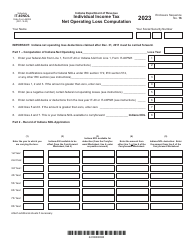

This version of the form is not currently in use and is provided for reference only. Download this version of

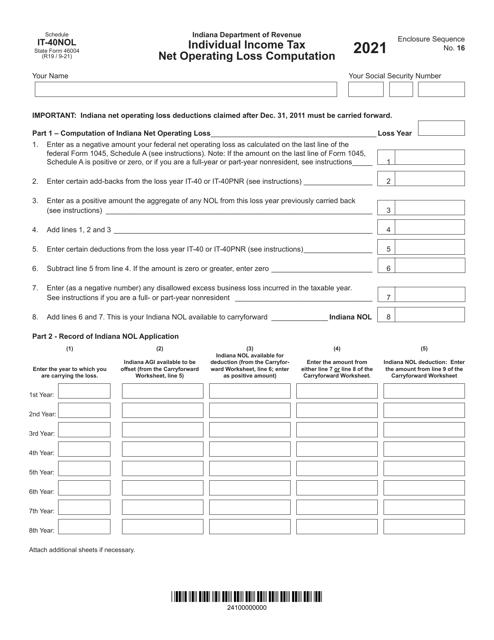

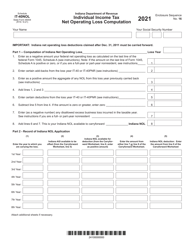

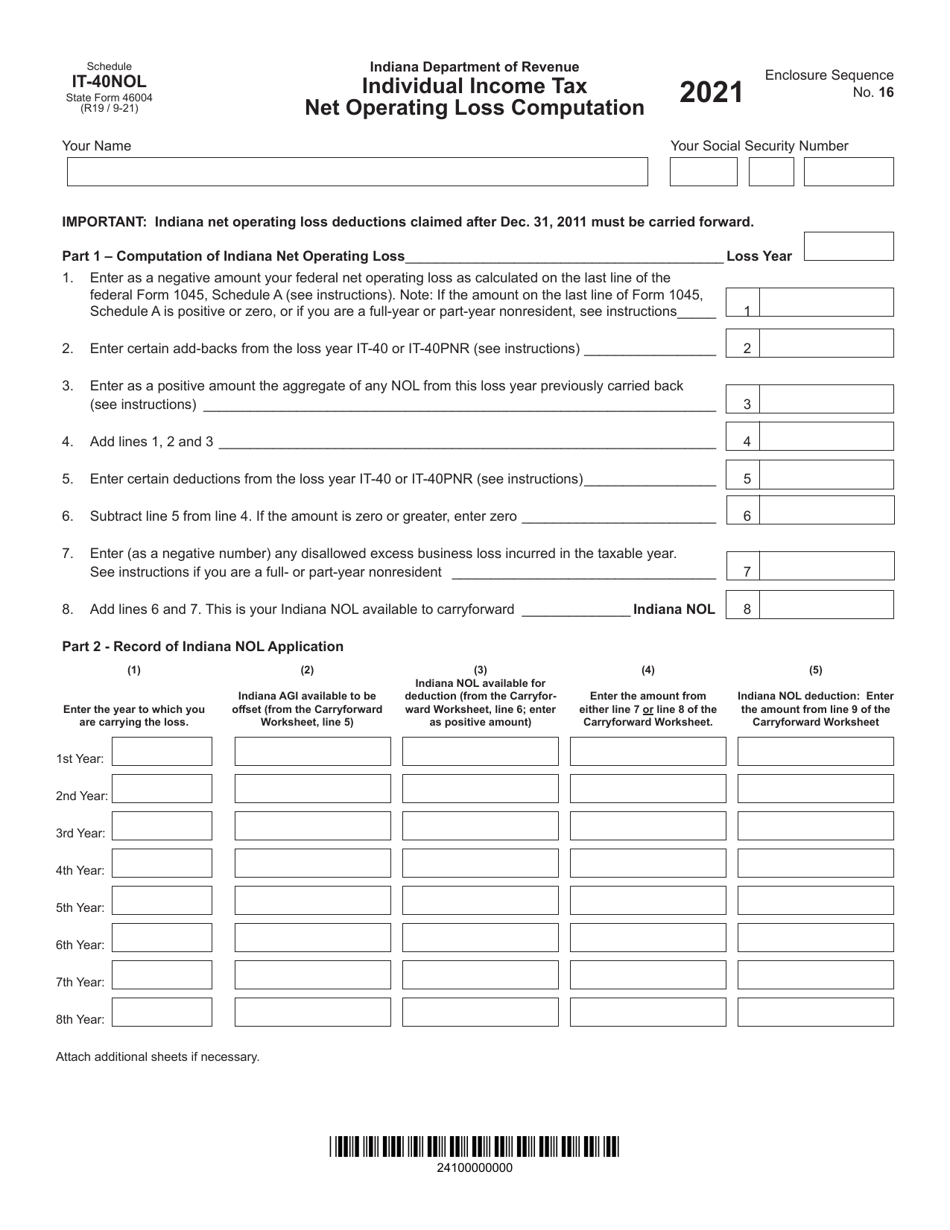

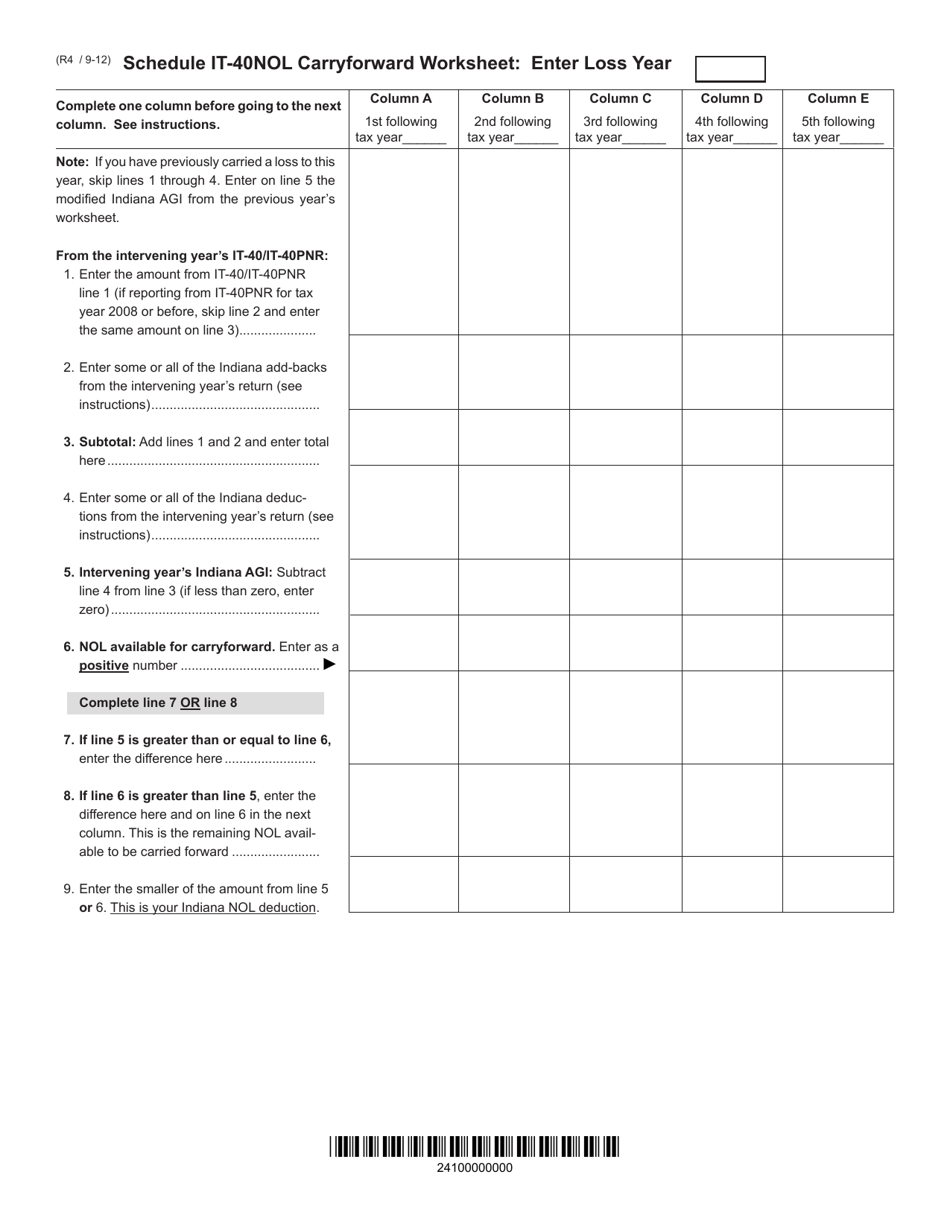

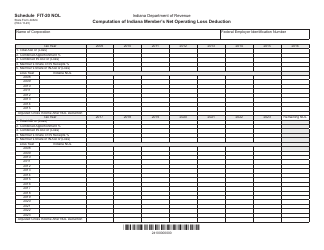

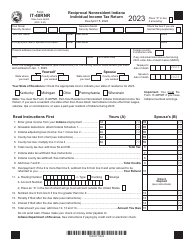

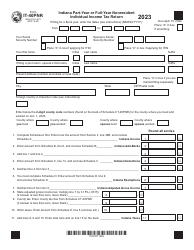

State Form 46004 Schedule IT-40NOL

for the current year.

State Form 46004 Schedule IT-40NOL Individual Income Tax Net Operating Loss Computation - Indiana

What Is State Form 46004 Schedule IT-40NOL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 46004 Schedule IT-40NOL?

