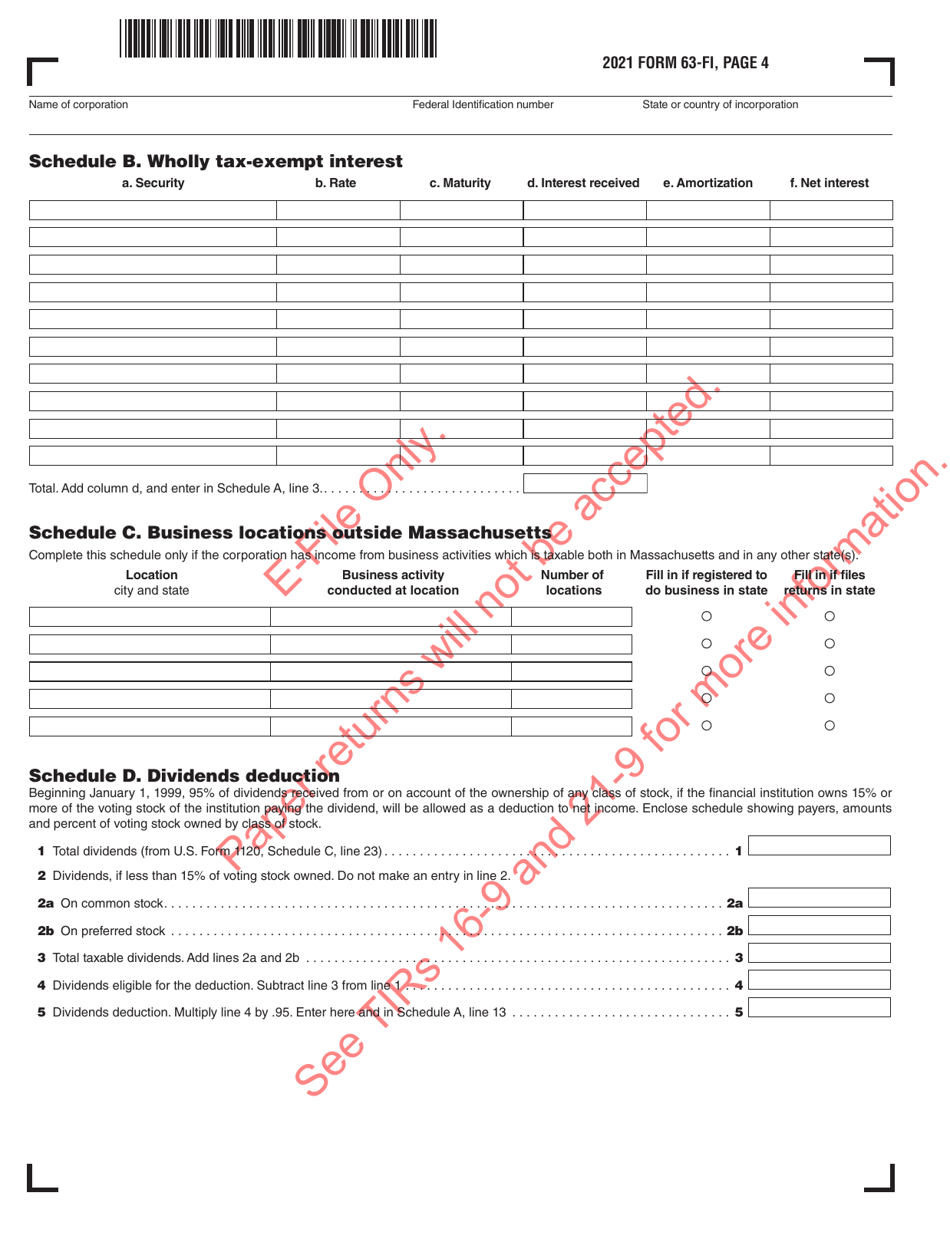

Q: What is the purpose of Form 63-FI?

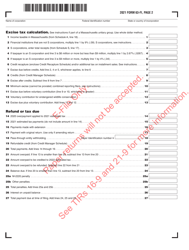

A: Form 63-FI is used to report and calculate the excise tax liability for financial institutions in Massachusetts.

Q: When is Form 63-FI due?

A: Form 63-FI is due by the 15th day of the 4th month following the close of the financial institution's taxable year.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the regulations. It is important to file the form on time and accurately.

Q: Is Form 63-FI only for financial institutions in Massachusetts?

A: Yes, Form 63-FI is specifically for financial institutions operating in Massachusetts.

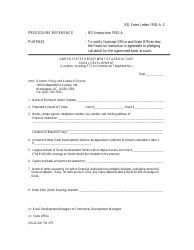

Q: What information do I need to complete Form 63-FI?

A: You will need various financial information, such as income, deductions, and credits, to complete Form 63-FI.

