This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

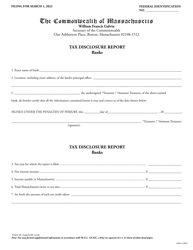

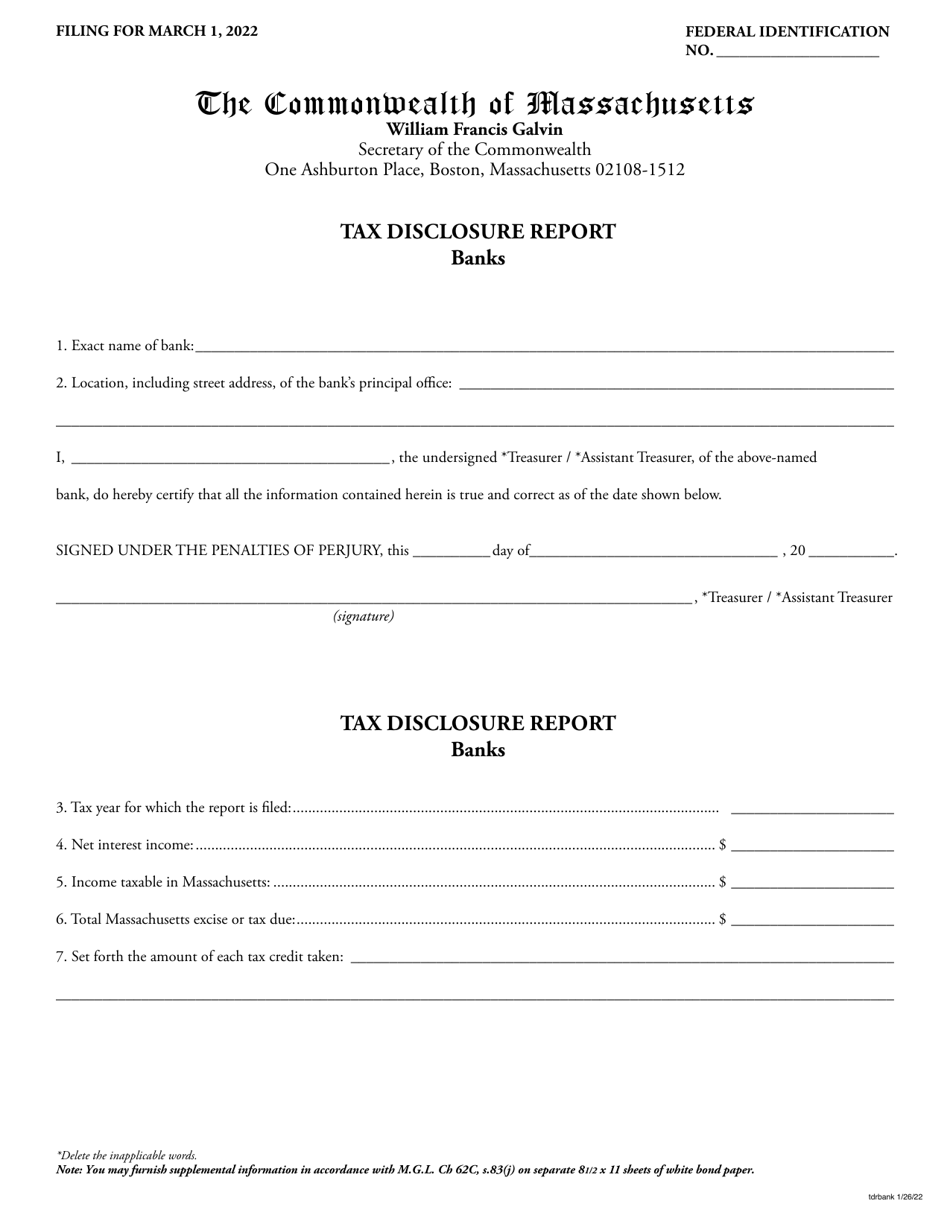

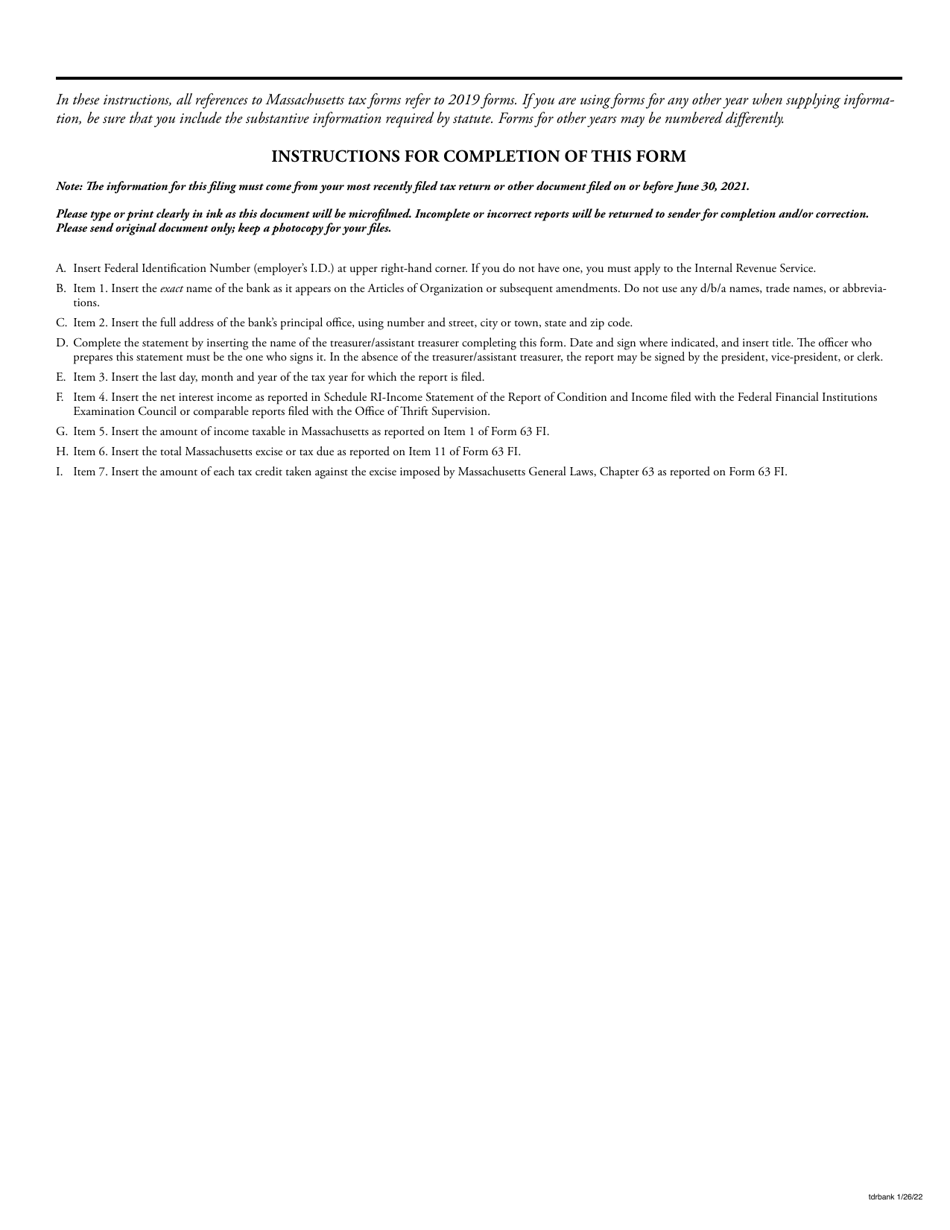

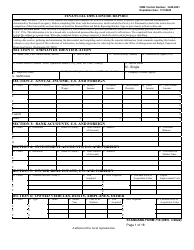

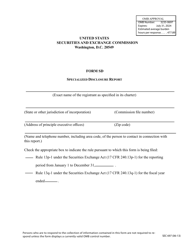

Tax Disclosure Report - Banks - Massachusetts

Tax Disclosure Report - Banks is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is a Tax Disclosure Report for Banks in Massachusetts?

A: A Tax Disclosure Report for Banks in Massachusetts is a report that banks are required to submit to the state regarding their tax obligations.

Q: Why do banks in Massachusetts have to submit Tax Disclosure Reports?

A: Banks in Massachusetts have to submit Tax Disclosure Reports to provide transparency on their tax obligations and ensure compliance with state tax laws.

Q: Who is responsible for submitting Tax Disclosure Reports for banks in Massachusetts?

A: The banks themselves are responsible for submitting Tax Disclosure Reports to the state of Massachusetts.

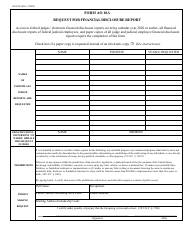

Q: What information is included in a Tax Disclosure Report for banks in Massachusetts?

A: A Tax Disclosure Report for banks in Massachusetts includes information on the bank's taxable income, nexus, apportionment, and other tax-related details.

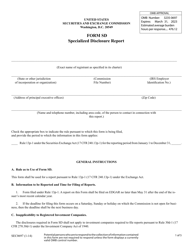

Form Details:

- Released on January 26, 2022;

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.