This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

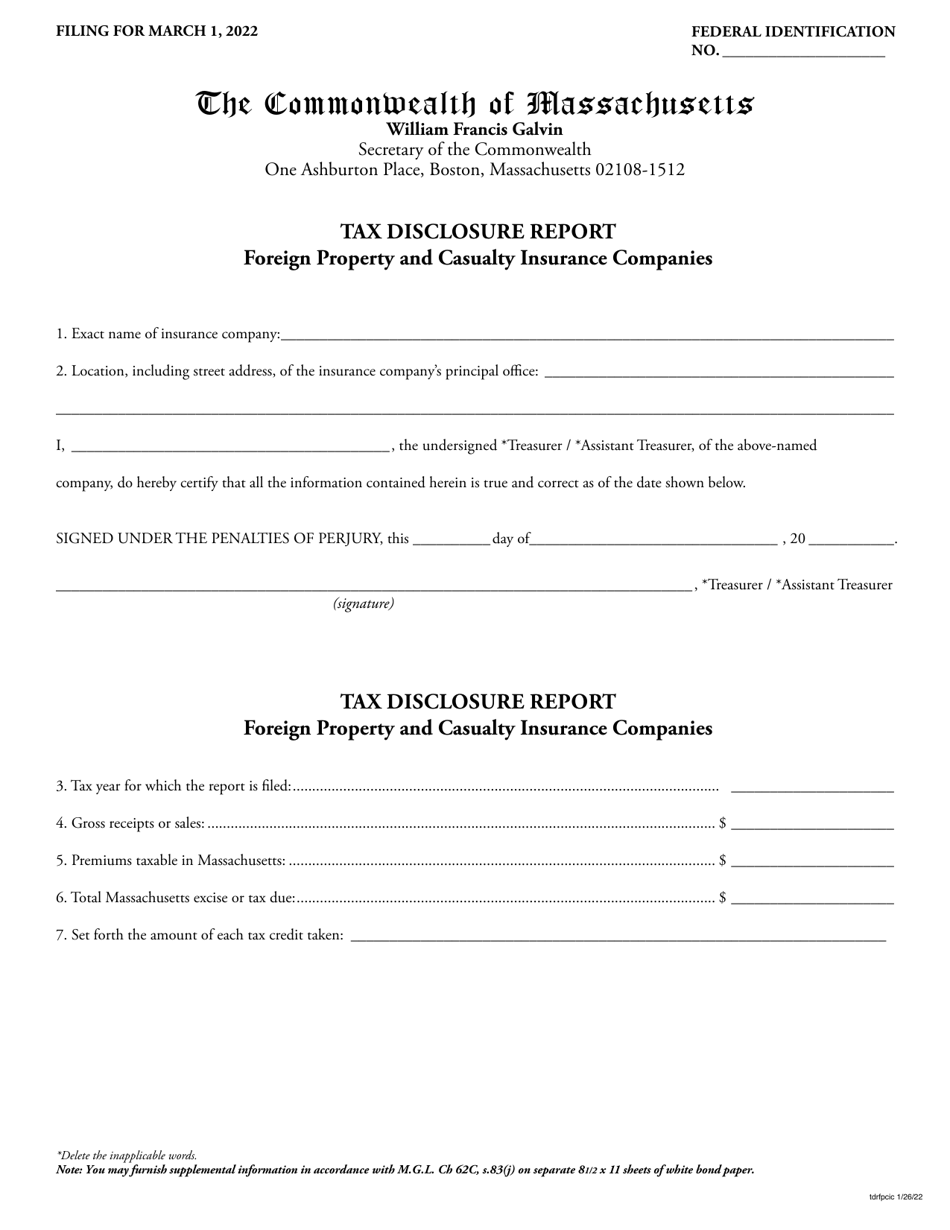

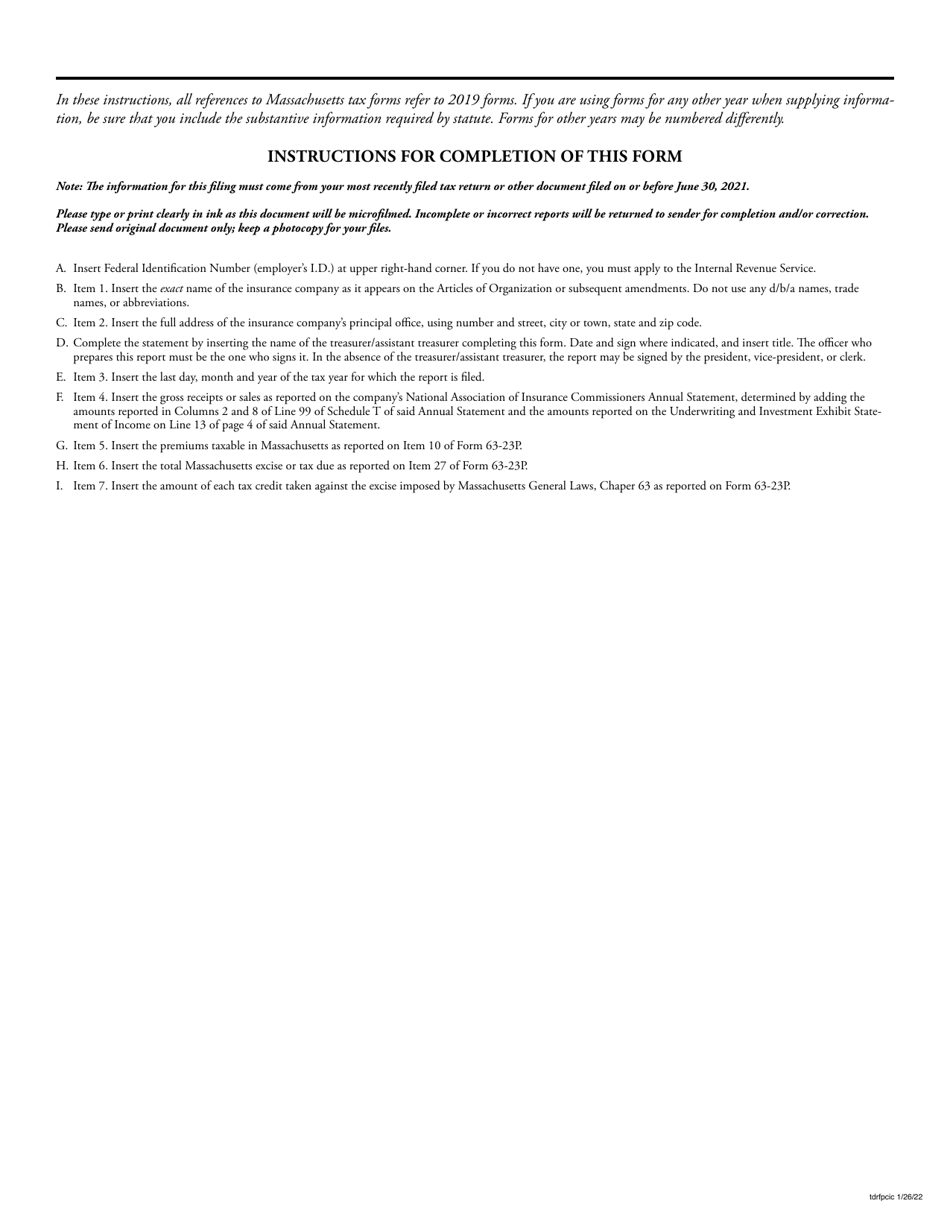

Tax Disclosure Report - Foreign Property and Casualty Insurance Companies - Massachusetts

Tax Casualty Insurance Companies is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is a Tax Disclosure Report?

A: A Tax Disclosure Report is a report that foreign Property and Casualty Insurance Companies in Massachusetts are required to file.

Q: Who needs to file a Tax Disclosure Report?

A: Foreign Property and Casualty Insurance Companies operating in Massachusetts need to file a Tax Disclosure Report.

Q: What information is provided in a Tax Disclosure Report?

A: A Tax Disclosure Report provides information about the premiums received, losses paid, capital and surplus, and other financial details of the foreign insurance company.

Q: Why is a Tax Disclosure Report required?

A: A Tax Disclosure Report is required to ensure that foreign insurance companies operating in Massachusetts are complying with tax regulations and contributing their fair share of taxes.

Q: How often does a Tax Disclosure Report need to be filed?

A: A Tax Disclosure Report must be filed annually by foreign Property and Casualty Insurance Companies in Massachusetts.

Q: What are the consequences of not filing a Tax Disclosure Report?

A: Failure to file a Tax Disclosure Report can result in penalties and legal consequences for foreign Property and Casualty Insurance Companies operating in Massachusetts.

Q: Are there any exemptions from filing a Tax Disclosure Report?

A: There are no specific exemptions mentioned in the document. However, it is advisable to consult with the Massachusetts Department of Revenue or a tax professional for any specific exemptions or requirements.

Form Details:

- Released on January 26, 2022;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.