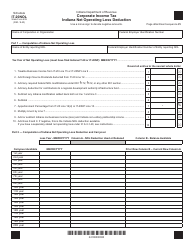

A: Form 46004 Schedule IT-40NOL is a tax form used in Indiana for calculating the net operating loss deduction for individual income tax.

Q: What is a net operating loss?

A: A net operating loss is when a taxpayer's allowable deductions exceed their taxable income in a given tax year.

Q: Who needs to file Form 46004 Schedule IT-40NOL?

A: Individual taxpayers in Indiana who have a net operating loss and want to claim a deduction on their income tax return.

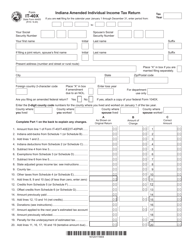

Q: How do I use Form 46004 Schedule IT-40NOL?

A: You use this form to calculate your net operating loss deduction and transfer the result to your Indiana IT-40 tax return.

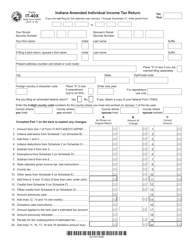

Q: Is there a deadline for filing Form 46004 Schedule IT-40NOL?

A: Yes, the deadline for filing Form 46004 Schedule IT-40NOL is the same as the deadline for filing your Indiana income tax return, usually April 15th.

Q: Can I e-file Form 46004 Schedule IT-40NOL?

A: Yes, you can e-file Form 46004 Schedule IT-40NOL together with your Indiana income tax return.

Q: Do I need to include any supporting documents with Form 46004 Schedule IT-40NOL?

A: No, you do not need to attach any supporting documents to Form 46004 Schedule IT-40NOL, but you should keep them for your records.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 46004 Schedule IT-40NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.