This version of the form is not currently in use and is provided for reference only. Download this version of

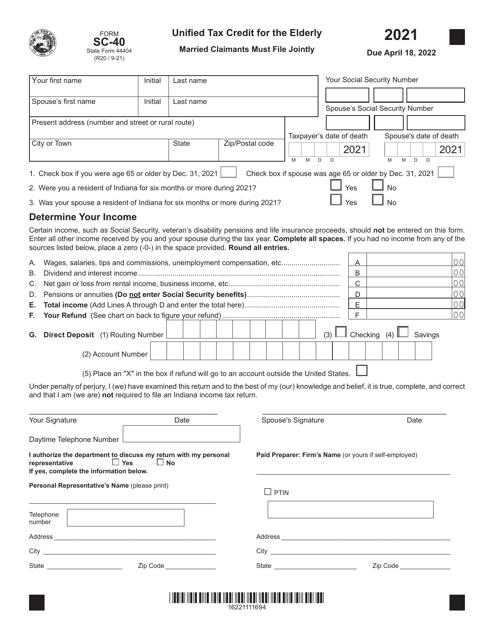

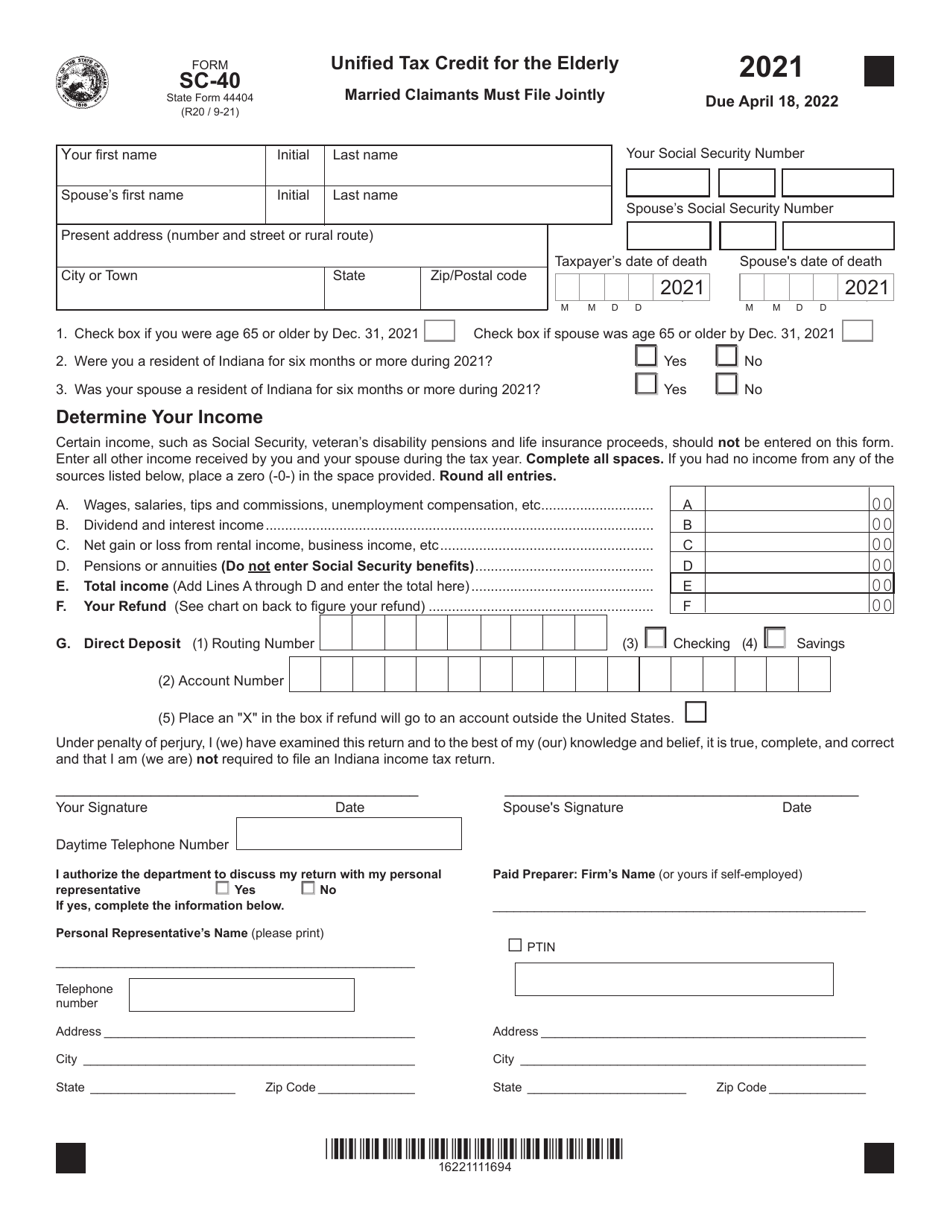

Form SC-40 (State Form 44404)

for the current year.

