This version of the form is not currently in use and is provided for reference only. Download this version of

Form 63-20P

for the current year.

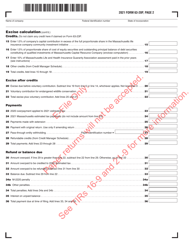

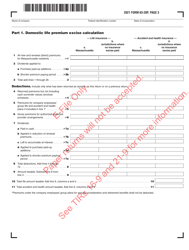

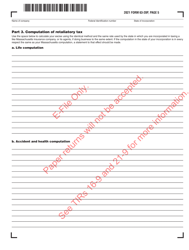

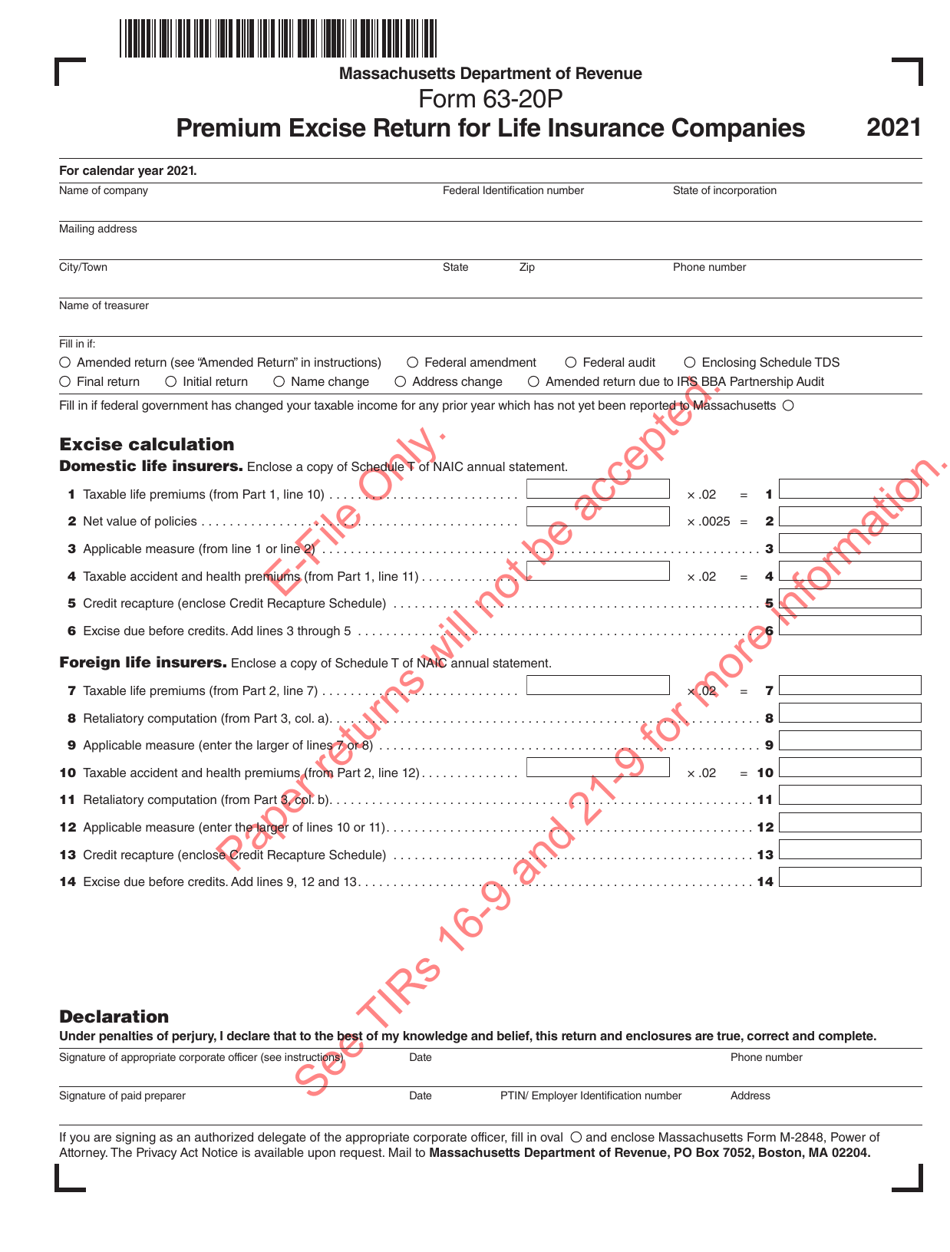

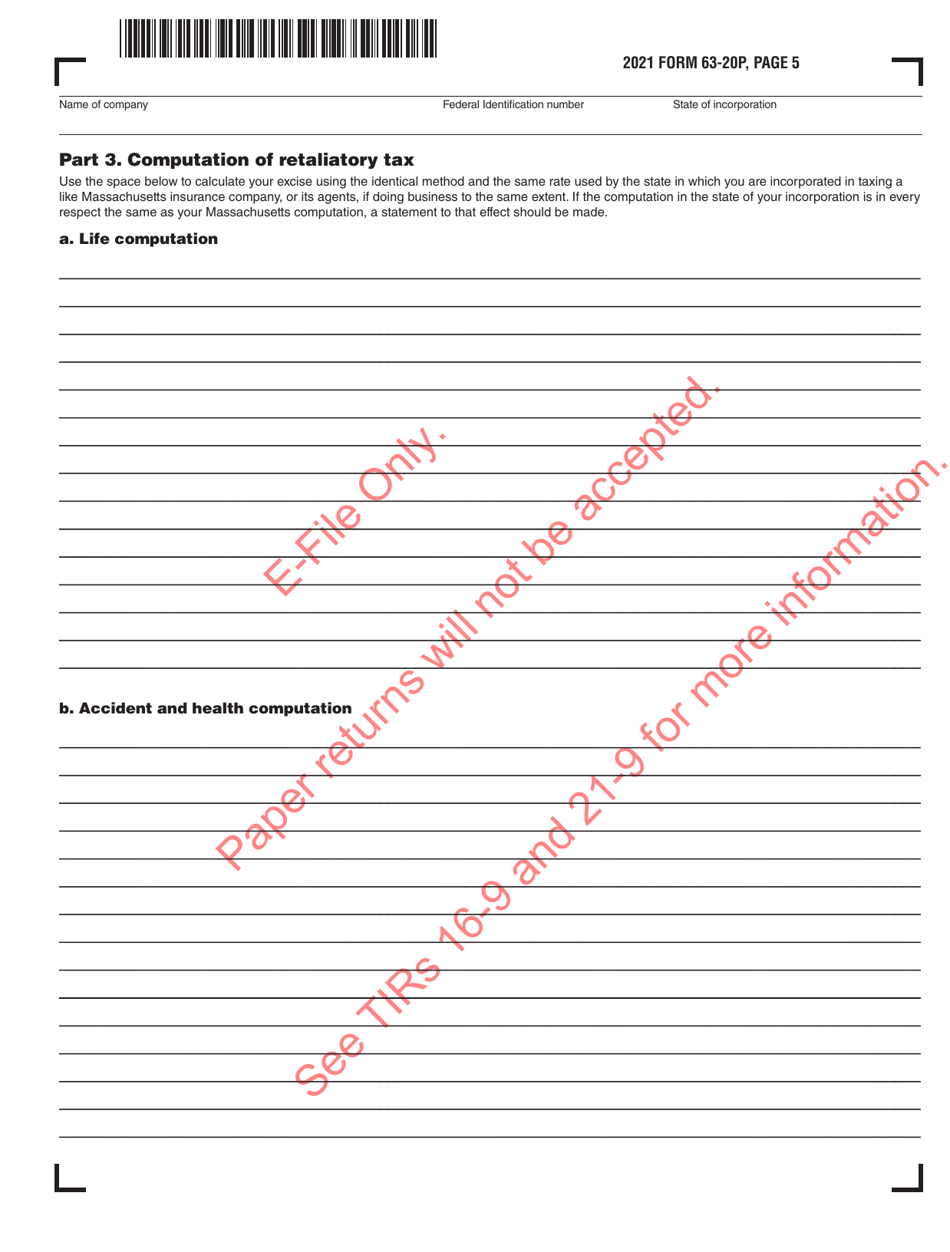

Form 63-20P Premium Excise Return for Life Insurance Companies - Massachusetts

What Is Form 63-20P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 63-20P?

A: Form 63-20P is a Premium Excise Return for Life Insurance Companies in Massachusetts.

Q: Who needs to file Form 63-20P?

A: Life insurance companies operating in Massachusetts need to file Form 63-20P.

Q: What is the purpose of Form 63-20P?

