This version of the form is not currently in use and is provided for reference only. Download this version of

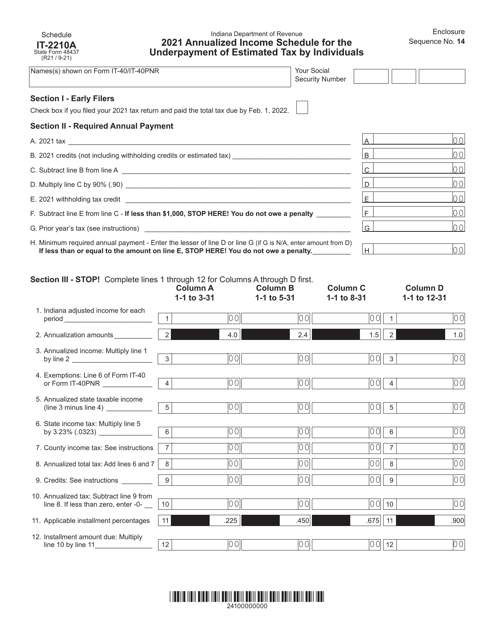

State Form 48437 Schedule IT-2210A

for the current year.

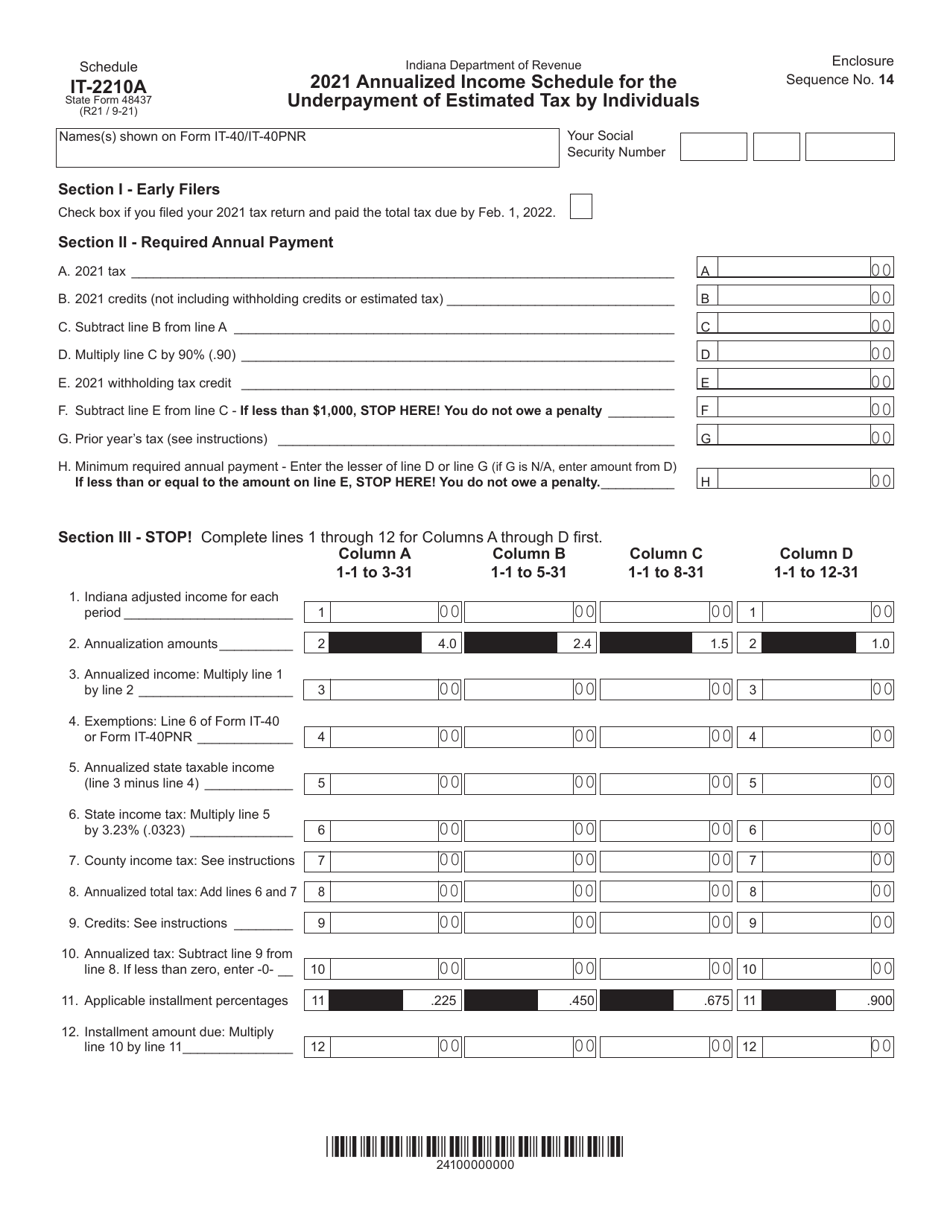

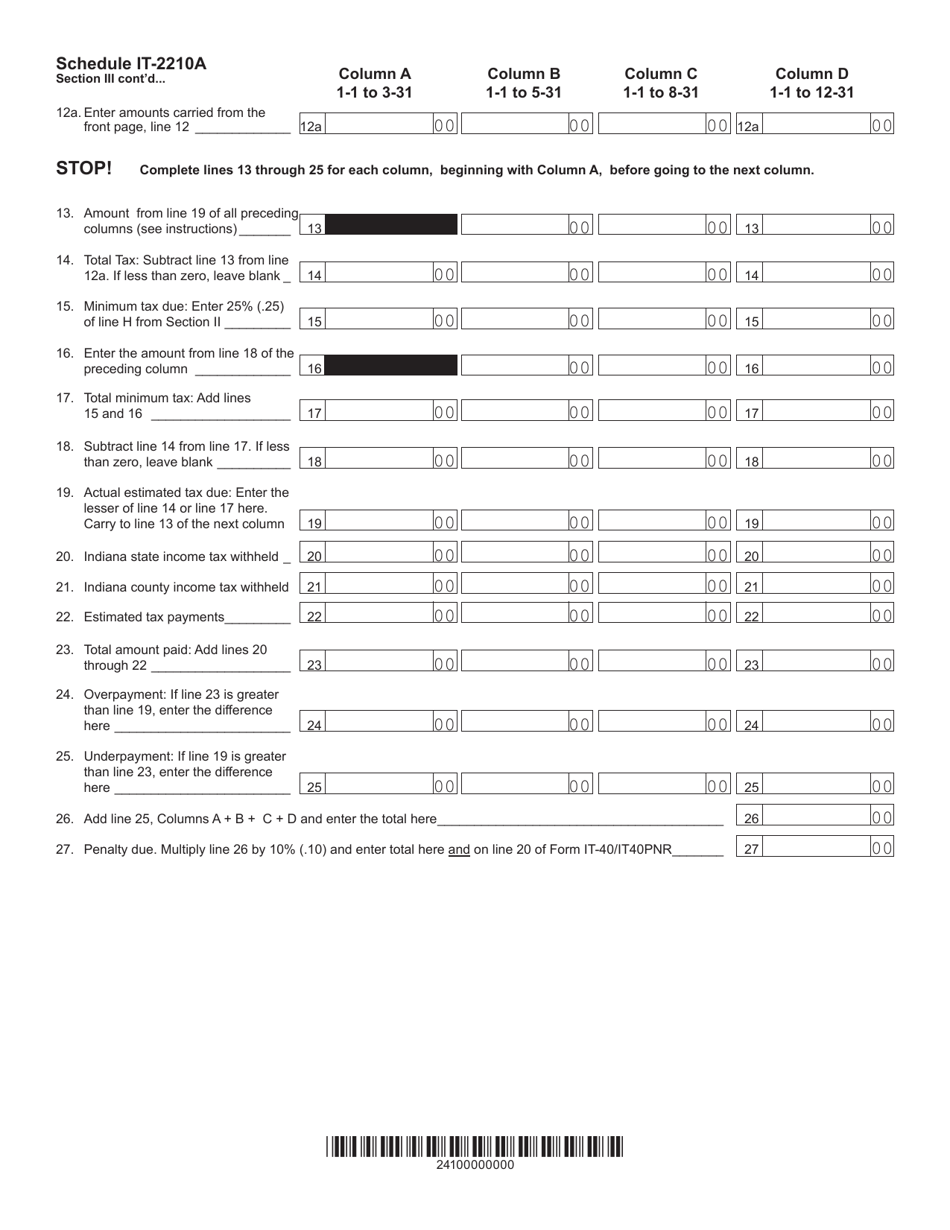

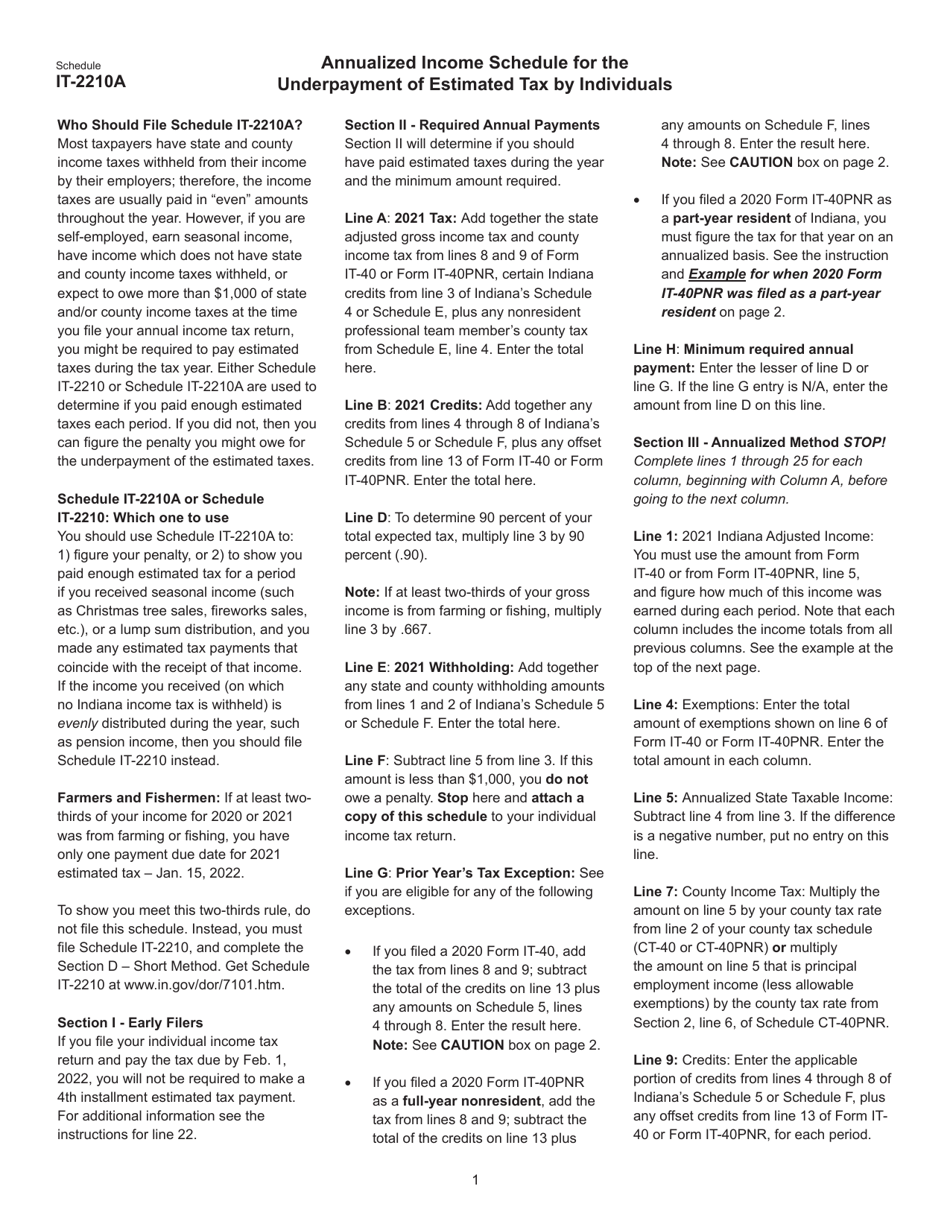

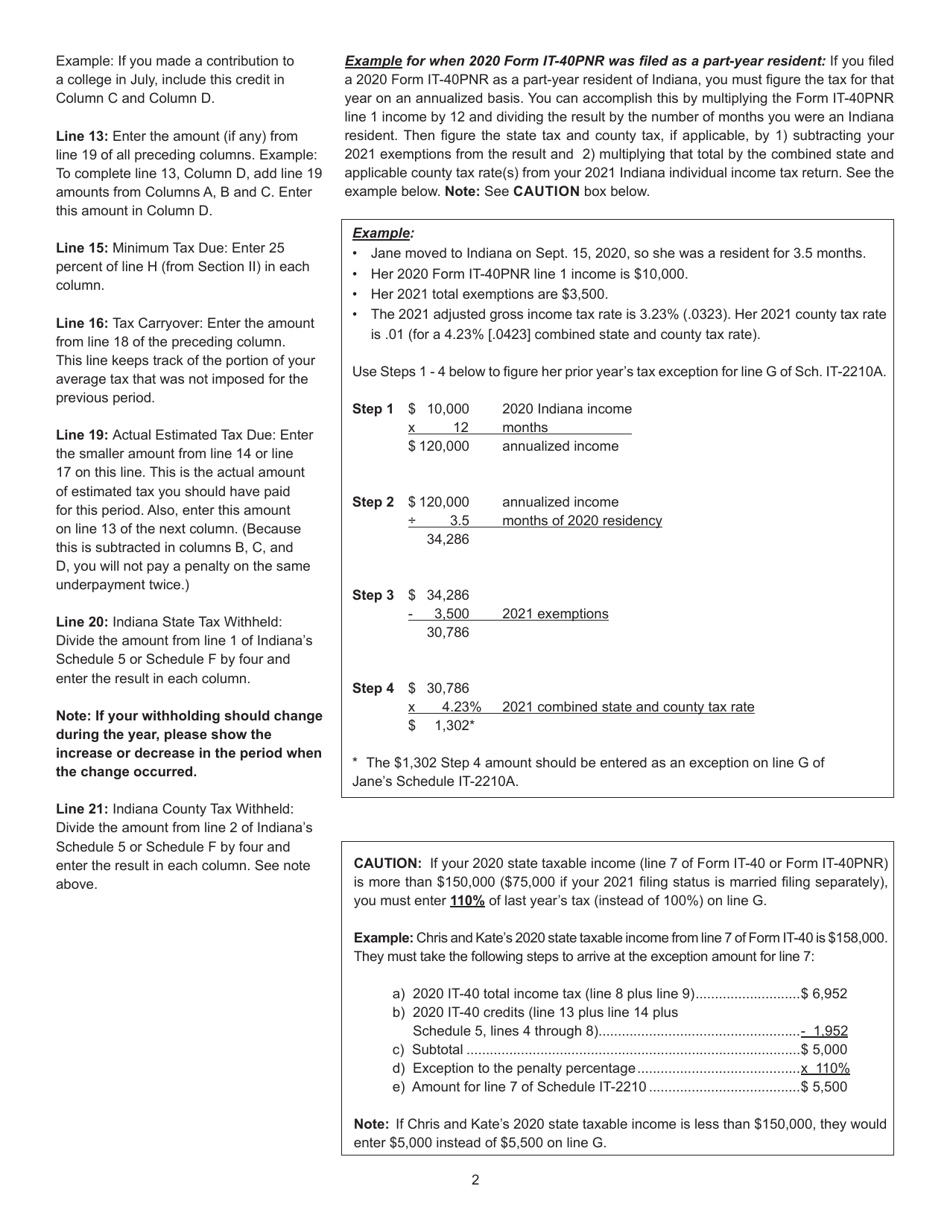

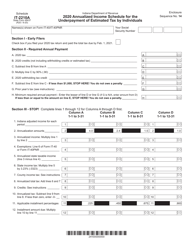

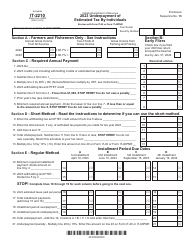

State Form 48437 Schedule IT-2210A Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals - Indiana

