This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

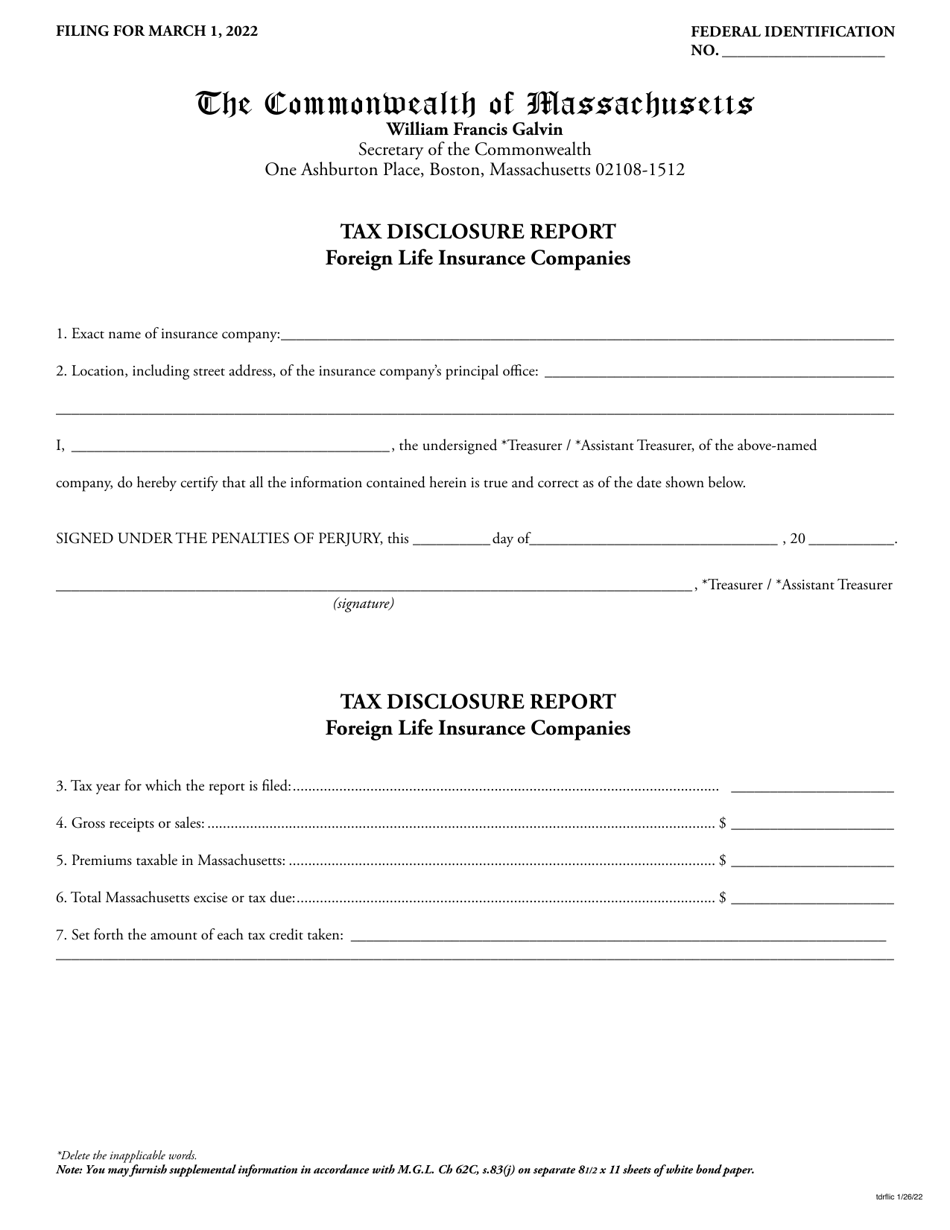

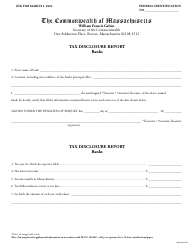

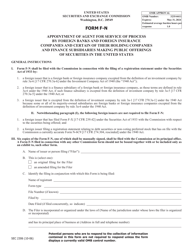

Tax Disclosure Report - Foreign Life Insurance Companies - Massachusetts

Tax Disclosure Report - Foreign Life Insurance Companies is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is the Tax Disclosure Report?

A: The Tax Disclosure Report is a document required from foreign life insurance companies operating in Massachusetts.

Q: Who needs to file the Tax Disclosure Report?

A: Foreign life insurance companies operating in Massachusetts need to file the Tax Disclosure Report.

Q: What information is included in the Tax Disclosure Report?

A: The Tax Disclosure Report includes information on the premiums received, policies issued, and taxes paid by foreign life insurance companies.

