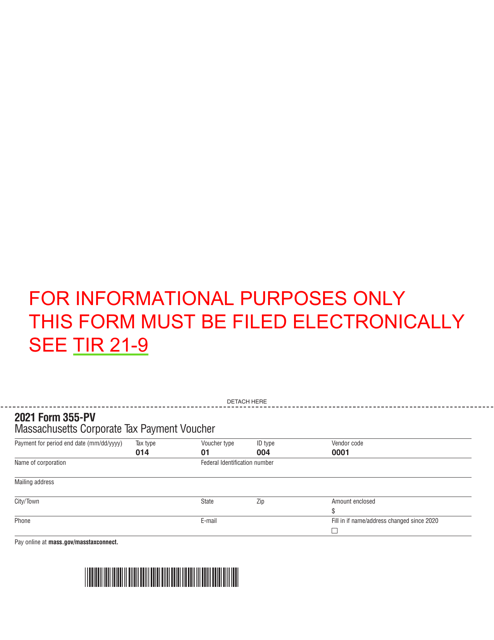

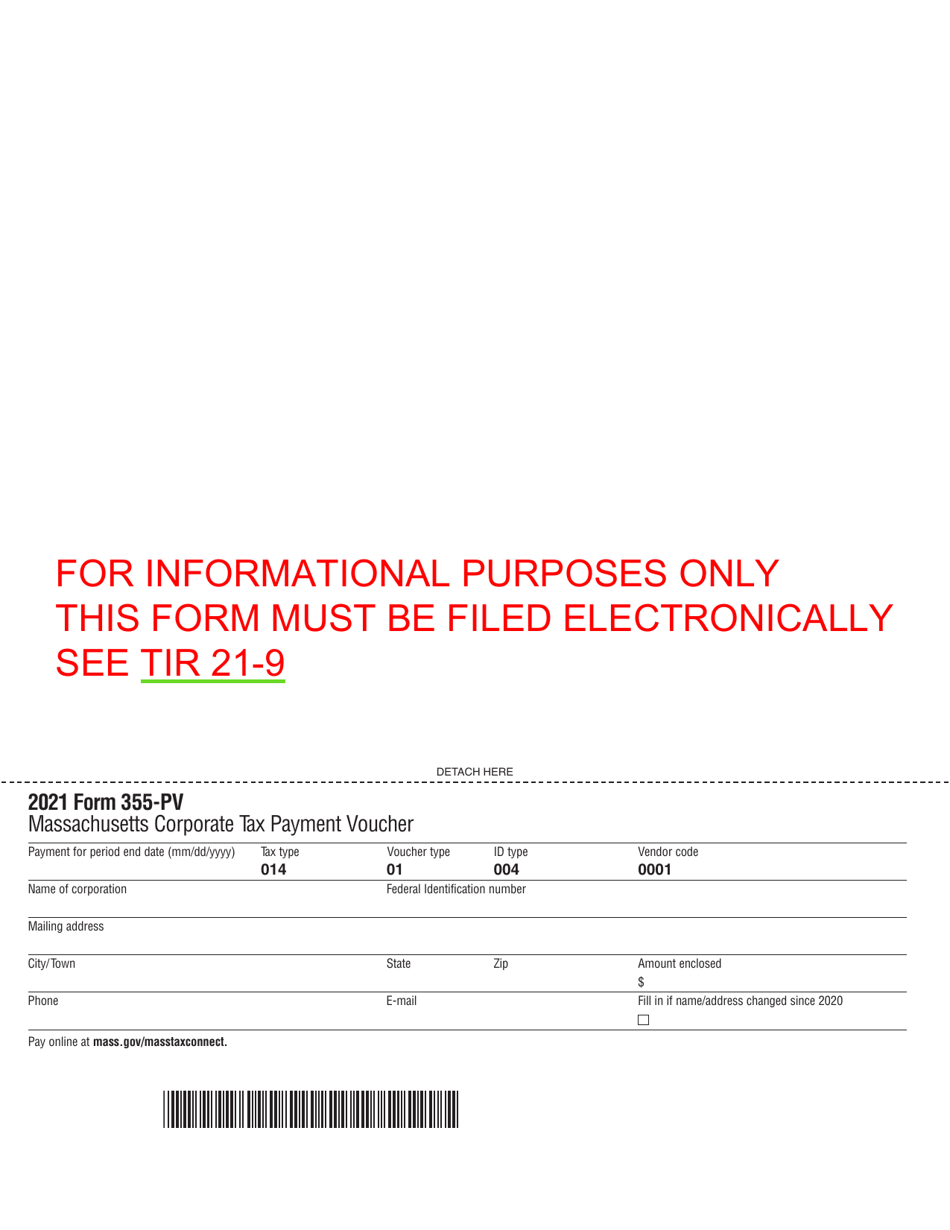

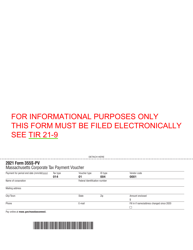

Form 355-PV Massachusetts Corporate Tax Payment Voucher - Massachusetts

What Is Form 355-PV?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 355-PV?

A: Form 355-PV is the Massachusetts Corporate Tax Payment Voucher.

Q: Who needs to file Form 355-PV?

A: Form 355-PV needs to be filed by corporations in Massachusetts that have a tax liability.

Q: What is the purpose of Form 355-PV?

A: The purpose of Form 355-PV is to make a payment for corporate taxes owed to the state of Massachusetts.

Q: When is Form 355-PV due?

A: Form 355-PV is due on the 15th day of the 3rd month following the close of the tax year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 355-PV by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.