This version of the form is not currently in use and is provided for reference only. Download this version of

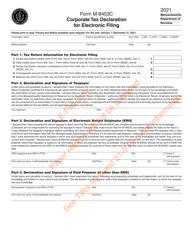

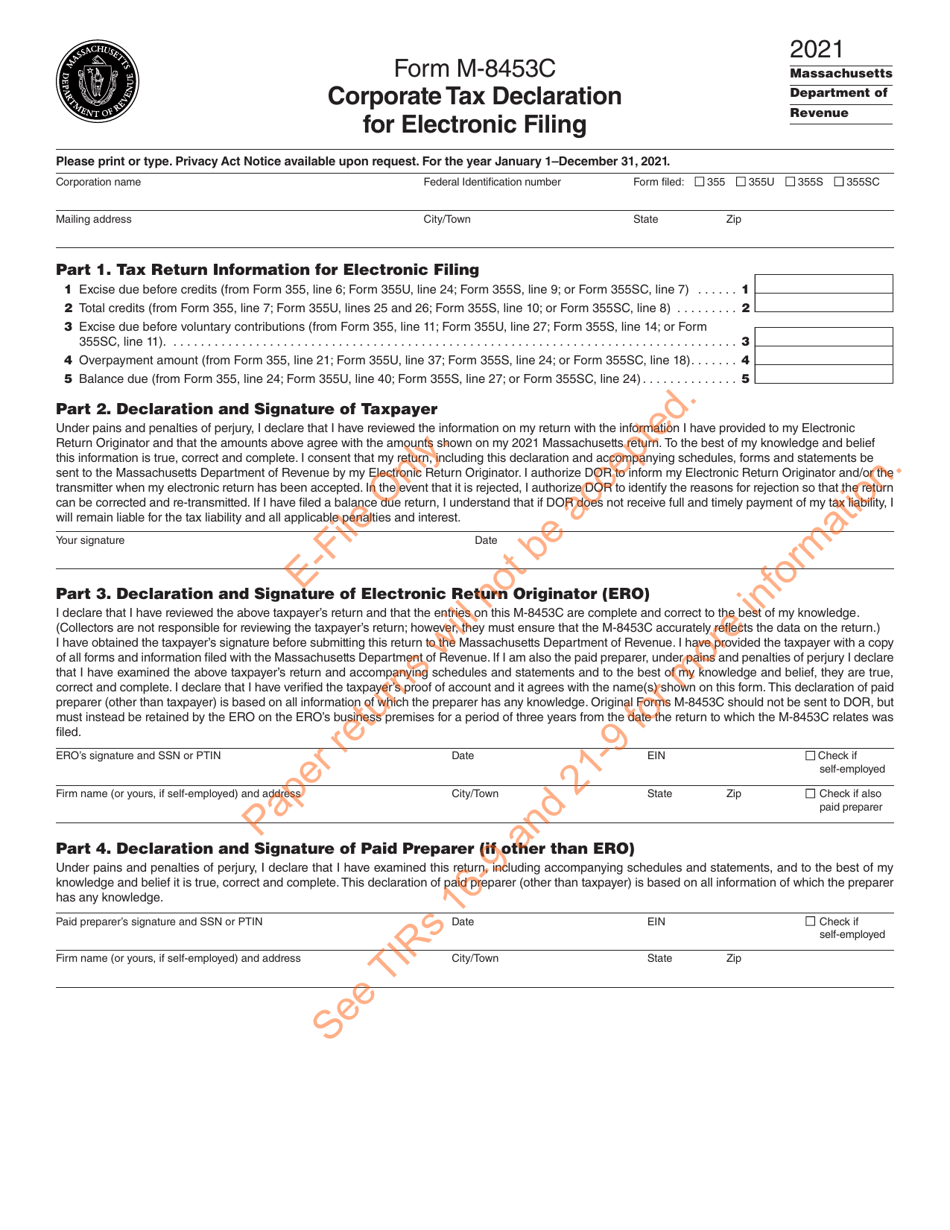

Form M-8453C

for the current year.

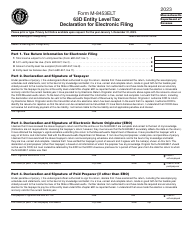

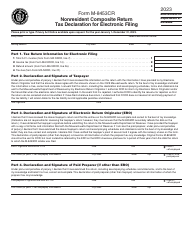

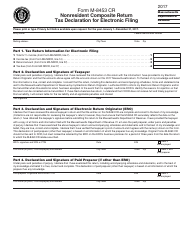

Form M-8453C Corporate Tax Declaration for Electronic Filing - Massachusetts

What Is Form M-8453C?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-8453C?

A: Form M-8453C is a declaration form required for electronic filing of corporate tax returns in Massachusetts.

Q: Who needs to file Form M-8453C?

A: Any corporate taxpayer who is electronically filing their tax return in Massachusetts needs to file Form M-8453C.

Q: What is the purpose of Form M-8453C?

A: Form M-8453C is used to authenticate and authorize the electronic filing of the corporate tax return.

Q: What information is required on Form M-8453C?

A: Form M-8453C requires the taxpayer's name, address, taxpayer identification number, and signature.

Q: When is Form M-8453C due?

A: Form M-8453C is generally due on the same date as the corporate tax return, which is usually April 15th.

Q: Can Form M-8453C be filed electronically?

A: Yes, Form M-8453C is specifically designed for electronic filing of corporate tax returns in Massachusetts.

Q: Are there any supporting documents required with Form M-8453C?

A: No, there are no supporting documents required to be filed with Form M-8453C.

Q: What happens after filing Form M-8453C?

A: After filing Form M-8453C, the taxpayer will receive an acknowledgement from the Massachusetts Department of Revenue to confirm receipt of the electronic filing.

Q: Can Form M-8453C be filed late?

A: It is generally not recommended to file Form M-8453C late, as it may result in penalties or interest charges.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8453C by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.