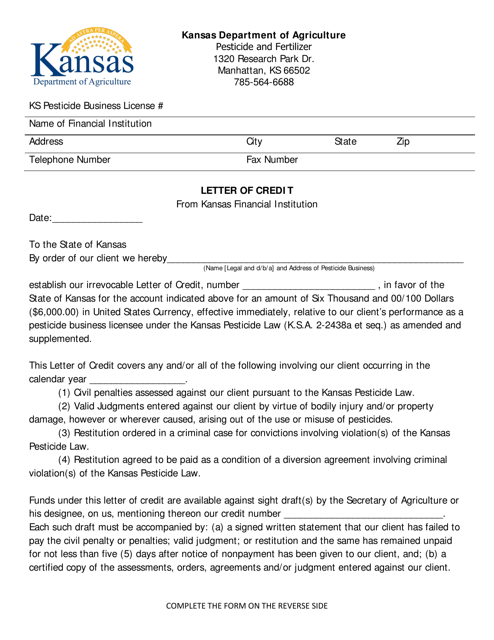

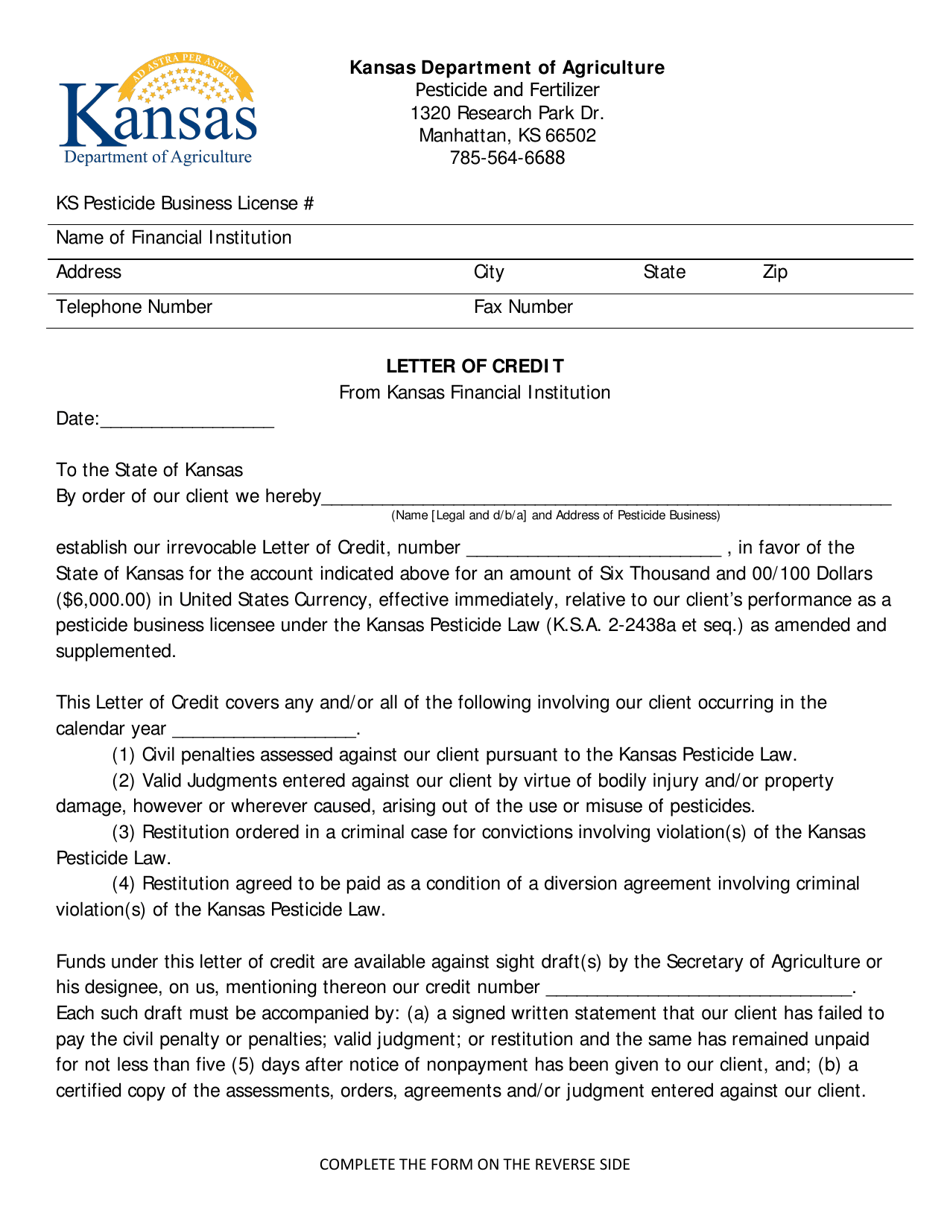

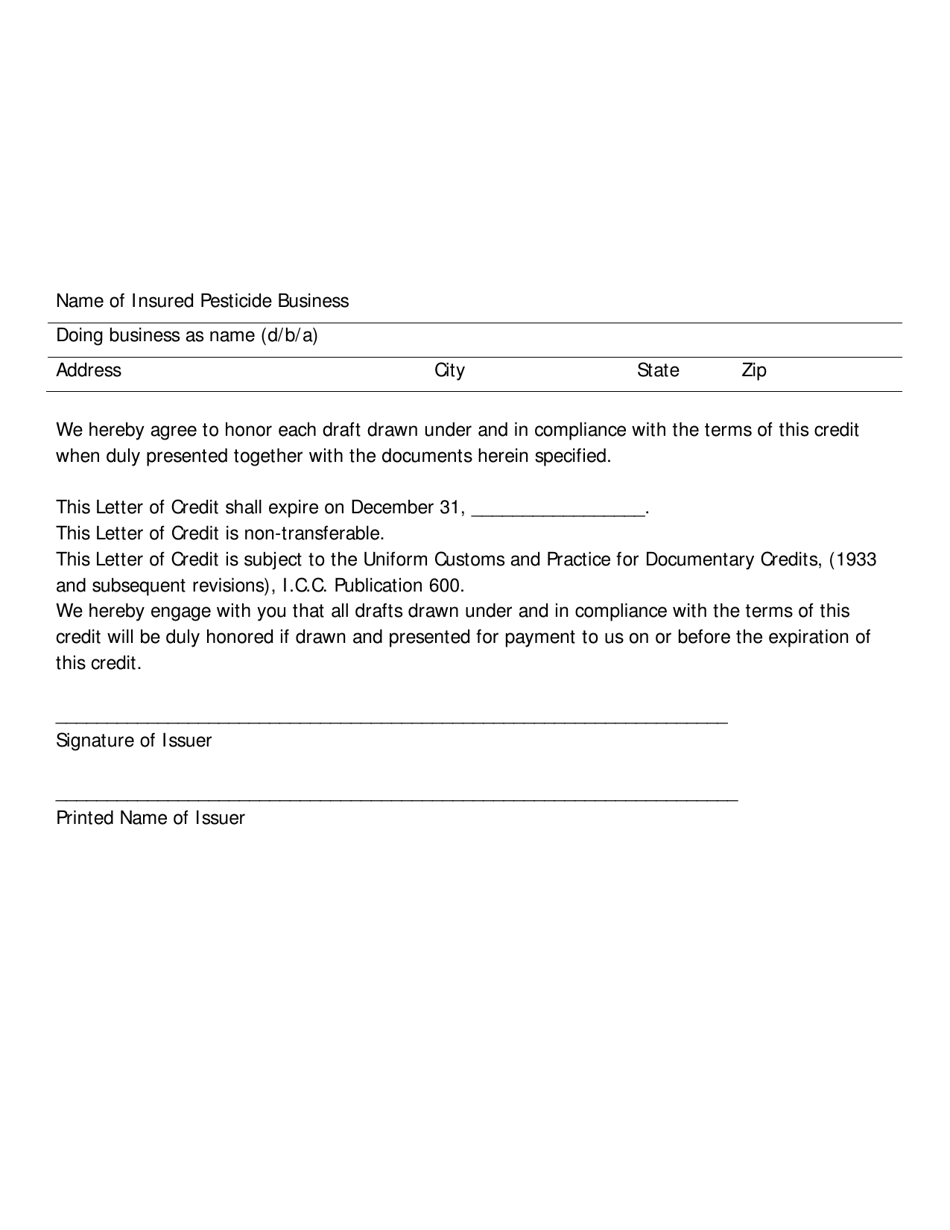

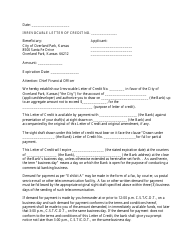

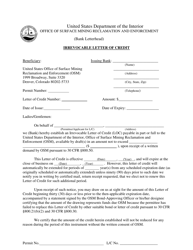

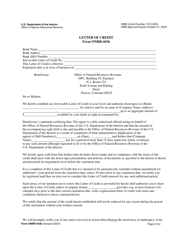

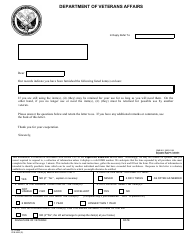

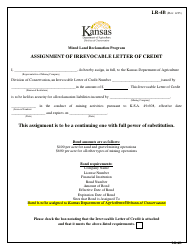

Letter of Credit - Kansas

Letter of Credit is a legal document that was released by the Kansas Department of Agriculture - a government authority operating within Kansas.

FAQ

Q: What is a letter of credit?

A: A letter of credit is a financial tool that guarantees payment to a seller, provided that certain terms and conditions are met.

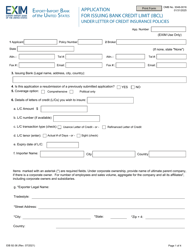

Q: Who uses letters of credit?

A: Letters of credit are commonly used in international trade transactions, where there is a need for a secure method of payment.

Q: How does a letter of credit work?

