This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

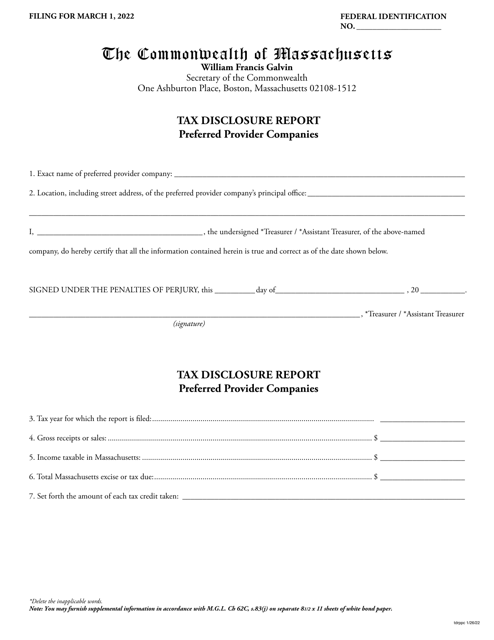

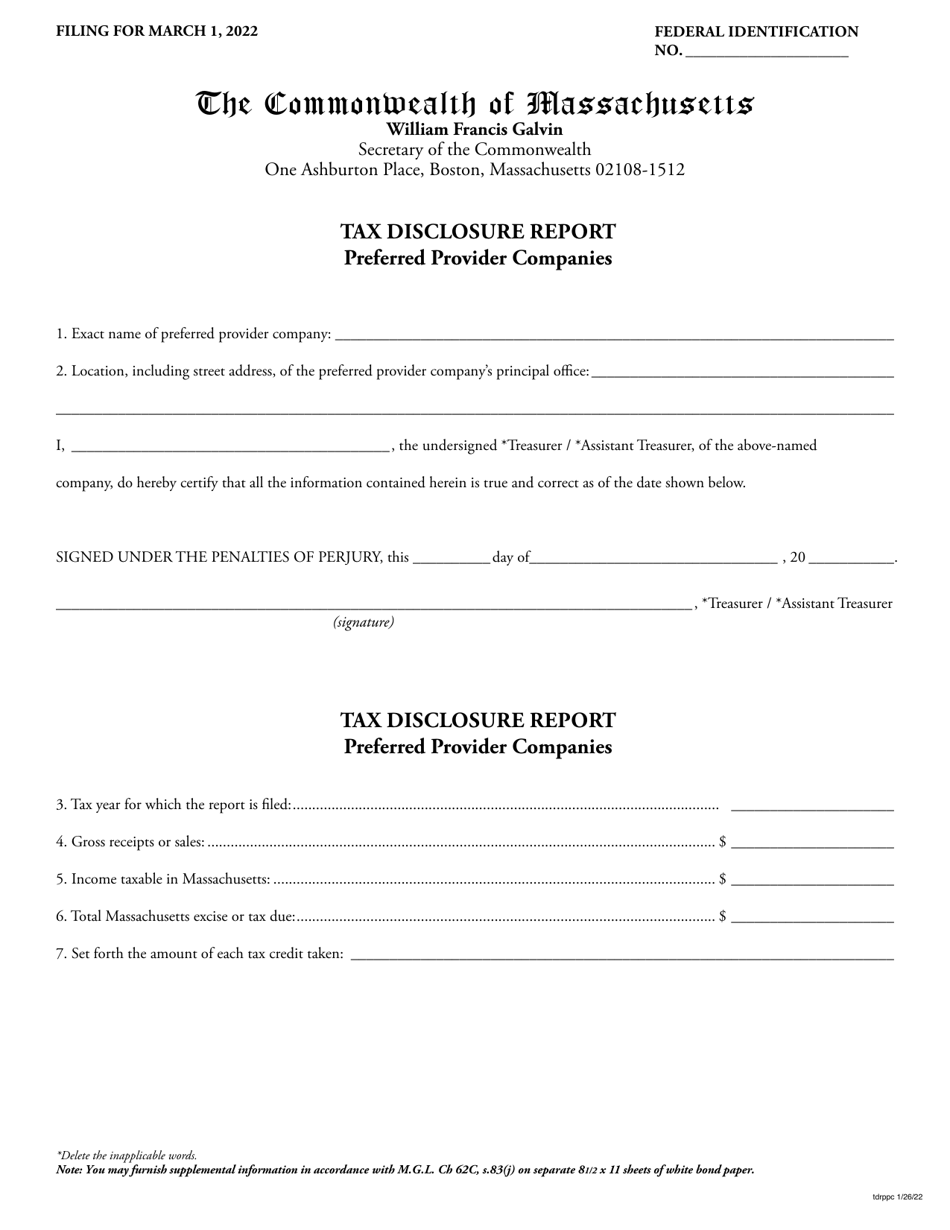

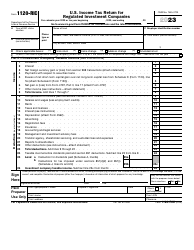

Tax Disclosure Report - Preferred Provider Companies - Massachusetts

Tax Disclosure Report - Preferred Provider Companies is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is a Tax Disclosure Report?

A: A Tax Disclosure Report is a document that discloses information about a company's tax status and practices.

Q: What are Preferred Provider Companies?

A: Preferred Provider Companies are companies that have been selected by an insurance provider to provide specific services to policyholders.

Q: Why is a Tax Disclosure Report required for Preferred Provider Companies in Massachusetts?

A: A Tax Disclosure Report is required for Preferred Provider Companies in Massachusetts to ensure transparency and accountability in tax reporting and compliance.

Q: What information is included in a Tax Disclosure Report?

A: A Tax Disclosure Report typically includes details about the company's tax identification number, tax liabilities, deductions, and other relevant tax-related information.

Q: Who is responsible for preparing a Tax Disclosure Report for Preferred Provider Companies?

A: The Preferred Provider Companies themselves are responsible for preparing their own Tax Disclosure Reports.

Form Details:

- Released on January 26, 2022;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.