This version of the form is not currently in use and is provided for reference only. Download this version of

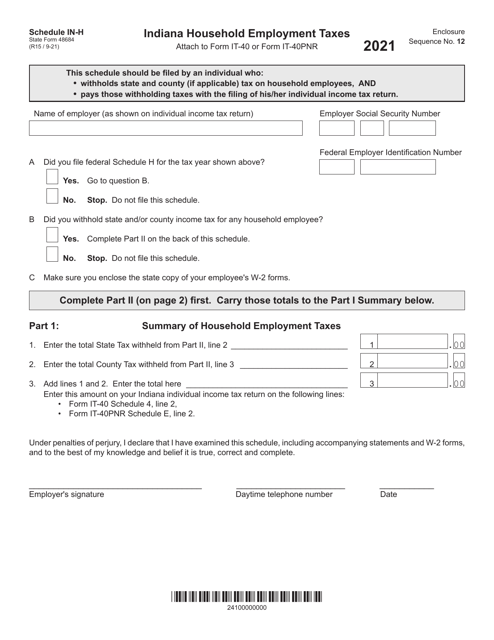

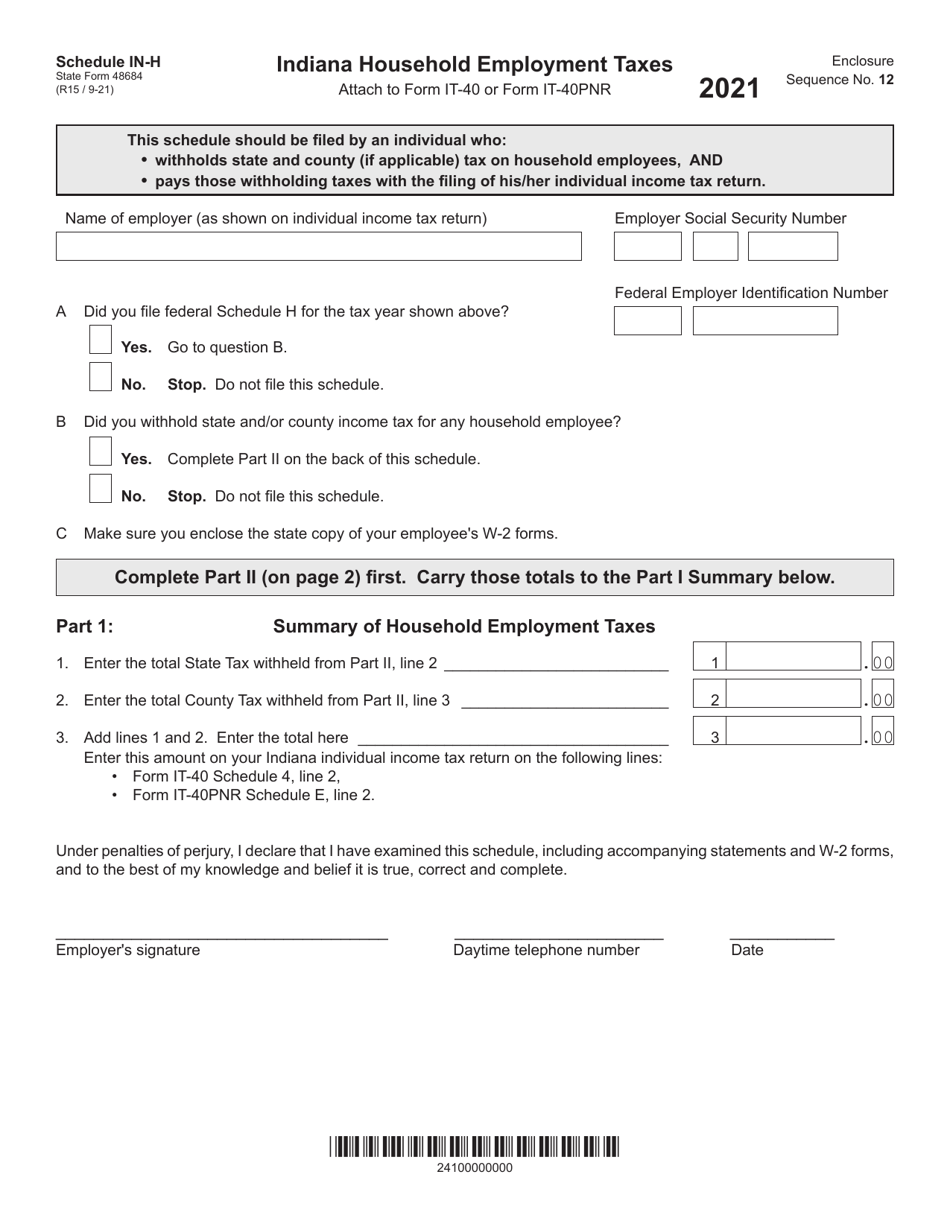

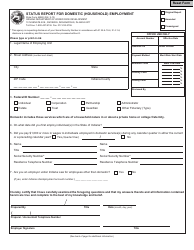

State Form 48684 Schedule IN-H

for the current year.