A: A letter of credit is issued by a bank on behalf of a buyer and guarantees payment to the seller. The bank agrees to make the payment once the seller submits the required documents specified in the letter of credit.

Q: What are the benefits of using a letter of credit?

A: Using a letter of credit provides security for both the buyer and the seller. The seller is assured of receiving payment if they comply with the terms, while the buyer can be confident that payment will only be made if the seller meets the agreed-upon conditions.

Q: Can letters of credit be used domestically within the US?

A: Yes, letters of credit can be used for domestic transactions in the US as well, although they are more commonly associated with international trade.

Q: Are there different types of letters of credit?

A: Yes, there are different types of letters of credit, including irrevocable letters of credit, revocable letters of credit, confirmed letters of credit, and standby letters of credit.

Q: What is the role of the issuing bank in a letter of credit?

A: The issuing bank is responsible for guaranteeing payment to the seller, subject to the submission of the required documents.

Q: What is the role of the advising bank in a letter of credit?

A: The advising bank is a bank located in the seller's country that receives the letter of credit from the issuing bank and forwards it to the seller.

Q: What is the role of the confirming bank in a letter of credit?

A: The confirming bank adds its own guarantee to the letter of credit, in addition to that of the issuing bank. This can provide extra security for the seller, particularly if the issuing bank is located in a different country.

Q: How long are letters of credit valid for?

A: The validity period of a letter of credit is typically specified in the terms and conditions, but it is usually for a fixed period of time, such as 30, 60, or 90 days.

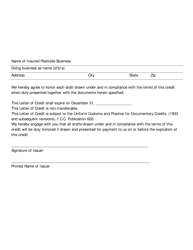

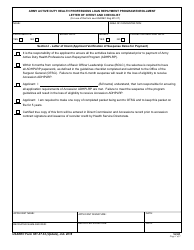

Form Details:

- The latest edition currently provided by the Kansas Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Kansas Department of Agriculture.