A: The purpose of Form 63-20P is to report and pay premium excise tax on life insurance policies issued in Massachusetts.

Q: When is Form 63-20P due?

A: Form 63-20P is generally due on or before March 15th of each year.

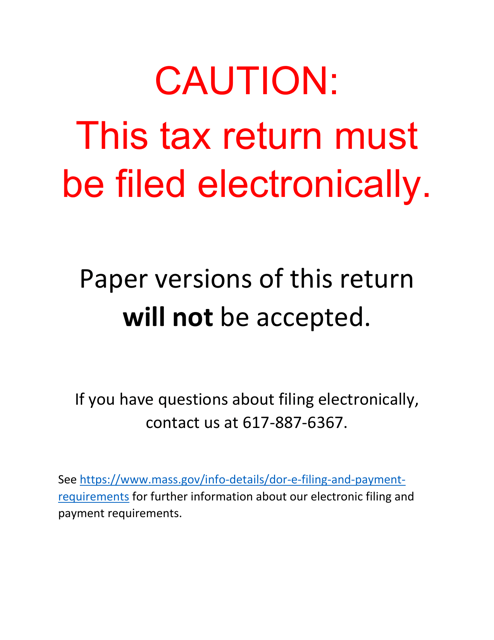

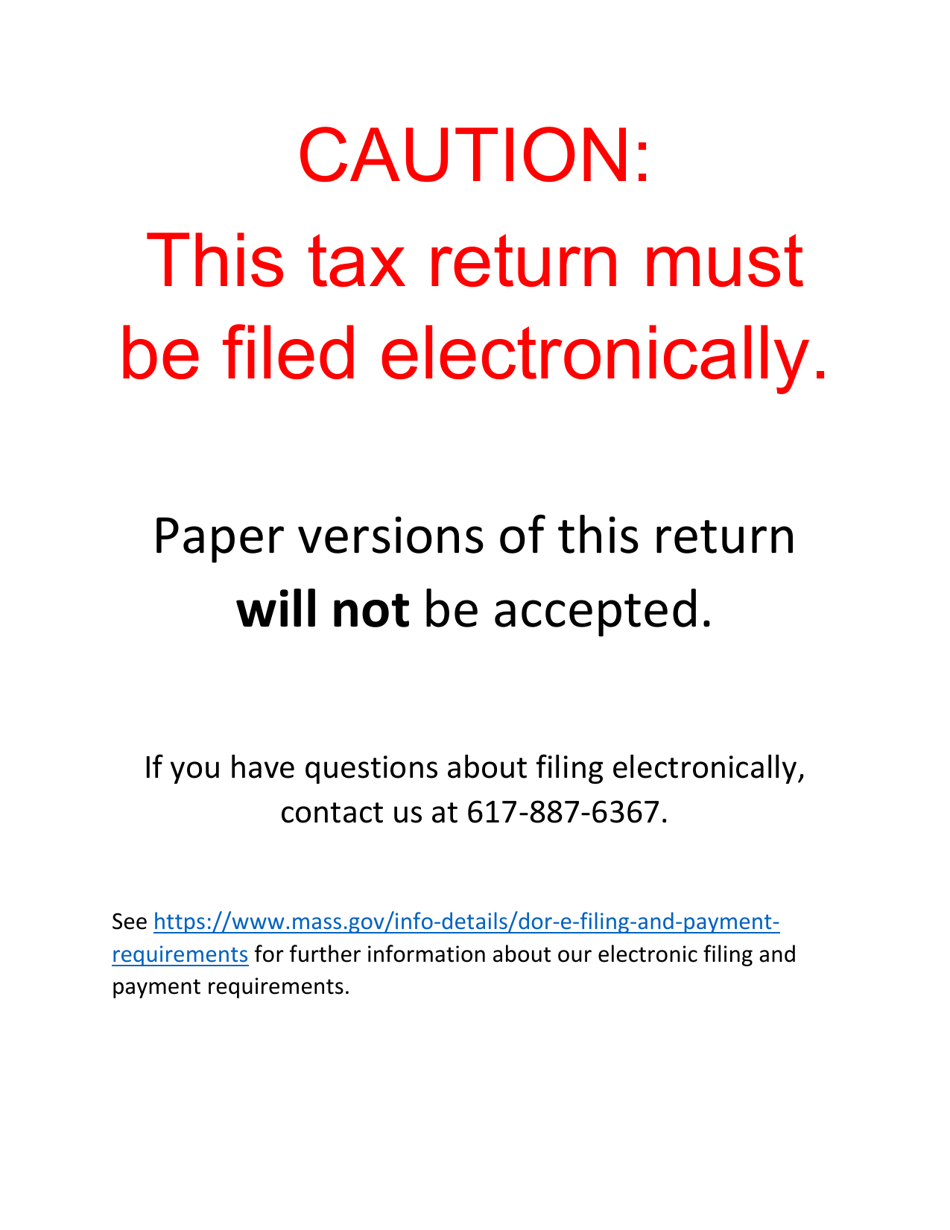

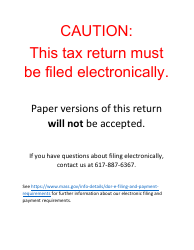

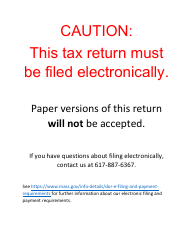

Q: How can Form 63-20P be filed?

A: Form 63-20P can be filed electronically or by mail. Electronic filing is recommended for faster processing.