What Is State Form 48437 Schedule IT-2210A?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 48437 Schedule IT-2210A?

A: Form 48437 Schedule IT-2210A is the Annualized Income Schedule for the Underpayment of Estimated Tax by Individuals in Indiana.

Q: Who needs to file Form 48437 Schedule IT-2210A?

A: Individuals in Indiana who have underpaid their estimated tax payments need to file Form 48437 Schedule IT-2210A.

Q: When do I need to file Form 48437 Schedule IT-2210A?

A: You need to file Form 48437 Schedule IT-2210A when you file your Indiana state tax return.

Q: What is the purpose of Form 48437 Schedule IT-2210A?

A: Form 48437 Schedule IT-2210A calculates the penalty for underpayment of estimated tax payments in Indiana.

Q: Do I need to include Form 48437 Schedule IT-2210A with my federal tax return?

A: No, Form 48437 Schedule IT-2210A is specific to the state of Indiana and should not be included with your federal tax return.

Q: What happens if I don't file Form 48437 Schedule IT-2210A?

A: If you are required to file Form 48437 Schedule IT-2210A and fail to do so, you may be subject to penalties and interest on your underpaid taxes in Indiana.

Q: Can I request an extension to file Form 48437 Schedule IT-2210A?

A: Yes, if you need more time to file Form 48437 Schedule IT-2210A, you can request an extension from the Indiana Department of Revenue.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48437 Schedule IT-2210A by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.