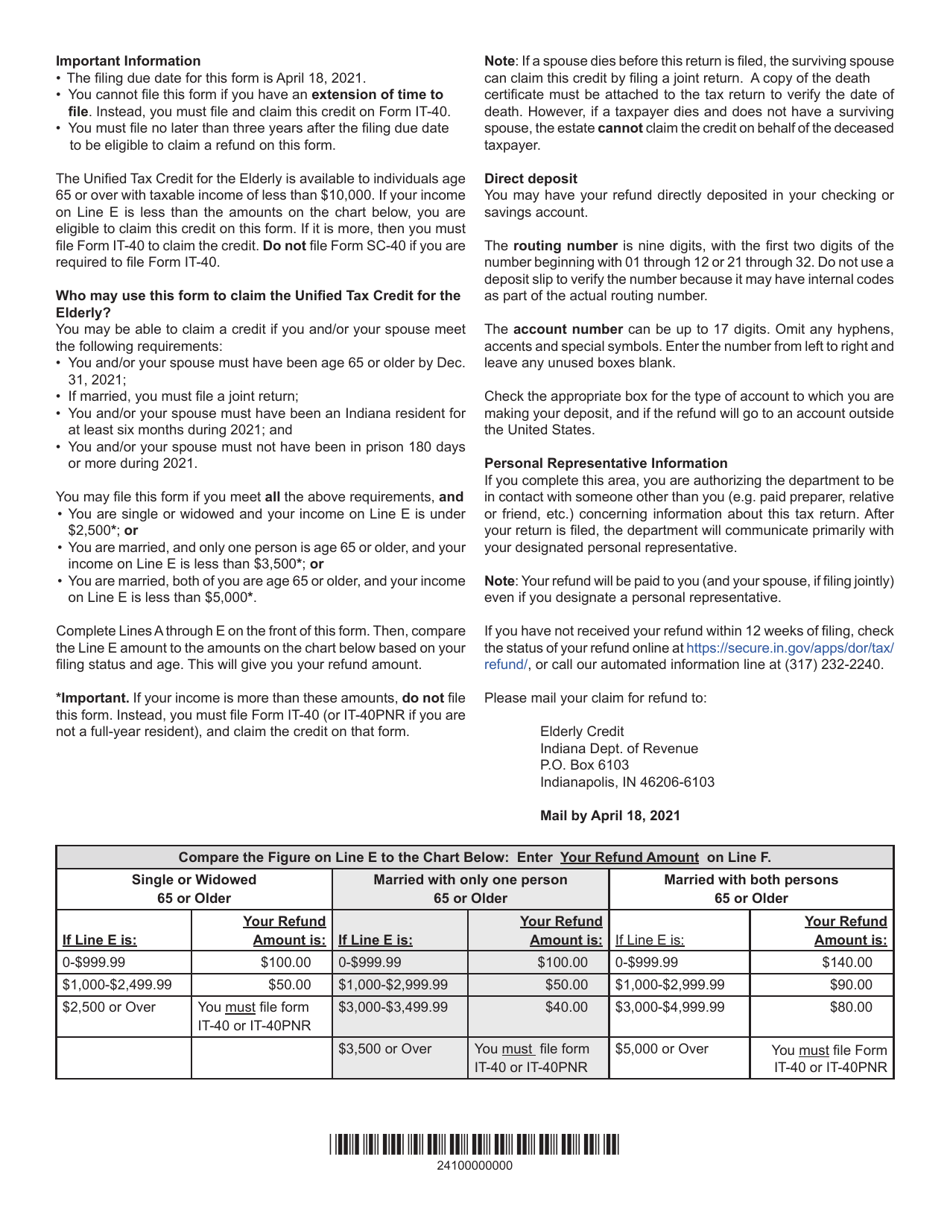

Form SC-40 (State Form 44404) Unified Tax Credit for the Elderly - Indiana

What Is Form SC-40 (State Form 44404)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC-40?

A: Form SC-40 is the application form for the Unified Tax Credit for the Elderly in Indiana.

Q: What is the Unified Tax Credit for the Elderly?

A: The Unified Tax Credit for the Elderly is a tax credit available to eligible senior citizens in Indiana.

Q: Who is eligible for the Unified Tax Credit for the Elderly?

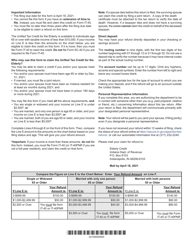

A: To be eligible for the Unified Tax Credit for the Elderly, you must meet certain age and income requirements set by the state of Indiana.

Q: What information do I need to complete Form SC-40?

A: You will need to provide personal information, income details, and any applicable deductions or credits that may affect your eligibility.

Q: When is the deadline to file Form SC-40?

A: The deadline to file Form SC-40 is typically April 15th of each year, unless it falls on a weekend or holiday.

Q: Can I file Form SC-40 electronically?

A: Yes, you can file Form SC-40 electronically if you prefer to do so.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SC-40 (State Form 44404) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.