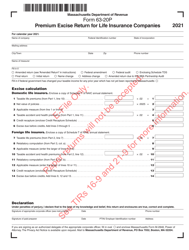

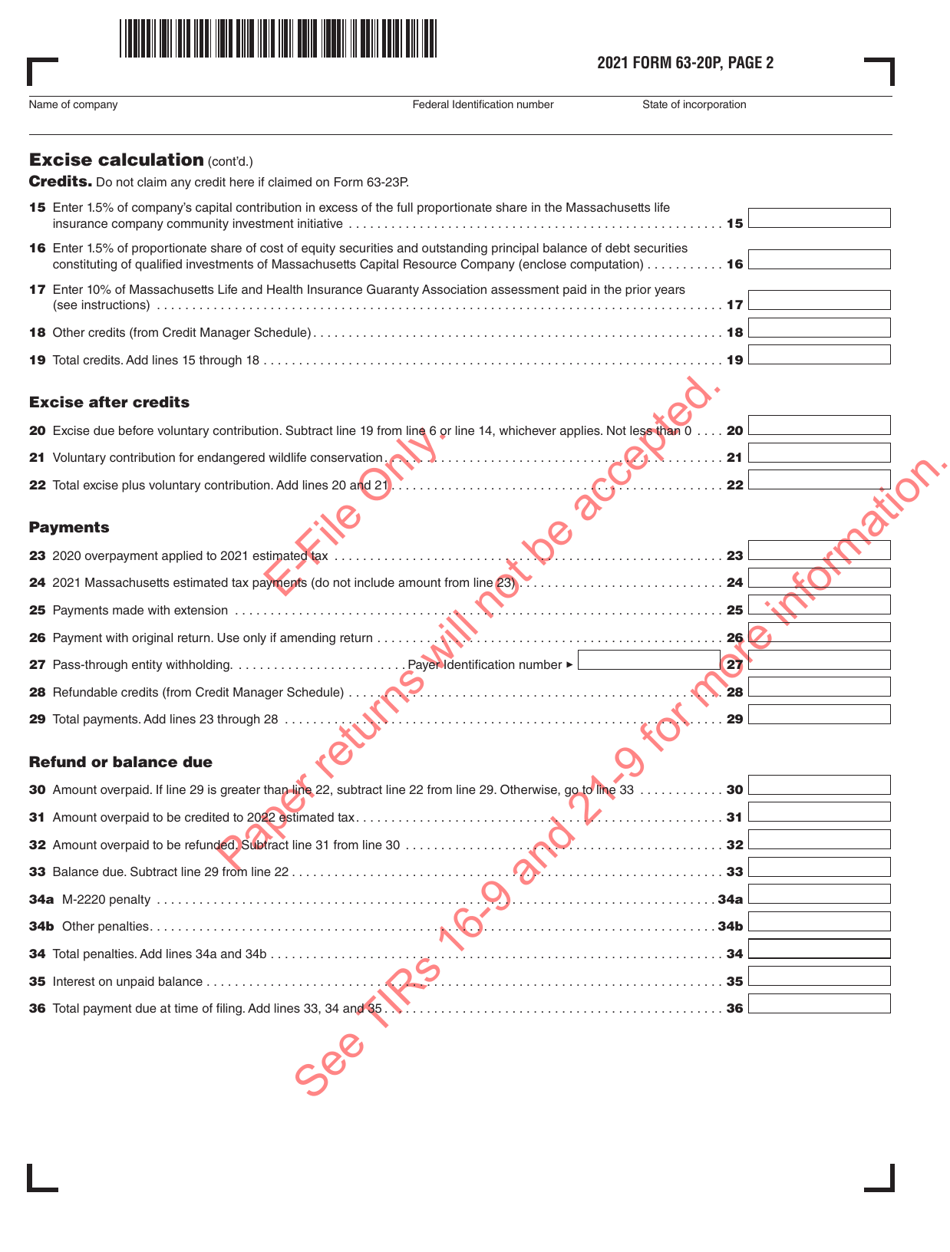

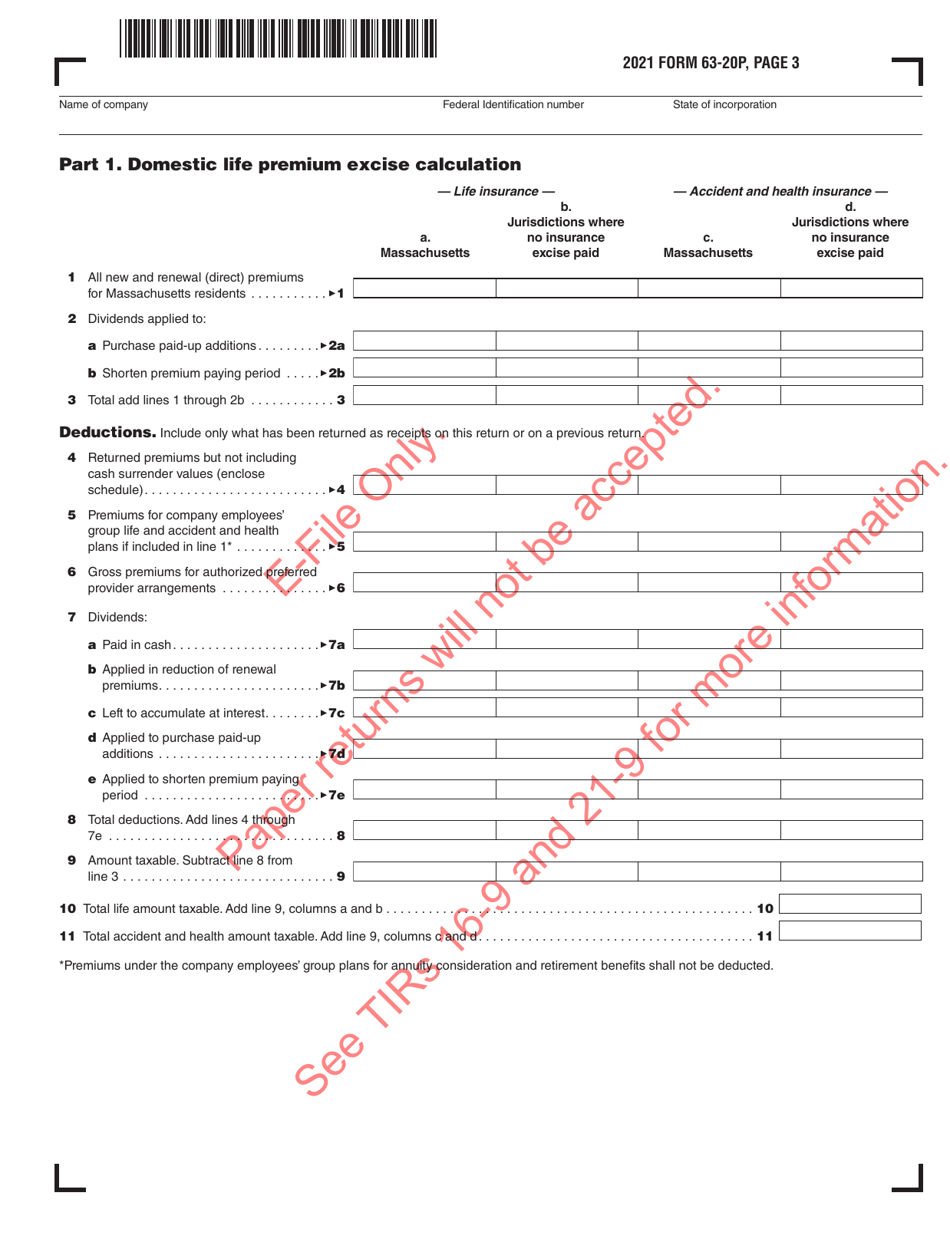

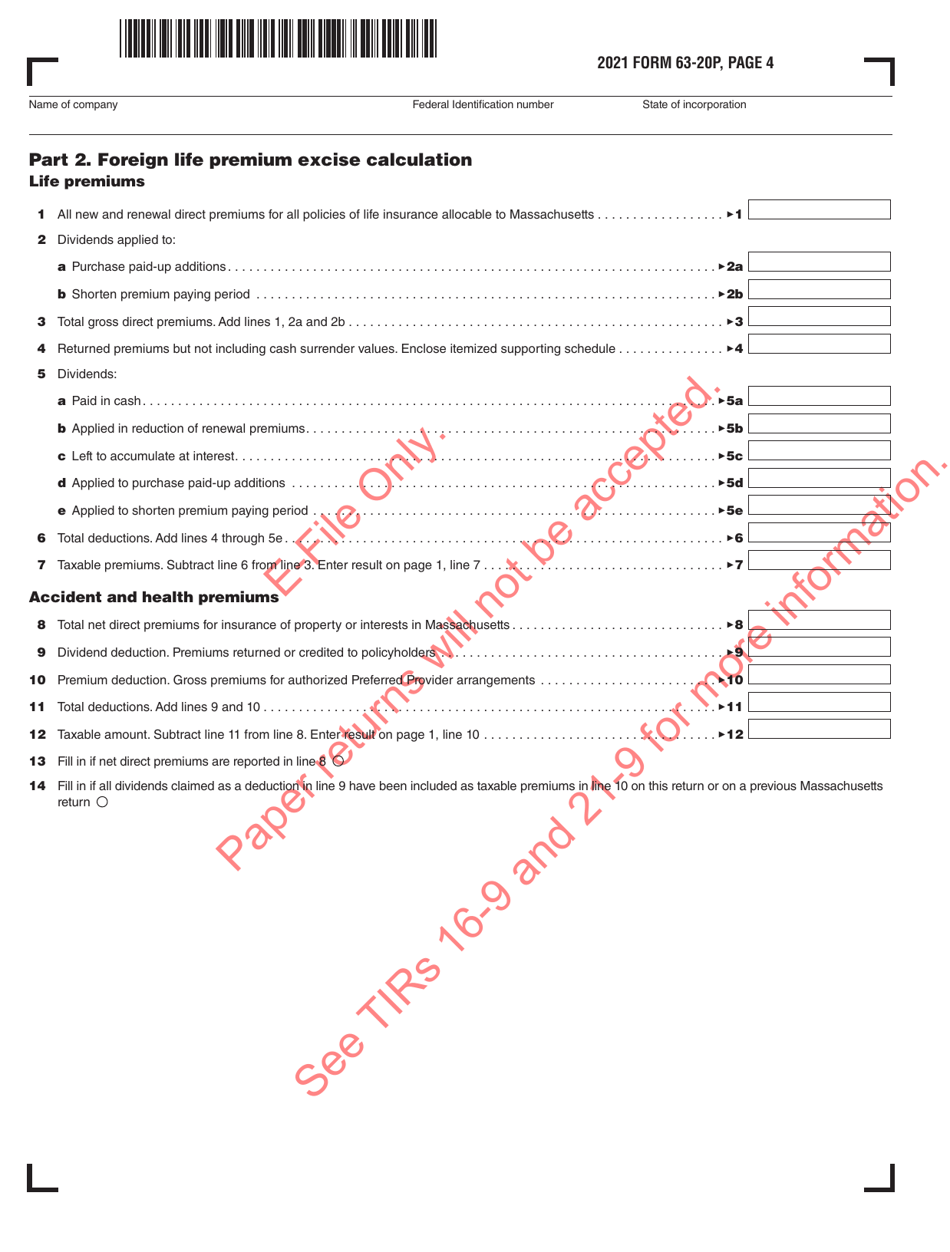

Q: What information is required on Form 63-20P?

A: Form 63-20P requires information on the premiums received, deductions, and taxable income of the life insurance company.

Q: Are there any penalties for late filing of Form 63-20P?

A: Yes, late filing of Form 63-20P may result in penalties and interest charges.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-20P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.