Q: Why is the Tax Disclosure Report required?

A: The Tax Disclosure Report is required to ensure compliance with tax laws and regulations for foreign life insurance companies operating in Massachusetts.

Q: How often does the Tax Disclosure Report need to be filed?

A: The Tax Disclosure Report needs to be filed annually by foreign life insurance companies operating in Massachusetts.

Q: Are there any penalties for not filing the Tax Disclosure Report?

A: Yes, there may be penalties for not filing the Tax Disclosure Report, such as fines or other legal consequences.

Q: Is the Tax Disclosure Report only required in Massachusetts?

A: Yes, the Tax Disclosure Report is specifically required for foreign life insurance companies operating in Massachusetts.

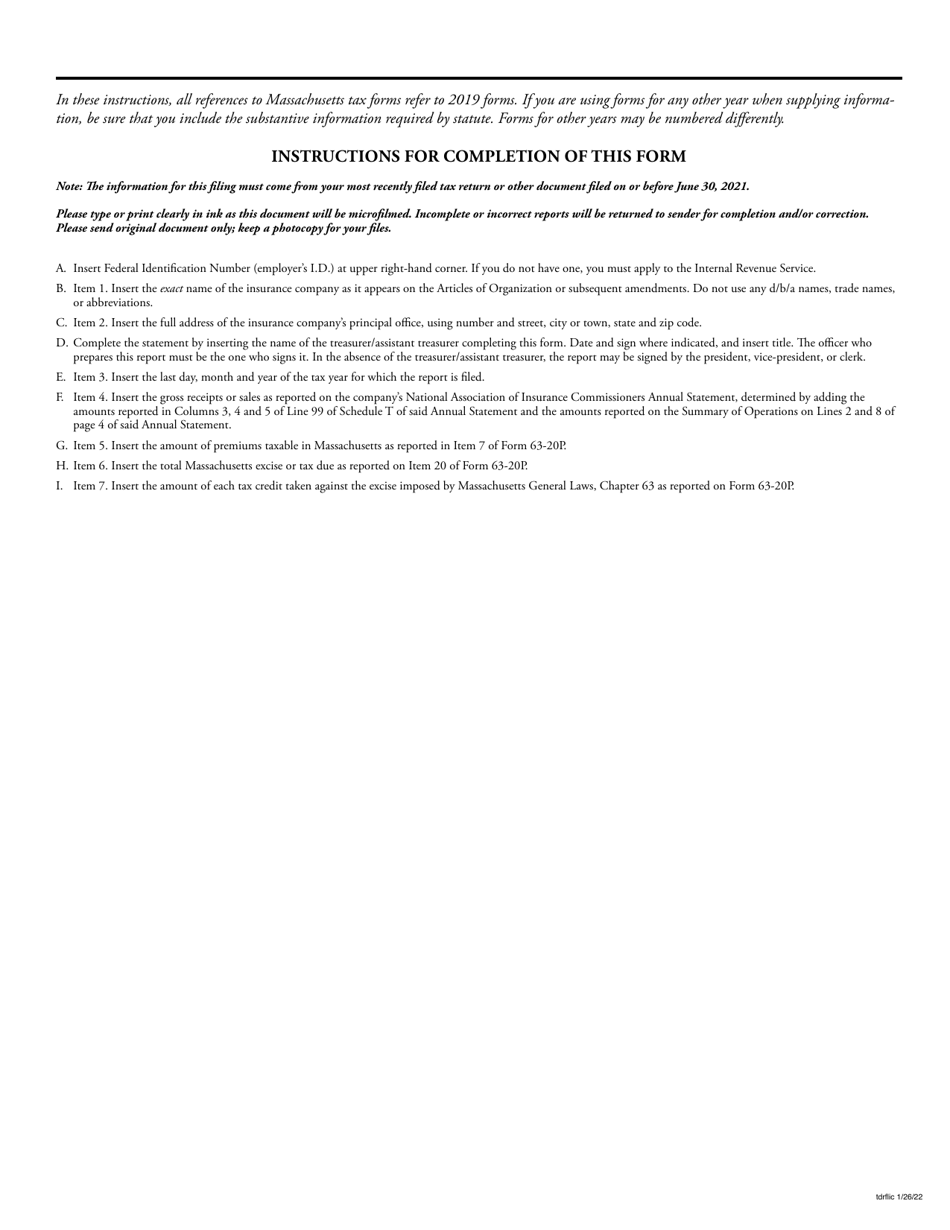

Q: Is there any specific format for the Tax Disclosure Report?

A: Yes, there is a specific format and guidelines provided by the Massachusetts Department of Revenue for filing the Tax Disclosure Report.

Form Details:

- Released on January 26, 2022;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.