State Form 48684 Schedule IN-H Indiana Household Employment Taxes - Indiana

What Is State Form 48684 Schedule IN-H?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 48684 Schedule IN-H?

A: Form 48684 Schedule IN-H is a tax form used in the state of Indiana to report household employment taxes.

Q: What are household employment taxes?

A: Household employment taxes are the taxes that employers must pay when they employ someone to work in their home, such as a nanny or a housekeeper.

Q: Who needs to file Form 48684 Schedule IN-H?

A: Individuals who employ household workers and need to report and pay household employment taxes in the state of Indiana need to file Form 48684 Schedule IN-H.

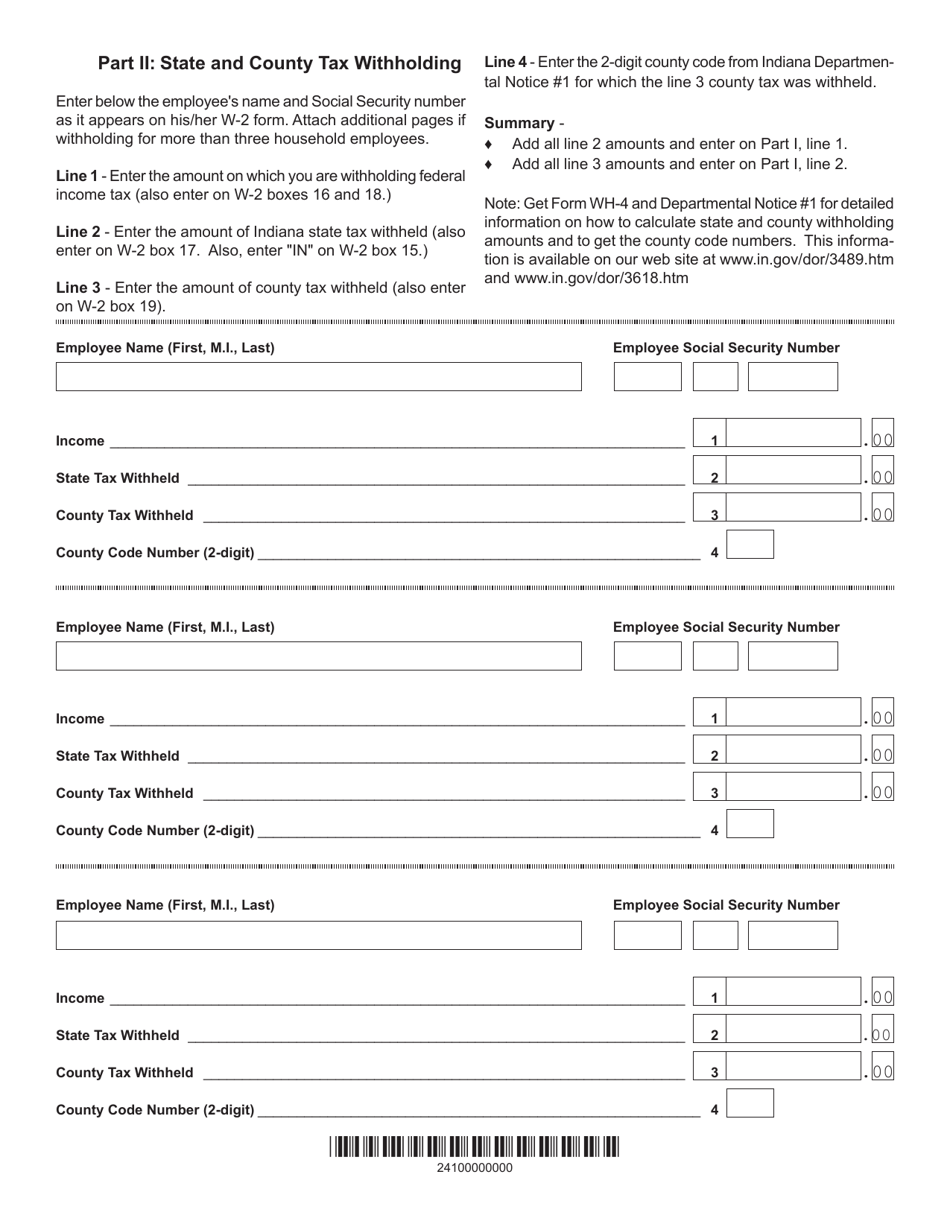

Q: What information is required on Form 48684 Schedule IN-H?

A: Form 48684 Schedule IN-H requires information about the household employer and the employee, including their names, Social Security numbers, and wages.

Q: When is the deadline to file Form 48684 Schedule IN-H?

A: The deadline to file Form 48684 Schedule IN-H is based on the individual's federal tax filing deadline, which is usually April 15th.

Q: Are there any penalties for not filing Form 48684 Schedule IN-H?

A: Yes, failure to file Form 48684 Schedule IN-H or pay household employment taxes can result in penalties and interest charges.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48684 Schedule IN-H by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.