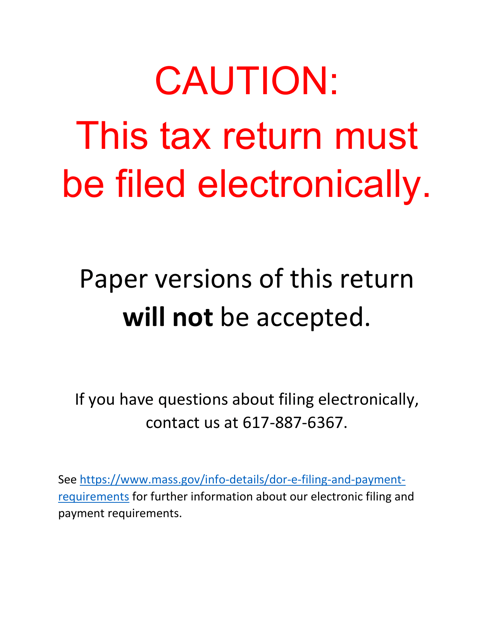

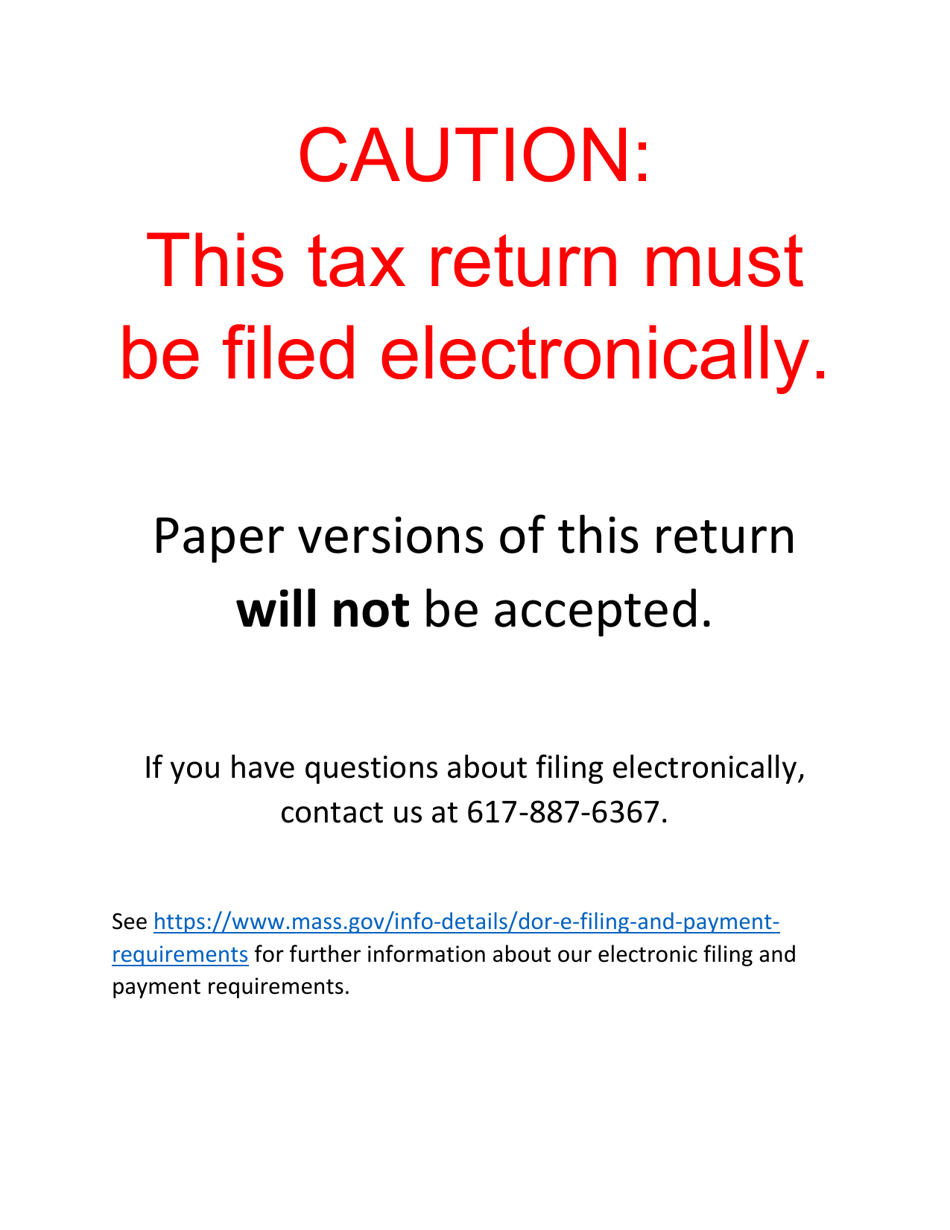

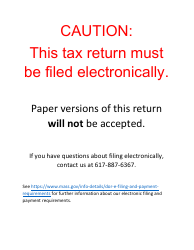

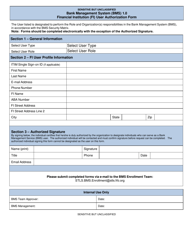

Q: Can I file Form 63-FI electronically?

A: Yes, electronic filing options are available for Form 63-FI.

Q: Can I get an extension to file Form 63-FI?

A: Yes, you can request an extension to file Form 63-FI, but you must still pay any tax liability by the original due date of the return.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-FI by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.